Loan Agreement Template

Understanding a Loan Agreement

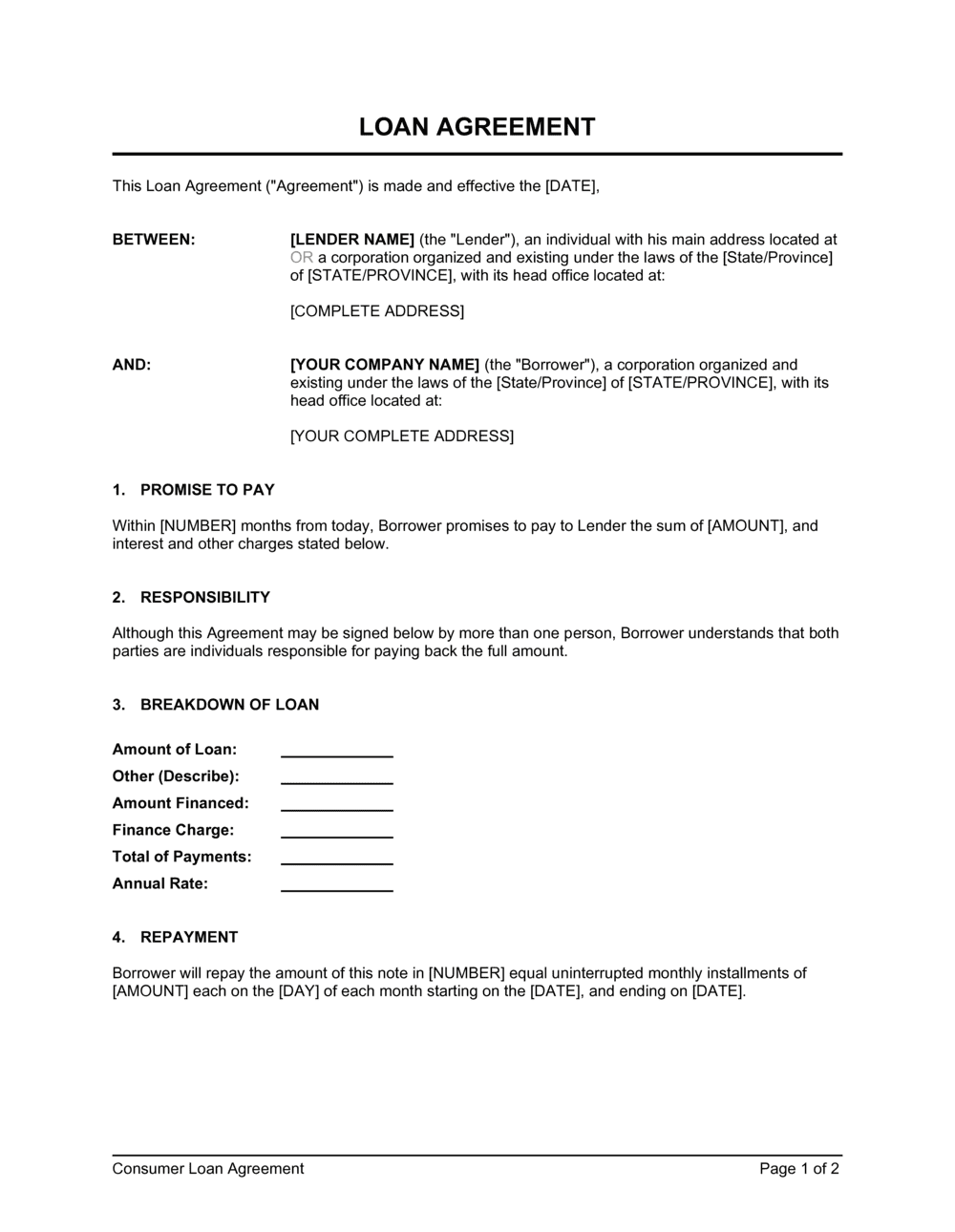

A Loan Agreement is a legally binding document that outlines the terms and conditions between a lender and a borrower. It serves as a contract that details the amount of the loan, repayment schedule, interest rates, and any collateral involved. The agreement ensures clarity and protects the interests of both parties by setting forth the obligations and expectations regarding the loan.

What is a Loan Agreement Template?

A Loan Agreement template provides a structured framework to effectively outline the key elements of a lending arrangement:

- Parties Involved - Clearly identifies the lender and borrower, along with their legal names, addresses, and contact details.

- Loan Amount and Purpose - Specifies the principal amount of the loan and the intended purpose for which the loan is granted.

- Interest Rate and Fees - Details the interest rate applied to the loan, including whether it’s fixed or variable, and any additional fees, such as origination or late fees.

- Repayment Schedule and Terms - Outlines the repayment schedule, including payment amounts, due dates, and the method of repayment.

- Collateral and Security - Specifies any collateral provided by the borrower to secure the loan, such as real estate or equipment, and the procedures for handling it.

- Covenants and Conditions - Details the obligations and conditions the borrower must adhere to, such as maintaining insurance or meeting financial ratios.

