Silent Partner Agreement Template

Document content

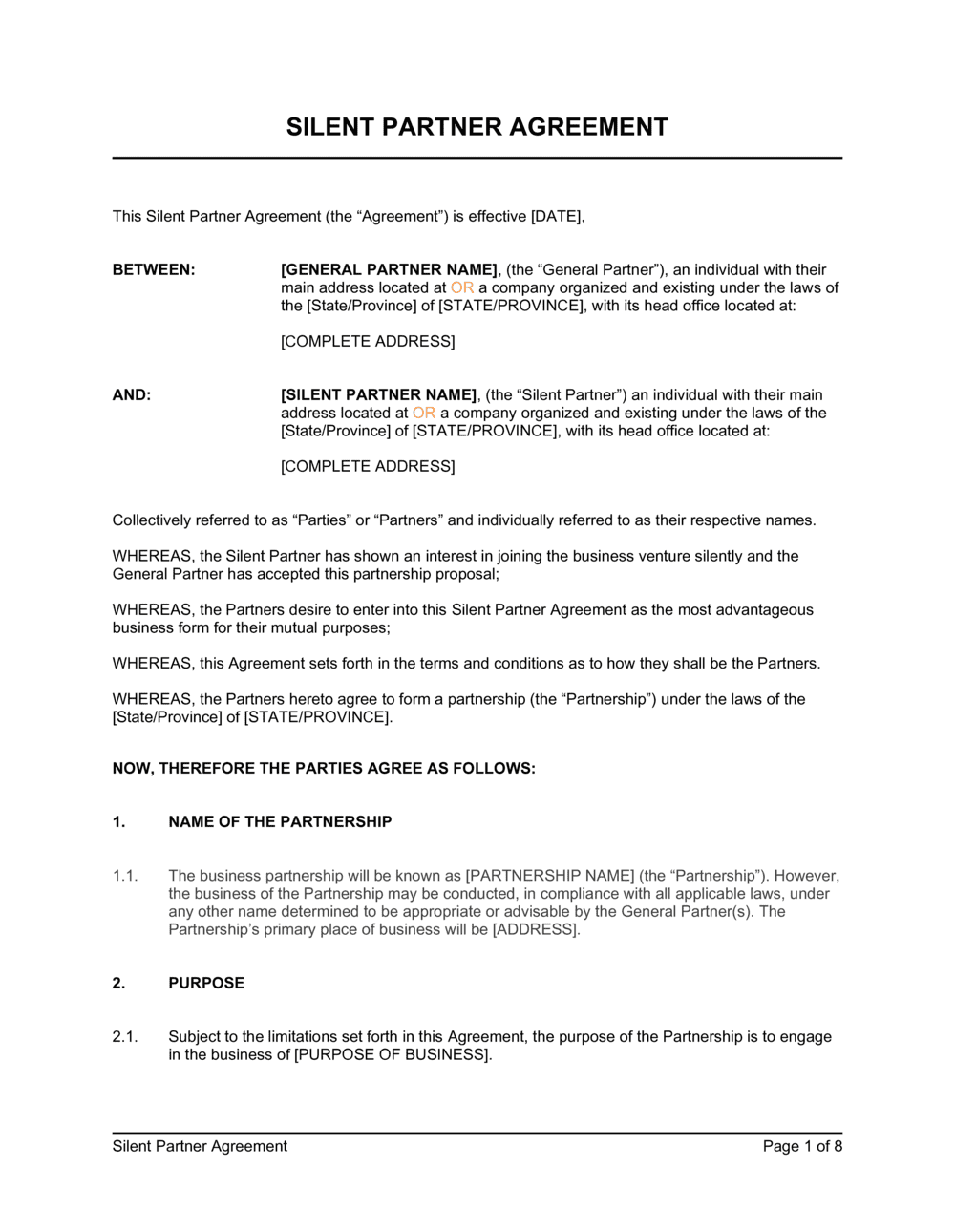

This silent partner agreement template has 8 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our silent partner agreement template:

