Severance Plan Template

Document content

This severance plan template has 7 pages and is a MS Word file type listed under our human resources documents.

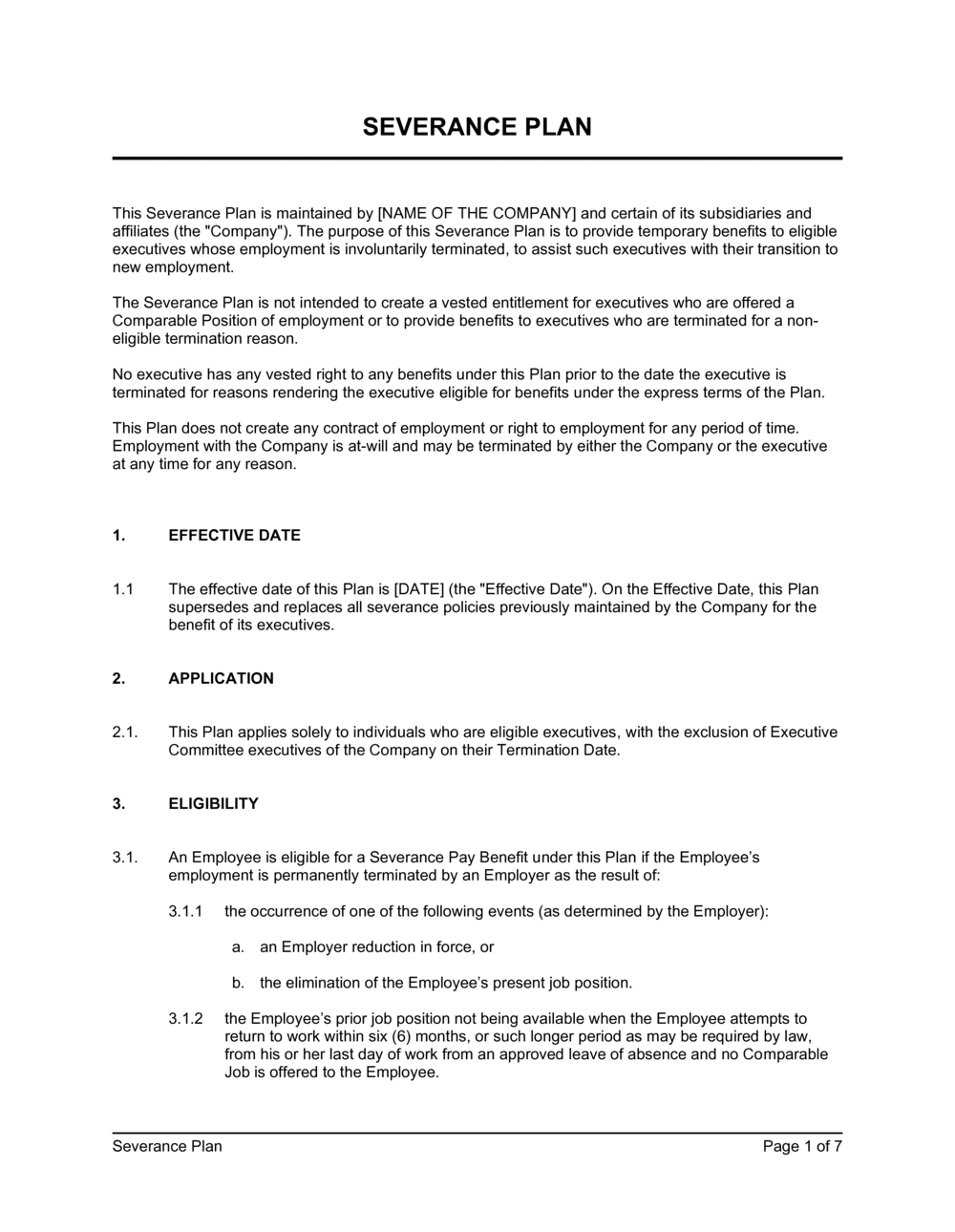

Sample of our severance plan template:

