Term Sheet for Series A Round of Financing Template

Document content

This term sheet for series a round of financing template has 5 pages and is a MS Word file type listed under our finance & accounting documents.

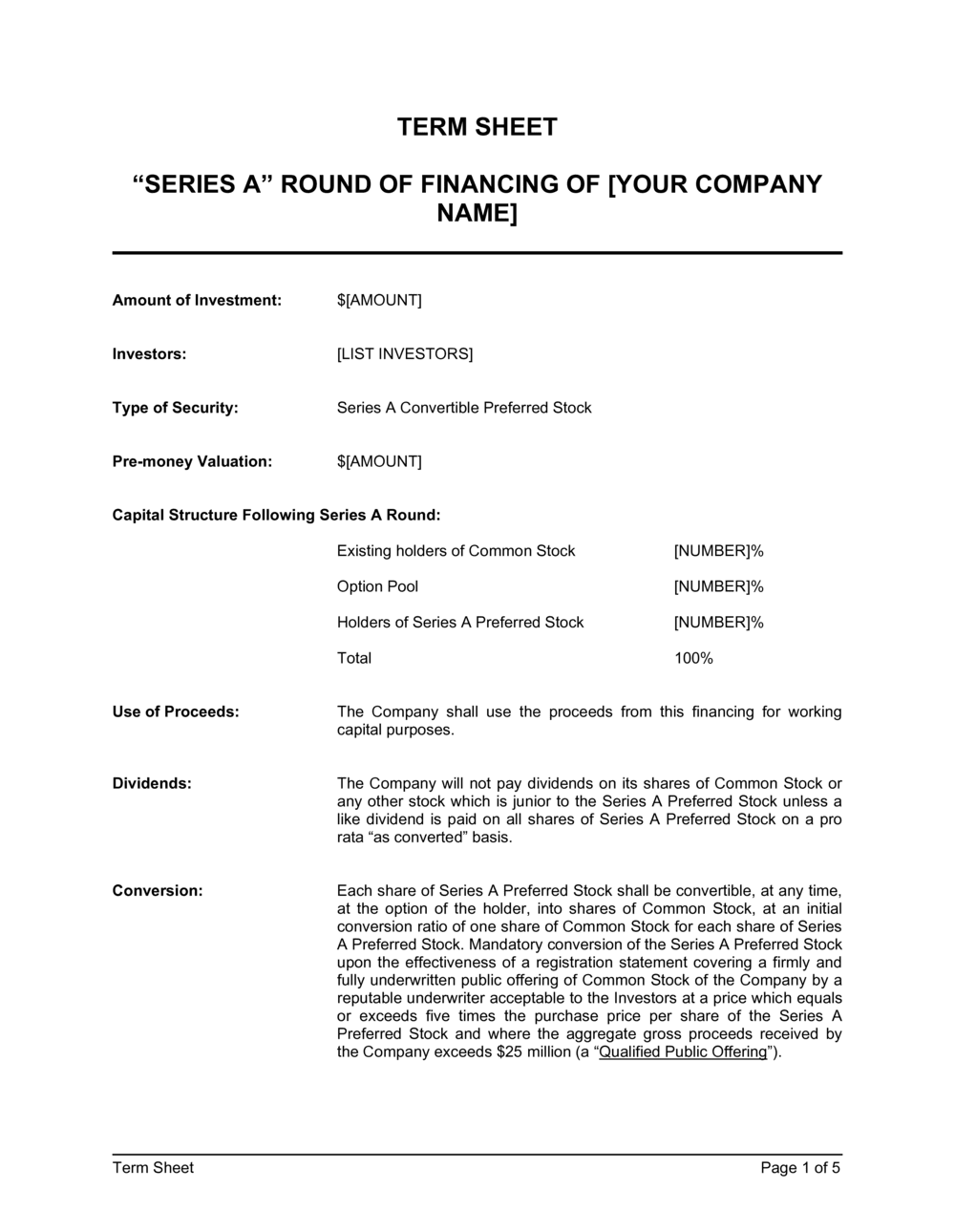

Sample of our term sheet for series a round of financing template:

TERM SHEET "SERIES A" ROUND OF FINANCING OF [YOUR COMPANY NAME] Amount of Investment: $[AMOUNT] Investors: [LIST INVESTORS] Type of Security: Series A Convertible Preferred Stock Pre-money Valuation: $[AMOUNT] Capital Structure Following Series A Round: Existing holders of Common Stock [NUMBER]% Option Pool [NUMBER]% Holders of Series A Preferred Stock [NUMBER]% Total 100% Use of Proceeds: The Company shall use the proceeds from this financing for working capital purposes. Dividends: The Company will not pay dividends on its shares of Common Stock or any other stock which is junior to the Series A Preferred Stock unless a like dividend is paid on all shares of Series A Preferred Stock on a pro rata "as converted" basis. Conversion: Each share of Series A Preferred Stock shall be convertible, at any time, at the option of the holder, into shares of Common Stock, at an initial conversion ratio of one share of Common Stock for each share of Series A Preferred Stock. Mandatory conversion of the Series A Preferred Stock upon the effectiveness of a registration statement covering a firmly and fully underwritten public offering of Common Stock of the Company by a reputable underwriter acceptable to the Investors at a price which equals or exceeds five times the purchase price per share of the Series A Preferred Stock and where the aggregate gross proceeds received by the Company exceeds $25 million (a "Qualified Public Offering"). Anti-dilution: The terms of the Series A Preferred Stock will contain standard "weighted average" anti-dilution protection with respect to the issuance by the Company of equity securities at a price per share less than the applicable conversion price then in effect, subject to standard and customary exceptions. The conversion rate of the Series A Preferred Stock into common stock will be adjusted appropriately to account for any stock splits, re-capitalizations, mergers, combinations and asset sales, stock dividends, and similar events. Anti-dilution protection shall not be triggered by the issuance of up to 1,000,000 shares of Common Stock (or options therefore) issued in accordance with the Company's Stock Option Plan. Voting Rights: On all matters submitted for stockholder approval, each share of Series A Preferred Stock shall be entitled to such number of votes as is equal to the number of shares of Common Stock into which such shares are convertible. In addition, the Company shall not, without the prior consent of the holders of at least a majority of the then issued and outstanding Series A Preferred Stock, voting as a separate class: Issue or create any series or class of securities with rights superior to or on a parity with the Series A Preferred Stock or increase the rights or preferences of any series or class having rights or preferences that are junior to the Series A Preferred Stock so as to make the rights or preferences of such series or class equal or senior to the Series A Preferred Stock. Pay dividends on shares of the capital stock of the Company. Effect any exchange or reclassification of any stock affecting the Series A Preferred Stock or any re-capitalization involving the Company and its subsidiaries taken as a whole. Re-purchase or redeem, or agree to repurchase or redeem, any securities of the Company other than from employees of the Company upon termination of their employment pursuant to prior existing agreements approved by the Board of Directors of the Company. Enter into any transaction with management or any member of the board of directors, except for employment contracts approved by the Board of Directors and transactions entered at arms-length terms which are no less favorable to the Company than could be obtained from unrelated third parties. Effect any amendment of the Company's Certificate of Incorporation or Bylaws which would materially adversely affect the rights of the Series A Preferred Stock. Incur or guarantee debt in excess of [AMOUNT]. Voluntarily dissolve or liquidate. Effect any merger or consolidation of the Company with or into another corporation or other entity (except one in the holders of the capital stock of the Company immediately prior to such a merger or consolidation continue to hold at least a majority of the capital stock of the surviving entity after the merger or consolidation) or sell, lease, or otherwise dispose of all or substantially all or a significant portion of the assets of the Company. Change the size of the Board of Directors or change any procedure of the Company relating to the designation, nomination, or election of the Board of Directors. Amend, alter, or repeal the preferences, special rights, or other powers of the Series A Preferred Stock so as to adversely affect the Series A Preferred Stock. Make capital expenditures of more than [amount] in a single expenditure or an aggregate of [AMOUNT] in any twelve-month period. Liquidation Preference: The holders of Series A Preferred Stock shall have preference upon liquidation over all holders of Common Stock and over the holders of any other class or series of stock that is junior to the Series A Preferred Stock for an amount equal to the greater of (i) amount paid for such Series A Preferred Stock plus any declared or accrued but unpaid dividends, and (ii) the amount which such holder would have received if such holder's shares of Series A Preferred Stock were converted to Common Stock immediately prior to such liquidation. Thereafter, the holders of Common Stock will be entitled to receive the remaining assets. For purposes of this section, a merger, consolidation, sale of all or substantially all of the Company's assets, or other corporate reorganization shall constitute a liquidation, unless the holders of at least a majority of the Series A Preferred Stock vote otherwise.

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This term sheet for series a round of financing template has 5 pages and is a MS Word file type listed under our finance & accounting documents.

