Loan Policy Template

Sample of Document Content

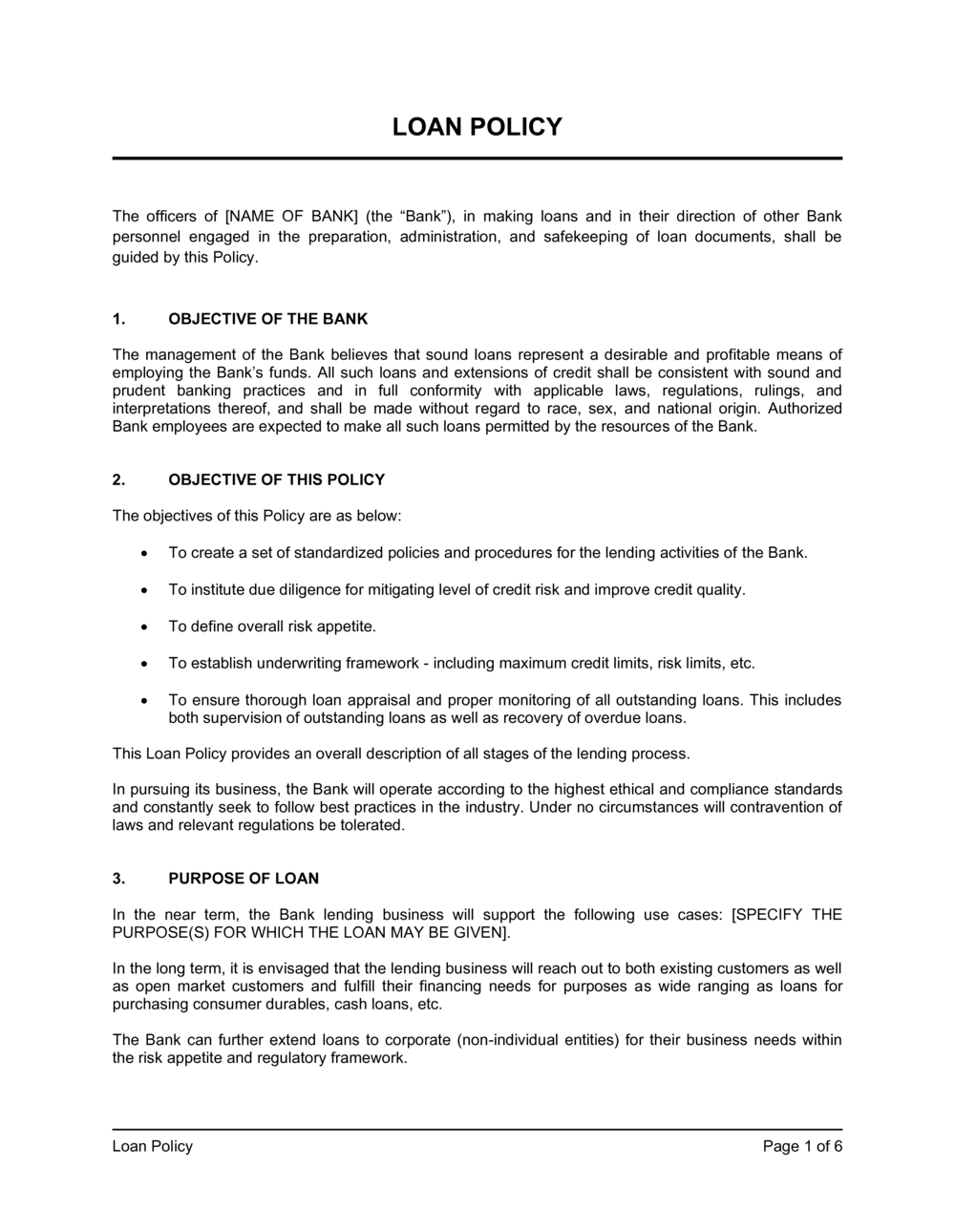

This loan policy template has 6 pages and is a MS Word file type listed under our legal agreements documents.

