Profit Sharing Plan Template

Document content

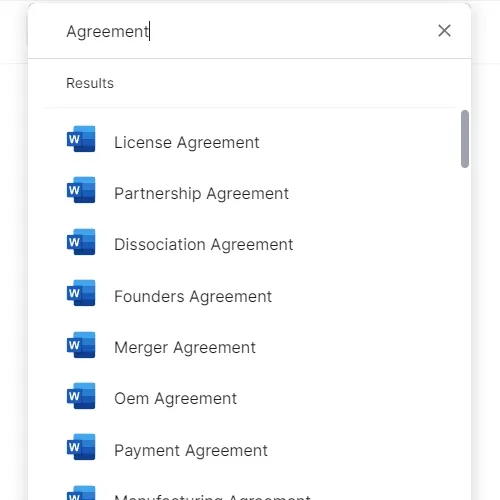

This profit sharing plan template has 24 pages and is a MS Word file type listed under our human resources documents.

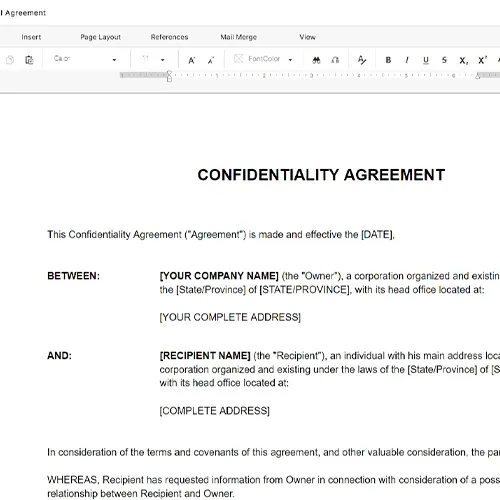

Sample of our profit sharing plan template:

