Revolving Credit Agreement Template

Document content

This revolving credit agreement template has 5 pages and is a MS Word file type listed under our legal agreements documents.

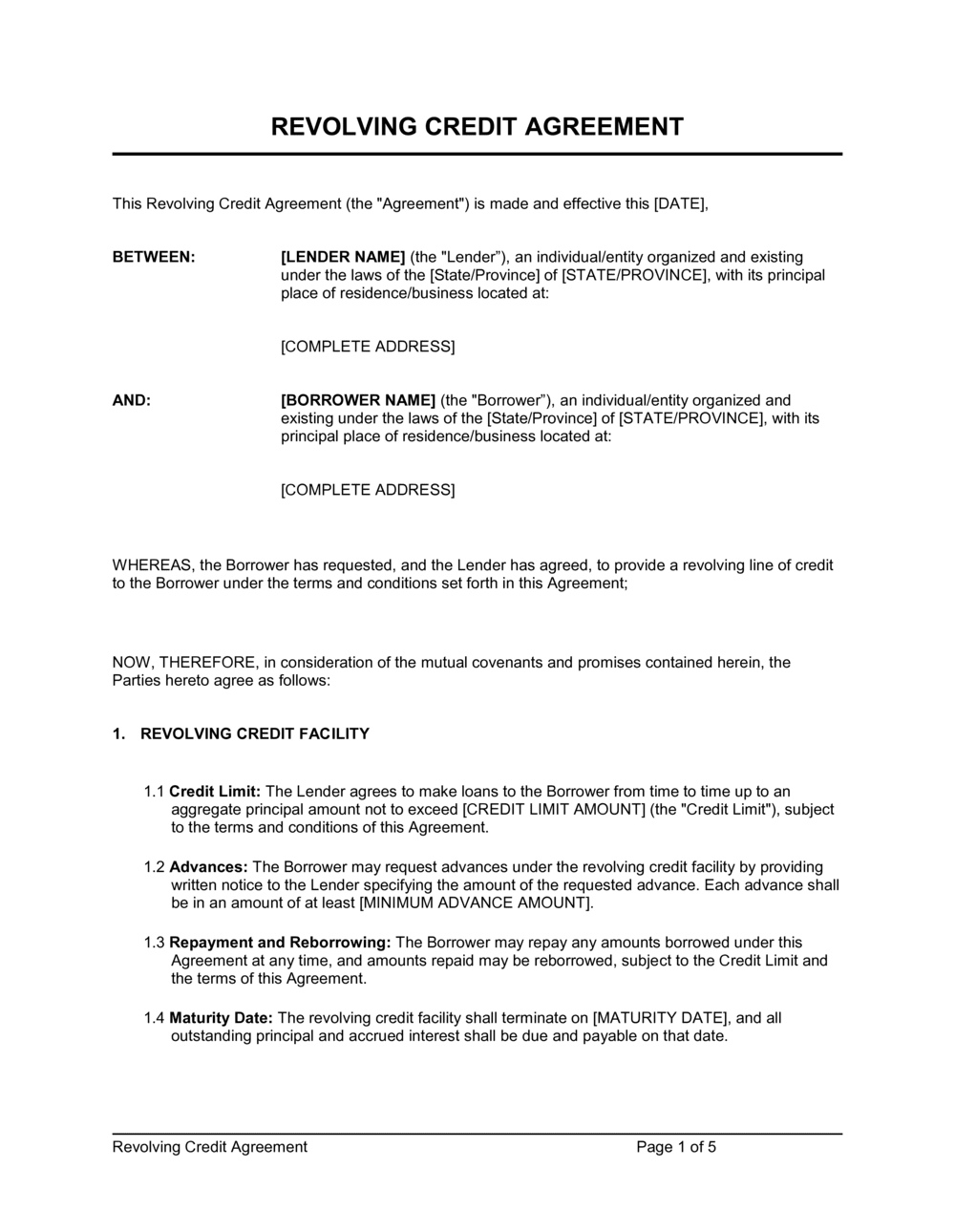

Sample of our revolving credit agreement template:

REVOLVING CREDIT AGREEMENT This Revolving Credit Agreement (the "Agreement") is made and effective this [DATE], BETWEEN: [LENDER NAME] (the "Lender"), an individual/entity organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its principal place of residence/business located at: [COMPLETE ADDRESS] AND: [BORROWER NAME] (the "Borrower"), an individual/entity organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its principal place of residence/business located at: [COMPLETE ADDRESS] WHEREAS, the Borrower has requested, and the Lender has agreed, to provide a revolving line of credit to the Borrower under the terms and conditions set forth in this Agreement; NOW, THEREFORE, in consideration of the mutual covenants and promises contained herein, the Parties hereto agree as follows: REVOLVING CREDIT FACILITY 1.1 Credit Limit: The Lender agrees to make loans to the Borrower from time to time up to an aggregate principal amount not to exceed [CREDIT LIMIT AMOUNT] (the "Credit Limit"), subject to the terms and conditions of this Agreement. 1.2 Advances: The Borrower may request advances under the revolving credit facility by providing written notice to the Lender specifying the amount of the requested advance. Each advance shall be in an amount of at least [MINIMUM ADVANCE AMOUNT]. 1.3 Repayment and Reborrowing: The Borrower may repay any amounts borrowed under this Agreement at any time, and amounts repaid may be reborrowed, subject to the Credit Limit and the terms of this Agreement. 1.4 Maturity Date: The revolving credit facility shall terminate on [MATURITY DATE], and all outstanding principal and accrued interest shall be due and payable on that date. INTEREST 2.1 Interest Rate: The outstanding principal amount of each advance shall bear interest at a rate of [INTEREST RATE]% per annum, calculated on the basis of a [360/365]-day year for the actual number of days elapsed. 2.2 Payment of Interest: Interest shall be payable [MONTHLY/QUARTERLY] in arrears on the [DAY] of each [MONTH/QUARTER], commencing on [FIRST PAYMENT DATE]. 2.3 Default Interest: If the Borrower fails to pay any amount due under this Agreement on the due date, the unpaid amount shall bear interest at the rate of [DEFAULT INTEREST RATE]% per annum from the due date until the date of payment. FEES 3.1 Commitment Fee: The Borrower shall pay the Lender a commitment fee equal to [COMMITMENT FEE PERCENTAGE]% of the Credit Limit, payable [ANNUALLY/QUARTERLY] in arrears on the [DAY] of [MONTH], commencing on [FIRST PAYMENT DATE]. 3.2 Unused Facility Fee: The Borrower shall pay the Lender an unused facility fee equal to [UNUSED FACILITY FEE PERCENTAGE]% per annum on the average daily unused portion of the Credit Limit, payable [MONTHLY/QUARTERLY] in arrears. PRECEDENT The obligation of the Lender to make any advance under this Agreement is subject to the following conditions precedent: 4.1 The Representations and Warranties: All representations and warranties of the Borrower contained in this Agreement shall be true and correct as of the date of the advance. 4.2 No Default: No event of default shall have occurred and be continuing under this Agreement or any other agreement between the Borrower and the Lender. 4.3 Required Documentation: The Lender shall have received all documentation and information reasonably requested by the Lender, including, but not limited to, evidence of the Borrower's authority to enter into this Agreement. REPRESENTATIONS AND WARRANTIES The Borrower represents and warrants to the Lender that: 5.1 Organization and Authority: The Borrower is duly organized, validly existing, and in good standing under the laws of the State/Province of [STATE/PROVINCE] and has the power and authority to enter into and perform its obligations under this Agreement. 5.2 Compliance with Laws: The Borrower is in compliance with all applicable federal, state, and local laws, regulations, and ordinances. 5

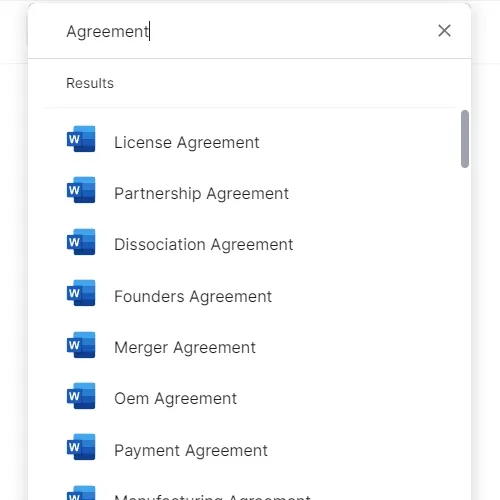

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This revolving credit agreement template has 5 pages and is a MS Word file type listed under our legal agreements documents.

