Purchase Agreement Short Version Template

Document content

This purchase agreement short version template has 9 pages and is a MS Word file type listed under our legal agreements documents.

Sample of our purchase agreement short version template:

Asset Purchase Agreement Your transaction description here. Table of Content 1. SALE AND PURCHASE 3 2. REPRESENTATIONS AND WARRANTIES OF THE VENDOR 4 3. REPRESENTATIONS AND WARRANTIES OF THE PURCHASER 5 4. SURVIVAL OF REPRESENTATIONS AND WARRANTIES 5 5. ADDITIONAL COVENANTS 6 6. GENERAL 6 ASSET PURCHASE AGREEMENT This Asset Purchase Agreement (the "Agreement") is effective [DATE], BETWEEN: [YOUR COMPANY NAME] (the "Vendor"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [SECOND PARTY NAME] (the "Purchaser"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] WHEREAS [SECOND PARTY NAME] (THE "Purchaser") has executed an offer to purchase [SPECIFY] for completion as of [DATE] (the "Offer to Purchase"); WHEREAS the Purchaser desires to purchase, and Vendor desires to sell, some assets, rights and interests as described in Schedule A hereof (the "Purchased Assets") in accordance with the terms, conditions and agreements hereinafter contained. NOW THEREFORE, the parties agree as follows: SALE AND PURCHASE Purchased Assets Upon and subject to the terms and conditions hereof, the Vendor sells to the Purchaser and the Purchaser purchases from the Vendor, as of the Effective Date and conditional upon all liens existing on the Purchased Assets being released, all of the rights, titles, benefits and interests of the Vendor in the Purchased Assets. Documentation The Vendor shall promptly provide the Purchaser with all relevant technical documentation available to the Vendor regarding the Purchased Assets including, but not limited to, documentation that is necessary to operate the Purchased Assets. Purchase Price The purchase price payable by the Purchaser to the Vendor for the Purchased Assets is [AMOUNT] (the "Purchase Price"). For all purposes, including for income tax purposes, the parties agree to allocate the Purchase Price in accordance with the provisions of Schedule A. The Purchase Price shall be payable as follows: [AMOUNT], representing the Purchase Price less the amounts owing from Vendor to Purchaser ([SPECIFY]), payable by certified check as of the Effective Date. Effective Date The sale and purchase of the Purchased Assets shall be conditional upon the release of all existing third party liens on the Purchased Assets and shall be effective upon the date of such release (the "Effective Date") which shall be no later than [DATE], failing which this Agreement shall become null and void, the Purchase Price shall be returned to the Purchaser and the Purchased Assets shall be returned to the Vendor. In such a case, no party shall be entitled to any compensation other than the return of the Purchase Price and Purchased Assets. Assumed Obligations The Purchaser shall assume and agree to satisfy and discharge, as the same shall become due, all of the following (collectively, the "Assumed Obligations"): 1.5.1 All of Vendor's obligations under contracts of Vendor which are identified in Schedule 1.3 and assigned to the Purchaser as of the date hereof, including without limitation any warranty for work performed by the Vendor before the Effective Date. 1.5.2 The Purchaser will also assume and cover all expenses related to the completion of the projects described in Schedule 1.3 including without limitation fuel, employee costs and contributions, material, equipment rentals and repairs, utility and office expenses and project management. Excluded Obligations Except for the Assumed Obligations or as expressly provided herein, the Purchaser is not assuming any past, present and future indebtedness, liabilities, obligations, contracts and commitments of the Vendor, whether arising out of or resulting from the Purchased Assets. Sales and Transfer Taxes The Purchaser shall pay any and all federal, provincial or local taxes, in the nature of income, sale, use, transfer, gain, recording and any similar tax, fee or duty required to be paid in respect of the assignment or transfer to the Purchaser of the Purchased Assets and the filing and recording thereof, including without limitation tax on the Purchase Price. REPRESENTATIONS AND WARRANTIES OF THE VENDOR The Vendor represents and warrants as at the date hereof to the Purchaser as follows and acknowledges that the Purchaser is relying on such representations and warranties in connection with its purchase of the Purchased Assets. Organization The Vendor is a corporation duly incorporated and organized and validly subsisting under the laws of [STATE/PROVINCE] and has the corporate power to own its property and to enter into this Agreement and to perform its obligations hereunder. Due Authorization The execution of this Agreement has been duly authorized, executed and delivered by the Vendor and constitutes legal, valid and binding obligations of the Vendor, enforceable against the Vendor in accordance with its terms. Title To The Assets The Purchased Assets are owned by the Vendor with a good and valid title, free and clear of any encumbrances other than those encumbrances for which the Vendor is in the process to obtain all appropriate consents to the consummation of the transaction contemplated herein. Residency The Vendor is a resident of [COUNTRY] for the purposes of the Income Tax Act ([COUNTRY]). As Is, Where Is The Purchaser acknowledges that the Purchased Assets are purchased on an "as is, where is" basis, that it has inspected the Purchased Assets and is relying entirely on its own investigations and its inspections in proceeding with the transactions contemplated hereunder