SILENT PARTNER AGREEMENT This Silent Partner Agreement (the "Agreement") is effective [DATE], BETWEEN: [GENERAL PARTNER NAME], (the "General Partner"), an individual with their main address located at OR a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] AND: [SILENT PARTNER NAME], (the "Silent Partner") an individual with their main address located at OR a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] Collectively referred to as "Parties" or "Partners" and individually referred to as their respective names. WHEREAS, the Silent Partner has shown an interest in joining the business venture silently and the General Partner has accepted this partnership proposal; WHEREAS, the Partners desire to enter into this Silent Partner Agreement as the most advantageous business form for their mutual purposes; WHEREAS, this Agreement sets forth in the terms and conditions as to how they shall be the Partners. WHEREAS, the Partners hereto agree to form a partnership (the "Partnership") under the laws of the [State/Province] of [STATE/PROVINCE]. NOW, THEREFORE THE PARTIES AGREE AS FOLLOWS: NAME OF THE PARTNERSHIP The business partnership will be known as [PARTNERSHIP NAME] (the "Partnership"). However, the business of the Partnership may be conducted, in compliance with all applicable laws, under any other name determined to be appropriate or advisable by the General Partner(s). The Partnership's primary place of business will be [ADDRESS]. PURPOSE Subject to the limitations set forth in this Agreement, the purpose of the Partnership is to engage in the business of [PURPOSE OF BUSINESS]. FORMATION AND TERM By this Agreement, the Partners enter into a general Partnership in accordance with the laws of [STATE/PROVINCE]. The rights and obligations of the Partners shall be as stated in the Partnership Act of [STATE/PROVINCE], except as otherwise provided herein. The Partnership shall commence on the Effective Date and shall continue thereafter until lawfully terminated. INTERESTS IN CONTRIBUTION No Partner's contribution to the capital of the Partnership shall bear interest in his or her favor. All interest earned on any contribution shall be payable in its entirety to the Partnership capital account. OWNERSHIP INTEREST IN THE PARTNERSHIP General Partner: [SPECIFY PERCENTAGE] % Silent Partner: [SPECIFY PERCENTAGE] % The Partners' authority will be defined by the following unless otherwise stated in the Agreement: All decisions for contract or otherwise will be made based on a majority vote of percent of ownership among General Partners. Each Partner will have the authority based on their percent ownership outlined above in the Agreement. CONTRIBUTION The Silent Partner shall contribute [SPECIFY AMOUNT] to the Partnership via [SPECIFY MODE AND TIME]. DUTIES OF GENERAL PARTNER The General Partner shall: Provide leadership; Build an effective management team; Manage the finances of the Partnership; Recruit and retain staff; Ensure the firm deals effectively with risk management; Deal with Partner issues; Participate in the decision making on insurance and benefits; Take an active role in people development; Provide strategic planning and vision; Be a catalyst for growth and expansion. DUTIES OF THE SILENT PARTNER The Partners agree that the Silent Partner shall be "silent" in the Partnership. The Silent Partner(s) shall not participate in or interfere in the operation of the Partnership and are not restricted from engaging in any other business or from entering any other partnerships. The Silent Partner(s) shall not be personally liable for any debts or other obligations of the Partnership. The Silent Partner shall treat confidentially the existence and the contents of the Silent Partner's interests in accordance with the confidentiality regulations. PROFIT AND LOSS All Partners, including the Silent Partner, shall share all items of income, gain, loss, deduction, or credit equally. Profits and losses shall be computed in accordance with generally accepted accounting principles, consistently applied. LIMITATION OF LIABILITY OF SILENT PARTNER The Silent Partner shall have the personal liability of any kind for any debts, liabilities, or other obligations of the Partnership. PARTNER ACCOUNTS A fixed capital account, a current account, a profit reserve account and a profit netting account shall be kept for the Silent Partner. The Silent Partner's contributions are fixed contributions which are entered in the fixed capital account, and which constitute the capital interests of the Silent Partner. Withdrawable profit claims, withdrawals, interest on such account and other payment transactions between the Silent Partner and the General Partner will be entered in the current accounts. The balances on the current accounts are liabilities and/or claims of the Silent Partner and of the General Partner. The accounts shall bear interest at a rate of [PERCENTAGE] % per annum calculated on an equated basis. Non-withdrawable profit claims will be entered in the profit reserve accounts. The accounts shall bear interest at a rate of [PERCENTAGE] % per annum calculated on an equated basis. These accounts do not constitute liabilities of the General Partner. However, in the event of liquidation of the General Partner, they vest a claim for preferential payment and may be transferred only together with the Silent Partner's interest. FISCAL YEAR The fiscal year of the Agreement shall end on the [DAY] day of [MONTH] each year. SALARIES As compensation for his or her services in and to the Partnership business, the Silent Partner shall be entitled to such salaries as shall be determined unanimously by the Partners, keeping in mind the designation and responsibility of each Partner. AUDIT Any of the Partners shall have the right to request an audit of the Partnership books. The cost of the audit shall be borne by the Partnership. The audit shall be performed by an accounting firm acceptable to all the Partners. Not more than one (1) audit shall be required by any or all of the Partners for any fiscal year. ANNUAL REPORT As soon as practicable after the close of each fiscal year, the General Partner shall furnish to the Silent Partner, an annual report showing a full and complete account of the condition of the Partnership. This report shall consist of at least the following documents: A statement of all information as shall be necessary for the preparation of the Partners' income or other tax returns, and any additional information that the Silent Partner may require. TRANSFER OF PARTNERSHIP INTEREST The Partners shall not in any way voluntarily alienate their interest in the Agreement or its assets without the unanimous consent of the other Partner and without exercising the Rights of First Refusal of the present Agreement. Any such prohibited transfer, if attempted, shall be void and without force or effect. RIGHT OF FIRST REFUSAL. If, at any time during the term of this Agreement, any Partner shall, in response to a bona fide offer to purchase all or part of its interest in the Partnership firm from a third party, desire to sell or otherwise dispose of such interest, it shall notify the other Partners in writing of the party to whom it desires to sell such interest and the price at which and the terms upon which it desires to sell the same, and the other Partners shall, within 30 days of receipt of the notice, notify the Selling Partner in writing whether it wishes to purchase such interest at the price and on the terms set forth in the notice