Sample of our revolving credit agreement template:

REVOLVING CREDIT AGREEMENT This Revolving Credit Agreement (the "Agreement") is made and effective this [DATE], BETWEEN: [LENDER NAME] (the "Lender"), an individual/entity organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its principal place of residence/business located at: [COMPLETE ADDRESS] AND: [BORROWER NAME] (the "Borrower"), an individual/entity organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its principal place of residence/business located at: [COMPLETE ADDRESS] WHEREAS, the Borrower has requested, and the Lender has agreed, to provide a revolving line of credit to the Borrower under the terms and conditions set forth in this Agreement; NOW, THEREFORE, in consideration of the mutual covenants and promises contained herein, the Parties hereto agree as follows: REVOLVING CREDIT FACILITY 1.1 Credit Limit: The Lender agrees to make loans to the Borrower from time to time up to an aggregate principal amount not to exceed [CREDIT LIMIT AMOUNT] (the "Credit Limit"), subject to the terms and conditions of this Agreement. 1.2 Advances: The Borrower may request advances under the revolving credit facility by providing written notice to the Lender specifying the amount of the requested advance. Each advance shall be in an amount of at least [MINIMUM ADVANCE AMOUNT]. 1.3 Repayment and Reborrowing: The Borrower may repay any amounts borrowed under this Agreement at any time, and amounts repaid may be reborrowed, subject to the Credit Limit and the terms of this Agreement. 1.4 Maturity Date: The revolving credit facility shall terminate on [MATURITY DATE], and all outstanding principal and accrued interest shall be due and payable on that date. INTEREST 2.1 Interest Rate: The outstanding principal amount of each advance shall bear interest at a rate of [INTEREST RATE]% per annum, calculated on the basis of a [360/365]-day year for the actual number of days elapsed. 2.2 Payment of Interest: Interest shall be payable [MONTHLY/QUARTERLY] in arrears on the [DAY] of each [MONTH/QUARTER], commencing on [FIRST PAYMENT DATE]. 2.3 Default Interest: If the Borrower fails to pay any amount due under this Agreement on the due date, the unpaid amount shall bear interest at the rate of [DEFAULT INTEREST RATE]% per annum from the due date until the date of payment. FEES 3.1 Commitment Fee: The Borrower shall pay the Lender a commitment fee equal to [COMMITMENT FEE PERCENTAGE]% of the Credit Limit, payable [ANNUALLY/QUARTERLY] in arrears on the [DAY] of [MONTH], commencing on [FIRST PAYMENT DATE]. 3.2 Unused Facility Fee: The Borrower shall pay the Lender an unused facility fee equal to [UNUSED FACILITY FEE PERCENTAGE]% per annum on the average daily unused portion of the Credit Limit, payable [MONTHLY/QUARTERLY] in arrears. PRECEDENT The obligation of the Lender to make any advance under this Agreement is subject to the following conditions precedent: 4.1 The Representations and Warranties: All representations and warranties of the Borrower contained in this Agreement shall be true and correct as of the date of the advance. 4.2 No Default: No event of default shall have occurred and be continuing under this Agreement or any other agreement between the Borrower and the Lender. 4.3 Required Documentation: The Lender shall have received all documentation and information reasonably requested by the Lender, including, but not limited to, evidence of the Borrower's authority to enter into this Agreement. REPRESENTATIONS AND WARRANTIES The Borrower represents and warrants to the Lender that: 5.1 Organization and Authority: The Borrower is duly organized, validly existing, and in good standing under the laws of the State/Province of [STATE/PROVINCE] and has the power and authority to enter into and perform its obligations under this Agreement. 5.2 Compliance with Laws: The Borrower is in compliance with all applicable federal, state, and local laws, regulations, and ordinances. 5

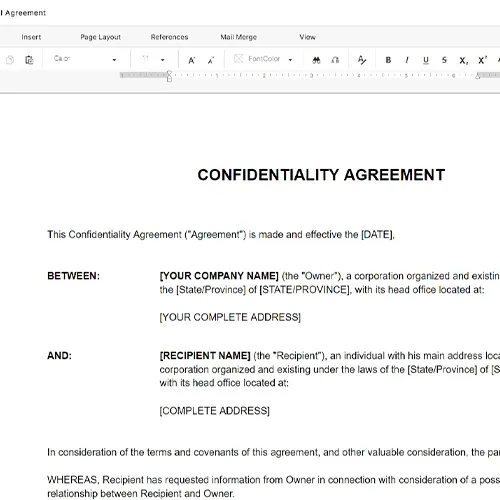

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

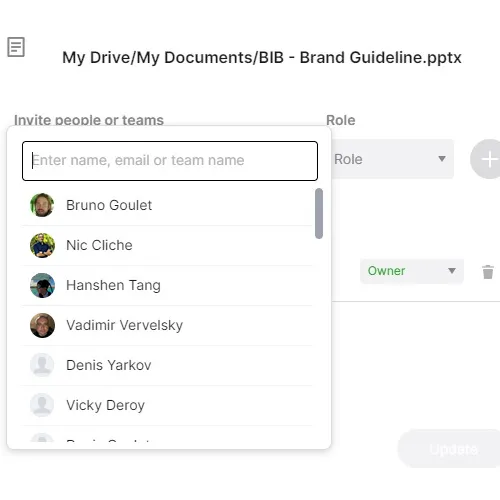

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.