Simplified Employee Pensions Plan Template

Document content

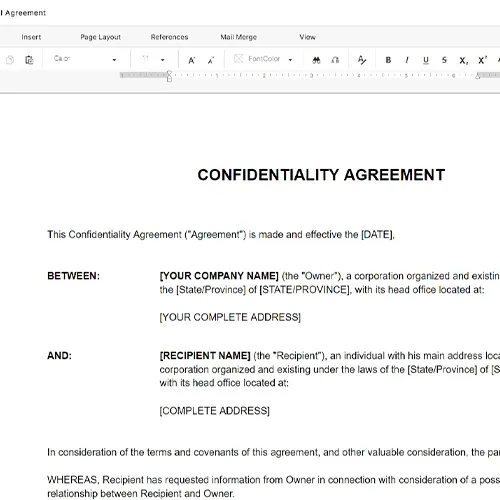

This simplified employee pensions plan template has 9 pages and is a MS Word file type listed under our human resources documents.

Sample of our simplified employee pensions plan template:

SIMPLIFIED EMPLOYEE PENSION PLAN The following document is a model simplified employee pension plan. At the end of a document is a sample salary reduction simplified employee plan, which is a SEP with a salary reduction feature tacked on. You can modify this form to meet your specific circumstances. Of course, if you intend to use this plan, you should make sure that your attorney reviews it and approves any changes you make. TABLE OF CONTENTS Article 1. Purpose 2. Definitions and Construction Definitions Principal Entities Determination of Contribution and Other Definitions Construction 3. Participation and Notifications Participation Notifications 4. Contributions Contributions by Participants Excess Contributions Maximum Employer Contributions 5. Benefits 6. Administration Fiduciary Responsibility Appointment of Committee Claims Procedure Records and Reports Other Committee Powers and Duties Rules and Decisions Notifications and Forms Indemnification of the Committee 7. Employer Rights Non-guarantee of Employment Action by Employer Choice of Simplified Employee Pension Amendments Successor Employer Right to Terminate Appendix A SEP allowing Salary Reduction SIMPLIFIED EMPLOYEE PENSION PLAN Purpose Effective as of [date plan goes into effect], to enable eligible employees to establish individual retirement accounts or individual retirement annuities [YOUR COMPANY NAME] (the "Employer") decided to adopt the Simplified Employee Pension Plan for Employees of [YOUR COMPANY NAME] (the "Plan"). The Plan is intended to meet the requirements of Section [NUMBER] of [CODE] (the "Code") as from time to time amended. The provisions of the Plan, as set forth herein, shall only apply to an eligible employee who is in the active employ of the Employer on or after [date of eligibility]. Definitions and Construction Definitions: Where the following words and phrases appear in this Plan, they shall have the respective meanings set forth in this Article, unless the context clearly indicates to the contrary. Principal Entities: Plan: The Simplified Employee Pension Plan for Employees for [YOUR COMPANY NAME], the Plan set forth herein, as amended from time to time. Simplified Employee Pension: The retirement savings vehicle chosen by a Participant for deposit of contributions made hereunder by the Employer. Such retirement savings vehicle may only be either an approved Individual Retirement Account under Section [NUMBER] of the [CODE]. Employer: [YOUR COMPANY NAME], a [legal status (i.e., a corporation)] organized and existing under the laws of the State of [name of state], or its successor or successors. Committee: The person or persons appointed pursuant to Section 6 to assist the Employer with Plan Administration in accordance with said Section. Employee: Any person who, on or after the Effective Date, is receiving remuneration for personal services rendered to the Employer. Participant: An Employee participating in the Plan in accordance with the provisions of Section 3.1. Fiduciaries: The Employer and the Committee, but only with respect to the specific responsibilities of each for Plan administration, all as described in Section 6.1. 2.3 Determination of Contribution and Other Definitions: Participation: The period or periods during which an Employee participates in this Plan as determined in accordance with Section 3.1. Compensation: The total of all amounts paid to a Participant for a given Year by the Employer for personal services and reported as wages for purposes of income tax, or substitute, less (1) amounts paid while covered by a collective bargaining agreement which does not provide for inclusion hereunder, (2) the cost of providing group term life insurance in excess of the statutory amount, (3) reimbursed moving expenses, (4) any other amount required to be reported which is not direct compensation for services performed and (5) amounts in excess of [AMOUNT]. Effective Date: [The effective date], the date on which the provisions of this Plan became effective. Year: The 12-month period commencing on January 1 and ending on December 31. Code: The [CODE], as amended from time to time. Construction: The masculine gender, where appearing in the Plan, shall be deemed to include the feminine gender, unless the context clearly indicates to the contrary. The words "hereof," "herein," "hereunder" and other similar compounds of the word "here" shall mean and refer to the entire Plan and not to any particular provision, Section or Article. Article and Section headings are for convenience of reference and not intended to add to or subtract from the terms of this Plan. Participation and Notifications Participation: Except for an Employee who, for the entire Year was covered by a collective bargaining agreement which does not provide for his inclusion hereunder, an Employee shall participate in the Plan for any Year in which he meets the following requirements: he attains age [AGE] or older he has performed services for the Employer at some time during the Year his Compensation for the Year is [AMOUNT] or greater, and the given Year is preceded by a [NUMBER]-year period that includes at least three Years in each of which he has performed services for the Employer at some time during the Year Notifications: The Committee shall notify an Employee in writing when he first becomes a Participant. Such notification shall include information required to be furnished by [AGENCY]. Such notification shall also advise the Participant that he should establish a Simplified Employee Pension and the date by which the establishment should be accomplished. If the Participant fails to notify the Committee of the establishment of a Simplified Employee Pension as of the prescribed date, the Committee shall choose a Simplified Employee Pension for such Participant and execute such forms and documents as may be necessary to establish a Simplified Employee Pension for and on behalf of such Participant. If the Participant's Simplified Employee Pension does not accept contributions for the Year in which the Participant attains age [AGE], the Committee shall choose a Simplified Employee Pension for such Participant, for such Year and succeeding Years unless the Participant notifies the Committee that he has chosen an alternate Simplified Employee Pension. Contributions NOTE: The following Section 4.1 incorporates the requirements of [CODE] regarding the permitted disparity in plan contributions. The contribution percentage for compensation above a certain level cannot exceed the contribution percentage on compensation below a certain level by more than the lesser of: the contribution percentage on compensation below a certain level, or the greater of: [%], or the percentage equal to the portion of the rate under [CODE] (in effect as of the beginning of the year) which is attributable to old-age insurance. Employer Contributions On and After [DATE]: Each Year the Employer shall determine whether or not a contribution will be made under the Plan for that Year. If the Employer determines that a contribution will be made for a Year, then, subject to the provisions of Section 4.4, the contribution made on behalf of each Employee who is a Participant for that Year shall be equal to: a percentage of Compensation, as determined by the Employer, payable to all Participants; to the extent any contribution has not been allocated under (a) above, an additional allocation shall be made to all Participants considering only their compensation in excess of the social security wage base for the Year. The percentage for any additional allocation under this Section 4.1(b) shall not exceed the lesser of: the percentage used under Section 4.1(a) above, or the greater of: [%], or