Profit Sharing Plan Your business slogan here. Prepared By: [YOUR NAME] [YOUR JOB TITLE] Phone 555.555.5555 Email info@yourbusiness.com www.yourbusiness.com PROFIT-SHARING PLAN FOR SELF-EMPLOYED INDIVIDUALS The following document is a model profit-sharing plan that is intended to give you an idea of what a typical profit-sharing plan contains. You can modify this form to meet your specific circumstances. Of course, if you intend to use this plan, you should make sure that your attorney reviews it and approves any changes you make. TABLE OF CONTENTS Article Preamble 1. Purpose and Definitions Preamble Purpose Definitions Construction 2. Service Credit and Participation Hour of Service Service Break in Service Loss of Service Multiple Trades and Businesses Participation Originating Under This Plan Cessation of Participation Service and Reentry 3. Contributions Contributions by Employer Member Voluntary Contributions Member Voluntary Contributions (Alternate) 4. Individual Accounts and Allocations Establishment of Individual Accounts Allocation of Employer Contributions Allocation of Gains and Losses Allocation of Forfeitures Notification to Members 5. Retirement Benefit 6. Death Designation of Beneficiary Benefit No Beneficiary 7. Disability Benefit 8. Termination of Employment, and Forfeitures Eligibility Benefit Forfeitures Early Retirement 9. Distribution Notices and Methods of Payment Notice to Trustee Subsequent Notices Time and Methods of Payment Limitations on Payment Minority or Disability Payments 10. Special Governmental Requirements Limit on Annual Additions Under [CODE SECTION] Top-Heavy Restrictions 11. Administration Appointment of Committee Committee Powers and Duties Claims Procedure Committee Procedures Authorization of Benefit Payments Payment of Expenses Unclaimed Benefits 12. Trust Fund Establishment of Trust Fund Payment of Contributions to Trust Fund 13. Amendments Right to Amend 14. Withdrawal and Termination Transfers of Plan Assets and Plan Mergers Plan Termination Suspension and Discontinuance of Contributions and Plan Termination Liquidation of Trust Fund 15. General Provisions Non-guarantee of Employment Manner of Payment Non-alienation of Benefits Amounts Returnable to the Employer Governing Law PROFIT-SHARING PLAN FOR SELF-EMPLOYED INDIVIDUALS OF [YOUR COMPANY NAME] Preamble [YOUR COMPANY NAME], organized and existing under the laws of the [State/Province] of [STATE/PROVINCE] of [state/PROVINCE], hereby establishes a profit-sharing plan for its employees as hereinafter defined, effective [the effective date]. Said organization, as part of the aforesaid Plan, adopts concurrently herewith a Trust agreement creating a Trust Fund (hereinafter at times referred to as the "Fund"), to which contributions shall be made and from which benefits shall be paid in accordance with the terms and conditions thereof. The Plan hereby established is conditioned upon its qualification under [SECTION] of [CODE] , as amended from time to time, with employer contributions being deductible under [SECTION] of [CODE] or any other applicable sections thereof, as amended from time to time. The Plan is intended to qualify as a profit-sharing plan. Purpose and Definitions Purpose: The purpose of this Plan is to encourage Employees to save and invest, systematically, a portion of their current Compensation in order that they may have a source of additional income upon their Retirement or Disability, or for their family in the event of death. The benefits provided by this Plan will be paid from the Trust Fund and will be in addition to the benefits Employees are entitled to receive under any other programs of the Employer. This Plan and the separate related Trust forming a part hereof are established and shall be maintained for the exclusive benefit of the eligible Employees of the Employer and their Beneficiaries. No part of the Trust Fund can ever revert to the Employer or be used for or diverted to any other purpose other than for the exclusive benefit of the Employees of the Employer and their Beneficiaries, except as provided in Section 18.4 hereof. Definitions: Where the following words and phrases appear in this Plan, they shall have the respective meanings set forth below, unless the context clearly indicates otherwise: Allocation Date: The date as of which contributions are allocated hereunder, which shall be the last day of the Plan Year. The Committee may use more frequent Allocation Dates if it so desires. Affiliated Employer: Any business entity (including an Employer hereunder) that, together with an Employer hereunder, constitutes a controlled group of corporations, a group of trades or businesses under common control, or an affiliated service group, all as defined in [CODE SECTION] (subject, however, to the provisions of [CODE SECTION] when applying the benefit limitations of [CODE SECTION]). Beneficiary: A person designated by a Member to receive benefits hereunder upon the death of such Member. Code: The [SECTION] of [CODE] , as amended from time to time. Committee: The person or persons appointed to administer the Plan in accordance with Article XII hereof. Compensation: As to Owner-Employees and any partner who owns less [%] capital or profits interest in the trade or business, Compensation means the Earned Income of such individual, which is net income from self-employment derived from the business with respect to which the Plan is established, provided his personal services are a material income producing factor in such business, determined without regard to items which are not included in gross income for purposes of federal income tax and the deductions properly allocable to or chargeable against such items, and determined after deduction for contributions on behalf of said Owner-Employee and all other Employees. Earned Income also includes gains which are not treated under the Code as gains from the sale or exchange of capital assets and net earnings derived from the sale or other disposition of, the transfer of any interest in, or the licensing of the use of property (other than goodwill) by an individual whose efforts created such property. It is the intent of the foregoing to incorporate the definition of earned income as set forth in [CODE SECTION]. As to any other Employee, the total cash remuneration paid to the Employee for a calendar year by an Employer (or predecessor company) for personal services as reported on the Employee's federal income tax withholding statement or statements. Effective for the Plan Year beginning in [year], this Plan shall not take into consideration compensation in excess of [AMOUNT], as indexed under [CODE SECTION], in computing any Plan benefits. Covered Employment: The employment category for which the Plan is maintained, which includes any employment with the Employer. Disability: A physical or mental condition which, in the judgment of the Committee, totally and presumably permanently prevents an Employee from engaging in substantial gainful employment with his Employer. Effective Date: [Effective date]. Employee: Any person who, on or after the Effective Date, is receiving remuneration for personal services rendered as a common law employee of the Employer or Affiliated Employer (or who would be receiving such remuneration except for an authorized Leave of Absence), or any Owner Employee, or a partner who has less than a [%] capital or profits interest in the trade or business. This Plan shall not cover leased employees

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This profit sharing plan template has 24 pages and is a MS Word file type listed under our human resources documents.