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This silent partner agreement template has 8 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our silent partner agreement template:

SILENT PARTNER AGREEMENT This Silent Partner Agreement (the "Agreement") is effective [DATE], BETWEEN: [GENERAL PARTNER NAME], (the "General Partner"), an individual with their main address located at OR a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] AND: [SILENT PARTNER NAME], (the "Silent Partner") an individual with their main address located at OR a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] Collectively referred to as "Parties" or "Partners" and individually referred to as their respective names. WHEREAS, the Silent Partner has shown an interest in joining the business venture silently and the General Partner has accepted this partnership proposal; WHEREAS, the Partners desire to enter into this Silent Partner Agreement as the most advantageous business form for their mutual purposes; WHEREAS, this Agreement sets forth in the terms and conditions as to how they shall be the Partners. WHEREAS, the Partners hereto agree to form a partnership (the "Partnership") under the laws of the [State/Province] of [STATE/PROVINCE]. NOW, THEREFORE THE PARTIES AGREE AS FOLLOWS: NAME OF THE PARTNERSHIP The business partnership will be known as [PARTNERSHIP NAME] (the "Partnership"). However, the business of the Partnership may be conducted, in compliance with all applicable laws, under any other name determined to be appropriate or advisable by the General Partner(s). The Partnership's primary place of business will be [ADDRESS]. PURPOSE Subject to the limitations set forth in this Agreement, the purpose of the Partnership is to engage in the business of [PURPOSE OF BUSINESS]. FORMATION AND TERM By this Agreement, the Partners enter into a general Partnership in accordance with the laws of [STATE/PROVINCE]. The rights and obligations of the Partners shall be as stated in the Partnership Act of [STATE/PROVINCE], except as otherwise provided herein. The Partnership shall commence on the Effective Date and shall continue thereafter until lawfully terminated. INTERESTS IN CONTRIBUTION No Partner's contribution to the capital of the Partnership shall bear interest in his or her favor. All interest earned on any contribution shall be payable in its entirety to the Partnership capital account. OWNERSHIP INTEREST IN THE PARTNERSHIP General Partner: [SPECIFY PERCENTAGE] % Silent Partner: [SPECIFY PERCENTAGE] % The Partners' authority will be defined by the following unless otherwise stated in the Agreement: All decisions for contract or otherwise will be made based on a majority vote of percent of ownership among General Partners. Each Partner will have the authority based on their percent ownership outlined above in the Agreement. CONTRIBUTION The Silent Partner shall contribute [SPECIFY AMOUNT] to the Partnership via [SPECIFY MODE AND TIME]. DUTIES OF GENERAL PARTNER The General Partner shall: Provide leadership; Build an effective management team; Manage the finances of the Partnership; Recruit and retain staff; Ensure the firm deals effectively with risk management; Deal with Partner issues; Participate in the decision making on insurance and benefits; Take an active role in people development; Provide strategic planning and vision; Be a catalyst for growth and expansion. DUTIES OF THE SILENT PARTNER The Partners agree that the Silent Partner shall be "silent" in the Partnership. The Silent Partner(s) shall not participate in or interfere in the operation of the Partnership and are not restricted from engaging in any other business or from entering any other partnerships. The Silent Partner(s) shall not be personally liable for any debts or other obligations of the Partnership. The Silent Partner shall treat confidentially the existence and