Revenue Recognition Policy Template

Document content

This revenue recognition policy template has 3 pages and is a MS Word file type listed under our human resources documents.

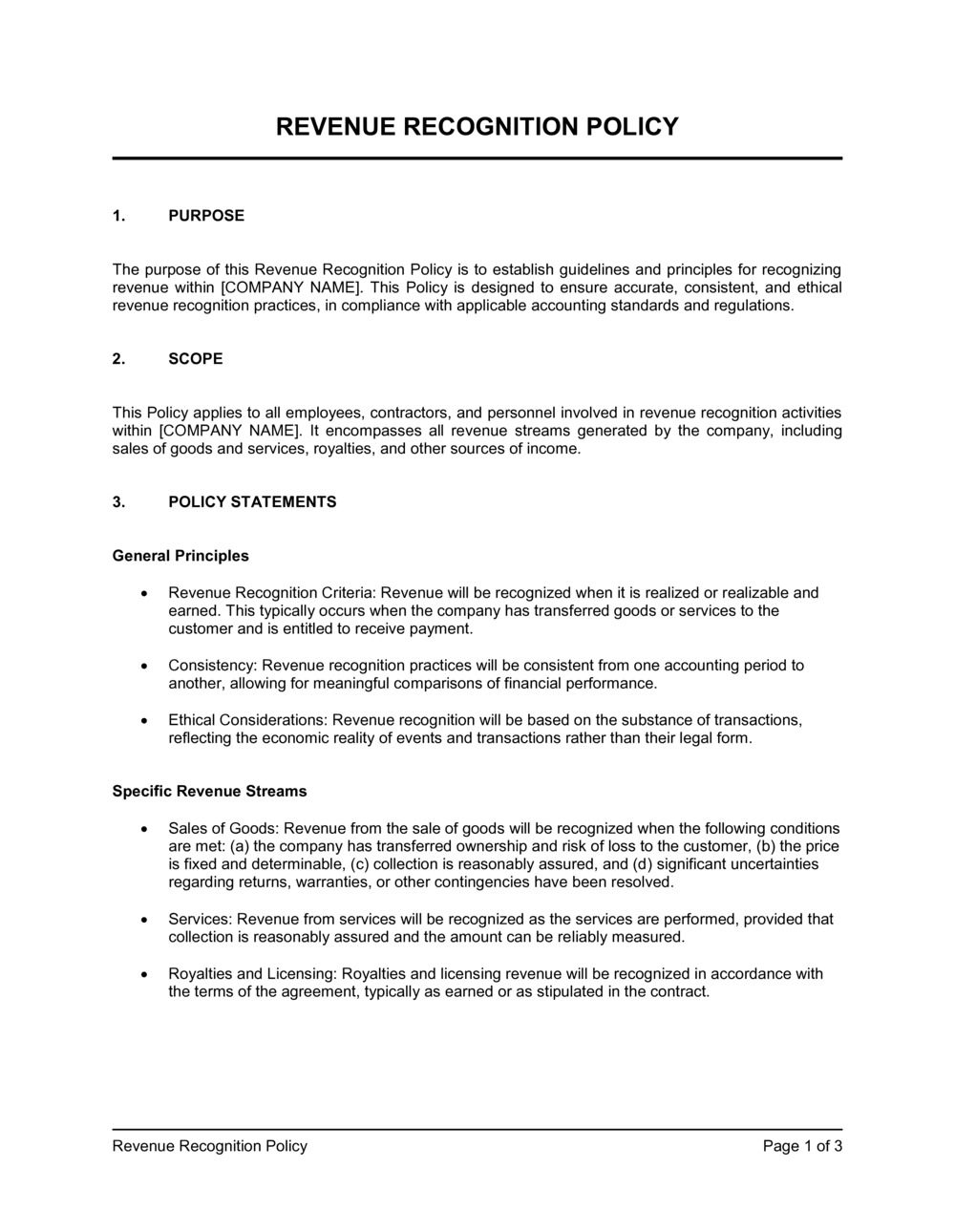

Sample of our revenue recognition policy template:

REVENUE RECOGNITION POLICY PURPOSE The purpose of this Revenue Recognition Policy is to establish guidelines and principles for recognizing revenue within [COMPANY NAME]. This Policy is designed to ensure accurate, consistent, and ethical revenue recognition practices, in compliance with applicable accounting standards and regulations. SCOPE This Policy applies to all employees, contractors, and personnel involved in revenue recognition activities within [COMPANY NAME]. It encompasses all revenue streams generated by the company, including sales of goods and services, royalties, and other sources of income. POLICY STATEMENTS General Principles Revenue Recognition Criteria: Revenue will be recognized when it is realized or realizable and earned. This typically occurs when the company has transferred goods or services to the customer and is entitled to receive payment. Consistency: Revenue recognition practices will be consistent from one accounting period to another, allowing for meaningful comparisons of financial performance. Ethical Considerations: Revenue recognition will be based on the substance of transactions, reflecting the economic reality of events and transactions rather than their legal form. Specific Revenue Streams Sales of Goods: Revenue from the sale of goods will be recognized when the following conditions are met: (a) the company has transferred ownership and risk of loss to the customer, (b) the price is fixed and determinable, (c) collection is reasonably assured, and (d) significant uncertainties regarding returns, warranties, or other contingencies have been resolved. Services: Revenue from services will be recognized as the services are performed, provided that collection is reasonably assured and the amount can be reliably measured. Royalties and Licensing: Royalties and licensing revenue will be recognized in accordance with the terms of the agreement, typically as earned or as stipulated in the contract. Contract Review

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This revenue recognition policy template has 3 pages and is a MS Word file type listed under our human resources documents.

Sample of our revenue recognition policy template:

REVENUE RECOGNITION POLICY PURPOSE The purpose of this Revenue Recognition Policy is to establish guidelines and principles for recognizing revenue within [COMPANY NAME]. This Policy is designed to ensure accurate, consistent, and ethical revenue recognition practices, in compliance with applicable accounting standards and regulations. SCOPE This Policy applies to all employees, contractors, and personnel involved in revenue recognition activities within [COMPANY NAME]. It encompasses all revenue streams generated by the company, including sales of goods and services, royalties, and other sources of income. POLICY STATEMENTS General Principles Revenue Recognition Criteria: Revenue will be recognized when it is realized or realizable and earned. This typically occurs when the company has transferred goods or services to the customer and is entitled to receive payment. Consistency: Revenue recognition practices will be consistent from one accounting period to another, allowing for meaningful comparisons of financial performance. Ethical Considerations: Revenue recognition will be based on the substance of transactions, reflecting the economic reality of events and transactions rather than their legal form. Specific Revenue Streams Sales of Goods: Revenue from the sale of goods will be recognized when the following conditions are met: (a) the company has transferred ownership and risk of loss to the customer, (b) the price is fixed and determinable, (c) collection is reasonably assured, and (d) significant uncertainties regarding returns, warranties, or other contingencies have been resolved. Services: Revenue from services will be recognized as the services are performed, provided that collection is reasonably assured and the amount can be reliably measured. Royalties and Licensing: Royalties and licensing revenue will be recognized in accordance with the terms of the agreement, typically as earned or as stipulated in the contract. Contract Review

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.