Investment Advisory Agreement Template

Document content

This investment advisory agreement template has 5 pages and is a MS Word file type listed under our business plan kit documents.

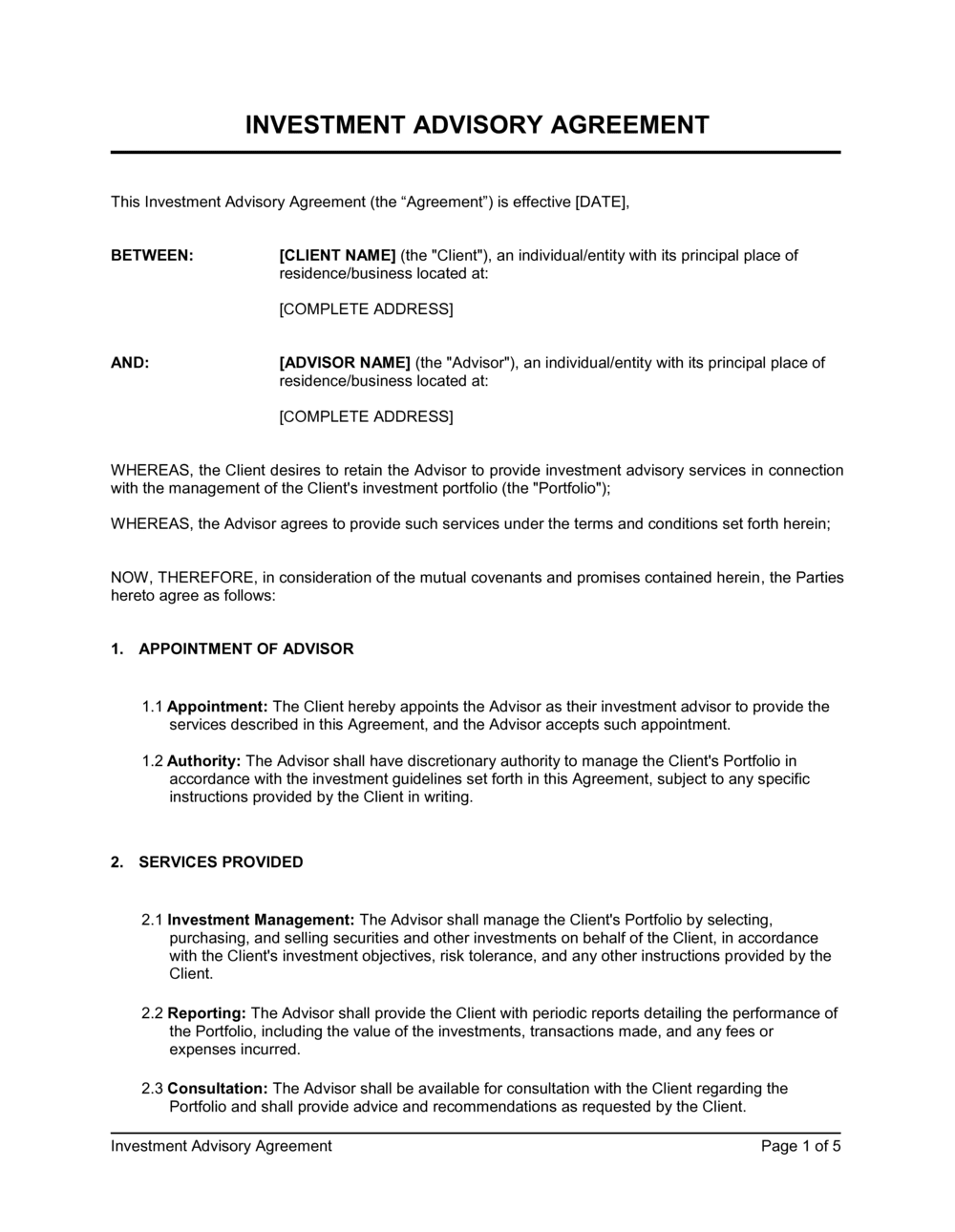

Sample of our investment advisory agreement template:

