Profit Share Agreement Template

Understanding a Profit-Sharing Agreement

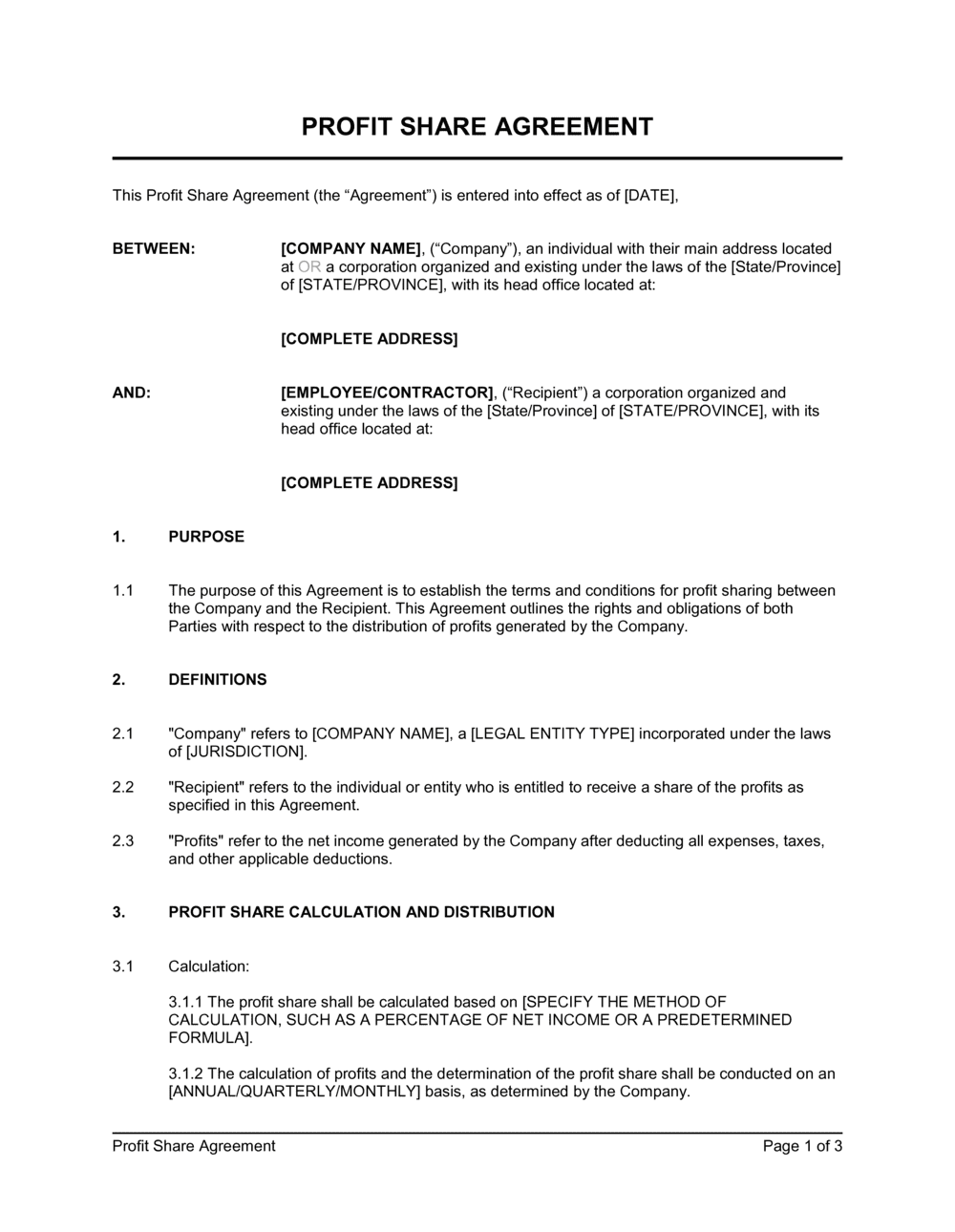

A Profit-Sharing Agreement is a crucial document that outlines the distribution of profits between business partners or stakeholders. It is a legally binding contract that specifies how profits and losses will be shared, ensuring transparency and preventing disputes. The agreement helps align incentives, fosters cooperation and encourages collective efforts toward the business's success.

What is a Profit Sharing Agreement?

A Profit Sharing Agreement template provides a structured framework to effectively outline the terms of profit distribution:

- Parties Involved - Clearly lists the names and roles of the parties participating in the profit-sharing arrangement.

- Purpose and Objectives - Explains the purpose of the agreement and its goals, such as aligning interests or rewarding contributions.

- Definitions and Interpretations - Provides definitions for key terms used in the agreement to ensure clarity and avoid misunderstandings.

- Profit Calculation Method - Details the method for calculating profits, including revenue recognition, cost allocation, and adjustments.

- Profit Distribution Terms - Specifies the proportion of profits to be distributed to each party, along with the schedule and method of distribution.

- Loss Allocation - Outlines how losses will be distributed among the parties, including thresholds and limits on liability.

- Roles and Responsibilities - Defines the roles and responsibilities of each party in managing, operating, and contributing to the business.

- Duration and Termination - Specifies the agreement's duration and the conditions under which it can be terminated, such as mutual consent or breach of terms.

- Dispute Resolution - Provides a framework for resolving disputes, such as mediation or arbitration, to avoid costly legal battles.

- Signature and Date - The signatures of all parties and the date to validate the document.