SEVERANCE PLAN This Severance Plan is maintained by [NAME OF THE COMPANY] and certain of its subsidiaries and affiliates (the "Company"). The purpose of this Severance Plan is to provide temporary benefits to eligible executives whose employment is involuntarily terminated, to assist such executives with their transition to new employment. The Severance Plan is not intended to create a vested entitlement for executives who are offered a Comparable Position of employment or to provide benefits to executives who are terminated for a non-eligible termination reason. No executive has any vested right to any benefits under this Plan prior to the date the executive is terminated for reasons rendering the executive eligible for benefits under the express terms of the Plan. This Plan does not create any contract of employment or right to employment for any period of time. Employment with the Company is at-will and may be terminated by either the Company or the executive at any time for any reason. EFFECTIVE DATE The effective date of this Plan is [DATE] (the "Effective Date"). On the Effective Date, this Plan supersedes and replaces all severance policies previously maintained by the Company for the benefit of its executives. APPLICATION This Plan applies solely to individuals who are eligible executives, with the exclusion of Executive Committee executives of the Company on their Termination Date. ELIGIBILITY An Employee is eligible for a Severance Pay Benefit under this Plan if the Employee's employment is permanently terminated by an Employer as the result of: the occurrence of one of the following events (as determined by the Employer): an Employer reduction in force, or the elimination of the Employee's present job position. the Employee's prior job position not being available when the Employee attempts to return to work within six (6) months, or such longer period as may be required by law, from his or her last day of work from an approved leave of absence and no Comparable Job is offered to the Employee. Notwithstanding anything to the contrary in 3.1(a), an Employee will not be eligible for a Severance Pay Benefit under this Plan as the result of: termination of the Employee's employment if: he or she accepts any position with an Employer, or he or she receives a Comparable Job offer, or the sale or other disposition of all of the stock or all or a portion of the business of an Employer, or merger of an Employer into or with another corporation, whether by sale of stock or assets or otherwise. The mere fact of a change in control, or sale or other disposition of all or a portion of any Employer will not be deemed a Termination of Employment for purposes of qualifying for a Severance Pay Benefit under this Plan; or, the Employee's retirement, disability, death, resignation, or discharge with or without cause for any reason other than set forth in this Plan in section 2.1. Notwithstanding anything to the contrary in this Plan, payment of a Severance Pay Benefit is conditioned upon: the Employee's execution of a general release of all claims against his or her Employer and the Company in a form acceptable to the Company; and the Employee's continued and acceptable performance of services for the Employer through the date for Termination of Employment chosen by the Employer. In the event that the Employee does not execute the general release or continue to perform services through Termination of Employment, any Severance Pay Benefit which would otherwise have been payable to the Employee under this Plan shall be forfeited. SEVERANCE PAY SCHEDULE AND OTHER BENEFITS Except as otherwise provided in a Schedule to this Plan, benefits under this Plan shall be paid as follows: [DESCRIBE HOW THE SEVERANCE PAY BENEFIT PAYMENT WILL BE CALCULATED FOR THE ELIGIBLE EMPLOYEES] Subject to the terms of any applicable plan documents, during the Severance Period, medical, dental, and prescription drug benefits coverage may be continued, and certain other welfare benefits may be continued as to the persons and for the periods of time determined by the Company in its absolute and sole discretion. Notwithstanding any other provision in this Plan, expatriates eligible for Severance Benefits under this Plan will receive only the greater of: the Severance Benefits the expatriate would be eligible to receive under this Plan; or the severance, termination, or similar pay the expatriate would be entitled to receive under the local law of the country or jurisdiction where the expatriate performs his or her expatriate duties for the Company. Any additional benefit provided after an Employee's Termination of Employment will be governed by and made available according to an Employer's policies and procedures or, if applicable, the plan document for a particular benefit, and will not be considered to be part of or provided under this Plan. REQUIREMENT OF RELEASE Payment of Severance Benefits is conditioned upon the executive signing, in a timely manner, an agreement and release (in a form satisfactory to the Company) which will include restrictive covenants and a comprehensive release of all claims, including but not limited to, all employment-related claims. Payment of Severance Benefits will commence no sooner than eight (8) days following the Employee's execution of the agreement and release. In no event will payment commence later than 31 days after separation from service if a waiver is requested from an individual or later than 55 days after separation from service if a waiver is requested in connection with an exit incentive or other employment termination program offered to a group or class of employees. If an executive's employment is terminated for a reason covered by this Plan but the executive dies prior to executing an agreement and release, his or her estate or representative may not execute an agreement and release, and no Severance Benefits will be paid under this Plan. DEATH If an Employee terminates employment and dies before receiving a Severance Pay Benefit to which he is entitled under the Plan, such Severance Pay Benefit will be paid to the following beneficiary(ies) in the following order of priority: the Employee's surviving spouse, the Employee's surviving children in equal shares, the Employee's surviving parents, in equal shares, or the Employee's estate. If the beneficiary survives the Employee, but dies prior to distribution of the Employee's entire Severance Pay Benefit, such Severance Pay Benefit will be paid to the following beneficiary(ies) in the following order of priority: the beneficiary's surviving spouse, the beneficiary's surviving children in equal shares, the beneficiary's surviving parents, in equal shares, or the beneficiary's estate. WITHHOLDING AND OFFSETS An Employer will have the right to take such action as it deems necessary or appropriate with respect to all or a portion of any Severance Pay Benefit payment to satisfy any requirement under federal, state or other tax law, or under any law relating to attachment, wage assignment, garnishment or similar procedures. Except as prohibited by state or other law, the Employer may withhold or make deductions from any Severance Pay Benefit payment in order to satisfy any amounts owed to the Employer by the Employee, including without limitation the portion of any medical or dental insurance premium which the Employee is responsible to pay. CORRECTION OF MISTAKES In the event the Committee discovers a mistake that affects the amount of or an Employee's rights to Severance Pay Benefits and/or Extension of Coverage Benefits, it will correct the mistake as soon as practicable in the manner it deems appropriate. APPOINTMENT OF COMMITTEE The Plan shall be administered by a Committee of at least two (2) persons appointed by the Human Resource Office ("HRO")