INVESTMENT ADVISORY AGREEMENT This Investment Advisory Agreement (the "Agreement") is effective [DATE], BETWEEN: [CLIENT NAME] (the "Client"), an individual/entity with its principal place of residence/business located at: [COMPLETE ADDRESS] AND: [ADVISOR NAME] (the "Advisor"), an individual/entity with its principal place of residence/business located at: [COMPLETE ADDRESS] WHEREAS, the Client desires to retain the Advisor to provide investment advisory services in connection with the management of the Client's investment portfolio (the "Portfolio"); WHEREAS, the Advisor agrees to provide such services under the terms and conditions set forth herein; NOW, THEREFORE, in consideration of the mutual covenants and promises contained herein, the Parties hereto agree as follows: APPOINTMENT OF ADVISOR Appointment: The Client hereby appoints the Advisor as their investment advisor to provide the services described in this Agreement, and the Advisor accepts such appointment. Authority: The Advisor shall have discretionary authority to manage the Client's Portfolio in accordance with the investment guidelines set forth in this Agreement, subject to any specific instructions provided by the Client in writing. SERVICES PROVIDED 2.1 Investment Management: The Advisor shall manage the Client's Portfolio by selecting, purchasing, and selling securities and other investments on behalf of the Client, in accordance with the Client's investment objectives, risk tolerance, and any other instructions provided by the Client. 2.2 Reporting: The Advisor shall provide the Client with periodic reports detailing the performance of the Portfolio, including the value of the investments, transactions made, and any fees or expenses incurred. 2.3 Consultation: The Advisor shall be available for consultation with the Client regarding the Portfolio and shall provide advice and recommendations as requested by the Client. 2.4 Compliance: The Advisor shall comply with all applicable laws, regulations, and fiduciary obligations in the performance of its duties under this Agreement. INVESTMENT OBJECTIVES AND GUIDELINES 3.1 Investment Objectives: The Client's investment objectives are [SPECIFY OBJECTIVES, e.g., capital preservation, income generation, growth, etc.]. The Advisor shall manage the Portfolio in accordance with these objectives. 3.2 Risk Tolerance: The Client's risk tolerance is [SPECIFY LEVEL OF RISK, e.g., conservative, moderate, aggressive]. The Advisor shall consider this risk tolerance when making investment decisions. 3.3 Investment Restrictions: The Client has provided the following investment restrictions, which the Advisor agrees to follow: [SPECIFY RESTRICTIONS, e.g., no investments in certain industries, limits on concentration, etc.]. COMPENSATION 4.1 Advisory Fees: The Client agrees to pay the Advisor a fee for its services, calculated as [SPECIFY FEE STRUCTURE, e.g., a percentage of the assets under management, a flat fee, or a combination thereof]. 4.2 Payment Terms: The advisory fee shall be payable [MONTHLY/QUARTERLY/ANNUALLY] in arrears, based on the average value of the Portfolio during the preceding period. The Advisor is authorized to deduct the fee directly from the Client's Portfolio account, unless otherwise agreed. 4.3 Expenses: The Client shall be responsible for all expenses related to the management of the Portfolio, including but not limited to brokerage commissions, custodial fees, and other transactional costs. TERM AND TERMINATION 5.1 Term: This Agreement shall commence on [START DATE] and continue until [END DATE], unless terminated earlier in accordance with the terms of this Agreement. 5.2 Termination by Client: The Client may terminate this Agreement at any time by providing [NUMBER OF DAYS] days' written notice to the Advisor. 5

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This investment advisory agreement template has 5 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our investment advisory agreement template:

INVESTMENT ADVISORY AGREEMENT This Investment Advisory Agreement (the "Agreement") is effective [DATE], BETWEEN: [CLIENT NAME] (the "Client"), an individual/entity with its principal place of residence/business located at: [COMPLETE ADDRESS] AND: [ADVISOR NAME] (the "Advisor"), an individual/entity with its principal place of residence/business located at: [COMPLETE ADDRESS] WHEREAS, the Client desires to retain the Advisor to provide investment advisory services in connection with the management of the Client's investment portfolio (the "Portfolio"); WHEREAS, the Advisor agrees to provide such services under the terms and conditions set forth herein; NOW, THEREFORE, in consideration of the mutual covenants and promises contained herein, the Parties hereto agree as follows: APPOINTMENT OF ADVISOR Appointment: The Client hereby appoints the Advisor as their investment advisor to provide the services described in this Agreement, and the Advisor accepts such appointment. Authority: The Advisor shall have discretionary authority to manage the Client's Portfolio in accordance with the investment guidelines set forth in this Agreement, subject to any specific instructions provided by the Client in writing. SERVICES PROVIDED 2.1 Investment Management: The Advisor shall manage the Client's Portfolio by selecting, purchasing, and selling securities and other investments on behalf of the Client, in accordance with the Client's investment objectives, risk tolerance, and any other instructions provided by the Client. 2.2 Reporting: The Advisor shall provide the Client with periodic reports detailing the performance of the Portfolio, including the value of the investments, transactions made, and any fees or expenses incurred. 2.3 Consultation: The Advisor shall be available for consultation with the Client regarding the Portfolio and shall provide advice and recommendations as requested by the Client. 2.4 Compliance: The Advisor shall comply with all applicable laws, regulations, and fiduciary obligations in the performance of its duties under this Agreement. INVESTMENT OBJECTIVES AND GUIDELINES 3.1 Investment Objectives: The Client's investment objectives are [SPECIFY OBJECTIVES, e.g., capital preservation, income generation, growth, etc.]. The Advisor shall manage the Portfolio in accordance with these objectives. 3.2 Risk Tolerance: The Client's risk tolerance is [SPECIFY LEVEL OF RISK, e.g., conservative, moderate, aggressive]. The Advisor shall consider this risk tolerance when making investment decisions. 3.3 Investment Restrictions: The Client has provided the following investment restrictions, which the Advisor agrees to follow: [SPECIFY RESTRICTIONS, e.g., no investments in certain industries, limits on concentration, etc.]. COMPENSATION 4.1 Advisory Fees: The Client agrees to pay the Advisor a fee for its services, calculated as [SPECIFY FEE STRUCTURE, e.g., a percentage of the assets under management, a flat fee, or a combination thereof]. 4.2 Payment Terms: The advisory fee shall be payable [MONTHLY/QUARTERLY/ANNUALLY] in arrears, based on the average value of the Portfolio during the preceding period. The Advisor is authorized to deduct the fee directly from the Client's Portfolio account, unless otherwise agreed. 4.3 Expenses: The Client shall be responsible for all expenses related to the management of the Portfolio, including but not limited to brokerage commissions, custodial fees, and other transactional costs. TERM AND TERMINATION 5.1 Term: This Agreement shall commence on [START DATE] and continue until [END DATE], unless terminated earlier in accordance with the terms of this Agreement. 5.2 Termination by Client: The Client may terminate this Agreement at any time by providing [NUMBER OF DAYS] days' written notice to the Advisor. 5

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.