Overtime Policy Guidance Template

Document content

This overtime policy guidance template has 8 pages and is a MS Word file type listed under our human resources documents.

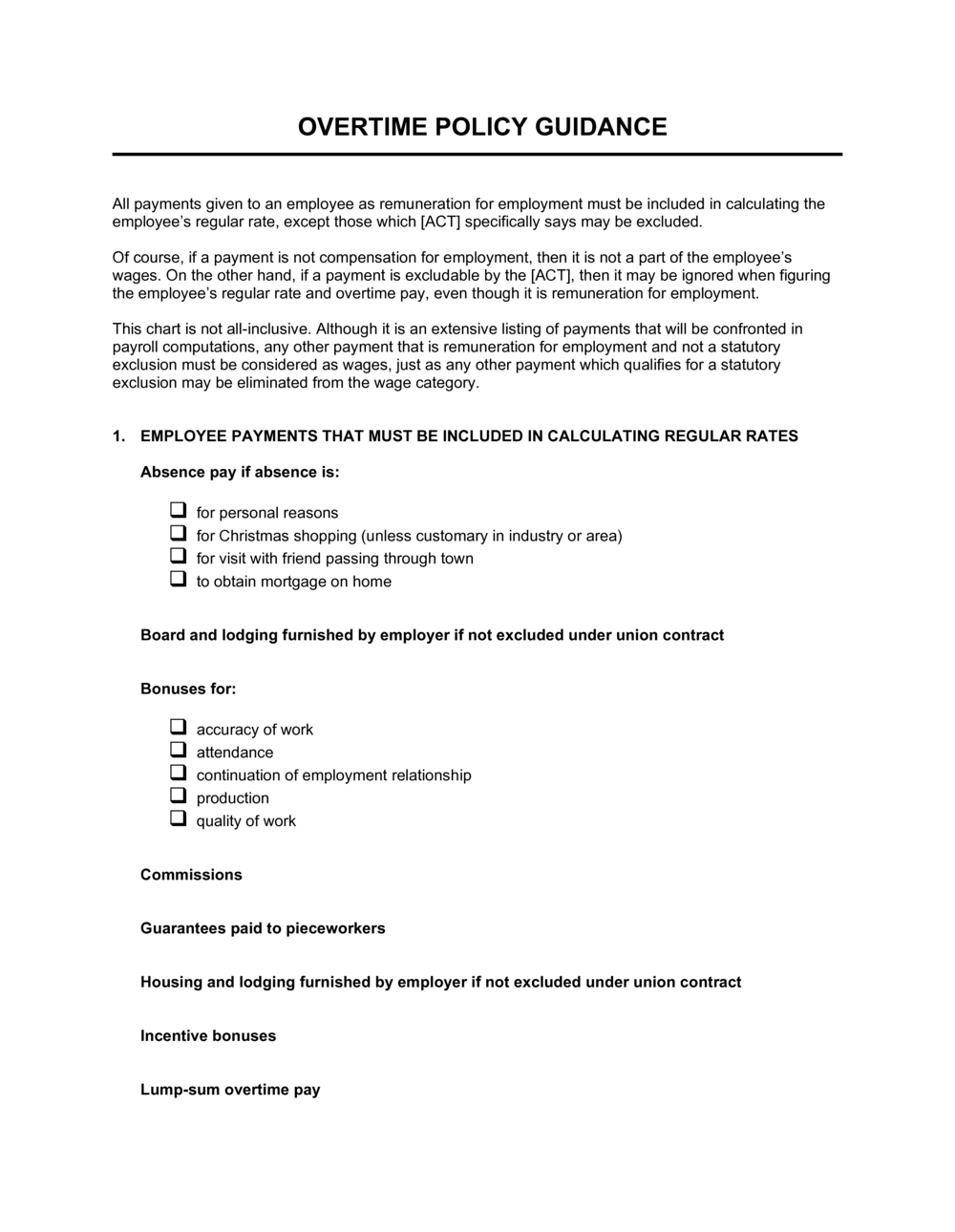

Sample of our overtime policy guidance template:

Overtime POLICY GUIDANCE All payments given to an employee as remuneration for employment must be included in calculating the employee's regular rate, except those which [ACT] specifically says may be excluded. Of course, if a payment is not compensation for employment, then it is not a part of the employee's wages. On the other hand, if a payment is excludable by the [ACT], then it may be ignored when figuring the employee's regular rate and overtime pay, even though it is remuneration for employment. This chart is not all-inclusive. Although it is an extensive listing of payments that will be confronted in payroll computations, any other payment that is remuneration for employment and not a statutory exclusion must be considered as wages, just as any other payment which qualifies for a statutory exclusion may be eliminated from the wage category. Employee payments that must be included in calculating regular rates Absence pay if absence is: for personal reasons for Christmas shopping (unless customary in industry or area) for visit with friend passing through town to obtain mortgage on home Board and lodging furnished by employer if not excluded under union contract Bonuses for: accuracy of work attendance continuation of employment relationship production quality of work Commissions Guarantees paid to pieceworkers Housing and lodging furnished by employer if not excluded under union contract Incentive bonuses Lump-sum overtime pay Contest prizes for: attendance cooperation courtesy efficiency number of overtime hours worked production quality of work sales stimulation Lunch expenses of employee paid by employer Meals furnished by employer if not excluded under union contract Merchandise furnished free at company stores (food, clothing, household articles) On-call pay Patent payments, if employer solicited invention Piecework earnings Production bonuses Rent of employee's living quarters paid by employer if not excluded under union contract Rest-period premiums (but only if they are paid more often than occasionally) Salary increases: current retroactive Shift differentials for night shift second shift swing shift third shift Transportation, not incident of employment, furnished by employer Traveling expenses of employee to and from work which are paid by employer Utilities furnished by employer for employee's personal use if not excluded under union contract Wage increases: current retroactive Wages for hours worked (whether productive or not), including: commissions day wages hourly guarantees to pieceworkers hourly wages job wages non-cash wages piecework earnings salaries shift differentials Employee payments that may be excluded in calculating regular rates Absence pay for infrequent or unpredictable absences (see also idle-time pay) caused by: funeral of family member holiday jury service sickness vacation Board, lodging, or other facilities excluded under union contract Bonuses: Christmas discretionary with employer percentage of total wages Call-back pay covering idle time Daily overtime pay of any amount for: hours in excess of [NUMBER] hours in excess of reasonable daily standard Day-of-rest pay at time and one-half Death benefits paid from welfare fund Director's fees Disability benefits paid from welfare fund Disaster relief payments Discretionary bonuses (discretionary with employer) Expense reimbursements for: equipment material tools which employer is required to furnish travel expenses in connection with employer's business uniforms which employer requires employee to wear Gifts Health and welfare plan contributions by employer Holiday pay for: idle time if equivalent to regular earnings time worked if at time and one-half Hospital expenses paid from welfare fund Idle-time pay (see also Absence pay) due to: call-back pay & show-up pay machinery breakdown supplies failing to arrive weather conditions making it impossible to work Insurance paid from welfare fund Loan to employee which is not deducted from wages Locker facilities Medical care on the job Medical services and hospitalization required by workmen's compensation laws Parking space furnished by employer Pension plan contributions by employer Percentage-of-total-wage bonuses Post-shift pay:

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This overtime policy guidance template has 8 pages and is a MS Word file type listed under our human resources documents.

Sample of our overtime policy guidance template:

Overtime POLICY GUIDANCE All payments given to an employee as remuneration for employment must be included in calculating the employee's regular rate, except those which [ACT] specifically says may be excluded. Of course, if a payment is not compensation for employment, then it is not a part of the employee's wages. On the other hand, if a payment is excludable by the [ACT], then it may be ignored when figuring the employee's regular rate and overtime pay, even though it is remuneration for employment. This chart is not all-inclusive. Although it is an extensive listing of payments that will be confronted in payroll computations, any other payment that is remuneration for employment and not a statutory exclusion must be considered as wages, just as any other payment which qualifies for a statutory exclusion may be eliminated from the wage category. Employee payments that must be included in calculating regular rates Absence pay if absence is: for personal reasons for Christmas shopping (unless customary in industry or area) for visit with friend passing through town to obtain mortgage on home Board and lodging furnished by employer if not excluded under union contract Bonuses for: accuracy of work attendance continuation of employment relationship production quality of work Commissions Guarantees paid to pieceworkers Housing and lodging furnished by employer if not excluded under union contract Incentive bonuses Lump-sum overtime pay Contest prizes for: attendance cooperation courtesy efficiency number of overtime hours worked production quality of work sales stimulation Lunch expenses of employee paid by employer Meals furnished by employer if not excluded under union contract Merchandise furnished free at company stores (food, clothing, household articles) On-call pay Patent payments, if employer solicited invention Piecework earnings Production bonuses Rent of employee's living quarters paid by employer if not excluded under union contract Rest-period premiums (but only if they are paid more often than occasionally) Salary increases: current retroactive Shift differentials for night shift second shift swing shift third shift Transportation, not incident of employment, furnished by employer Traveling expenses of employee to and from work which are paid by employer Utilities furnished by employer for employee's personal use if not excluded under union contract Wage increases: current retroactive Wages for hours worked (whether productive or not), including: commissions day wages hourly guarantees to pieceworkers hourly wages job wages non-cash wages piecework earnings salaries shift differentials Employee payments that may be excluded in calculating regular rates Absence pay for infrequent or unpredictable absences (see also idle-time pay) caused by: funeral of family member holiday jury service sickness vacation Board, lodging, or other facilities excluded under union contract Bonuses: Christmas discretionary with employer percentage of total wages Call-back pay covering idle time Daily overtime pay of any amount for: hours in excess of [NUMBER] hours in excess of reasonable daily standard Day-of-rest pay at time and one-half Death benefits paid from welfare fund Director's fees Disability benefits paid from welfare fund Disaster relief payments Discretionary bonuses (discretionary with employer) Expense reimbursements for: equipment material tools which employer is required to furnish travel expenses in connection with employer's business uniforms which employer requires employee to wear Gifts Health and welfare plan contributions by employer Holiday pay for: idle time if equivalent to regular earnings time worked if at time and one-half Hospital expenses paid from welfare fund Idle-time pay (see also Absence pay) due to: call-back pay & show-up pay machinery breakdown supplies failing to arrive weather conditions making it impossible to work Insurance paid from welfare fund Loan to employee which is not deducted from wages Locker facilities Medical care on the job Medical services and hospitalization required by workmen's compensation laws Parking space furnished by employer Pension plan contributions by employer Percentage-of-total-wage bonuses Post-shift pay:

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.