Tax Preparation Company Business Plan Template

Document content

This tax preparation company business plan template has 35 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our tax preparation company business plan template:

Confidentiality Agreement The undersigned reader acknowledges that the information provided by [YOUR COMPANY NAME] in this business plan is confidential; therefore, reader agrees not to disclose it without the express written permission of [YOUR COMPANY NAME]. It is acknowledged by reader that information to be furnished in this business plan is in all respects confidential in nature, other than information which is in the public domain through other means and that any disclosure or use of same by reader, may cause serious harm or damage to [YOUR COMPANY NAME]. Upon request, this document is to be immediately returned to [YOUR COMPANY NAME]. ___________________ Signature ___________________ Name (typed or printed) ___________________ Date This is a business plan. It does not imply an offering of securities. 1.0 Executive Summary 1 Chart: Highlights 2 1.1 Objectives 2 1.2 Mission 2 1.3 Keys to Success 3 2.0 Company Summary 3 2.1 Company Ownership 3 2.2 Company History 3 Table: Past Performance 4 Chart: Past Performance 5 3.0 Services 6 4.0 Market Analysis Summary 7 4.1 Market Segmentation 7 Table: Market Analysis 8 Chart: Market Analysis (Pie) 8 4.2 Target Market Segment Strategy 9 4.3 Service Business Analysis 9 4.3.1 Competition and Buying Patterns 9 5.0 Strategy and Implementation Summary 10 5.1 SWOT Analysis 10 5.1.1 Strengths 10 5.1.2 Weaknesses 10 5.1.3 Opportunities 10 5.1.4 Threats 10 5.2 Competitive Edge 11 5.3 Marketing Strategy 11 5.4 Sales Strategy 11 5.4.1 Sales Forecast 12 Table: Sales Forecast 12 Chart: Sales Monthly 13 Chart: Sales by Year 13 5.5 Milestones 14 Table: Milestones 14 Chart: Milestones 15 6.0 Management Summary 16 6.1 Personnel Plan 16 Table: Personnel 16 7.0 Financial Plan 17 7.1 Important Assumptions 17 7.2 Break-even Analysis 17 Table: Break-even Analysis 17 Chart: Break-even Analysis 18 7.3 Projected Profit and Loss 18 Table: Profit and Loss 19 Chart: Profit Monthly 20 Chart: Profit Yearly 20 Chart: Gross Margin Monthly 21 Chart: Gross Margin Yearly 21 7.4 Projected Cash Flow 22 Table: Cash Flow 22 Chart: Cash 23 7.5 Projected Balance Sheet 24 Table: Balance Sheet 24 7.6 Business Ratios 25 Table: Ratios 25 Table: Sales Forecast 1 Table: Personnel 2 Table: Personnel 2 Table: Profit and Loss 3 Table: Profit and Loss 3 Table: Cash Flow 4 Table: Cash Flow 4 Table: Balance Sheet 5 Table: Balance Sheet 5 1.0 Executive Summary [YOUR COMPANY NAME] is a successful accounting and tax preparation service owned and supervised by [YOUR NAME] in [YOUR CITY], [YOUR STATE/PROVINCE]. The firm offers tax preparation and planning, accounting, payroll, unemployment consulting, personal household budgeting, loan analysis, product management and marketing, as well as QuickBooks training and support. The business will expand its services to include three new offices in Elkhart County and financial education classes, on how to budget and manage debt. Additionally, the company will add an equipment leasing website database, to assist local companies in procuring expensive manufacturing related equipment on a part-time basis from one another. This will require an investment in the form of a $560,000 grant. The company is requesting this grant to be used throughout the plan's period of three years and beyond, to complete its expansion. This business plan organizes the strategy and tactics for the business' growth over the next three years. The business will offer clients accounting services with the oversight of an experienced accountant at a price they can afford. To do this involves hiring additional accountants, tax preparers (staff accountants) and accounting managers. It will also need to keep fixed costs as low as possible and continuing to define the expertise of the company through its financial education courses and leasing website resources. The effects will allow sales to grow substantially over the three years; as 18 staff accountants are deployed to clients, as needed, while two officer managers and a regional officer manager supervise the Elkhart County operations. The principal and an additional salesperson will operate the leasing equipment database division, while the financial education courses will utilize a dedicated instructor. Chart: Highlights 1.1 Objectives [YOUR COMPANY NAME] seeks to launch two new lines of services to add to its individual and small business tax and accounting firm. They include financial education classes and a manufacturing leasing service, which will be offered to the same ongoing clients and to its new client base in [CITY] as it adds three new offices there. [YOUR COMPANY NAME] has set the following objectives: To launch it's accounting services in new offices in [YOUR CITY] and throughout [YOUR STATE/PROVINCE] To achieve substantially greater annual revenues within three years To hire two seasoned accounting mangers, a salesperson, for the leasing division, and a teacher, for the course offering by 2011 To employ a total of 18 staff accountants and add one more manager by the end of 2012. 1.2 Mission [YOUR COMPANY NAME] seeks to provide tax, accounting and consulting services at a more affordable cost to individual and small businesses in both [CITY] and [CITY] in [YOUR STATE/PROVINCE]. It will also offer budgeting and debt consulting courses to the public, allowing students to make valuable financial management decisions from their numbers. By the end of 2012 it plans to have an additional 3 offices and add 17 employees; eventually seeking to expand its operations to 10 offices and 50 employees. The focus on community proliferation will intensify to include a new website database to allow businesses save while lease manufacturing related equipment on a part-time basis from each other. 1.3 Keys to Success The keys to success for [YOUR COMPANY NAME] are: Continue to build trust within the community through financial education classes Maintaining up-to-date technologies and education on accounting practices and laws Create jobs and profits for clientele through the website for manufactures' Adhering to ethical practices when it comes to transparency, reporting, and taxes 2.0 Company Summary [YOUR COMPANY NAME] , established in 2006 by [YOUR NAME], is a firm that provides tax services, accounting, cost consulting, and QuickBooks and budget management training. Its clients are individuals and small businesses in [CITY], [YOUR STATE/PROVINCE] region. [YOUR COMPANY NAME] plans to add a manufactures' leasing exchange website and financial education classes to its suite of offerings to better serve its current and future clients, and the community as a whole. 2.1 Company Ownership [YOUR NAME] is founder and 100% owner of [YOUR COMPANY NAME]; a sole proprietorship. 2.2 Company History Founded by [YOUR NAME] in 2006, [YOUR COMPANY NAME] has transformed from a part-time operation to becoming, in 2009, a full-time endeavor for [NAME]. The company has since added a debt reduction website and finance education to its line of tax and accounting services. [YOUR COMPANY NAME] has grown significantly in the past three years from $8,107 to $138,720 in total annual revenue, but has had difficulty taking on additional work due to its singular location and because about 40% of its clients commute from neighboring Elkhart County; thus the need for offices outside of Lagrange County. The business continues to operate from one location in Lagrange County and has grown to 6 employees. Table: Past Performance Past Performance 2007 2008 2009 Sales $8,107 $37,187 $138,720 Gross Margin $8,107 $37,187 $138,720 Gross Margin % 100.00% 100.00% 100