Sample of our profit sharing plan template:

Profit Sharing Plan Your business slogan here. Prepared By: [YOUR NAME] [YOUR JOB TITLE] Phone 555.555.5555 Email info@yourbusiness.com www.yourbusiness.com PROFIT-SHARING PLAN FOR SELF-EMPLOYED INDIVIDUALS The following document is a model profit-sharing plan that is intended to give you an idea of what a typical profit-sharing plan contains. You can modify this form to meet your specific circumstances. Of course, if you intend to use this plan, you should make sure that your attorney reviews it and approves any changes you make. TABLE OF CONTENTS Article Preamble 1. Purpose and Definitions Preamble Purpose Definitions Construction 2. Service Credit and Participation Hour of Service Service Break in Service Loss of Service Multiple Trades and Businesses Participation Originating Under This Plan Cessation of Participation Service and Reentry 3. Contributions Contributions by Employer Member Voluntary Contributions Member Voluntary Contributions (Alternate) 4. Individual Accounts and Allocations Establishment of Individual Accounts Allocation of Employer Contributions Allocation of Gains and Losses Allocation of Forfeitures Notification to Members 5. Retirement Benefit 6. Death Designation of Beneficiary Benefit No Beneficiary 7. Disability Benefit 8. Termination of Employment, and Forfeitures Eligibility Benefit Forfeitures Early Retirement 9. Distribution Notices and Methods of Payment Notice to Trustee Subsequent Notices Time and Methods of Payment Limitations on Payment Minority or Disability Payments 10. Special Governmental Requirements Limit on Annual Additions Under [CODE SECTION] Top-Heavy Restrictions 11. Administration Appointment of Committee Committee Powers and Duties Claims Procedure Committee Procedures Authorization of Benefit Payments Payment of Expenses Unclaimed Benefits 12. Trust Fund Establishment of Trust Fund Payment of Contributions to Trust Fund 13. Amendments Right to Amend 14. Withdrawal and Termination Transfers of Plan Assets and Plan Mergers Plan Termination Suspension and Discontinuance of Contributions and Plan Termination Liquidation of Trust Fund 15. General Provisions Non-guarantee of Employment Manner of Payment Non-alienation of Benefits Amounts Returnable to the Employer Governing Law PROFIT-SHARING PLAN FOR SELF-EMPLOYED INDIVIDUALS OF [YOUR COMPANY NAME] Preamble [YOUR COMPANY NAME], organized and existing under the laws of the [State/Province] of [STATE/PROVINCE] of [state/PROVINCE], hereby establishes a profit-sharing plan for its employees as hereinafter defined, effective [the effective date]. Said organization, as part of the aforesaid Plan, adopts concurrently herewith a Trust agreement creating a Trust Fund (hereinafter at times referred to as the "Fund"), to which contributions shall be made and from which benefits shall be paid in accordance with the terms and conditions thereof. The Plan hereby established is conditioned upon its qualification under [SECTION] of [CODE] , as amended from time to time, with employer contributions being deductible under [SECTION] of [CODE] or any other applicable sections thereof, as amended from time to time. The Plan is intended to qualify as a profit-sharing plan. Purpose and Definitions Purpose: The purpose of this Plan is to encourage Employees to save and invest, systematically, a portion of their current Compensation in order that they may have a source of additional income upon their Retirement or Disability, or for their family in the event of death. The benefits provided by this Plan will be paid from the Trust Fund and will be in addition to the benefits Employees are entitled to receive under any other programs of the Employer. This Plan and the separate related Trust forming a part hereof are established and shall be maintained for the exclusive benefit