Term Sheet Important Things to Know Template

Document content

This term sheet important things to know template has 3 pages and is a MS Word file type listed under our finance & accounting documents.

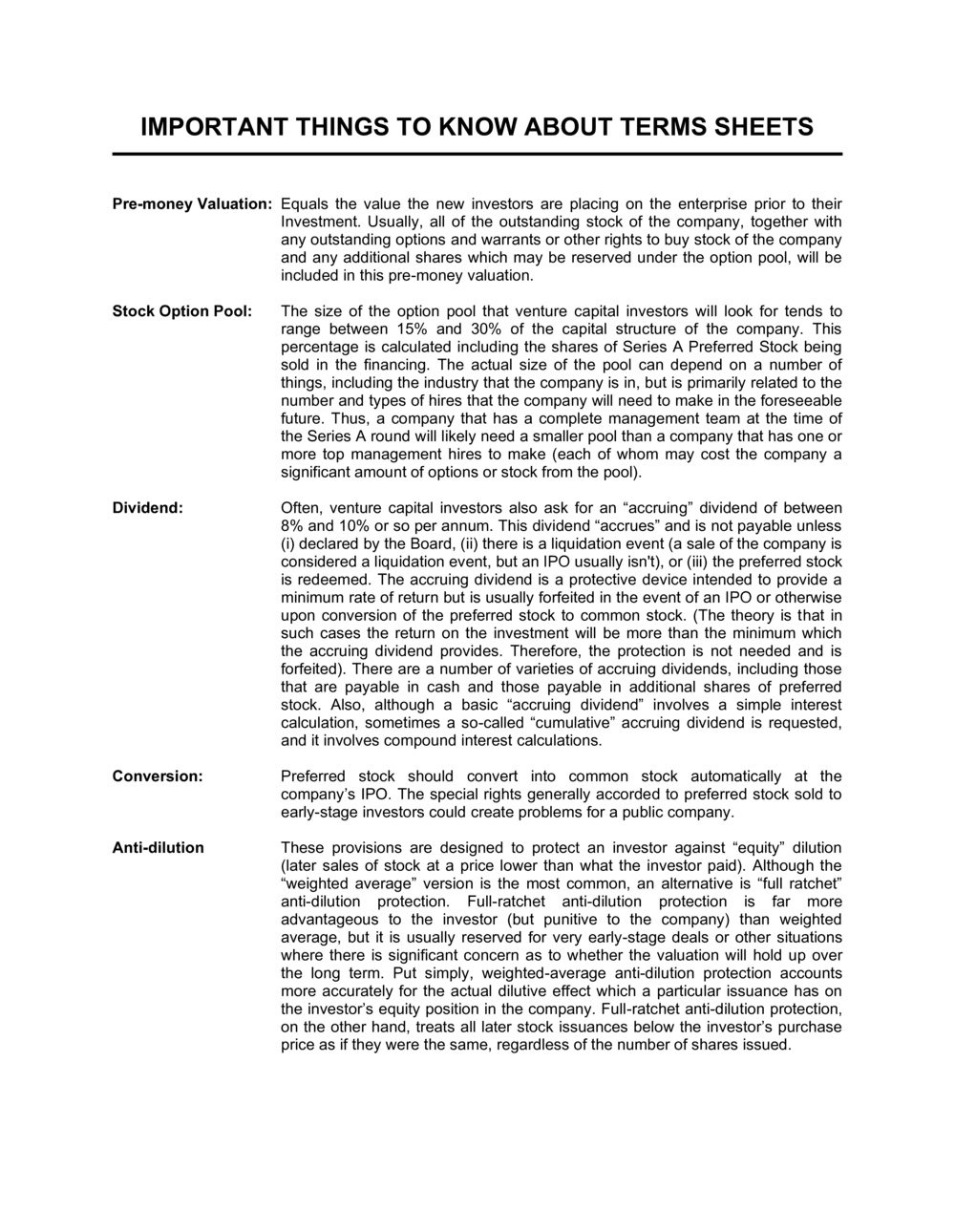

Sample of our term sheet important things to know template:

IMPORTANT THINGS TO KNOW ABOUT TERMS SHEETS Pre-money Valuation: Equals the value the new investors are placing on the enterprise prior to their Investment. Usually, all of the outstanding stock of the company, together with any outstanding options and warrants or other rights to buy stock of the company and any additional shares which may be reserved under the option pool, will be included in this pre-money valuation. Stock Option Pool: The size of the option pool that venture capital investors will look for tends to range between 15% and 30% of the capital structure of the company. This percentage is calculated including the shares of Series A Preferred Stock being sold in the financing. The actual size of the pool can depend on a number of things, including the industry that the company is in, but is primarily related to the number and types of hires that the company will need to make in the foreseeable future. Thus, a company that has a complete management team at the time of the Series A round will likely need a smaller pool than a company that has one or more top management hires to make (each of whom may cost the company a significant amount of options or stock from the pool). Dividend: Often, venture capital investors also ask for an "accruing" dividend of between 8% and 10% or so per annum. This dividend "accrues" and is not payable unless (i) declared by the Board, (ii) there is a liquidation event (a sale of the company is considered a liquidation event, but an IPO usually isn't), or (iii) the preferred stock is redeemed. The accruing dividend is a protective device intended to provide a minimum rate of return but is usually forfeited in the event of an IPO or otherwise upon conversion of the preferred stock to common stock. (The theory is that in such cases the return on the investment will be more than the minimum which the accruing dividend provides. Therefore, the protection is not needed and is forfeited). There are a number of varieties of accruing dividends, including those that are payable in cash and those payable in additional shares of preferred stock. Also, although a basic "accruing dividend" involves a simple interest calculation, sometimes a so-called "cumulative" accruing dividend is requested, and it involves compound interest calculations. Conversion: Preferred stock should convert into common stock automatically at the company's IPO. The special rights generally accorded to preferred stock sold to early-stage investors could create problems for a public company. Anti-dilution These provisions are designed to protect an investor against "equity" dilution (later sales of stock at a price lower than what the investor paid). Although the "weighted average" version is the most common, an alternative is "full ratchet" anti-dilution protection. Full-ratchet anti-dilution protection is far more advantageous to the investor (but punitive to the company) than weighted average, but it is usually reserved for very early-stage deals or other situations where there is significant concern as to whether the valuation will hold up over the long term. Put simply, weighted-average anti-dilution protection accounts more accurately for the actual dilutive effect which a particular issuance has on the investor's equity position in the company. Full-ratchet anti-dilution protection, on the other hand, treats all later stock issuances below the investor's purchase price as if they were the same, regardless of the number of shares issued. Voting rights: Although there are venture capital investors that ask for other veto rights, this list covers some of the most frequently requested veto rights. You may not have to provide veto rights with respect to each of these matters. The key here is to try to limit veto rights to major corporate events and to try to avoid turning day-to-day operational matters into matters for a preferred stockholder vote. Thus, for example, (g) and (1) could be problematic if the dollar limits are too low

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This term sheet important things to know template has 3 pages and is a MS Word file type listed under our finance & accounting documents.

Sample of our term sheet important things to know template:

IMPORTANT THINGS TO KNOW ABOUT TERMS SHEETS Pre-money Valuation: Equals the value the new investors are placing on the enterprise prior to their Investment. Usually, all of the outstanding stock of the company, together with any outstanding options and warrants or other rights to buy stock of the company and any additional shares which may be reserved under the option pool, will be included in this pre-money valuation. Stock Option Pool: The size of the option pool that venture capital investors will look for tends to range between 15% and 30% of the capital structure of the company. This percentage is calculated including the shares of Series A Preferred Stock being sold in the financing. The actual size of the pool can depend on a number of things, including the industry that the company is in, but is primarily related to the number and types of hires that the company will need to make in the foreseeable future. Thus, a company that has a complete management team at the time of the Series A round will likely need a smaller pool than a company that has one or more top management hires to make (each of whom may cost the company a significant amount of options or stock from the pool). Dividend: Often, venture capital investors also ask for an "accruing" dividend of between 8% and 10% or so per annum. This dividend "accrues" and is not payable unless (i) declared by the Board, (ii) there is a liquidation event (a sale of the company is considered a liquidation event, but an IPO usually isn't), or (iii) the preferred stock is redeemed. The accruing dividend is a protective device intended to provide a minimum rate of return but is usually forfeited in the event of an IPO or otherwise upon conversion of the preferred stock to common stock. (The theory is that in such cases the return on the investment will be more than the minimum which the accruing dividend provides. Therefore, the protection is not needed and is forfeited). There are a number of varieties of accruing dividends, including those that are payable in cash and those payable in additional shares of preferred stock. Also, although a basic "accruing dividend" involves a simple interest calculation, sometimes a so-called "cumulative" accruing dividend is requested, and it involves compound interest calculations. Conversion: Preferred stock should convert into common stock automatically at the company's IPO. The special rights generally accorded to preferred stock sold to early-stage investors could create problems for a public company. Anti-dilution These provisions are designed to protect an investor against "equity" dilution (later sales of stock at a price lower than what the investor paid). Although the "weighted average" version is the most common, an alternative is "full ratchet" anti-dilution protection. Full-ratchet anti-dilution protection is far more advantageous to the investor (but punitive to the company) than weighted average, but it is usually reserved for very early-stage deals or other situations where there is significant concern as to whether the valuation will hold up over the long term. Put simply, weighted-average anti-dilution protection accounts more accurately for the actual dilutive effect which a particular issuance has on the investor's equity position in the company. Full-ratchet anti-dilution protection, on the other hand, treats all later stock issuances below the investor's purchase price as if they were the same, regardless of the number of shares issued. Voting rights: Although there are venture capital investors that ask for other veto rights, this list covers some of the most frequently requested veto rights. You may not have to provide veto rights with respect to each of these matters. The key here is to try to limit veto rights to major corporate events and to try to avoid turning day-to-day operational matters into matters for a preferred stockholder vote. Thus, for example, (g) and (1) could be problematic if the dollar limits are too low

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.