the contents of the Silent Partner's interests in accordance with the confidentiality regulations. PROFIT AND LOSS All Partners, including the Silent Partner, shall share all items of income, gain, loss, deduction, or credit equally. Profits and losses shall be computed in accordance with generally accepted accounting principles, consistently applied. LIMITATION OF LIABILITY OF SILENT PARTNER The Silent Partner shall have the personal liability of any kind for any debts, liabilities, or other obligations of the Partnership. PARTNER ACCOUNTS A fixed capital account, a current account, a profit reserve account and a profit netting account shall be kept for the Silent Partner. The Silent Partner's contributions are fixed contributions which are entered in the fixed capital account, and which constitute the capital interests of the Silent Partner. Withdrawable profit claims, withdrawals, interest on such account and other payment transactions between the Silent Partner and the General Partner will be entered in the current accounts. The balances on the current accounts are liabilities and/or claims of the Silent Partner and of the General Partner. The accounts shall bear interest at a rate of [PERCENTAGE] % per annum calculated on an equated basis. Non-withdrawable profit claims will be entered in the profit reserve accounts. The accounts shall bear interest at a rate of [PERCENTAGE] % per annum calculated on an equated basis. These accounts do not constitute liabilities of the General Partner. However, in the event of liquidation of the General Partner, they vest a claim for preferential payment and may be transferred only together with the Silent Partner's interest. FISCAL YEAR The fiscal year of the Agreement shall end on the [DAY] day of [MONTH] each year. SALARIES As compensation for his or her services in and to the Partnership business, the Silent Partner shall be entitled to such salaries as shall be determined unanimously by the Partners, keeping in mind the designation and responsibility of each Partner. AUDIT Any of the Partners shall have the right to request an audit of the Partnership books. The cost of the audit shall be borne by the Partnership. The audit shall be performed by an accounting firm acceptable to all the Partners. Not more than one (1) audit shall be required by any or all of the Partners for any fiscal year. ANNUAL REPORT As soon as practicable after the close of each fiscal year, the General Partner shall furnish to the Silent Partner, an annual report showing a full and complete account of the condition of the Partnership. This report shall consist of at least the following documents: A statement of all information as shall be necessary for the preparation of the Partners' income or other tax returns, and any additional information that the Silent Partner may require. TRANSFER OF PARTNERSHIP INTEREST The Partners shall not in any way voluntarily alienate their interest in the Agreement or its assets without the unanimous consent of the other Partner and without exercising the Rights of First Refusal of the present Agreement. Any such prohibited transfer, if attempted, shall be void and without force or effect. RIGHT OF FIRST REFUSAL. If, at any time during the term of this Agreement, any Partner shall, in response to a bona fide offer to purchase all or part of its interest in the Partnership firm from a third party, desire to sell or otherwise dispose of such interest, it shall notify the other Partners in writing of the party to whom it desires to sell such interest and the price at which and the terms upon which it desires to sell the same, and the other Partners shall, within 30 days of receipt of the notice, notify the Selling Partner in writing whether it wishes to purchase such interest at the price and on the terms set forth in the notice

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.