Subordination Agreement Template

Understanding a Subordination Agreement Template

Get a subordination agreement template that establishes one debt positioned behind another in priority for collecting repayment from a debtor.

What is a Subordination Agreement?

A subordination agreement is a type of financial document that has to do with the priority of debt payments. It has very broad uses in the world of mortgages and the lending of money to individuals, but it also has some applications in the business world, and as we will see, it is very important for businesses to understand to put it in practice.

To understand what subordination agreement templates do, we need to first understand how loans work. Let’s first explain the case of a mortgage refinancing. Let’s say that Bank 1 lends $150K to a person to buy their home, and finances it at a certain rate. For some reason, it is convenient for the person to refinance the mortgage with Bank 2, who agrees to do so, but only if Bank 1 signs a subordination agreement.

Why is this the case? A subordination agreement serves the purpose of changing the priority of the lien between the lenders. The lien is the right to sell the asset, in this case, the house of the person that took the mortgage, in case they are not able to meet the obligations of the loan contract.

This is the case for the mortgage, but in companies and businesses, a subordination agreement template is required when you, as a borrower, need to refinance your debt for any reason (usually interest rates being better, after taking out a fixed-rate loan), and you need to have this subordination agreement signed by the two lending parties for you to take advantage of refinancing. Having this agreement ready under your belt can speed up the process for you to reap the benefits and improve your debt situation with a simple refinancing deal.

In Which Cases Do You Need a Subordination Agreement?

This question is like asking: when do you need to refinance your debt? Because, in the case of a company seeking leverage for a new project to create value, any chance you take to get better conditions in your debt has direct impacts in your profit/loss statements and will generate better financial results over time.

The cases in which you would need to refinance your debt are when interest rates favor a refinancing. These interest rates fluctuate regularly, but macroeconomic factors can impact the rates very substantially, and in some cases, the interest rates may go down to a point where the interest you pay on your loan will be substantially less, in which case, a subordination agreement template would be necessary to have your banks sign to refinance your debt.

Additionally, if you feel that any bank has practices that you do not like, or simply want to take your business to a single lender for convenience or any other situations, a subordination agreement is very necessary to have your debt transferred to your preferred financial institution.

Subordination Agreement Template Overview

Using a subordination agreement is complex, because the financial aspects of it, and the involvement of the distinct parties involved is quite difficult to understand and effectively use without a knowledgeable legal team. The business and legal templates within Business-in-a-box can bring a robust understanding of the legal and financial environments and give you simple to use templates for all the paperwork you require.

Whether you need to refinance debt due to a favorable change in interest rates, a better relationship with a bank, or due to any other reason that may show up in your business, in the following sections, we will show you the key parts of subordination agreement templates, so that you are more familiar with what you need, and you can pick the best option out of our multiple subordination agreement templates.

How to Write a Subordination Agreement

In the next section of this article, we will show and explain the sections and clauses of a subordination agreement template so that you can better understand the legal details of this particularly useful finance document, that surprisingly, not many people know of.

Keep in mind that the whole purpose, summed up in quite simple terms, is just a contract like that issued to an employee, only that this is shorter term, and is pertinent to a specific task. This sort of financial technical paperwork that involves debt, collaterals, liens, and other concepts can get a little complex, and you can quickly get stuck up in the details if you do not have a template made for you beforehand.

A useful thing to keep in mind is that the whole purpose of a subordination agreement is to transfer the “first in line right” from your original lender to a new one if anything goes wrong with the fulfillment of the obligations of the debt contract. It passes the priority of receiving the funds in case of an asset liquidation to the next lender that has a specific characteristic that makes you want to transfer your debt.

In the following section, we will explain the subordination agreement template sample parts in a detailed fashion, so that you understand the most important clauses and sections.

Subordination Agreement Template Sample

1. Definition

Just like with any other contract, yours should start with the definitions. Here you will need to include all the terminology used throughout the rest of the document, this will allow you to clarify any uncertainty that might arise when you refer to the “Holders” or the “Obligors”. Be clear but concise, this will help you to easily address your points without the need for backtracking for explanations.

Even if it seems simple, it is one of the most difficult parts of writing an agreement due to the extensive amount of terminology and knowledge needed to correctly identify and describe each actor and their role.

2. Agreement to Subordinate

This clause is the central part of the agreement, in short, here you will describe the subordinated obligations that are set upon the initial lender to the obligor while talking about the initial payment, and how you as the borrower will then guarantee the payment of said loans to the new party for the refinancing. In other words, here you will ensure that both parties are bound by the agreement by surrendering the default of the loan if you, as the borrower, are not capable of its repayment.

It is one of the more complex clauses since it involves a multitude of parties and the description of how they are intertwined with one another. All of this while ensuring that both the lender and the obligor are compensated and that you, as the borrower, are still bound to a new loan agreement.