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This tax preparation company business plan template has 35 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our tax preparation company business plan template:

Confidentiality Agreement The undersigned reader acknowledges that the information provided by [YOUR COMPANY NAME] in this business plan is confidential; therefore, reader agrees not to disclose it without the express written permission of [YOUR COMPANY NAME]. It is acknowledged by reader that information to be furnished in this business plan is in all respects confidential in nature, other than information which is in the public domain through other means and that any disclosure or use of same by reader, may cause serious harm or damage to [YOUR COMPANY NAME]. Upon request, this document is to be immediately returned to [YOUR COMPANY NAME]. ___________________ Signature ___________________ Name (typed or printed) ___________________ Date This is a business plan. It does not imply an offering of securities. 1.0 Executive Summary 1 Chart: Highlights 2 1.1 Objectives 2 1.2 Mission 2 1.3 Keys to Success 3 2.0 Company Summary 3 2.1 Company Ownership 3 2.2 Company History 3 Table: Past Performance 4 Chart: Past Performance 5 3.0 Services 6 4.0 Market Analysis Summary 7 4.1 Market Segmentation 7 Table: Market Analysis 8 Chart: Market Analysis (Pie) 8 4.2 Target Market Segment Strategy 9 4.3 Service Business Analysis 9 4.3.1 Competition and Buying Patterns 9 5.0 Strategy and Implementation Summary 10 5.1 SWOT Analysis 10 5.1.1 Strengths 10 5.1.2 Weaknesses 10 5.1.3 Opportunities 10 5.1.4 Threats 10 5.2 Competitive Edge 11 5.3 Marketing Strategy 11 5.4 Sales Strategy 11 5.4.1 Sales Forecast 12 Table: Sales Forecast 12 Chart: Sales Monthly 13 Chart: Sales by Year 13 5.5 Milestones 14 Table: Milestones 14 Chart: Milestones 15 6.0 Management Summary 16 6.1 Personnel Plan 16 Table: Personnel 16 7.0 Financial Plan 17 7.1 Important Assumptions 17 7.2 Break-even Analysis 17 Table: Break-even Analysis 17 Chart: Break-even Analysis 18 7.3 Projected Profit and Loss 18 Table: Profit and Loss 19 Chart: Profit Monthly 20 Chart: Profit Yearly 20 Chart: Gross Margin Monthly 21 Chart: Gross Margin Yearly 21 7.4 Projected Cash Flow 22 Table: Cash Flow 22 Chart: Cash 23 7.5 Projected Balance Sheet 24 Table: Balance Sheet 24 7.6 Business Ratios 25 Table: Ratios 25 Table: Sales Forecast 1 Table: Personnel 2 Table: Personnel 2 Table: Profit and Loss 3 Table: Profit and Loss 3 Table: Cash Flow 4 Table: Cash Flow 4 Table: Balance Sheet 5 Table: Balance Sheet 5 1.0 Executive Summary [YOUR COMPANY NAME] is a successful accounting and tax preparation service owned and supervised by [YOUR NAME] in [YOUR CITY], [YOUR STATE/PROVINCE]. The firm offers tax preparation and planning, accounting, payroll, unemployment consulting, personal household budgeting, loan analysis, product management and marketing, as well as QuickBooks training and support. The business will expand its services to include three new offices in Elkhart County and financial education classes, on how to budget and manage debt. Additionally, the company will add an equipment leasing website database, to assist local companies in procuring expensive manufacturing related equipment on a part-time basis from one another. This will require an investment in the form of a $560,000 grant. The company is requesting this grant to be used throughout the plan's period of three years and beyond, to complete its expansion. This business plan organizes the strategy and tactics for the business' growth over the next three years. The business will offer clients accounting services with the oversight of an experienced accountant at a price they can afford. To do this involves hiring additional accountants, tax preparers (staff accountants) and accounting managers. It will also need to keep fixed costs as low as possible and continuing to define the expertise of the company through its financial