Pledge Agreement Debenture Template

Document content

This pledge agreement debenture template has 5 pages and is a MS Word file type listed under our legal agreements documents.

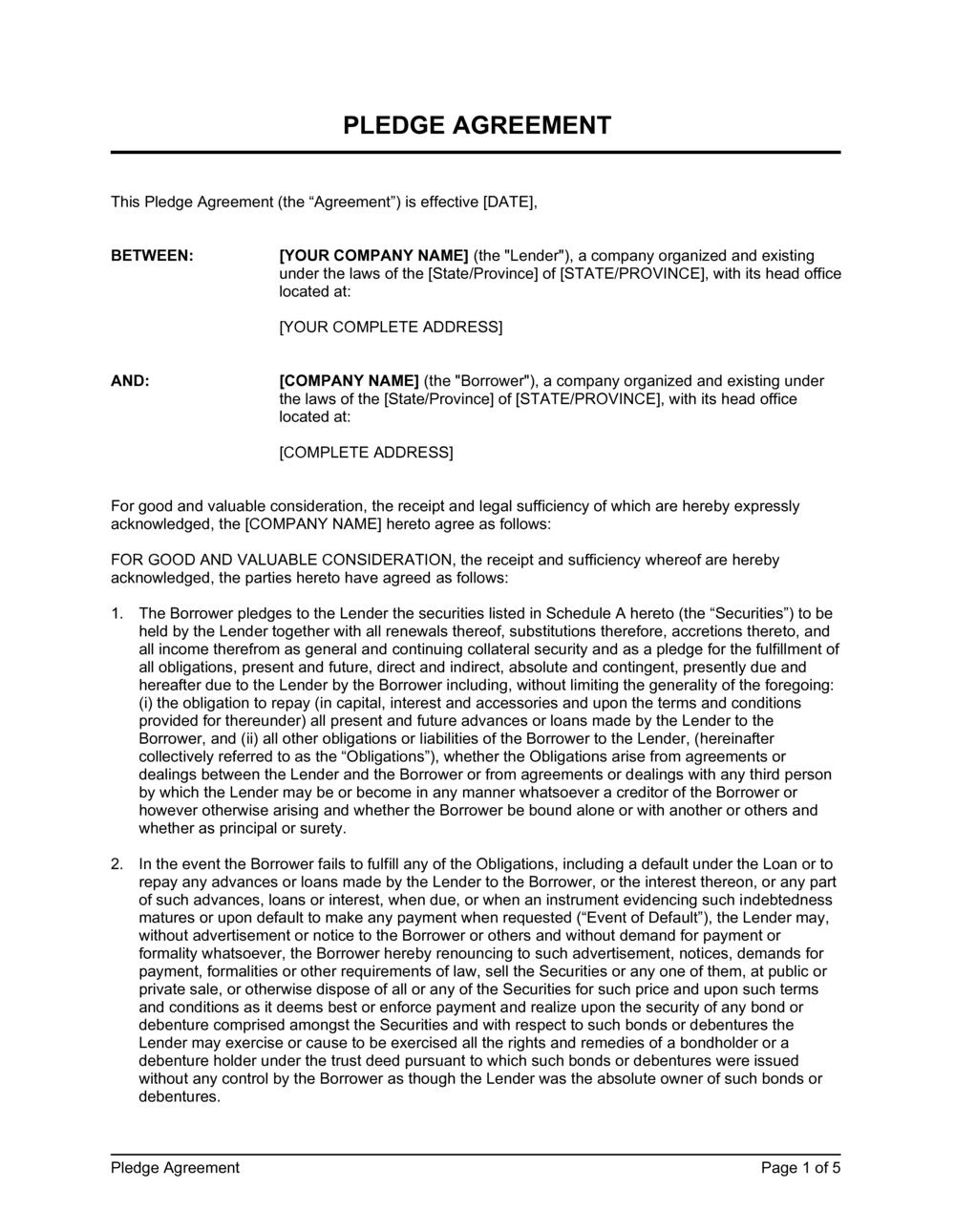

Sample of our pledge agreement debenture template:

PLEDGE AGREEMENT This Pledge Agreement (the "Agreement") is effective [DATE], BETWEEN: [YOUR COMPANY NAME] (the "Lender"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [COMPANY NAME] (the "Borrower"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] For good and valuable consideration, the receipt and legal sufficiency of which are hereby expressly acknowledged, the [COMPANY NAME] hereto agree as follows: FOR GOOD AND VALUABLE CONSIDERATION, the receipt and sufficiency whereof are hereby acknowledged, the parties hereto have agreed as follows: The Borrower pledges to the Lender the securities listed in Schedule A hereto (the "Securities") to be held by the Lender together with all renewals thereof, substitutions therefore, accretions thereto, and all income therefrom as general and continuing collateral security and as a pledge for the fulfillment of all obligations, present and future, direct and indirect, absolute and contingent, presently due and hereafter due to the Lender by the Borrower including, without limiting the generality of the foregoing: (i) the obligation to repay (in capital, interest and accessories and upon the terms and conditions provided for thereunder) all present and future advances or loans made by the Lender to the Borrower, and (ii) all other obligations or liabilities of the Borrower to the Lender, (hereinafter collectively referred to as the "Obligations"), whether the Obligations arise from agreements or dealings between the Lender and the Borrower or from agreements or dealings with any third person by which the Lender may be or become in any manner whatsoever a creditor of the Borrower or however otherwise arising and whether the Borrower be bound alone or with another or others and whether as principal or surety. In the event the Borrower fails to fulfill any of the Obligations, including a default under the Loan or to repay any advances or loans made by the Lender to the Borrower, or the interest thereon, or any part of such advances, loans or interest, when due, or when an instrument evidencing such indebtedness matures or upon default to make any payment when requested ("Event of Default"), the Lender may, without advertisement or notice to the Borrower or others and without demand for payment or formality whatsoever, the Borrower hereby renouncing to such advertisement, notices, demands for payment, formalities or other requirements of law, sell the Securities or any one of them, at public or private sale, or otherwise dispose of all or any of the Securities for such price and upon such terms and conditions as it deems best or enforce payment and realize upon the security of any bond or debenture comprised amongst the Securities and with respect to such bonds or debentures the Lender may exercise or cause to be exercised all the rights and remedies of a bondholder or a debenture holder under the trust deed pursuant to which such bonds or debentures were issued without any control by the Borrower as though the Lender was the absolute owner of such bonds or debentures. All income from the Securities and the proceeds of any sale or realization of the Securities, after deduction of all expenses thereof, with interest on such expenses at the rate then borne by the advances or loans by the Lender to the Borrower, may be held by the Lender as security as aforesaid, and, when the Lender deems it desirable so to do, from time to time, may be applied against any of the Obligations as the Lender deems best. With respect to any bonds or debentures comprised amongst the Securities and whether or not the Borrower be in default under this Agreement, the Lender shall be considered the owner of such bonds or debentures as regards the trustee or trustees under the trust deeds pursuant to which the same were issued, for all purposes of such trust deeds. The Lender is hereby authorized to exercise all rights, remedies, powers, privileges, guarantees and recourses available to a bondholder or a debenture holder under such trust deeds, and the trustee or trustees under such deeds shall act upon instructions and directions of the Lender. The Lender shall not be bound to realize on any or all of the Securities nor to permit the alienation of same and it shall not be responsible for any loss resulting from the sale of any or all of the Securities, the retention thereof or refusal to sell, dispose of or realize upon the same; nor shall the Lender be required to collect or receive the interest or dividends thereon nor to demand payment thereof. In the event that the Borrower should receive a dividend or interest payment on any of the Securities, all sums thus received shall be immediately paid to the Lender and the default of the Borrower to do so shall constitute an Event of Default under the provisions hereof. The Lender or any officer of the Lender is hereby constituted the irrevocable attorney of the Borrower, with power to delegate and sub-delegate, for the purpose of transferring all or any of the Securities and the Lender may endorse the Securities and/or execute any transfers of stocks, bonds or debentures or any power of attorney and generally all documents required to complete the transfer and alienation of all or any of the Securities. The Lender and its nominees are hereby empowered to exercise all rights and powers (and to perform all acts of ownership) in respect of all or any of the Securities to the same extent as the Borrower might do and the Borrower shall forthwith repay all consequent outlays and expenses with interest at the rate then borne by the advances or loans by the Lender to the Borrower, failing which such sums shall be added by the Lender to the sums due and guaranteed by the Securities.

Reviewed on

Document content

This pledge agreement debenture template has 5 pages and is a MS Word file type listed under our legal agreements documents.