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This purchase agreement short version template has 9 pages and is a MS Word file type listed under our legal agreements documents.

Sample of our purchase agreement short version template:

Asset Purchase Agreement Your transaction description here. Table of Content 1. SALE AND PURCHASE 3 2. REPRESENTATIONS AND WARRANTIES OF THE VENDOR 4 3. REPRESENTATIONS AND WARRANTIES OF THE PURCHASER 5 4. SURVIVAL OF REPRESENTATIONS AND WARRANTIES 5 5. ADDITIONAL COVENANTS 6 6. GENERAL 6 ASSET PURCHASE AGREEMENT This Asset Purchase Agreement (the "Agreement") is effective [DATE], BETWEEN: [YOUR COMPANY NAME] (the "Vendor"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [SECOND PARTY NAME] (the "Purchaser"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] WHEREAS [SECOND PARTY NAME] (THE "Purchaser") has executed an offer to purchase [SPECIFY] for completion as of [DATE] (the "Offer to Purchase"); WHEREAS the Purchaser desires to purchase, and Vendor desires to sell, some assets, rights and interests as described in Schedule A hereof (the "Purchased Assets") in accordance with the terms, conditions and agreements hereinafter contained. NOW THEREFORE, the parties agree as follows: SALE AND PURCHASE Purchased Assets Upon and subject to the terms and conditions hereof, the Vendor sells to the Purchaser and the Purchaser purchases from the Vendor, as of the Effective Date and conditional upon all liens existing on the Purchased Assets being released, all of the rights, titles, benefits and interests of the Vendor in the Purchased Assets. Documentation The Vendor shall promptly provide the Purchaser with all relevant technical documentation available to the Vendor regarding the Purchased Assets including, but not limited to, documentation that is necessary to operate the Purchased Assets. Purchase Price The purchase price payable by the Purchaser to the Vendor for the Purchased Assets is [AMOUNT] (the "Purchase Price"). For all purposes, including for income tax purposes, the parties agree to allocate the Purchase Price in accordance with the provisions of Schedule A. The Purchase Price shall be payable as follows: [AMOUNT], representing the Purchase Price less the amounts owing from Vendor to Purchaser ([SPECIFY]), payable by certified check as of the Effective Date. Effective Date The sale and purchase of the Purchased Assets shall be conditional upon the release of all existing third party liens on the Purchased Assets and shall be effective upon the date of such release (the "Effective Date") which shall be no later than [DATE], failing which this Agreement shall become null and void, the Purchase Price shall be returned to the Purchaser and the Purchased Assets shall be returned to the Vendor. In such a case, no party shall be entitled to any compensation other than the return of the Purchase Price and Purchased Assets. Assumed Obligations The Purchaser shall assume and agree to satisfy and discharge, as the same shall become due, all of the following (collectively, the "Assumed Obligations"): 1.5.1 All of Vendor's obligations under contracts of Vendor which are identified in Schedule 1.3 and assigned to the Purchaser as of the date hereof, including without limitation any warranty for work performed by the Vendor before the Effective Date. 1.5.2 The Purchaser will also assume and cover all expenses related to the completion of the projects described in Schedule 1.3 including without limitation fuel, employee costs and contributions, material, equipment rentals and repairs, utility and office expenses and project management. Excluded Obligations Except for the Assumed Obligations or as expressly provided herein, the Purchaser is not assuming any past, present and future indebtedness, liabilities, obligations, contracts and commitments of the Vendor, whether arising out of or resulting from the Purchased Assets. Sales and Transfer Taxes The Purchaser shall pay any and all federal, provincial or local taxes, in the nature of income, sale, use, transfer, gain, recording and any similar tax, fee or duty required to be paid in respect of the assignment or transfer to the Purchaser of the Purchased Assets and the filing and recording thereof, including without limitation tax on the Purchase Price. REPRESENTATIONS AND WARRANTIES OF THE VENDOR The Vendor represents and warrants as at the date hereof to the Purchaser as follows and acknowledges that the Purchaser is relying on such representations and warranties in connection with its purchase of the Purchased Assets. Organization The Vendor is a corporation duly incorporated and organized and validly subsisting under the laws of [STATE/PROVINCE] and has the corporate power to own its property and to enter into this Agreement and to perform its obligations hereunder. Due Authorization The execution of this Agreement has been duly authorized, executed and delivered by the Vendor and constitutes legal, valid and binding obligations of the Vendor, enforceable against the Vendor in accordance with its terms. Title To The Assets The Purchased Assets are owned by the Vendor with a good and valid title, free and clear of any encumbrances other than those encumbrances for which the Vendor is in the process to obtain all appropriate consents to the consummation of the transaction contemplated herein. Residency The Vendor is a resident of [COUNTRY] for the purposes of the Income Tax Act ([COUNTRY]). As Is, Where Is The Purchaser acknowledges that the Purchased Assets are purchased on an "as is, where is" basis, that it has inspected the Purchased Assets and is relying entirely on its own investigations and its inspections in proceeding with the transactions contemplated hereunder