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This severance plan template has 7 pages and is a MS Word file type listed under our human resources documents.

Sample of our severance plan template:

SEVERANCE PLAN This Severance Plan is maintained by [NAME OF THE COMPANY] and certain of its subsidiaries and affiliates (the "Company"). The purpose of this Severance Plan is to provide temporary benefits to eligible executives whose employment is involuntarily terminated, to assist such executives with their transition to new employment. The Severance Plan is not intended to create a vested entitlement for executives who are offered a Comparable Position of employment or to provide benefits to executives who are terminated for a non-eligible termination reason. No executive has any vested right to any benefits under this Plan prior to the date the executive is terminated for reasons rendering the executive eligible for benefits under the express terms of the Plan. This Plan does not create any contract of employment or right to employment for any period of time. Employment with the Company is at-will and may be terminated by either the Company or the executive at any time for any reason. EFFECTIVE DATE The effective date of this Plan is [DATE] (the "Effective Date"). On the Effective Date, this Plan supersedes and replaces all severance policies previously maintained by the Company for the benefit of its executives. APPLICATION This Plan applies solely to individuals who are eligible executives, with the exclusion of Executive Committee executives of the Company on their Termination Date. ELIGIBILITY An Employee is eligible for a Severance Pay Benefit under this Plan if the Employee's employment is permanently terminated by an Employer as the result of: the occurrence of one of the following events (as determined by the Employer): an Employer reduction in force, or the elimination of the Employee's present job position. the Employee's prior job position not being available when the Employee attempts to return to work within six (6) months, or such longer period as may be required by law, from his or her last day of work from an approved leave of absence and no Comparable Job is offered to the Employee. Notwithstanding anything to the contrary in 3.1(a), an Employee will not be eligible for a Severance Pay Benefit under this Plan as the result of: termination of the Employee's employment if: he or she accepts any position with an Employer, or he or she receives a Comparable Job offer, or the sale or other disposition of all of the stock or all or a portion of the business of an Employer, or merger of an Employer into or with another corporation, whether by sale of stock or assets or otherwise. The mere fact of a change in control, or sale or other disposition of all or a portion of any Employer will not be deemed a Termination of Employment for purposes of qualifying for a Severance Pay Benefit under this Plan; or, the Employee's retirement, disability, death, resignation, or discharge with or without cause for any reason other than set forth in this Plan in section 2.1. Notwithstanding anything to the contrary in this Plan, payment of a Severance Pay Benefit is conditioned upon: the Employee's execution of a general release of all claims against his or her Employer and the Company in a form acceptable to the Company; and the Employee's continued and acceptable performance of services for the Employer through the date for Termination of Employment chosen by the Employer. In the event that the Employee does not execute the general release or continue to perform services through Termination of Employment, any Severance Pay Benefit which would otherwise have been payable to the Employee under this Plan shall be forfeited. SEVERANCE PAY SCHEDULE AND OTHER BENEFITS Except as otherwise provided in a Schedule to this Plan, benefits under this Plan shall be paid as follows: [DESCRIBE HOW THE SEVERANCE PAY BENEFIT PAYMENT WILL BE CALCULATED FOR THE ELIGIBLE EMPLOYEES] Subject to the terms