Sample of our pledge agreement debenture template:

PLEDGE AGREEMENT This Pledge Agreement (the "Agreement") is effective [DATE], BETWEEN: [YOUR COMPANY NAME] (the "Lender"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [COMPANY NAME] (the "Borrower"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] For good and valuable consideration, the receipt and legal sufficiency of which are hereby expressly acknowledged, the [COMPANY NAME] hereto agree as follows: FOR GOOD AND VALUABLE CONSIDERATION, the receipt and sufficiency whereof are hereby acknowledged, the parties hereto have agreed as follows: The Borrower pledges to the Lender the securities listed in Schedule A hereto (the "Securities") to be held by the Lender together with all renewals thereof, substitutions therefore, accretions thereto, and all income therefrom as general and continuing collateral security and as a pledge for the fulfillment of all obligations, present and future, direct and indirect, absolute and contingent, presently due and hereafter due to the Lender by the Borrower including, without limiting the generality of the foregoing: (i) the obligation to repay (in capital, interest and accessories and upon the terms and conditions provided for thereunder) all present and future advances or loans made by the Lender to the Borrower, and (ii) all other obligations or liabilities of the Borrower to the Lender, (hereinafter collectively referred to as the "Obligations"), whether the Obligations arise from agreements or dealings between the Lender and the Borrower or from agreements or dealings with any third person by which the Lender may be or become in any manner whatsoever a creditor of the Borrower or however otherwise arising and whether the Borrower be bound alone or with another or others and whether as principal or surety. In the event the Borrower fails to fulfill any of the Obligations, including a default under the Loan or to repay any advances or loans made by the Lender to the Borrower, or the interest thereon, or any part of such advances, loans or interest, when due, or when an instrument evidencing such indebtedness matures or upon default to make any payment when requested ("Event of Default"), the Lender may, without advertisement or notice to the Borrower or others and without demand for payment or formality whatsoever, the Borrower hereby renouncing to such advertisement, notices, demands for payment, formalities or other requirements of law, sell the Securities or any one of them, at public or private sale, or otherwise dispose of all or any of the Securities for such price and upon such terms and conditions as it deems best or enforce payment and realize upon the security of any bond or debenture comprised amongst the Securities and with respect to such bonds or debentures the Lender may exercise or cause to be exercised all the rights and remedies of a bondholder or a debenture holder under the trust deed pursuant to which such bonds or debentures were issued without any control by the Borrower as though the Lender was the absolute owner of such bonds or debentures. All income from the Securities and the proceeds of any sale or realization of the Securities, after deduction of all expenses thereof, with interest on such expenses at the rate then borne by the advances or loans by the Lender to the Borrower, may be held by the Lender as security as aforesaid, and, when the Lender deems it desirable so to do, from time to time, may be applied against any of the Obligations as the Lender deems best. With respect to any bonds or debentures comprised amongst the Securities and whether or not the Borrower be in default under this Agreement, the Lender shall be considered the owner of such bonds or debentures as regards the trustee or trustees under the trust deeds pursuant to which the same were issued, for all purposes of such trust deeds. The Lender is hereby authorized to exercise all rights, remedies, powers, privileges, guarantees and recourses available to a bondholder or a debenture holder under such trust deeds, and the trustee or trustees under such deeds shall act upon instructions and directions of the Lender. The Lender shall not be bound to realize on any or all of the Securities nor to permit the alienation of same and it shall not be responsible for any loss resulting from the sale of any or all of the Securities, the retention thereof or refusal to sell, dispose of or realize upon the same; nor shall the Lender be required to collect or receive the interest or dividends thereon nor to demand payment thereof. In the event that the Borrower should receive a dividend or interest payment on any of the Securities, all sums thus received shall be immediately paid to the Lender and the default of the Borrower to do so shall constitute an Event of Default under the provisions hereof. The Lender or any officer of the Lender is hereby constituted the irrevocable attorney of the Borrower, with power to delegate and sub-delegate, for the purpose of transferring all or any of the Securities and the Lender may endorse the Securities and/or execute any transfers of stocks, bonds or debentures or any power of attorney and generally all documents required to complete the transfer and alienation of all or any of the Securities. The Lender and its nominees are hereby empowered to exercise all rights and powers (and to perform all acts of ownership) in respect of all or any of the Securities to the same extent as the Borrower might do and the Borrower shall forthwith repay all consequent outlays and expenses with interest at the rate then borne by the advances or loans by the Lender to the Borrower, failing which such sums shall be added by the Lender to the sums due and guaranteed by the Securities.

Easily Create Any Business Document You Need in Minutes.

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.