Phantom Equity Agreement Template

Document content

This phantom equity agreement template has 4 pages and is a MS Word file type listed under our legal agreements documents.

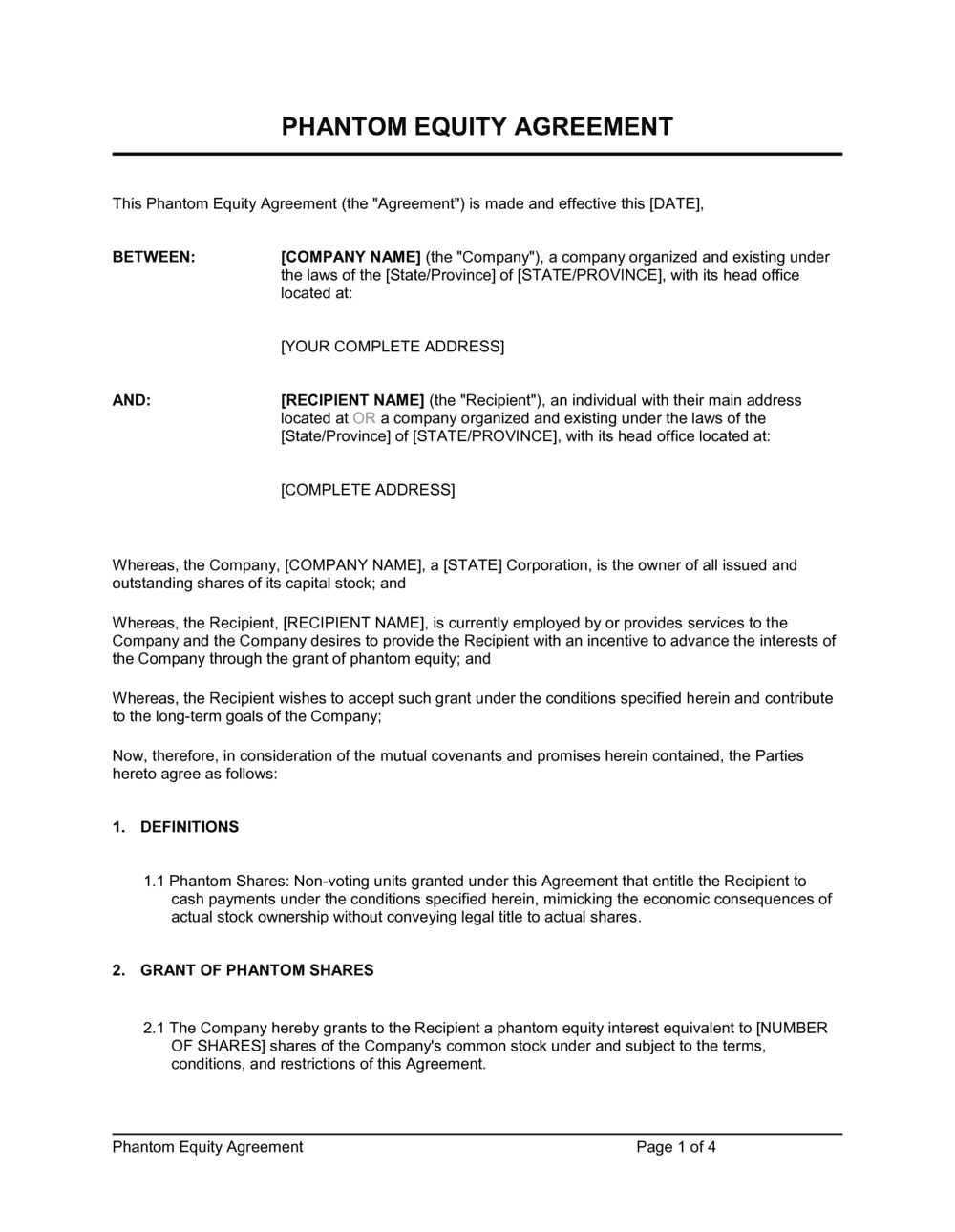

Sample of our phantom equity agreement template:

