Stock Compensation Agreement Template

Document content

This stock compensation agreement template has 4 pages and is a MS Word file type listed under our business plan kit documents.

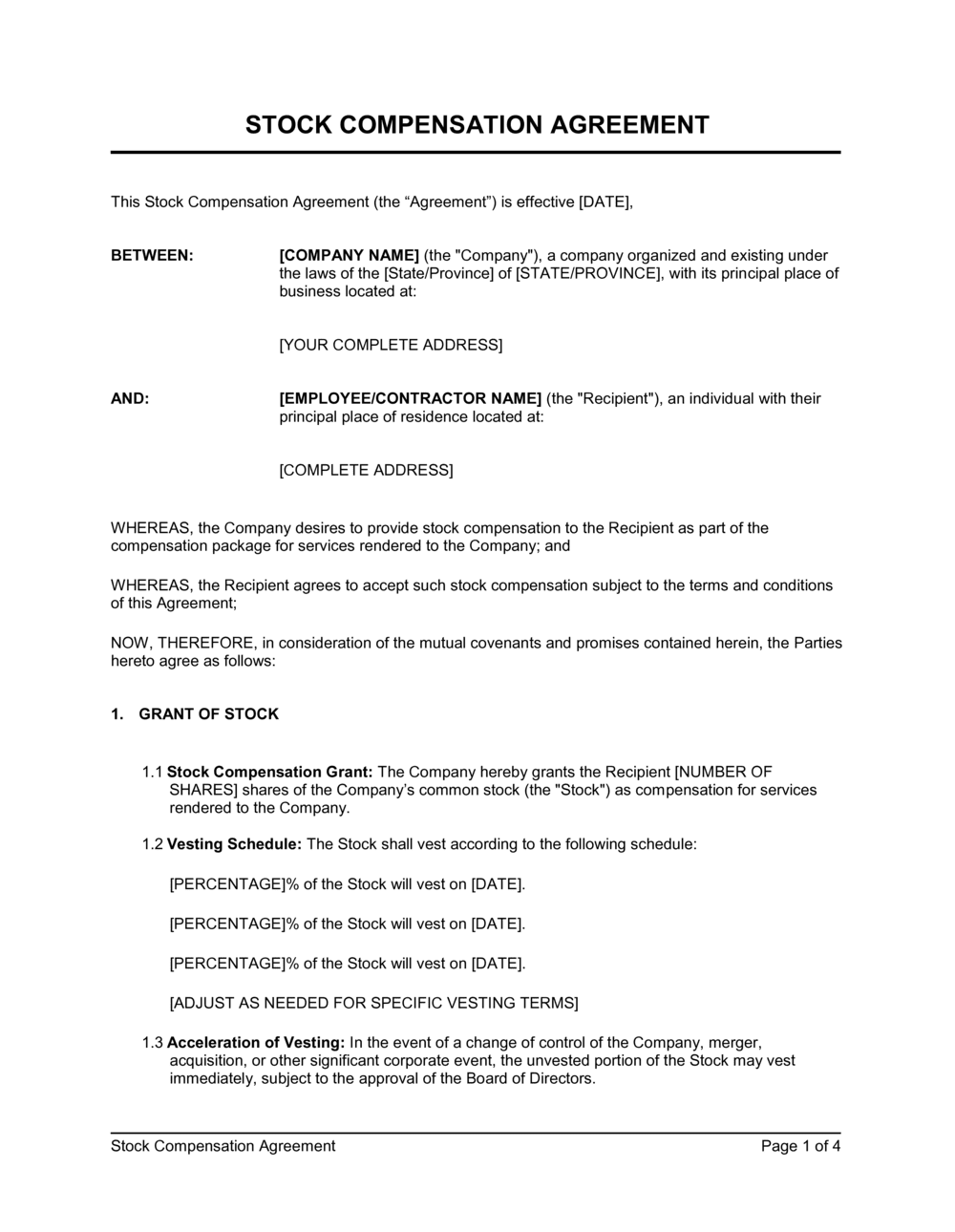

Sample of our stock compensation agreement template:

