Phantom Stock Agreement Template

Document content

This phantom stock agreement template has 4 pages and is a MS Word file type listed under our finance & accounting documents.

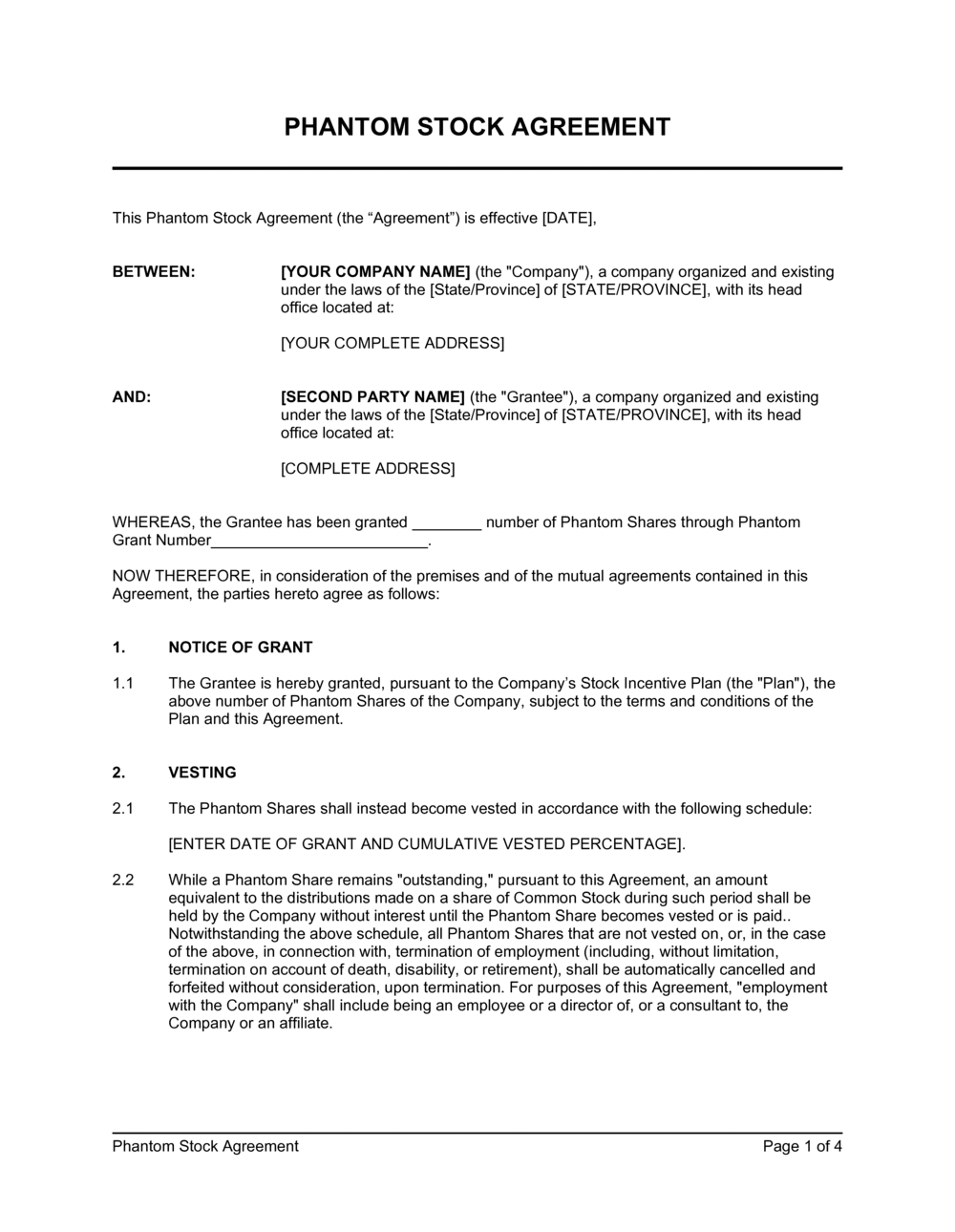

Sample of our phantom stock agreement template:

PHANTOM STOCK AGREEMENT This Phantom Stock Agreement (the "Agreement") is effective [DATE], BETWEEN: [YOUR COMPANY NAME] (the "Company"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [SECOND PARTY NAME] (the "Grantee"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] WHEREAS, the Grantee has been granted ________ number of Phantom Shares through Phantom Grant Number_________________________. NOW THEREFORE, in consideration of the premises and of the mutual agreements contained in this Agreement, the parties hereto agree as follows: NOTICE OF GRANT The Grantee is hereby granted, pursuant to the Company's Stock Incentive Plan (the "Plan"), the above number of Phantom Shares of the Company, subject to the terms and conditions of the Plan and this Agreement. VESTING The Phantom Shares shall instead become vested in accordance with the following schedule: [ENTER DATE OF GRANT AND CUMULATIVE VESTED PERCENTAGE]. While a Phantom Share remains "outstanding," pursuant to this Agreement, an amount equivalent to the distributions made on a share of Common Stock during such period shall be held by the Company without interest until the Phantom Share becomes vested or is paid.. Notwithstanding the above schedule, all Phantom Shares that are not vested on, or, in the case of the above, in connection with, termination of employment (including, without limitation, termination on account of death, disability, or retirement), shall be automatically cancelled and forfeited without consideration, upon termination. For purposes of this Agreement, "employment with the Company" shall include being an employee or a director of, or a consultant to, the Company or an affiliate. RIGHT OF REPURCHASE OF UNVESTED SHARES Payment/Certificates: Upon vesting of the Phantom Shares, the Company shall either: (a) cause a certificate or certificates for shares of Common Stock to be issued in the Grantee's name without legend (except for any legend required pursuant to applicable securities laws or any other agreement to which the Grantee is a party); (b) cause to be paid to the Grantee an amount equal to the fair market value of the shares that would otherwise be issued to the Grantee; or (c) cause to be paid and issued to the Grantee a combination of cash and shares, which, in combination, equal the fair market value of the shares that would otherwise be issued to the Grantee; in each case, in cancellation of the Phantom Shares that have been vested; provided, however, in no event shall such payment or issuance of shares be made prior to the first day, or such payment would not be subject to the additional tax. RESTRICTIONS ON TRANSFERS 4.1 The Grantee may not sell, transfer, pledge, exchange, hypothecate or dispose of Phantom Shares in any manner. A breach of these terms of this Agreement shall cause a forfeiture of the Phantom Shares. WITHHOLDING OF TAX

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This phantom stock agreement template has 4 pages and is a MS Word file type listed under our finance & accounting documents.

Sample of our phantom stock agreement template:

PHANTOM STOCK AGREEMENT This Phantom Stock Agreement (the "Agreement") is effective [DATE], BETWEEN: [YOUR COMPANY NAME] (the "Company"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [SECOND PARTY NAME] (the "Grantee"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] WHEREAS, the Grantee has been granted ________ number of Phantom Shares through Phantom Grant Number_________________________. NOW THEREFORE, in consideration of the premises and of the mutual agreements contained in this Agreement, the parties hereto agree as follows: NOTICE OF GRANT The Grantee is hereby granted, pursuant to the Company's Stock Incentive Plan (the "Plan"), the above number of Phantom Shares of the Company, subject to the terms and conditions of the Plan and this Agreement. VESTING The Phantom Shares shall instead become vested in accordance with the following schedule: [ENTER DATE OF GRANT AND CUMULATIVE VESTED PERCENTAGE]. While a Phantom Share remains "outstanding," pursuant to this Agreement, an amount equivalent to the distributions made on a share of Common Stock during such period shall be held by the Company without interest until the Phantom Share becomes vested or is paid.. Notwithstanding the above schedule, all Phantom Shares that are not vested on, or, in the case of the above, in connection with, termination of employment (including, without limitation, termination on account of death, disability, or retirement), shall be automatically cancelled and forfeited without consideration, upon termination. For purposes of this Agreement, "employment with the Company" shall include being an employee or a director of, or a consultant to, the Company or an affiliate. RIGHT OF REPURCHASE OF UNVESTED SHARES Payment/Certificates: Upon vesting of the Phantom Shares, the Company shall either: (a) cause a certificate or certificates for shares of Common Stock to be issued in the Grantee's name without legend (except for any legend required pursuant to applicable securities laws or any other agreement to which the Grantee is a party); (b) cause to be paid to the Grantee an amount equal to the fair market value of the shares that would otherwise be issued to the Grantee; or (c) cause to be paid and issued to the Grantee a combination of cash and shares, which, in combination, equal the fair market value of the shares that would otherwise be issued to the Grantee; in each case, in cancellation of the Phantom Shares that have been vested; provided, however, in no event shall such payment or issuance of shares be made prior to the first day, or such payment would not be subject to the additional tax. RESTRICTIONS ON TRANSFERS 4.1 The Grantee may not sell, transfer, pledge, exchange, hypothecate or dispose of Phantom Shares in any manner. A breach of these terms of this Agreement shall cause a forfeiture of the Phantom Shares. WITHHOLDING OF TAX

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.