- Default and Remedies - Defines what constitutes default on the loan and the actions the lender can take, such as foreclosure or legal proceedings, to recover the loan.

- Prepayment and Penalties - States whether the borrower can make early payments on the loan and any penalties that may apply for prepayment.

- Governing Law and Jurisdiction - Specifies the jurisdiction whose laws will govern the agreement and the location where any legal disputes will be resolved.

- Signature and Date - The signatures of both parties and the date to validate the document.

Supporting Documents for Structuring a Loan Agreement

To enhance the clarity and comprehensiveness of a Loan Agreement, including related documents is advisable:

- Financial Report - A comprehensive report containing the borrower’s financial information, such as income statements, balance sheets, and cash flow statements, provides the lender with insight into the borrower’s financial health and repayment capability.

- Loan Guarantee Agreement - A legal document in which a third party, known as the guarantor, agrees to assume the borrower’s debt obligations if the borrower defaults, offering additional security for the lender.

- Notice of Default - A formal notice sent by the lender to the borrower, indicating that the borrower has failed to meet the terms of the loan agreement, such as missing payments, and specifying the required corrective actions or potential consequences.

Why Use a Comprehensive Loan Agreement Template?

Using a structured template for drafting a Loan Agreement offers significant benefits:

- Clarity and Transparency - Clearly defines the terms of the loan, reducing the likelihood of misunderstandings or disputes.

- Legal Protection - Offers legal protection to both parties by outlining the rights and obligations of each in clear terms.

- Financial Planning - Provides a structured repayment plan, helping the borrower to manage their finances effectively.

- Risk Mitigation - Details the collateral and conditions that protect the lender in case of default, reducing risk.

Adopting a comprehensive Loan Agreement is crucial for ensuring a smooth lending process. It provides a clear and actionable framework for the loan’s terms, supporting transparency and protecting the interests of both the lender and the borrower.

Updated in May 2024

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Understanding a Loan Agreement

A Loan Agreement is a legally binding document that outlines the terms and conditions between a lender and a borrower. It serves as a contract that details the amount of the loan, repayment schedule, interest rates, and any collateral involved. The agreement ensures clarity and protects the interests of both parties by setting forth the obligations and expectations regarding the loan.

What is a Loan Agreement Template?

A Loan Agreement template provides a structured framework to effectively outline the key elements of a lending arrangement:

- Parties Involved - Clearly identifies the lender and borrower, along with their legal names, addresses, and contact details.

- Loan Amount and Purpose - Specifies the principal amount of the loan and the intended purpose for which the loan is granted.

- Interest Rate and Fees - Details the interest rate applied to the loan, including whether it’s fixed or variable, and any additional fees, such as origination or late fees.

- Repayment Schedule and Terms - Outlines the repayment schedule, including payment amounts, due dates, and the method of repayment.

- Collateral and Security - Specifies any collateral provided by the borrower to secure the loan, such as real estate or equipment, and the procedures for handling it.

- Covenants and Conditions - Details the obligations and conditions the borrower must adhere to, such as maintaining insurance or meeting financial ratios.

- Default and Remedies - Defines what constitutes default on the loan and the actions the lender can take, such as foreclosure or legal proceedings, to recover the loan.

- Prepayment and Penalties - States whether the borrower can make early payments on the loan and any penalties that may apply for prepayment.

- Governing Law and Jurisdiction - Specifies the jurisdiction whose laws will govern the agreement and the location where any legal disputes will be resolved.

- Signature and Date - The signatures of both parties and the date to validate the document.

Supporting Documents for Structuring a Loan Agreement

To enhance the clarity and comprehensiveness of a Loan Agreement, including related documents is advisable:

- Financial Report - A comprehensive report containing the borrower’s financial information, such as income statements, balance sheets, and cash flow statements, provides the lender with insight into the borrower’s financial health and repayment capability.

- Loan Guarantee Agreement - A legal document in which a third party, known as the guarantor, agrees to assume the borrower’s debt obligations if the borrower defaults, offering additional security for the lender.

- Notice of Default - A formal notice sent by the lender to the borrower, indicating that the borrower has failed to meet the terms of the loan agreement, such as missing payments, and specifying the required corrective actions or potential consequences.

Why Use a Comprehensive Loan Agreement Template?

Using a structured template for drafting a Loan Agreement offers significant benefits:

- Clarity and Transparency - Clearly defines the terms of the loan, reducing the likelihood of misunderstandings or disputes.

- Legal Protection - Offers legal protection to both parties by outlining the rights and obligations of each in clear terms.

- Financial Planning - Provides a structured repayment plan, helping the borrower to manage their finances effectively.

- Risk Mitigation - Details the collateral and conditions that protect the lender in case of default, reducing risk.

Adopting a comprehensive Loan Agreement is crucial for ensuring a smooth lending process. It provides a clear and actionable framework for the loan’s terms, supporting transparency and protecting the interests of both the lender and the borrower.

Updated in May 2024

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.