Fixed Assets Policy Template

Document content

This fixed assets policy template has 4 pages and is a MS Word file type listed under our human resources documents.

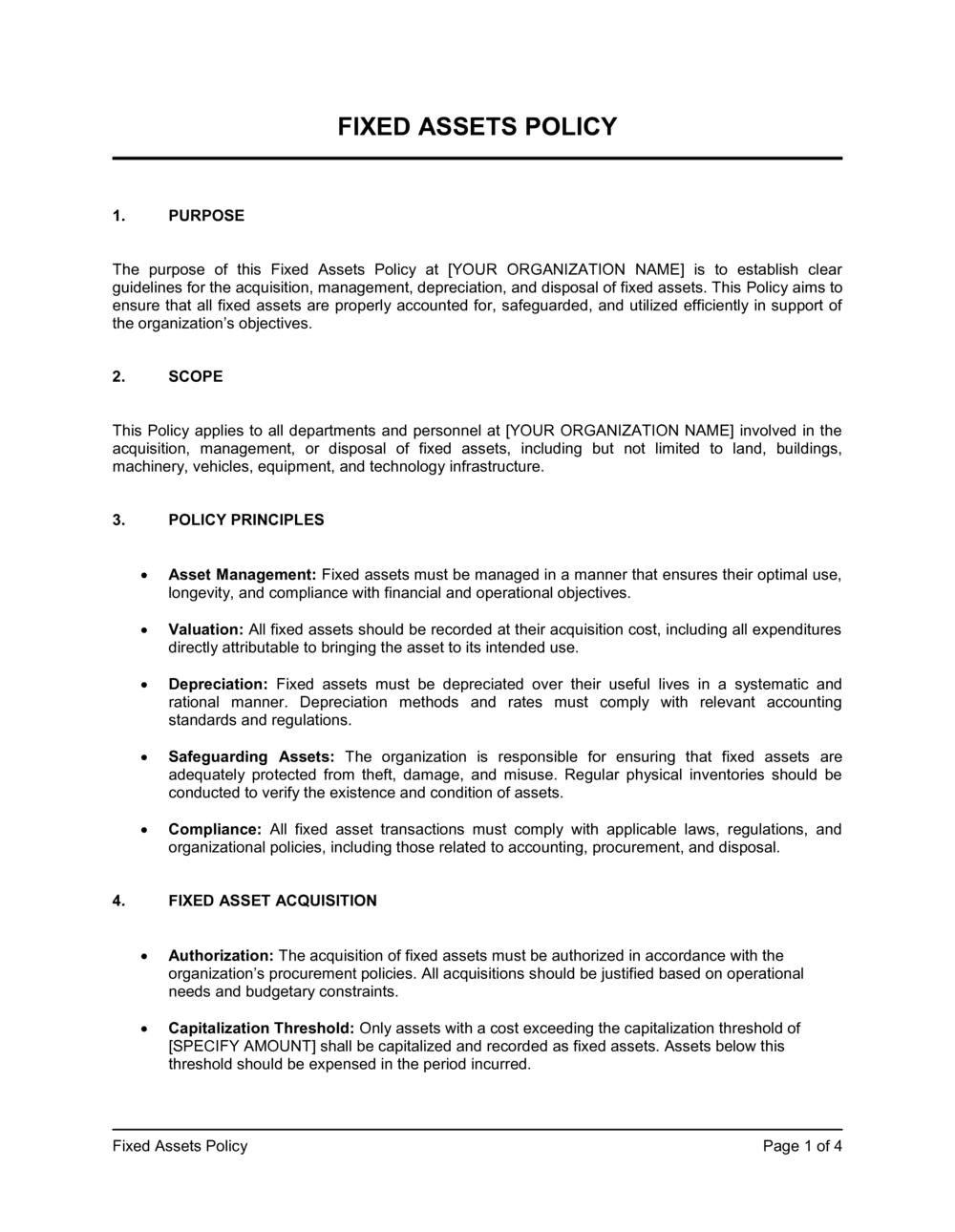

Sample of our fixed assets policy template:

FIXED ASSETS POLICY PURPOSE The purpose of this Fixed Assets Policy at [YOUR ORGANIZATION NAME] is to establish clear guidelines for the acquisition, management, depreciation, and disposal of fixed assets. This Policy aims to ensure that all fixed assets are properly accounted for, safeguarded, and utilized efficiently in support of the organization's objectives. SCOPE This Policy applies to all departments and personnel at [YOUR ORGANIZATION NAME] involved in the acquisition, management, or disposal of fixed assets, including but not limited to land, buildings, machinery, vehicles, equipment, and technology infrastructure. POLICY PRINCIPLES Asset Management: Fixed assets must be managed in a manner that ensures their optimal use, longevity, and compliance with financial and operational objectives. Valuation: All fixed assets should be recorded at their acquisition cost, including all expenditures directly attributable to bringing the asset to its intended use. Depreciation: Fixed assets must be depreciated over their useful lives in a systematic and rational manner. Depreciation methods and rates must comply with relevant accounting standards and regulations. Safeguarding Assets: The organization is responsible for ensuring that fixed assets are adequately protected from theft, damage, and misuse. Regular physical inventories should be conducted to verify the existence and condition of assets. Compliance: All fixed asset transactions must comply with applicable laws, regulations, and organizational policies, including those related to accounting, procurement, and disposal. FIXED ASSET ACQUISITION Authorization: The acquisition of fixed assets must be authorized in accordance with the organization's procurement policies. All acquisitions should be justified based on operational needs and budgetary constraints. Capitalization Threshold: Only assets with a cost exceeding the capitalization threshold of [SPECIFY AMOUNT] shall be capitalized and recorded as fixed assets. Assets below this threshold should be expensed in the period incurred. Documentation: All acquisitions must be supported by appropriate documentation, including purchase orders, invoices, and contracts. These documents should be retained in accordance with the organization's record-keeping policies. DEPRECIATION AND AMORTIZATION Depreciation Methods: The organization shall use the [STRAIGHT-LINE, DECLINING BALANCE, OR OTHER] depreciation method unless otherwise specified by accounting standards. The method chosen should reflect the pattern in which the asset's economic benefits are consumed. Useful Life: The useful life of each fixed asset should be determined based on the nature of the asset, industry standards, and experience. Useful lives must be periodically reviewed and adjusted, if necessary. Residual Value: Residual value, if applicable, should be estimated and considered in the calculation of depreciation. ASSET MAINTENANCE Routine Maintenance: Fixed assets must be maintained regularly to ensure they remain in good working condition

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This fixed assets policy template has 4 pages and is a MS Word file type listed under our human resources documents.

Sample of our fixed assets policy template:

FIXED ASSETS POLICY PURPOSE The purpose of this Fixed Assets Policy at [YOUR ORGANIZATION NAME] is to establish clear guidelines for the acquisition, management, depreciation, and disposal of fixed assets. This Policy aims to ensure that all fixed assets are properly accounted for, safeguarded, and utilized efficiently in support of the organization's objectives. SCOPE This Policy applies to all departments and personnel at [YOUR ORGANIZATION NAME] involved in the acquisition, management, or disposal of fixed assets, including but not limited to land, buildings, machinery, vehicles, equipment, and technology infrastructure. POLICY PRINCIPLES Asset Management: Fixed assets must be managed in a manner that ensures their optimal use, longevity, and compliance with financial and operational objectives. Valuation: All fixed assets should be recorded at their acquisition cost, including all expenditures directly attributable to bringing the asset to its intended use. Depreciation: Fixed assets must be depreciated over their useful lives in a systematic and rational manner. Depreciation methods and rates must comply with relevant accounting standards and regulations. Safeguarding Assets: The organization is responsible for ensuring that fixed assets are adequately protected from theft, damage, and misuse. Regular physical inventories should be conducted to verify the existence and condition of assets. Compliance: All fixed asset transactions must comply with applicable laws, regulations, and organizational policies, including those related to accounting, procurement, and disposal. FIXED ASSET ACQUISITION Authorization: The acquisition of fixed assets must be authorized in accordance with the organization's procurement policies. All acquisitions should be justified based on operational needs and budgetary constraints. Capitalization Threshold: Only assets with a cost exceeding the capitalization threshold of [SPECIFY AMOUNT] shall be capitalized and recorded as fixed assets. Assets below this threshold should be expensed in the period incurred. Documentation: All acquisitions must be supported by appropriate documentation, including purchase orders, invoices, and contracts. These documents should be retained in accordance with the organization's record-keeping policies. DEPRECIATION AND AMORTIZATION Depreciation Methods: The organization shall use the [STRAIGHT-LINE, DECLINING BALANCE, OR OTHER] depreciation method unless otherwise specified by accounting standards. The method chosen should reflect the pattern in which the asset's economic benefits are consumed. Useful Life: The useful life of each fixed asset should be determined based on the nature of the asset, industry standards, and experience. Useful lives must be periodically reviewed and adjusted, if necessary. Residual Value: Residual value, if applicable, should be estimated and considered in the calculation of depreciation. ASSET MAINTENANCE Routine Maintenance: Fixed assets must be maintained regularly to ensure they remain in good working condition

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.