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

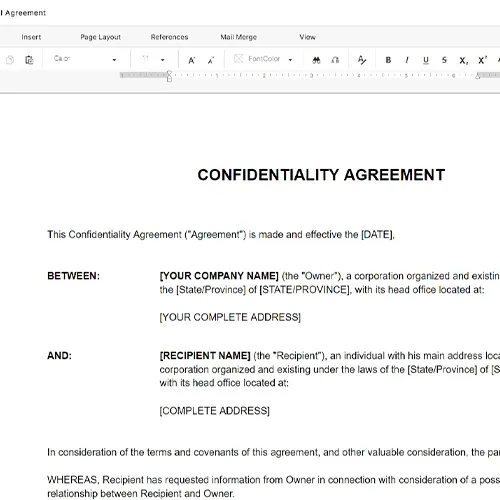

Customize your ready-made business document template and save it in the cloud.

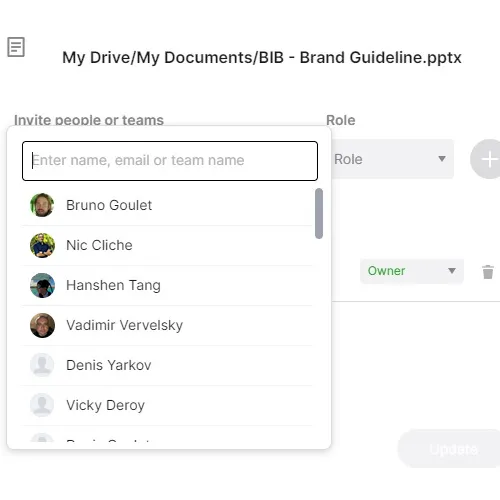

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.