3. Reorganization

The reorganization clause focuses on the hypotheticals, it details the protocol that should be followed should the borrowing party change ownership or in the case of a financial restructuring. It aims to protect the lenders, so that their right to their initial investment, along with the interest rate, is still their own even if any restructuring should occur on the other party’s end.

- Bounds the borrowing party to fulfill the full payment.

- The subordinated creditors may issue a payment request. This may vary, as it is also common for the creditors to be able to collect the deliverable payments.

4. Restrictions on Payments and Actions

The Restrictions on Payments and Actions clause is all about defaulting or inability to fulfill the borrower's subordinated obligations in respect of the initial agreement. In this clause, the parties will agree on the steps that should be taken in case of default as well as what the compensations are in several different cases depending on the extent of the effects.

5. Negative Covenants of the Subordinated Creditors

As for the Negative Covenants of the Subordinated Creditors section, if the payment has not been fully covered, it prevents the creditors from cashing on a variety of benefits, which may include:

- Receive any benefits of any lien in order concerning the subordinated obligations.

- Receive any benefits of any guarantee to secure any subordinated obligations.

- Subordinate an additional security interest.

7. Unconditional Obligations

As its name suggests, this section highlights the unconditional obligations of both the Subordinated Creditors and the Obligors legally bound to the agreement. It discusses matters from what is expected when talking about the term, manner, and place of the payment, as well as a notification system, should any of the established mechanisms change. Any protection requirements as well as all other notices are represented and clarified to maintain a fruitful relationship between parties.

8. Subrogation

This section describes the right that the lender reserves to legally pursue the borrower should an insurance loss be insured. This way the leading party is legally bound to have a way to claim on their investment should the senior obligations not have yet been fully paid.

It is an optional clause that is used most when talking about property and to ensure that settlements under insurance policy go without issue.

9. Severability

The severability clause is not brief and simple and is one of the few that is not specific to subordination agreement templates but instead is usually included in most legally binding documents. What it does, is it states that each clause is separate from the whole and that if an external entity, usually a jury, deems a particular section invalid that the rest of the contract, by this clause of severability, still stands functional and legally binding until the term is reached or if it is absolved in any other way. This section is not difficult to implement, but due to its importance, it must be professionally written and structured to ensure your legal security.

10. Jurisdiction

This last component is also optional but can also be useful. The jurisdiction section binds this agreement to a single state/country, this is commonly referred to as an exclusive jurisdiction clause, where both parties agree to choose their jurisdiction, most of the time due to preferred judicial system or the specific method of law enforcement.

Business-in-a-Box has a collection of over 2,000 high quality legal document templates, such as this subordination agreement template. Sign up to get full access to the documents that will kickstart your business.

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Understanding a Subordination Agreement Template

Get a subordination agreement template that establishes one debt positioned behind another in priority for collecting repayment from a debtor.

What is a Subordination Agreement?

A subordination agreement is a type of financial document that has to do with the priority of debt payments. It has very broad uses in the world of mortgages and the lending of money to individuals, but it also has some applications in the business world, and as we will see, it is very important for businesses to understand to put it in practice.

To understand what subordination agreement templates do, we need to first understand how loans work. Let’s first explain the case of a mortgage refinancing. Let’s say that Bank 1 lends $150K to a person to buy their home, and finances it at a certain rate. For some reason, it is convenient for the person to refinance the mortgage with Bank 2, who agrees to do so, but only if Bank 1 signs a subordination agreement.

Why is this the case? A subordination agreement serves the purpose of changing the priority of the lien between the lenders. The lien is the right to sell the asset, in this case, the house of the person that took the mortgage, in case they are not able to meet the obligations of the loan contract.

This is the case for the mortgage, but in companies and businesses, a subordination agreement template is required when you, as a borrower, need to refinance your debt for any reason (usually interest rates being better, after taking out a fixed-rate loan), and you need to have this subordination agreement signed by the two lending parties for you to take advantage of refinancing. Having this agreement ready under your belt can speed up the process for you to reap the benefits and improve your debt situation with a simple refinancing deal.

In Which Cases Do You Need a Subordination Agreement?

This question is like asking: when do you need to refinance your debt? Because, in the case of a company seeking leverage for a new project to create value, any chance you take to get better conditions in your debt has direct impacts in your profit/loss statements and will generate better financial results over time.

The cases in which you would need to refinance your debt are when interest rates favor a refinancing. These interest rates fluctuate regularly, but macroeconomic factors can impact the rates very substantially, and in some cases, the interest rates may go down to a point where the interest you pay on your loan will be substantially less, in which case, a subordination agreement template would be necessary to have your banks sign to refinance your debt.