Loan policy template

LOAN POLICY The officers of [NAME OF BANK] (the "Bank"), in making loans and in their direction of other Bank personnel engaged in the preparation, administration, and safekeeping of loan documents, shall be guided by this Policy. OBJECTIVE OF THE BANK The management of the Bank believes that sound loans represent a desirable and profitable means of employing the Bank's funds. All such loans and extensions of credit shall be consistent with sound and prudent banking practices and in full conformity with applicable laws, regulations, rulings, and interpretations thereof, and shall be made without regard to race, sex, and national origin. Authorized Bank employees are expected to make all such loans permitted by the resources of the Bank. OBJECTIVE OF THIS POLICY The objectives of this Policy are as below: To create a set of standardized policies and procedures for the lending activities of the Bank. To institute due diligence for mitigating level of credit risk and improve credit quality. To define overall risk appetite. To establish underwriting framework - including maximum credit limits, risk limits, etc. To ensure thorough loan appraisal and proper monitoring of all outstanding loans. This includes both supervision of outstanding loans as well as recovery of overdue loans. This Loan Policy provides an overall description of all stages of the lending process. In pursuing its business, the Bank will operate according to the highest ethical and compliance standards and constantly seek to follow best practices in the industry. Under no circumstances will contravention of laws and relevant regulations be tolerated. PURPOSE OF LOAN In the near term, the Bank lending business will support the following use cases: [SPECIFY THE PURPOSE(S) FOR WHICH THE LOAN MAY BE GIVEN]. In the long term, it is envisaged that the lending business will reach out to both existing customers as well as open market customers and fulfill their financing needs for purposes as wide ranging as loans for purchasing consumer durables, cash loans, etc. The Bank can further extend loans to corporate (non-individual entities) for their business needs within the risk appetite and regulatory framework. ELIGIBILITY In case of individuals, loans shall be provided to: Salaried employees of public sector institutions/companies/undertakings Salaried employees of private sector companies Self-employed Individuals Students In case of business segments: The Bank aims to extend loans to the public for personal loans including consumer durables, travel, marriage and such. The Loan Policy enumerates the customer segments, purpose of loan, process of loan approval and disbursal, interest rate determination of the loan disbursal and charges to be borne by an individual customer. The Bank can further extend loans to anybody corporate(s), firm(s), or non-individual entities. SANCTIONING AUTHORITY The Investment and Lending Committee (herein after referred to as the "Authority" or the "Committee") shall be the sanctioning authority. The Authority may approve the proposal from any other sector on a case-by-case basis covering the entire spectrum of aspects, that is, the purposes, size, interest rate, term, repayment terms, and security required, and any other conditions will be as decided by the Committee. The sanctions accorded shall be placed before the Board in their ensuing meeting for the purpose of review and ratification. If the Committee decides that any particular loan or any other feature of a program needs to be placed before the Board, the same can be placed before the Board for seeking their approval as well. LOAN UNDERWRITING The process will start from the receipt of customer's request and the processing of same, including approval of the loan. The process ends with the communication of an approval of loan to the customer through a term sheet/sanction letter. Loan Application: The customer shall submit a form at either offline or online touch points to inform the Bank regarding the interest in a certain loan product Document Verification: The documents submitted by the customer will be required to be analyzed, either using competent technological or human resources. Credit Appraisal: This step involves arriving at a decision to provide the loan or not. The Bank shall require additional documents from the customer such as an income statement, or others considered necessary. The final decision to provide the loan or not will remain with the Bank after all the previous steps have been taken. PRICING AND DETERMINATION OF RATE OF INTEREST In the existing scenario of dynamic interest rates, competition, and the need for the Bank to expand the direct finance portfolio with addition of quality assets, the need for a dynamic pricing strategy is essential. The pricing of loans is carried out as per the gradation of risk determined by the internal ratings for various customer segments. With a view to remaining competitive in the market, the existing practice of fixing the interest/discount rate depending upon competitiveness/demand, asset cover and such other factors, may continue. As regards assistance sanctioned for infrastructure projects and such other projects under a joint finance/consortium arrangement, the interest rate stipulated by the lead institution/other banks would normally be followed. In the case of projects involving multiple/joint/consortium financing, interest rate reset clauses would be in line with other banks/institutions. The base interest rate comprises the cost of funds, operational costs, and the minimum rate of return desired. The further spread will consider factors of the creditworthiness of the customer in the form of risk premium. Other relevant factors have been enumerated below: Interest shall be accrued and charged periodically but not less than monthly rests. Fees/charges may be levied upfront or at other specific intervals as per the agreed terms and conditions. Some fees or commissions may have to be paid before the commencement of the loan; the customer shall be required make advance payment of such funds to the Bank. In all cases, the effective interest rate shall be clearly communicated to the customer, and all fees, commissions, interest rates and their calculations shall be transparent and explained in a manner that could be understood by the customer, and the duplicate term sheet duly signed shall be obtained from the borrower in token of acceptance of the terms and conditions of the loan. The Interest Rate Policy will be reviewed periodically to consider market forces, inflation and risk factors.

