How to Review Debtors Accounts Template

Document content

This how to review debtors accounts template has 2 pages and is a MS Word file type listed under our business plan kit documents.

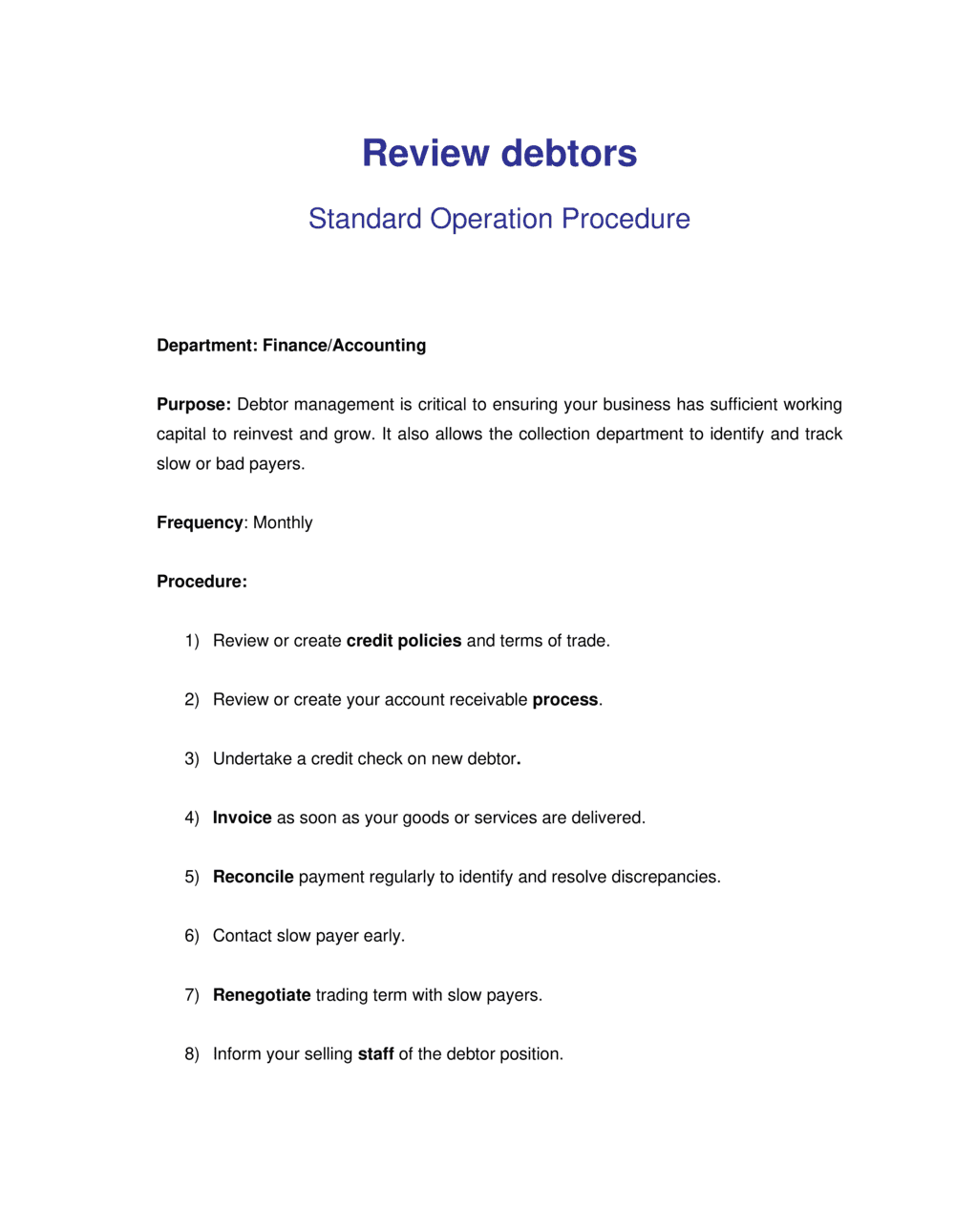

Sample of our how to review debtors accounts template:

Review Debtors Standard Operating Procedure Department: Finance/Accounting Purpose: Debtor management is critical to ensuring your business has sufficient working capital to reinvest and grow. It also allows the collection department to identify and track slow or bad payers. Frequency: Monthly Procedure: Review or create credit policies and terms of trade. Review or create your account receivable process. Undertake a credit check on new debtor. Invoice as soon as your goods or services are delivered. Reconcile payment regularly to identify and resolve discrepancies. Contact slow payer early. Renegotiate trading term with slow payers. Inform your selling staff of the debtor position. Send bad debts to collection agents. Definition/Explanation: Credit policies: Credit policies must be enforced. They also need to be written in a way to ensure they are appropriate for the organisation's risk profile

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This how to review debtors accounts template has 2 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our how to review debtors accounts template:

Review Debtors Standard Operating Procedure Department: Finance/Accounting Purpose: Debtor management is critical to ensuring your business has sufficient working capital to reinvest and grow. It also allows the collection department to identify and track slow or bad payers. Frequency: Monthly Procedure: Review or create credit policies and terms of trade. Review or create your account receivable process. Undertake a credit check on new debtor. Invoice as soon as your goods or services are delivered. Reconcile payment regularly to identify and resolve discrepancies. Contact slow payer early. Renegotiate trading term with slow payers. Inform your selling staff of the debtor position. Send bad debts to collection agents. Definition/Explanation: Credit policies: Credit policies must be enforced. They also need to be written in a way to ensure they are appropriate for the organisation's risk profile

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.