PHANTOM EQUITY AGREEMENT This Phantom Equity Agreement (the "Agreement") is made and effective this [DATE], BETWEEN: [COMPANY NAME] (the "Company"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [RECIPIENT NAME] (the "Recipient"), an individual with their main address located at OR a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] Whereas, the Company, [COMPANY NAME], a [STATE] Corporation, is the owner of all issued and outstanding shares of its capital stock; and Whereas, the Recipient, [RECIPIENT NAME], is currently employed by or provides services to the Company and the Company desires to provide the Recipient with an incentive to advance the interests of the Company through the grant of phantom equity; and Whereas, the Recipient wishes to accept such grant under the conditions specified herein and contribute to the long-term goals of the Company; Now, therefore, in consideration of the mutual covenants and promises herein contained, the Parties hereto agree as follows: Definitions 1.1 Phantom Shares: Non-voting units granted under this Agreement that entitle the Recipient to cash payments under the conditions specified herein, mimicking the economic consequences of actual stock ownership without conveying legal title to actual shares. GRANT OF PHANTOM SHARES 2.1 The Company hereby grants to the Recipient a phantom equity interest equivalent to [NUMBER OF SHARES] shares of the Company's common stock under and subject to the terms, conditions, and restrictions of this Agreement. Vesting 3.1 The Phantom Shares will vest in increments of [E.G., 25%] annually over [E.G., FOUR YEARS] from the date of grant, contingent upon the Recipient's continuous service to the Company. 3.2 Vesting accelerates upon a Change in Control, when any of the following events take place: a) Sale of the Company: The sale of all or substantially all of the Company's assets to an unrelated third party. b) Merger or Acquisition: A merger or consolidation in which the Company is not the surviving entity, or in which the owners of the Company's outstanding voting stock immediately before the transaction own less than 50% of the voting power of the surviving entity immediately after the transaction. c) Transfer of Shares: The acquisition by any unrelated person or group of persons (excluding an acquisition from another shareholder), in a single transaction or in a series of related transactions, of more than 50% of the outstanding voting stock of the Company. 3

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This phantom equity agreement template has 4 pages and is a MS Word file type listed under our legal agreements documents.

Sample of our phantom equity agreement template:

PHANTOM EQUITY AGREEMENT This Phantom Equity Agreement (the "Agreement") is made and effective this [DATE], BETWEEN: [COMPANY NAME] (the "Company"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [RECIPIENT NAME] (the "Recipient"), an individual with their main address located at OR a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] Whereas, the Company, [COMPANY NAME], a [STATE] Corporation, is the owner of all issued and outstanding shares of its capital stock; and Whereas, the Recipient, [RECIPIENT NAME], is currently employed by or provides services to the Company and the Company desires to provide the Recipient with an incentive to advance the interests of the Company through the grant of phantom equity; and Whereas, the Recipient wishes to accept such grant under the conditions specified herein and contribute to the long-term goals of the Company; Now, therefore, in consideration of the mutual covenants and promises herein contained, the Parties hereto agree as follows: Definitions 1.1 Phantom Shares: Non-voting units granted under this Agreement that entitle the Recipient to cash payments under the conditions specified herein, mimicking the economic consequences of actual stock ownership without conveying legal title to actual shares. GRANT OF PHANTOM SHARES 2.1 The Company hereby grants to the Recipient a phantom equity interest equivalent to [NUMBER OF SHARES] shares of the Company's common stock under and subject to the terms, conditions, and restrictions of this Agreement. Vesting 3.1 The Phantom Shares will vest in increments of [E.G., 25%] annually over [E.G., FOUR YEARS] from the date of grant, contingent upon the Recipient's continuous service to the Company. 3.2 Vesting accelerates upon a Change in Control, when any of the following events take place: a) Sale of the Company: The sale of all or substantially all of the Company's assets to an unrelated third party. b) Merger or Acquisition: A merger or consolidation in which the Company is not the surviving entity, or in which the owners of the Company's outstanding voting stock immediately before the transaction own less than 50% of the voting power of the surviving entity immediately after the transaction. c) Transfer of Shares: The acquisition by any unrelated person or group of persons (excluding an acquisition from another shareholder), in a single transaction or in a series of related transactions, of more than 50% of the outstanding voting stock of the Company. 3

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.