Reviewed on

Sample of Document Content

This loan policy template has 6 pages and is a MS Word file type listed under our legal agreements documents.

Sample of our loan policy template:

LOAN POLICY The officers of [NAME OF BANK] (the "Bank"), in making loans and in their direction of other Bank personnel engaged in the preparation, administration, and safekeeping of loan documents, shall be guided by this Policy. OBJECTIVE OF THE BANK The management of the Bank believes that sound loans represent a desirable and profitable means of employing the Bank's funds. All such loans and extensions of credit shall be consistent with sound and prudent banking practices and in full conformity with applicable laws, regulations, rulings, and interpretations thereof, and shall be made without regard to race, sex, and national origin. Authorized Bank employees are expected to make all such loans permitted by the resources of the Bank. OBJECTIVE OF THIS POLICY The objectives of this Policy are as below: To create a set of standardized policies and procedures for the lending activities of the Bank. To institute due diligence for mitigating level of credit risk and improve credit quality. To define overall risk appetite. To establish underwriting framework - including maximum credit limits, risk limits, etc. To ensure thorough loan appraisal and proper monitoring of all outstanding loans. This includes both supervision of outstanding loans as well as recovery of overdue loans. This Loan Policy provides an overall description of all stages of the lending process. In pursuing its business, the Bank will operate according to the highest ethical and compliance standards and constantly seek to follow best practices in the industry. Under no circumstances will contravention of laws and relevant regulations be tolerated. PURPOSE OF LOAN In the near term, the Bank lending business will support the following use cases: [SPECIFY THE PURPOSE(S) FOR WHICH THE LOAN MAY BE GIVEN]. In the long term, it is envisaged that the lending business will reach out to both existing customers as well as open market customers and fulfill their financing needs for purposes as wide ranging as loans for purchasing consumer durables, cash loans, etc. The Bank can further extend loans to corporate (non-individual entities) for their business needs within the risk appetite and regulatory framework. ELIGIBILITY In case of individuals, loans shall be provided to: Salaried employees of public sector institutions/companies/undertakings Salaried employees of private sector companies Self-employed Individuals Students In case of business segments: The Bank aims to extend loans to the public for personal loans including consumer durables, travel, marriage and such. The Loan Policy enumerates the customer segments, purpose of loan, process of loan approval and disbursal, interest rate determination of the loan disbursal and charges to be borne by an individual customer. The Bank can further extend loans to anybody corporate(s), firm(s), or non-individual entities. SANCTIONING AUTHORITY The Investment and Lending Committee (herein after referred to as the "Authority" or the "Committee") shall be the sanctioning authority. The Authority may approve the proposal from any other sector on a case-by-case basis covering the entire spectrum of aspects, that is, the purposes, size, interest rate, term, repayment terms, and security required, and any other conditions will be as decided by the Committee. The sanctions accorded shall be placed before the Board in their ensuing meeting for the purpose of review and ratification. If the Committee decides that any particular loan or any other feature of a program needs to be placed before the Board, the same can be placed before the Board for seeking their approval as well. LOAN UNDERWRITING The process will start from the receipt of customer's request and the processing of same, including approval of the loan. The process ends with the communication of an approval of loan to the customer through a term sheet/sanction letter. Loan Application: The customer shall submit a form at either offline or online touch points to inform the Bank regarding the interest in a certain loan product Document Verification: The documents submitted by the customer will be required to be analyzed, either using competent technological or human resources. Credit Appraisal: This step involves arriving at a decision to provide the loan or not. The Bank shall require additional documents from the customer such as an income statement, or others considered necessary. The final decision to provide the loan or not will remain with the Bank after all the previous steps have been taken. PRICING AND DETERMINATION OF RATE OF INTEREST In the existing scenario of dynamic interest rates, competition, and the need for the Bank to expand the direct finance portfolio with addition of quality assets, the need for a dynamic pricing strategy is essential. The pricing of loans is carried out as per the gradation of risk determined by the internal ratings for various customer segments. With a view to remaining competitive in the market, the existing practice of fixing the interest/discount rate depending upon competitiveness/demand, asset cover and such other factors, may continue. As regards assistance sanctioned for infrastructure projects and such other projects under a joint finance/consortium arrangement, the interest rate stipulated by the lead institution/other banks would normally be followed. In the case of projects involving multiple/joint/consortium financing, interest rate reset clauses would be in line with other banks/institutions. The base interest rate comprises the cost of funds, operational costs, and the minimum rate of return desired. The further spread will consider factors of the creditworthiness of the customer in the form of risk premium. Other relevant factors have been enumerated below: Interest shall be accrued and charged periodically but not less than monthly rests. Fees/charges may be levied upfront or at other specific intervals as per the agreed terms and conditions. Some fees or commissions may have to be paid before the commencement of the loan; the customer shall be required make advance payment of such funds to the Bank. In all cases, the effective interest rate shall be clearly communicated to the customer, and all fees, commissions, interest rates and their calculations shall be transparent and explained in a manner that could be understood by the customer, and the duplicate term sheet duly signed shall be obtained from the borrower in token of acceptance of the terms and conditions of the loan. The Interest Rate Policy will be reviewed periodically to consider market forces, inflation and risk factors.