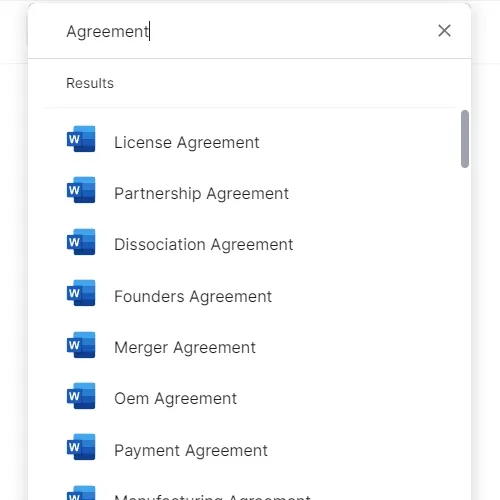

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This simplified employee pensions plan template has 9 pages and is a MS Word file type listed under our human resources documents.

Sample of our simplified employee pensions plan template:

SIMPLIFIED EMPLOYEE PENSION PLAN The following document is a model simplified employee pension plan. At the end of a document is a sample salary reduction simplified employee plan, which is a SEP with a salary reduction feature tacked on. You can modify this form to meet your specific circumstances. Of course, if you intend to use this plan, you should make sure that your attorney reviews it and approves any changes you make. TABLE OF CONTENTS Article 1. Purpose 2. Definitions and Construction Definitions Principal Entities Determination of Contribution and Other Definitions Construction 3. Participation and Notifications Participation Notifications 4. Contributions Contributions by Participants Excess Contributions Maximum Employer Contributions 5. Benefits 6. Administration Fiduciary Responsibility Appointment of Committee Claims Procedure Records and Reports Other Committee Powers and Duties Rules and Decisions Notifications and Forms Indemnification of the Committee 7. Employer Rights Non-guarantee of Employment Action by Employer Choice of Simplified Employee Pension Amendments Successor Employer Right to Terminate Appendix A SEP allowing Salary Reduction SIMPLIFIED EMPLOYEE PENSION PLAN Purpose Effective as of [date plan goes into effect], to enable eligible employees to establish individual retirement accounts or individual retirement annuities [YOUR COMPANY NAME] (the "Employer") decided to adopt the Simplified Employee Pension Plan for Employees of [YOUR COMPANY NAME] (the "Plan"). The Plan is intended to meet the requirements of Section [NUMBER] of [CODE] (the "Code") as from time to time amended. The provisions of the Plan, as set forth herein, shall only apply to an eligible employee who is in the active employ of the Employer on or after [date of eligibility]. Definitions and Construction Definitions: Where the following words and phrases appear in this Plan, they shall have the respective meanings set forth in this Article, unless the context clearly indicates to the contrary. Principal Entities: Plan: The Simplified Employee Pension Plan for Employees for [YOUR COMPANY NAME], the Plan set forth herein, as amended from time to time. Simplified Employee Pension: The retirement savings vehicle chosen by a Participant for deposit of contributions made hereunder by the Employer. Such retirement savings vehicle may only be either an approved Individual Retirement Account under Section [NUMBER] of the [CODE]. Employer: [YOUR COMPANY NAME], a [legal status (i.e., a corporation)] organized and existing under the laws of the State of [name of state], or its successor or successors. Committee: The person or persons appointed pursuant to Section 6 to assist the Employer with Plan Administration in accordance with said Section. Employee: Any person who, on or after the Effective Date, is receiving remuneration for personal services rendered to the Employer. Participant: An Employee participating in the Plan in accordance with the provisions of Section 3.1. Fiduciaries: The Employer and the Committee, but only with respect to the specific responsibilities of each for Plan administration, all as described in Section 6.1. 2.3 Determination of Contribution and Other Definitions: Participation: The period or periods during which an Employee participates in this Plan as determined in accordance with Section 3.1. Compensation: The total of all amounts paid to a Participant for a given Year by the Employer for personal services and reported as wages for purposes of income tax, or substitute, less (1) amounts paid while covered by a collective bargaining agreement which does not provide for inclusion hereunder, (2) the cost of providing group term life insurance in excess of the statutory amount, (3) reimbursed moving expenses, (4) any other amount