Additionally, if you feel that any bank has practices that you do not like, or simply want to take your business to a single lender for convenience or any other situations, a subordination agreement is very necessary to have your debt transferred to your preferred financial institution.

Subordination Agreement Template Overview

Using a subordination agreement is complex, because the financial aspects of it, and the involvement of the distinct parties involved is quite difficult to understand and effectively use without a knowledgeable legal team. The business and legal templates within Business-in-a-box can bring a robust understanding of the legal and financial environments and give you simple to use templates for all the paperwork you require.

Whether you need to refinance debt due to a favorable change in interest rates, a better relationship with a bank, or due to any other reason that may show up in your business, in the following sections, we will show you the key parts of subordination agreement templates, so that you are more familiar with what you need, and you can pick the best option out of our multiple subordination agreement templates.

How to Write a Subordination Agreement

In the next section of this article, we will show and explain the sections and clauses of a subordination agreement template so that you can better understand the legal details of this particularly useful finance document, that surprisingly, not many people know of.

Keep in mind that the whole purpose, summed up in quite simple terms, is just a contract like that issued to an employee, only that this is shorter term, and is pertinent to a specific task. This sort of financial technical paperwork that involves debt, collaterals, liens, and other concepts can get a little complex, and you can quickly get stuck up in the details if you do not have a template made for you beforehand.

A useful thing to keep in mind is that the whole purpose of a subordination agreement is to transfer the “first in line right” from your original lender to a new one if anything goes wrong with the fulfillment of the obligations of the debt contract. It passes the priority of receiving the funds in case of an asset liquidation to the next lender that has a specific characteristic that makes you want to transfer your debt.

In the following section, we will explain the subordination agreement template sample parts in a detailed fashion, so that you understand the most important clauses and sections.