STOCK COMPENSATION AGREEMENT This Stock Compensation Agreement (the "Agreement") is effective [DATE], BETWEEN: [COMPANY NAME] (the "Company"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its principal place of business located at: [YOUR COMPLETE ADDRESS] AND: [EMPLOYEE/CONTRACTOR NAME] (the "Recipient"), an individual with their principal place of residence located at: [COMPLETE ADDRESS] WHEREAS, the Company desires to provide stock compensation to the Recipient as part of the compensation package for services rendered to the Company; and WHEREAS, the Recipient agrees to accept such stock compensation subject to the terms and conditions of this Agreement; NOW, THEREFORE, in consideration of the mutual covenants and promises contained herein, the Parties hereto agree as follows: GRANT OF STOCK Stock Compensation Grant: The Company hereby grants the Recipient [NUMBER OF SHARES] shares of the Company's common stock (the "Stock") as compensation for services rendered to the Company. Vesting Schedule: The Stock shall vest according to the following schedule: [PERCENTAGE]% of the Stock will vest on [DATE]. [PERCENTAGE]% of the Stock will vest on [DATE]. [PERCENTAGE]% of the Stock will vest on [DATE]. [ADJUST AS NEEDED FOR SPECIFIC VESTING TERMS] Acceleration of Vesting: In the event of a change of control of the Company, merger, acquisition, or other significant corporate event, the unvested portion of the Stock may vest immediately, subject to the approval of the Board of Directors. RIGHTS AND RESTRICTIONS 2.1 Shareholder Rights: The Recipient shall have no shareholder rights with respect to any unvested shares of Stock. Once the shares vest, the Recipient will have all the rights of a shareholder, including voting rights and the right to receive dividends. 2.2 Restrictions on Transfer: The Stock granted under this Agreement may not be sold, transferred, assigned, pledged, or otherwise encumbered, except in accordance with the terms of this Agreement and applicable securities laws. 2.3 Lock-Up Period: The Recipient agrees not to sell or transfer any vested shares of Stock for a period of [NUMBER OF MONTHS/YEARS] months/years following the date of this Agreement, except as permitted by the Company or as required by law. TAX LIABILITY 3.1 Tax Withholding: The Recipient acknowledges that the Company may be required to withhold taxes in connection with the grant or vesting of the Stock. The Company will withhold such taxes in accordance with applicable tax laws. 3.2 Recipient's Responsibility: The Recipient acknowledges that they are responsible for reporting and paying any taxes associated with the receipt, vesting, and sale of the Stock. The Company makes no guarantees regarding the tax treatment of the Stock. TERMINATION OF EMPLOYMENT 4.1 Termination for Cause: If the Recipient's employment or engagement with the Company is terminated for cause, any unvested shares of Stock will immediately be forfeited, and the Recipient shall have no further rights with respect to the forfeited shares. 4

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This stock compensation agreement template has 4 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our stock compensation agreement template:

STOCK COMPENSATION AGREEMENT This Stock Compensation Agreement (the "Agreement") is effective [DATE], BETWEEN: [COMPANY NAME] (the "Company"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its principal place of business located at: [YOUR COMPLETE ADDRESS] AND: [EMPLOYEE/CONTRACTOR NAME] (the "Recipient"), an individual with their principal place of residence located at: [COMPLETE ADDRESS] WHEREAS, the Company desires to provide stock compensation to the Recipient as part of the compensation package for services rendered to the Company; and WHEREAS, the Recipient agrees to accept such stock compensation subject to the terms and conditions of this Agreement; NOW, THEREFORE, in consideration of the mutual covenants and promises contained herein, the Parties hereto agree as follows: GRANT OF STOCK Stock Compensation Grant: The Company hereby grants the Recipient [NUMBER OF SHARES] shares of the Company's common stock (the "Stock") as compensation for services rendered to the Company. Vesting Schedule: The Stock shall vest according to the following schedule: [PERCENTAGE]% of the Stock will vest on [DATE]. [PERCENTAGE]% of the Stock will vest on [DATE]. [PERCENTAGE]% of the Stock will vest on [DATE]. [ADJUST AS NEEDED FOR SPECIFIC VESTING TERMS] Acceleration of Vesting: In the event of a change of control of the Company, merger, acquisition, or other significant corporate event, the unvested portion of the Stock may vest immediately, subject to the approval of the Board of Directors. RIGHTS AND RESTRICTIONS 2.1 Shareholder Rights: The Recipient shall have no shareholder rights with respect to any unvested shares of Stock. Once the shares vest, the Recipient will have all the rights of a shareholder, including voting rights and the right to receive dividends. 2.2 Restrictions on Transfer: The Stock granted under this Agreement may not be sold, transferred, assigned, pledged, or otherwise encumbered, except in accordance with the terms of this Agreement and applicable securities laws. 2.3 Lock-Up Period: The Recipient agrees not to sell or transfer any vested shares of Stock for a period of [NUMBER OF MONTHS/YEARS] months/years following the date of this Agreement, except as permitted by the Company or as required by law. TAX LIABILITY 3.1 Tax Withholding: The Recipient acknowledges that the Company may be required to withhold taxes in connection with the grant or vesting of the Stock. The Company will withhold such taxes in accordance with applicable tax laws. 3.2 Recipient's Responsibility: The Recipient acknowledges that they are responsible for reporting and paying any taxes associated with the receipt, vesting, and sale of the Stock. The Company makes no guarantees regarding the tax treatment of the Stock. TERMINATION OF EMPLOYMENT 4.1 Termination for Cause: If the Recipient's employment or engagement with the Company is terminated for cause, any unvested shares of Stock will immediately be forfeited, and the Recipient shall have no further rights with respect to the forfeited shares. 4

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.