of any applicable plan documents, during the Severance Period, medical, dental, and prescription drug benefits coverage may be continued, and certain other welfare benefits may be continued as to the persons and for the periods of time determined by the Company in its absolute and sole discretion. Notwithstanding any other provision in this Plan, expatriates eligible for Severance Benefits under this Plan will receive only the greater of: the Severance Benefits the expatriate would be eligible to receive under this Plan; or the severance, termination, or similar pay the expatriate would be entitled to receive under the local law of the country or jurisdiction where the expatriate performs his or her expatriate duties for the Company. Any additional benefit provided after an Employee's Termination of Employment will be governed by and made available according to an Employer's policies and procedures or, if applicable, the plan document for a particular benefit, and will not be considered to be part of or provided under this Plan. REQUIREMENT OF RELEASE Payment of Severance Benefits is conditioned upon the executive signing, in a timely manner, an agreement and release (in a form satisfactory to the Company) which will include restrictive covenants and a comprehensive release of all claims, including but not limited to, all employment-related claims. Payment of Severance Benefits will commence no sooner than eight (8) days following the Employee's execution of the agreement and release. In no event will payment commence later than 31 days after separation from service if a waiver is requested from an individual or later than 55 days after separation from service if a waiver is requested in connection with an exit incentive or other employment termination program offered to a group or class of employees. If an executive's employment is terminated for a reason covered by this Plan but the executive dies prior to executing an agreement and release, his or her estate or representative may not execute an agreement and release, and no Severance Benefits will be paid under this Plan. DEATH If an Employee terminates employment and dies before receiving a Severance Pay Benefit to which he is entitled under the Plan, such Severance Pay Benefit will be paid to the following beneficiary(ies) in the following order of priority: the Employee's surviving spouse, the Employee's surviving children in equal shares, the Employee's surviving parents, in equal shares, or the Employee's estate. If the beneficiary survives the Employee, but dies prior to distribution of the Employee's entire Severance Pay Benefit, such Severance Pay Benefit will be paid to the following beneficiary(ies) in the following order of priority: the beneficiary's surviving spouse, the beneficiary's surviving children in equal shares, the beneficiary's surviving parents, in equal shares, or the beneficiary's estate. WITHHOLDING AND OFFSETS An Employer will have the right to take such action as it deems necessary or appropriate with respect to all or a portion of any Severance Pay Benefit payment to satisfy any requirement under federal, state or other tax law, or under any law relating to attachment, wage assignment, garnishment or similar procedures. Except as prohibited by state or other law, the Employer may withhold or make deductions from any Severance Pay Benefit payment in order to satisfy any amounts owed to the Employer by the Employee, including without limitation the portion of any medical or dental insurance premium which the Employee is responsible to pay. CORRECTION OF MISTAKES In the event the Committee discovers a mistake that affects the amount of or an Employee's rights to Severance Pay Benefits and/or Extension of Coverage Benefits, it will correct the mistake as soon as practicable in the manner it deems appropriate. APPOINTMENT OF COMMITTEE The Plan shall be administered by a Committee of at least two (2) persons appointed by the Human Resource Office ("HRO")

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.