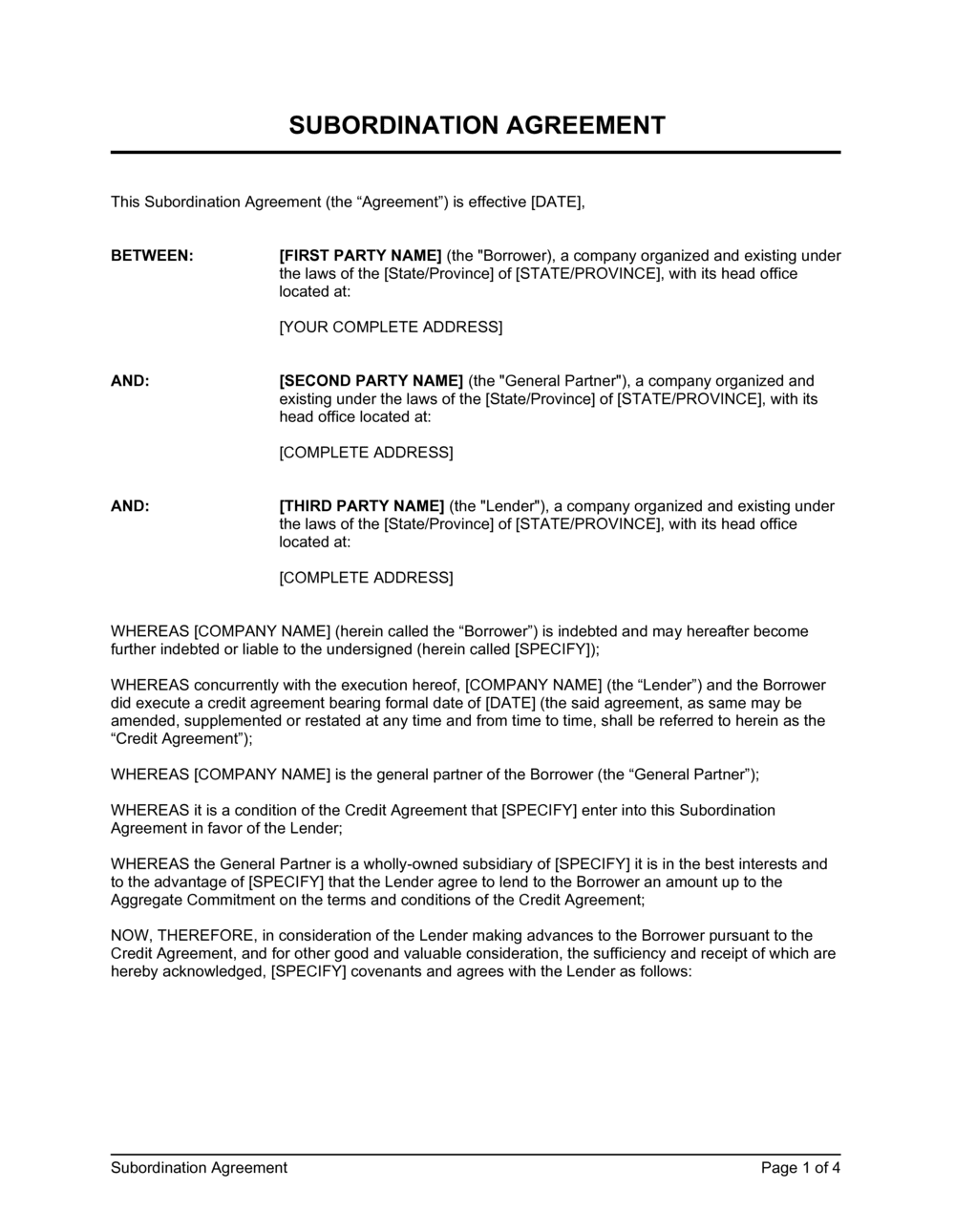

Subordination Agreement Template Sample

1. Definition

Just like with any other contract, yours should start with the definitions. Here you will need to include all the terminology used throughout the rest of the document, this will allow you to clarify any uncertainty that might arise when you refer to the “Holders” or the “Obligors”. Be clear but concise, this will help you to easily address your points without the need for backtracking for explanations.

Even if it seems simple, it is one of the most difficult parts of writing an agreement due to the extensive amount of terminology and knowledge needed to correctly identify and describe each actor and their role.

2. Agreement to Subordinate

This clause is the central part of the agreement, in short, here you will describe the subordinated obligations that are set upon the initial lender to the obligor while talking about the initial payment, and how you as the borrower will then guarantee the payment of said loans to the new party for the refinancing. In other words, here you will ensure that both parties are bound by the agreement by surrendering the default of the loan if you, as the borrower, are not capable of its repayment.

It is one of the more complex clauses since it involves a multitude of parties and the description of how they are intertwined with one another. All of this while ensuring that both the lender and the obligor are compensated and that you, as the borrower, are still bound to a new loan agreement.

3. Reorganization

The reorganization clause focuses on the hypotheticals, it details the protocol that should be followed should the borrowing party change ownership or in the case of a financial restructuring. It aims to protect the lenders, so that their right to their initial investment, along with the interest rate, is still their own even if any restructuring should occur on the other party’s end.

- Bounds the borrowing party to fulfill the full payment.

- The subordinated creditors may issue a payment request. This may vary, as it is also common for the creditors to be able to collect the deliverable payments.

4. Restrictions on Payments and Actions

The Restrictions on Payments and Actions clause is all about defaulting or inability to fulfill the borrower's subordinated obligations in respect of the initial agreement. In this clause, the parties will agree on the steps that should be taken in case of default as well as what the compensations are in several different cases depending on the extent of the effects.

5. Negative Covenants of the Subordinated Creditors

As for the Negative Covenants of the Subordinated Creditors section, if the payment has not been fully covered, it prevents the creditors from cashing on a variety of benefits, which may include:

- Receive any benefits of any lien in order concerning the subordinated obligations.

- Receive any benefits of any guarantee to secure any subordinated obligations.

- Subordinate an additional security interest.

7. Unconditional Obligations

As its name suggests, this section highlights the unconditional obligations of both the Subordinated Creditors and the Obligors legally bound to the agreement. It discusses matters from what is expected when talking about the term, manner, and place of the payment, as well as a notification system, should any of the established mechanisms change. Any protection requirements as well as all other notices are represented and clarified to maintain a fruitful relationship between parties.

8. Subrogation

This section describes the right that the lender reserves to legally pursue the borrower should an insurance loss be insured. This way the leading party is legally bound to have a way to claim on their investment should the senior obligations not have yet been fully paid.

It is an optional clause that is used most when talking about property and to ensure that settlements under insurance policy go without issue.

9. Severability

The severability clause is not brief and simple and is one of the few that is not specific to subordination agreement templates but instead is usually included in most legally binding documents. What it does, is it states that each clause is separate from the whole and that if an external entity, usually a jury, deems a particular section invalid that the rest of the contract, by this clause of severability, still stands functional and legally binding until the term is reached or if it is absolved in any other way. This section is not difficult to implement, but due to its importance, it must be professionally written and structured to ensure your legal security.

10. Jurisdiction

This last component is also optional but can also be useful. The jurisdiction section binds this agreement to a single state/country, this is commonly referred to as an exclusive jurisdiction clause, where both parties agree to choose their jurisdiction, most of the time due to preferred judicial system or the specific method of law enforcement.

Business-in-a-Box has a collection of over 2,000 high quality legal document templates, such as this subordination agreement template. Sign up to get full access to the documents that will kickstart your business.

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.