Sample of our term sheet for series a round of financing template:

TERM SHEET "SERIES A" ROUND OF FINANCING OF [YOUR COMPANY NAME] Amount of Investment: $[AMOUNT] Investors: [LIST INVESTORS] Type of Security: Series A Convertible Preferred Stock Pre-money Valuation: $[AMOUNT] Capital Structure Following Series A Round: Existing holders of Common Stock [NUMBER]% Option Pool [NUMBER]% Holders of Series A Preferred Stock [NUMBER]% Total 100% Use of Proceeds: The Company shall use the proceeds from this financing for working capital purposes. Dividends: The Company will not pay dividends on its shares of Common Stock or any other stock which is junior to the Series A Preferred Stock unless a like dividend is paid on all shares of Series A Preferred Stock on a pro rata "as converted" basis. Conversion: Each share of Series A Preferred Stock shall be convertible, at any time, at the option of the holder, into shares of Common Stock, at an initial conversion ratio of one share of Common Stock for each share of Series A Preferred Stock. Mandatory conversion of the Series A Preferred Stock upon the effectiveness of a registration statement covering a firmly and fully underwritten public offering of Common Stock of the Company by a reputable underwriter acceptable to the Investors at a price which equals or exceeds five times the purchase price per share of the Series A Preferred Stock and where the aggregate gross proceeds received by the Company exceeds $25 million (a "Qualified Public Offering"). Anti-dilution: The terms of the Series A Preferred Stock will contain standard "weighted average" anti-dilution protection with respect to the issuance by the Company of equity securities at a price per share less than the applicable conversion price then in effect, subject to standard and customary exceptions. The conversion rate of the Series A Preferred Stock into common stock will be adjusted appropriately to account for any stock splits, re-capitalizations, mergers, combinations and asset sales, stock dividends, and similar events. Anti-dilution protection shall not be triggered by the issuance of up to 1,000,000 shares of Common Stock (or options therefore) issued in accordance with the Company's Stock Option Plan. Voting Rights: On all matters submitted for stockholder approval, each share of Series A Preferred Stock shall be entitled to such number of votes as is equal to the number of shares of Common Stock into which such shares are convertible. In addition, the Company shall not, without the prior consent of the holders of at least a majority of the then issued and outstanding Series A Preferred Stock, voting as a separate class: Issue or create any series or class of securities with rights superior to or on a parity with the Series A Preferred Stock or increase the rights or preferences of any series or class having rights or preferences that are junior to the Series A Preferred Stock so as to make the rights or preferences of such series or class equal or senior to the Series A Preferred Stock. Pay dividends on shares of the capital stock of the Company. Effect any exchange or reclassification of any stock affecting the Series A Preferred Stock or any re-capitalization involving the Company and its subsidiaries taken as a whole. Re-purchase or redeem, or agree to repurchase or redeem, any securities of the Company other than from employees of the Company upon termination of their employment pursuant to prior existing agreements approved by the Board of Directors of the Company. Enter into any transaction with management or any member of the board of directors, except for employment contracts approved by the Board of Directors and transactions entered at arms-length terms which are no less favorable to the Company than could be obtained from unrelated third parties. Effect any amendment of the Company's Certificate of Incorporation or Bylaws which would materially adversely affect the rights of the Series A Preferred Stock. Incur or guarantee debt in excess of [AMOUNT]. Voluntarily dissolve or liquidate. Effect any merger or consolidation of the Company with or into another corporation or other entity (except one in the holders of the capital stock of the Company immediately prior to such a merger or consolidation continue to hold at least a majority of the capital stock of the surviving entity after the merger or consolidation) or sell, lease, or otherwise dispose of all or substantially all or a significant portion of the assets of the Company. Change the size of the Board of Directors or change any procedure of the Company relating to the designation, nomination, or election of the Board of Directors. Amend, alter, or repeal the preferences, special rights, or other powers of the Series A Preferred Stock so as to adversely affect the Series A Preferred Stock. Make capital expenditures of more than [amount] in a single expenditure or an aggregate of [AMOUNT] in any twelve-month period. Liquidation Preference: The holders of Series A Preferred Stock shall have preference upon liquidation over all holders of Common Stock and over the holders of any other class or series of stock that is junior to the Series A Preferred Stock for an amount equal to the greater of (i) amount paid for such Series A Preferred Stock plus any declared or accrued but unpaid dividends, and (ii) the amount which such holder would have received if such holder's shares of Series A Preferred Stock were converted to Common Stock immediately prior to such liquidation. Thereafter, the holders of Common Stock will be entitled to receive the remaining assets. For purposes of this section, a merger, consolidation, sale of all or substantially all of the Company's assets, or other corporate reorganization shall constitute a liquidation, unless the holders of at least a majority of the Series A Preferred Stock vote otherwise.

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.