of the eligible Employees of the Employer and their Beneficiaries. No part of the Trust Fund can ever revert to the Employer or be used for or diverted to any other purpose other than for the exclusive benefit of the Employees of the Employer and their Beneficiaries, except as provided in Section 18.4 hereof. Definitions: Where the following words and phrases appear in this Plan, they shall have the respective meanings set forth below, unless the context clearly indicates otherwise: Allocation Date: The date as of which contributions are allocated hereunder, which shall be the last day of the Plan Year. The Committee may use more frequent Allocation Dates if it so desires. Affiliated Employer: Any business entity (including an Employer hereunder) that, together with an Employer hereunder, constitutes a controlled group of corporations, a group of trades or businesses under common control, or an affiliated service group, all as defined in [CODE SECTION] (subject, however, to the provisions of [CODE SECTION] when applying the benefit limitations of [CODE SECTION]). Beneficiary: A person designated by a Member to receive benefits hereunder upon the death of such Member. Code: The [SECTION] of [CODE] , as amended from time to time. Committee: The person or persons appointed to administer the Plan in accordance with Article XII hereof. Compensation: As to Owner-Employees and any partner who owns less [%] capital or profits interest in the trade or business, Compensation means the Earned Income of such individual, which is net income from self-employment derived from the business with respect to which the Plan is established, provided his personal services are a material income producing factor in such business, determined without regard to items which are not included in gross income for purposes of federal income tax and the deductions properly allocable to or chargeable against such items, and determined after deduction for contributions on behalf of said Owner-Employee and all other Employees. Earned Income also includes gains which are not treated under the Code as gains from the sale or exchange of capital assets and net earnings derived from the sale or other disposition of, the transfer of any interest in, or the licensing of the use of property (other than goodwill) by an individual whose efforts created such property. It is the intent of the foregoing to incorporate the definition of earned income as set forth in [CODE SECTION]. As to any other Employee, the total cash remuneration paid to the Employee for a calendar year by an Employer (or predecessor company) for personal services as reported on the Employee's federal income tax withholding statement or statements. Effective for the Plan Year beginning in [year], this Plan shall not take into consideration compensation in excess of [AMOUNT], as indexed under [CODE SECTION], in computing any Plan benefits. Covered Employment: The employment category for which the Plan is maintained, which includes any employment with the Employer. Disability: A physical or mental condition which, in the judgment of the Committee, totally and presumably permanently prevents an Employee from engaging in substantial gainful employment with his Employer. Effective Date: [Effective date]. Employee: Any person who, on or after the Effective Date, is receiving remuneration for personal services rendered as a common law employee of the Employer or Affiliated Employer (or who would be receiving such remuneration except for an authorized Leave of Absence), or any Owner Employee, or a partner who has less than a [%] capital or profits interest in the trade or business. This Plan shall not cover leased employees

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

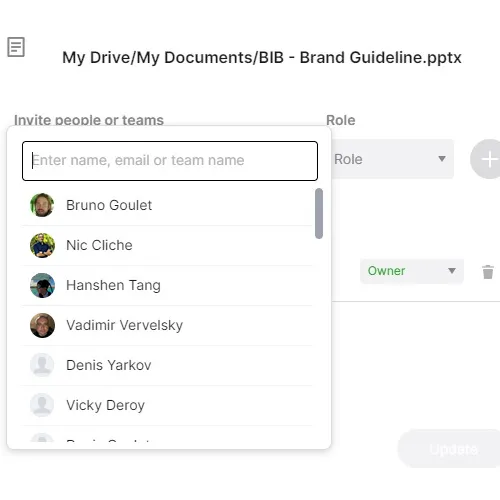

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.