education courses and leasing website resources. The effects will allow sales to grow substantially over the three years; as 18 staff accountants are deployed to clients, as needed, while two officer managers and a regional officer manager supervise the Elkhart County operations. The principal and an additional salesperson will operate the leasing equipment database division, while the financial education courses will utilize a dedicated instructor. Chart: Highlights 1.1 Objectives [YOUR COMPANY NAME] seeks to launch two new lines of services to add to its individual and small business tax and accounting firm. They include financial education classes and a manufacturing leasing service, which will be offered to the same ongoing clients and to its new client base in [CITY] as it adds three new offices there. [YOUR COMPANY NAME] has set the following objectives: To launch it's accounting services in new offices in [YOUR CITY] and throughout [YOUR STATE/PROVINCE] To achieve substantially greater annual revenues within three years To hire two seasoned accounting mangers, a salesperson, for the leasing division, and a teacher, for the course offering by 2011 To employ a total of 18 staff accountants and add one more manager by the end of 2012. 1.2 Mission [YOUR COMPANY NAME] seeks to provide tax, accounting and consulting services at a more affordable cost to individual and small businesses in both [CITY] and [CITY] in [YOUR STATE/PROVINCE]. It will also offer budgeting and debt consulting courses to the public, allowing students to make valuable financial management decisions from their numbers. By the end of 2012 it plans to have an additional 3 offices and add 17 employees; eventually seeking to expand its operations to 10 offices and 50 employees. The focus on community proliferation will intensify to include a new website database to allow businesses save while lease manufacturing related equipment on a part-time basis from each other. 1.3 Keys to Success The keys to success for [YOUR COMPANY NAME] are: Continue to build trust within the community through financial education classes Maintaining up-to-date technologies and education on accounting practices and laws Create jobs and profits for clientele through the website for manufactures' Adhering to ethical practices when it comes to transparency, reporting, and taxes 2.0 Company Summary [YOUR COMPANY NAME] , established in 2006 by [YOUR NAME], is a firm that provides tax services, accounting, cost consulting, and QuickBooks and budget management training. Its clients are individuals and small businesses in [CITY], [YOUR STATE/PROVINCE] region. [YOUR COMPANY NAME] plans to add a manufactures' leasing exchange website and financial education classes to its suite of offerings to better serve its current and future clients, and the community as a whole. 2.1 Company Ownership [YOUR NAME] is founder and 100% owner of [YOUR COMPANY NAME]; a sole proprietorship. 2.2 Company History Founded by [YOUR NAME] in 2006, [YOUR COMPANY NAME] has transformed from a part-time operation to becoming, in 2009, a full-time endeavor for [NAME]. The company has since added a debt reduction website and finance education to its line of tax and accounting services. [YOUR COMPANY NAME] has grown significantly in the past three years from $8,107 to $138,720 in total annual revenue, but has had difficulty taking on additional work due to its singular location and because about 40% of its clients commute from neighboring Elkhart County; thus the need for offices outside of Lagrange County. The business continues to operate from one location in Lagrange County and has grown to 6 employees. Table: Past Performance Past Performance 2007 2008 2009 Sales $8,107 $37,187 $138,720 Gross Margin $8,107 $37,187 $138,720 Gross Margin % 100.00% 100.00% 100

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

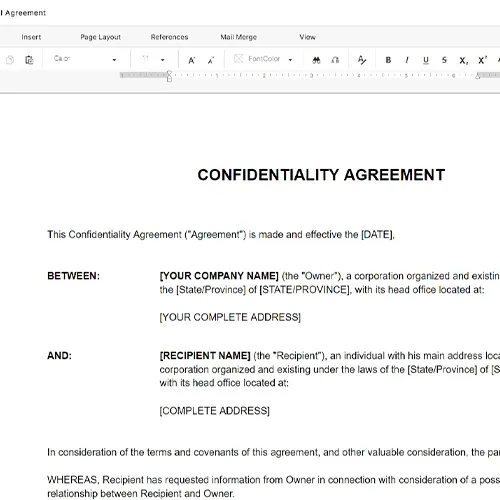

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.