Mileage Reimbursement Policy Template

Document content

This mileage reimbursement policy template has 3 pages and is a MS Word file type listed under our legal agreements documents.

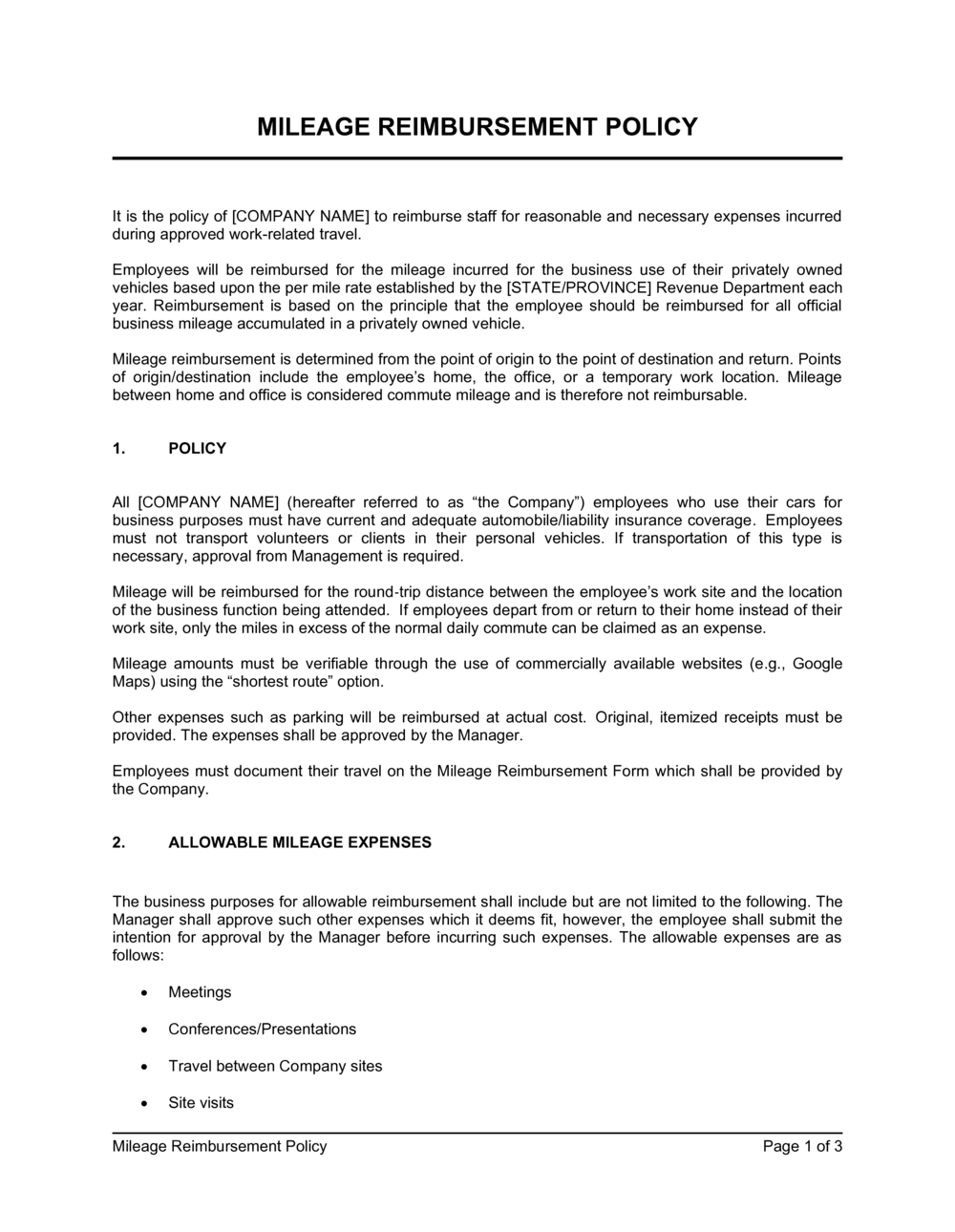

Sample of our mileage reimbursement policy template:

MILEAGE REIMBURSEMENT POLICY It is the policy of [COMPANY NAME] to reimburse staff for reasonable and necessary expenses incurred during approved work-related travel. Employees will be reimbursed for the mileage incurred for the business use of their privately owned vehicles based upon the per mile rate established by the [STATE/PROVINCE] Revenue Department each year. Reimbursement is based on the principle that the employee should be reimbursed for all official business mileage accumulated in a privately owned vehicle. Mileage reimbursement is determined from the point of origin to the point of destination and return. Points of origin/destination include the employee's home, the office, or a temporary work location. Mileage between home and office is considered commute mileage and is therefore not reimbursable. POLICY All [COMPANY NAME] (hereafter referred to as "the Company") employees who use their cars for business purposes must have current and adequate automobile/liability insurance coverage. Employees must not transport volunteers or clients in their personal vehicles. If transportation of this type is necessary, approval from Management is required. Mileage will be reimbursed for the round‐trip distance between the employee's work site and the location of the business function being attended. If employees depart from or return to their home instead of their work site, only the miles in excess of the normal daily commute can be claimed as an expense. Mileage amounts must be verifiable through the use of commercially available websites (e.g., Google Maps) using the "shortest route" option. Other expenses such as parking will be reimbursed at actual cost. Original, itemized receipts must be provided. The expenses shall be approved by the Manager. Employees must document their travel on the Mileage Reimbursement Form which shall be provided by the Company. ALLOWABLE MILEAGE EXPENSES The business purposes for allowable reimbursement shall include but are not limited to the following. The Manager shall approve such other expenses which it deems fit, however, the employee shall submit the intention for approval by the Manager before incurring such expenses. The allowable expenses are as follows: Meetings Conferences/Presentations

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This mileage reimbursement policy template has 3 pages and is a MS Word file type listed under our legal agreements documents.

Sample of our mileage reimbursement policy template:

MILEAGE REIMBURSEMENT POLICY It is the policy of [COMPANY NAME] to reimburse staff for reasonable and necessary expenses incurred during approved work-related travel. Employees will be reimbursed for the mileage incurred for the business use of their privately owned vehicles based upon the per mile rate established by the [STATE/PROVINCE] Revenue Department each year. Reimbursement is based on the principle that the employee should be reimbursed for all official business mileage accumulated in a privately owned vehicle. Mileage reimbursement is determined from the point of origin to the point of destination and return. Points of origin/destination include the employee's home, the office, or a temporary work location. Mileage between home and office is considered commute mileage and is therefore not reimbursable. POLICY All [COMPANY NAME] (hereafter referred to as "the Company") employees who use their cars for business purposes must have current and adequate automobile/liability insurance coverage. Employees must not transport volunteers or clients in their personal vehicles. If transportation of this type is necessary, approval from Management is required. Mileage will be reimbursed for the round‐trip distance between the employee's work site and the location of the business function being attended. If employees depart from or return to their home instead of their work site, only the miles in excess of the normal daily commute can be claimed as an expense. Mileage amounts must be verifiable through the use of commercially available websites (e.g., Google Maps) using the "shortest route" option. Other expenses such as parking will be reimbursed at actual cost. Original, itemized receipts must be provided. The expenses shall be approved by the Manager. Employees must document their travel on the Mileage Reimbursement Form which shall be provided by the Company. ALLOWABLE MILEAGE EXPENSES The business purposes for allowable reimbursement shall include but are not limited to the following. The Manager shall approve such other expenses which it deems fit, however, the employee shall submit the intention for approval by the Manager before incurring such expenses. The allowable expenses are as follows: Meetings Conferences/Presentations

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.