How To Open A Bank Account For A Business

Document content

This how to open a bank account for a business template has 7 pages and is a MS Word file type listed under our finance & accounting documents.

Sample of our how to open a bank account for a business template:

HOW TO OPEN A BUSINESS BANK ACCOUNT When you're starting a fresh business, setting up a bank account for the business is a crucial step. Using a separate account to your personal bank account for your business can help you get organized, track your expenses, and monitor your transactions easily. Opening a bank account requires only a few moments. However, it's vital to be ready with the documents needed and to know the kind of bank account you wish to open, and the preferred bank. In this article, we've put together a guide to help you with the process of opening your business's bank account. What is a Business Bank Account? A business account is highly similar to a personal bank account. You can use it to credit money, make transactions via a debit card, transfer money to several bank accounts, and establish bill payments. The only significant difference is that you open this bank account under your business's name. Additionally, possessing a business bank account allows you to gain authenticity and reflects the professional standards of your enterprise. On a different note, some merchants or small business owners might use their personal bank accounts instead of a business account. Nonetheless, you should confirm with your bank before initiating operations, as a few banks don't allow conducting business through personal accounts. By now, you must have gained an understanding of the importance of opening a separate bank account for your business. Let's dive into how you can do so! Select a Suitable Type of Account Online and offline banks and credit unions typically offer a wide range of accounts with different features, services, and fees. A few banks provide free accounts with no minimum credit, known as zero balance accounts, while others offer a waiver on monthly charges. On the other hand, online bank accounts usually don't charge a fee and are more suitable for businesses not involving any cash deposits. Mentioned below are the various types of bank accounts you can open for your business: Free Business Bank Account: Most banks charge a minimum fee for letting you open and maintain an account, but a few don't charge a periodic maintenance fee. Also, some banks present the criterion of keeping a minimum balance to avoid paying any fees. It's necessary to remember that having a free business bank account doesn't make you ineligible for certain service charges. The banks can still charge you for specific transactions, overdrafts, and wire transfers. Conventional Business Checking Account: A conventional business checking account bears a resemblance to a personal checking account. It consists of numerous features, including funding and withdrawal abilities, writing checks, processing digital fund transfers, and purchasing and withdrawing cash through a debit card. Generally, these features incur ATM fees, deposit fees, transaction fees, and maintenance fees. Online Business Checking Account: If you own a business that doesn't demand daily cash transactions or doesn't require visiting a physical bank branch, an online business checking account is well-suited to you. Such accounts don't allow account holders to deposit cash. Business Savings Accounts: A savings account is the most viable option for intelligent businesses, as it enables you to earn interest on the deposited money. If you're opting for a business savings account, you should select a bank after evaluating the account terms. These terms include account fees, balance requirements, and annual percentage yield (APY). Look for the Right Bank Since there are numerous options out there, looking for the right bank can be a daunting task

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This how to open a bank account for a business template has 7 pages and is a MS Word file type listed under our finance & accounting documents.

Sample of our how to open a bank account for a business template:

HOW TO OPEN A BUSINESS BANK ACCOUNT When you're starting a fresh business, setting up a bank account for the business is a crucial step. Using a separate account to your personal bank account for your business can help you get organized, track your expenses, and monitor your transactions easily. Opening a bank account requires only a few moments. However, it's vital to be ready with the documents needed and to know the kind of bank account you wish to open, and the preferred bank. In this article, we've put together a guide to help you with the process of opening your business's bank account. What is a Business Bank Account? A business account is highly similar to a personal bank account. You can use it to credit money, make transactions via a debit card, transfer money to several bank accounts, and establish bill payments. The only significant difference is that you open this bank account under your business's name. Additionally, possessing a business bank account allows you to gain authenticity and reflects the professional standards of your enterprise. On a different note, some merchants or small business owners might use their personal bank accounts instead of a business account. Nonetheless, you should confirm with your bank before initiating operations, as a few banks don't allow conducting business through personal accounts. By now, you must have gained an understanding of the importance of opening a separate bank account for your business. Let's dive into how you can do so! Select a Suitable Type of Account Online and offline banks and credit unions typically offer a wide range of accounts with different features, services, and fees. A few banks provide free accounts with no minimum credit, known as zero balance accounts, while others offer a waiver on monthly charges. On the other hand, online bank accounts usually don't charge a fee and are more suitable for businesses not involving any cash deposits. Mentioned below are the various types of bank accounts you can open for your business: Free Business Bank Account: Most banks charge a minimum fee for letting you open and maintain an account, but a few don't charge a periodic maintenance fee. Also, some banks present the criterion of keeping a minimum balance to avoid paying any fees. It's necessary to remember that having a free business bank account doesn't make you ineligible for certain service charges. The banks can still charge you for specific transactions, overdrafts, and wire transfers. Conventional Business Checking Account: A conventional business checking account bears a resemblance to a personal checking account. It consists of numerous features, including funding and withdrawal abilities, writing checks, processing digital fund transfers, and purchasing and withdrawing cash through a debit card. Generally, these features incur ATM fees, deposit fees, transaction fees, and maintenance fees. Online Business Checking Account: If you own a business that doesn't demand daily cash transactions or doesn't require visiting a physical bank branch, an online business checking account is well-suited to you. Such accounts don't allow account holders to deposit cash. Business Savings Accounts: A savings account is the most viable option for intelligent businesses, as it enables you to earn interest on the deposited money. If you're opting for a business savings account, you should select a bank after evaluating the account terms. These terms include account fees, balance requirements, and annual percentage yield (APY). Look for the Right Bank Since there are numerous options out there, looking for the right bank can be a daunting task

Easily Create Any Business Document You Need in Minutes.

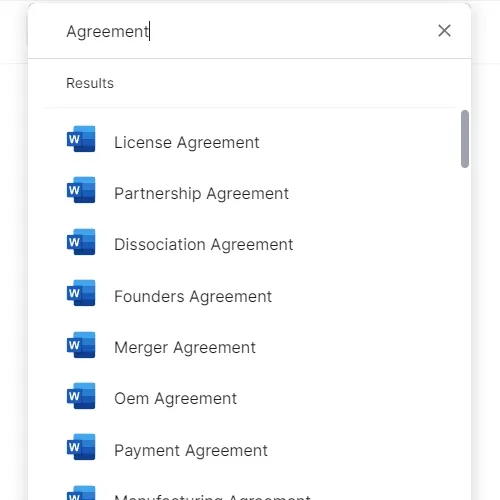

Access over 3,000+ business and legal templates for any business task, project or initiative.

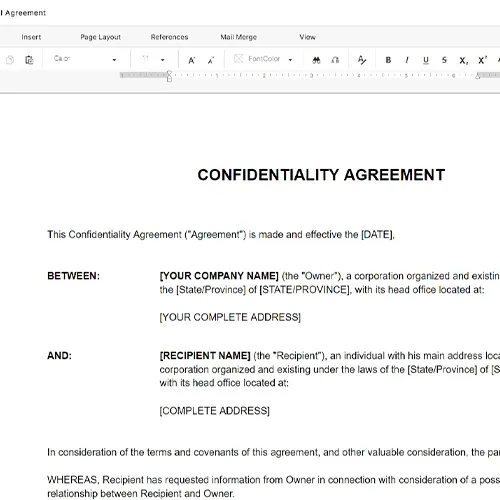

Customize your ready-made business document template and save it in the cloud.

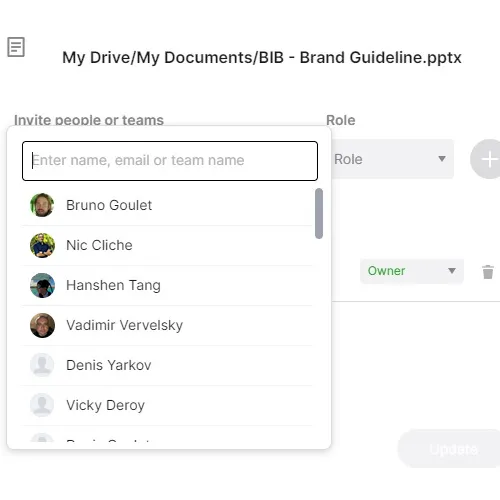

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.