Relocation Policy Template

Sample of Document Content

This relocation policy template has 3 pages and is a MS Word file type listed under our legal agreements documents.

Relocation policy template

RELOCATION POLICY When it is in the best interest of [COMPANY NAME] (the "Company") to relocate an employee, the Company will provide relocation assistance to the employee under the provisions of this Policy. This Policy is designed to assist in transferring employees and approved new hires to their Company requested relocation. Assistance provided is in the form of services and financial support. The intent of this assistance is to support the employee or new hire and their family during the move process and reduce the cost impact of the relocation. It is not the intent of the Company to assist in upgrading housing or lifestyle. All assistance is provided at the discretion of the Company management and the Human Resources Department and is subject to change at any time. The Company offers a complete relocation program, including professional assistance and financial support. Our objective is to reduce the burden on you and your family. You are strongly encouraged to use this assistance, regardless of how many times you have moved. The world is constantly changing, including real estate markets, national and local economies, laws, practices, trends, and tastes. Keeping up with all the things that impact relocation is impossible. Use this assistance to make educated decisions about your home and your future lifestyle. ELIGIBILITY Exempt employees being reassigned to work locations more than [NUMBER OF MILES/KILOMETERS] miles [or Kilometers] away from their former worksite may be eligible for relocation assistance. Limited relocation assistance may be provided on a case-by-case basis to nonexempt employees; however, provisions of any agreement will require the approval of the department head and the HR Department. DURATION Any assistance provided under the terms of this Policy (excluding Category 5 below) will be provided within six months of the date the employee is reassigned to the new location. ADVANCES/REIMBURSEMENT Some expenses will be handled via corporate advance, while others will be handled as a reimbursement item like business travel expenses. These will be identified in the employee's Relocation Agreement. REPAYMENT PROVISION If the employee voluntarily leaves the Company within 12 months of relocation to the new worksite, the employee must agree to reimburse the Company for costs incurred under Categories 3 and 4, as mentioned in the Policy below. TAXES The Company will maintain a record of cumulative relocation expenses and will provide the appropriate tax forms to the employee for personal federal and state income tax filings in the appropriate year. AGREEMENT

Reviewed on

Sample of Document Content

This relocation policy template has 3 pages and is a MS Word file type listed under our legal agreements documents.