Supporting Documents for Structuring a Profit-Sharing Agreement

To enhance the clarity and comprehensiveness of a Profit Sharing Agreement, including related documents is advisable:

- Financial Report - A comprehensive document that provides a detailed analysis of the business’s financial performance, including revenues, expenses, assets, and liabilities. These reports offer an accurate and transparent view of the company’s overall financial health, often including comparative analysis and insights into financial trends over time.

- Tax Compliance Policy - A structured set of guidelines that outlines the company’s approach to tax compliance, ensuring adherence to relevant tax laws and regulations. It provides a framework for accurately reporting and managing taxes to ensure profit distribution meets legal requirements.

- Business Plan - A detailed blueprint of the business’s objectives, strategies, and operational plans. It includes market analysis, marketing strategies, organizational structure, and financial projections, providing a comprehensive context for understanding the business's direction and impact on profit-sharing arrangements.

- Shareholders Agreement - A legal document that sets forth the rights, responsibilities, and obligations of shareholders in a company. This agreement ensures a common understanding among shareholders regarding ownership, voting rights, profit distribution, and the processes for resolving disputes, thereby aligning interests with the company's profit-sharing framework.

Why Use a Comprehensive Profit Sharing Agreement Template?

Using a structured template for drafting a Profit Sharing Agreement offers significant benefits:

- Transparency and Trust - Clearly outlines the rules for profit distribution, fostering trust and minimizing misunderstandings.

- Motivation and Alignment - Aligns the interests of all parties, motivating them to work towards common goals.

- Legal Protection - Provides legal clarity and protection for all parties, reducing the risk of disputes and ensuring compliance with regulations.

- Operational Efficiency - Offers a structured approach to profit-sharing, making the process efficient and scalable.

Adopting a comprehensive Profit-Sharing Agreement is crucial for ensuring smooth collaboration among business partners. It provides a clear and actionable framework for profit distribution, supports transparency, and protects the interests of all parties involved.

Updated in May 2024

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Understanding a Profit-Sharing Agreement

A Profit-Sharing Agreement is a crucial document that outlines the distribution of profits between business partners or stakeholders. It is a legally binding contract that specifies how profits and losses will be shared, ensuring transparency and preventing disputes. The agreement helps align incentives, fosters cooperation and encourages collective efforts toward the business's success.

What is a Profit Sharing Agreement?

A Profit Sharing Agreement template provides a structured framework to effectively outline the terms of profit distribution:

- Parties Involved - Clearly lists the names and roles of the parties participating in the profit-sharing arrangement.

- Purpose and Objectives - Explains the purpose of the agreement and its goals, such as aligning interests or rewarding contributions.

- Definitions and Interpretations - Provides definitions for key terms used in the agreement to ensure clarity and avoid misunderstandings.

- Profit Calculation Method - Details the method for calculating profits, including revenue recognition, cost allocation, and adjustments.

- Profit Distribution Terms - Specifies the proportion of profits to be distributed to each party, along with the schedule and method of distribution.

- Loss Allocation - Outlines how losses will be distributed among the parties, including thresholds and limits on liability.

- Roles and Responsibilities - Defines the roles and responsibilities of each party in managing, operating, and contributing to the business.

- Duration and Termination - Specifies the agreement's duration and the conditions under which it can be terminated, such as mutual consent or breach of terms.

- Dispute Resolution - Provides a framework for resolving disputes, such as mediation or arbitration, to avoid costly legal battles.

- Signature and Date - The signatures of all parties and the date to validate the document.

Supporting Documents for Structuring a Profit-Sharing Agreement

To enhance the clarity and comprehensiveness of a Profit Sharing Agreement, including related documents is advisable:

- Financial Report - A comprehensive document that provides a detailed analysis of the business’s financial performance, including revenues, expenses, assets, and liabilities. These reports offer an accurate and transparent view of the company’s overall financial health, often including comparative analysis and insights into financial trends over time.

- Tax Compliance Policy - A structured set of guidelines that outlines the company’s approach to tax compliance, ensuring adherence to relevant tax laws and regulations. It provides a framework for accurately reporting and managing taxes to ensure profit distribution meets legal requirements.

- Business Plan - A detailed blueprint of the business’s objectives, strategies, and operational plans. It includes market analysis, marketing strategies, organizational structure, and financial projections, providing a comprehensive context for understanding the business's direction and impact on profit-sharing arrangements.

- Shareholders Agreement - A legal document that sets forth the rights, responsibilities, and obligations of shareholders in a company. This agreement ensures a common understanding among shareholders regarding ownership, voting rights, profit distribution, and the processes for resolving disputes, thereby aligning interests with the company's profit-sharing framework.

Why Use a Comprehensive Profit Sharing Agreement Template?

Using a structured template for drafting a Profit Sharing Agreement offers significant benefits:

- Transparency and Trust - Clearly outlines the rules for profit distribution, fostering trust and minimizing misunderstandings.

- Motivation and Alignment - Aligns the interests of all parties, motivating them to work towards common goals.

- Legal Protection - Provides legal clarity and protection for all parties, reducing the risk of disputes and ensuring compliance with regulations.

- Operational Efficiency - Offers a structured approach to profit-sharing, making the process efficient and scalable.

Adopting a comprehensive Profit-Sharing Agreement is crucial for ensuring smooth collaboration among business partners. It provides a clear and actionable framework for profit distribution, supports transparency, and protects the interests of all parties involved.

Updated in May 2024

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.