required to be reported which is not direct compensation for services performed and (5) amounts in excess of [AMOUNT]. Effective Date: [The effective date], the date on which the provisions of this Plan became effective. Year: The 12-month period commencing on January 1 and ending on December 31. Code: The [CODE], as amended from time to time. Construction: The masculine gender, where appearing in the Plan, shall be deemed to include the feminine gender, unless the context clearly indicates to the contrary. The words "hereof," "herein," "hereunder" and other similar compounds of the word "here" shall mean and refer to the entire Plan and not to any particular provision, Section or Article. Article and Section headings are for convenience of reference and not intended to add to or subtract from the terms of this Plan. Participation and Notifications Participation: Except for an Employee who, for the entire Year was covered by a collective bargaining agreement which does not provide for his inclusion hereunder, an Employee shall participate in the Plan for any Year in which he meets the following requirements: he attains age [AGE] or older he has performed services for the Employer at some time during the Year his Compensation for the Year is [AMOUNT] or greater, and the given Year is preceded by a [NUMBER]-year period that includes at least three Years in each of which he has performed services for the Employer at some time during the Year Notifications: The Committee shall notify an Employee in writing when he first becomes a Participant. Such notification shall include information required to be furnished by [AGENCY]. Such notification shall also advise the Participant that he should establish a Simplified Employee Pension and the date by which the establishment should be accomplished. If the Participant fails to notify the Committee of the establishment of a Simplified Employee Pension as of the prescribed date, the Committee shall choose a Simplified Employee Pension for such Participant and execute such forms and documents as may be necessary to establish a Simplified Employee Pension for and on behalf of such Participant. If the Participant's Simplified Employee Pension does not accept contributions for the Year in which the Participant attains age [AGE], the Committee shall choose a Simplified Employee Pension for such Participant, for such Year and succeeding Years unless the Participant notifies the Committee that he has chosen an alternate Simplified Employee Pension. Contributions NOTE: The following Section 4.1 incorporates the requirements of [CODE] regarding the permitted disparity in plan contributions. The contribution percentage for compensation above a certain level cannot exceed the contribution percentage on compensation below a certain level by more than the lesser of: the contribution percentage on compensation below a certain level, or the greater of: [%], or the percentage equal to the portion of the rate under [CODE] (in effect as of the beginning of the year) which is attributable to old-age insurance. Employer Contributions On and After [DATE]: Each Year the Employer shall determine whether or not a contribution will be made under the Plan for that Year. If the Employer determines that a contribution will be made for a Year, then, subject to the provisions of Section 4.4, the contribution made on behalf of each Employee who is a Participant for that Year shall be equal to: a percentage of Compensation, as determined by the Employer, payable to all Participants; to the extent any contribution has not been allocated under (a) above, an additional allocation shall be made to all Participants considering only their compensation in excess of the social security wage base for the Year. The percentage for any additional allocation under this Section 4.1(b) shall not exceed the lesser of: the percentage used under Section 4.1(a) above, or the greater of: [%], or

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

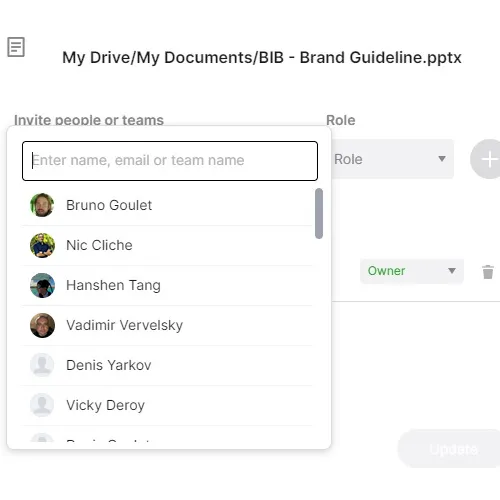

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.