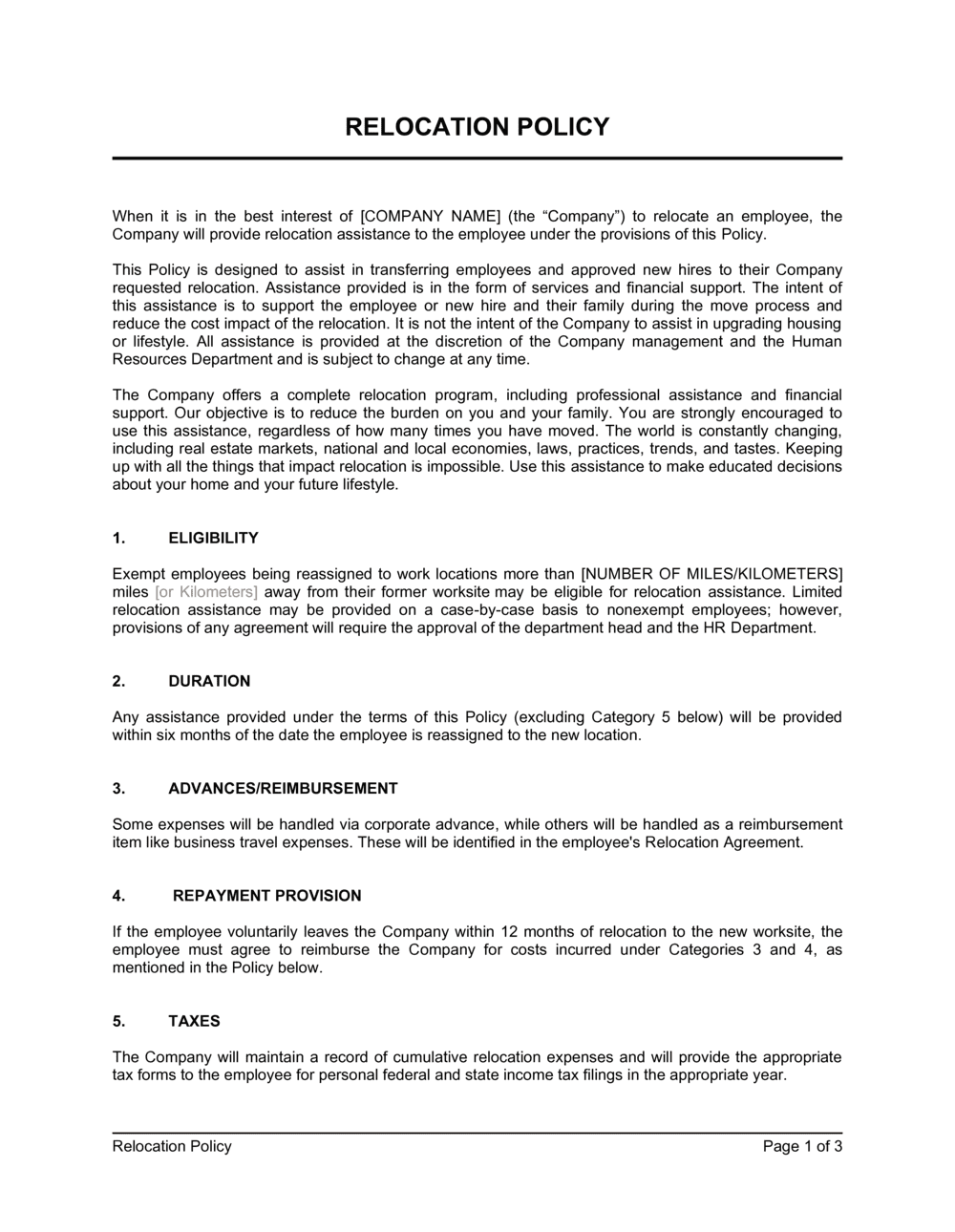

Sample of our relocation policy template:

RELOCATION POLICY When it is in the best interest of [COMPANY NAME] (the "Company") to relocate an employee, the Company will provide relocation assistance to the employee under the provisions of this Policy. This Policy is designed to assist in transferring employees and approved new hires to their Company requested relocation. Assistance provided is in the form of services and financial support. The intent of this assistance is to support the employee or new hire and their family during the move process and reduce the cost impact of the relocation. It is not the intent of the Company to assist in upgrading housing or lifestyle. All assistance is provided at the discretion of the Company management and the Human Resources Department and is subject to change at any time. The Company offers a complete relocation program, including professional assistance and financial support. Our objective is to reduce the burden on you and your family. You are strongly encouraged to use this assistance, regardless of how many times you have moved. The world is constantly changing, including real estate markets, national and local economies, laws, practices, trends, and tastes. Keeping up with all the things that impact relocation is impossible. Use this assistance to make educated decisions about your home and your future lifestyle. ELIGIBILITY Exempt employees being reassigned to work locations more than [NUMBER OF MILES/KILOMETERS] miles [or Kilometers] away from their former worksite may be eligible for relocation assistance. Limited relocation assistance may be provided on a case-by-case basis to nonexempt employees; however, provisions of any agreement will require the approval of the department head and the HR Department. DURATION Any assistance provided under the terms of this Policy (excluding Category 5 below) will be provided within six months of the date the employee is reassigned to the new location. ADVANCES/REIMBURSEMENT Some expenses will be handled via corporate advance, while others will be handled as a reimbursement item like business travel expenses. These will be identified in the employee's Relocation Agreement. REPAYMENT PROVISION If the employee voluntarily leaves the Company within 12 months of relocation to the new worksite, the employee must agree to reimburse the Company for costs incurred under Categories 3 and 4, as mentioned in the Policy below. TAXES The Company will maintain a record of cumulative relocation expenses and will provide the appropriate tax forms to the employee for personal federal and state income tax filings in the appropriate year. AGREEMENT

Easily Create Any Business Document You Need in Minutes.

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.