Easily Create Any Business Document You Need in Minutes.

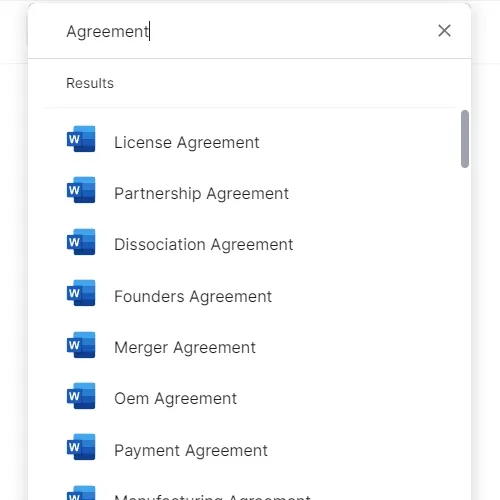

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

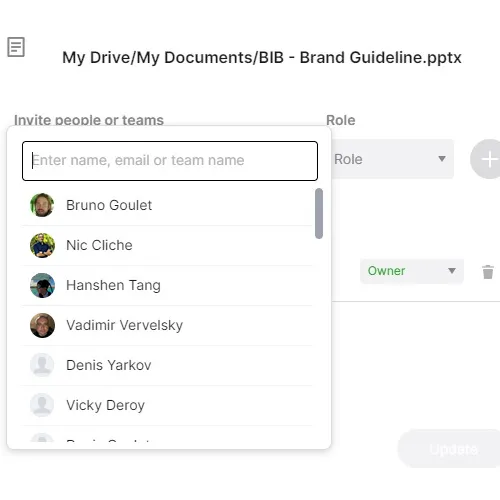

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.