Financial Risk Assessment Template

Document content

This financial risk assessment template has 4 pages and is a MS Word file type listed under our human resources documents.

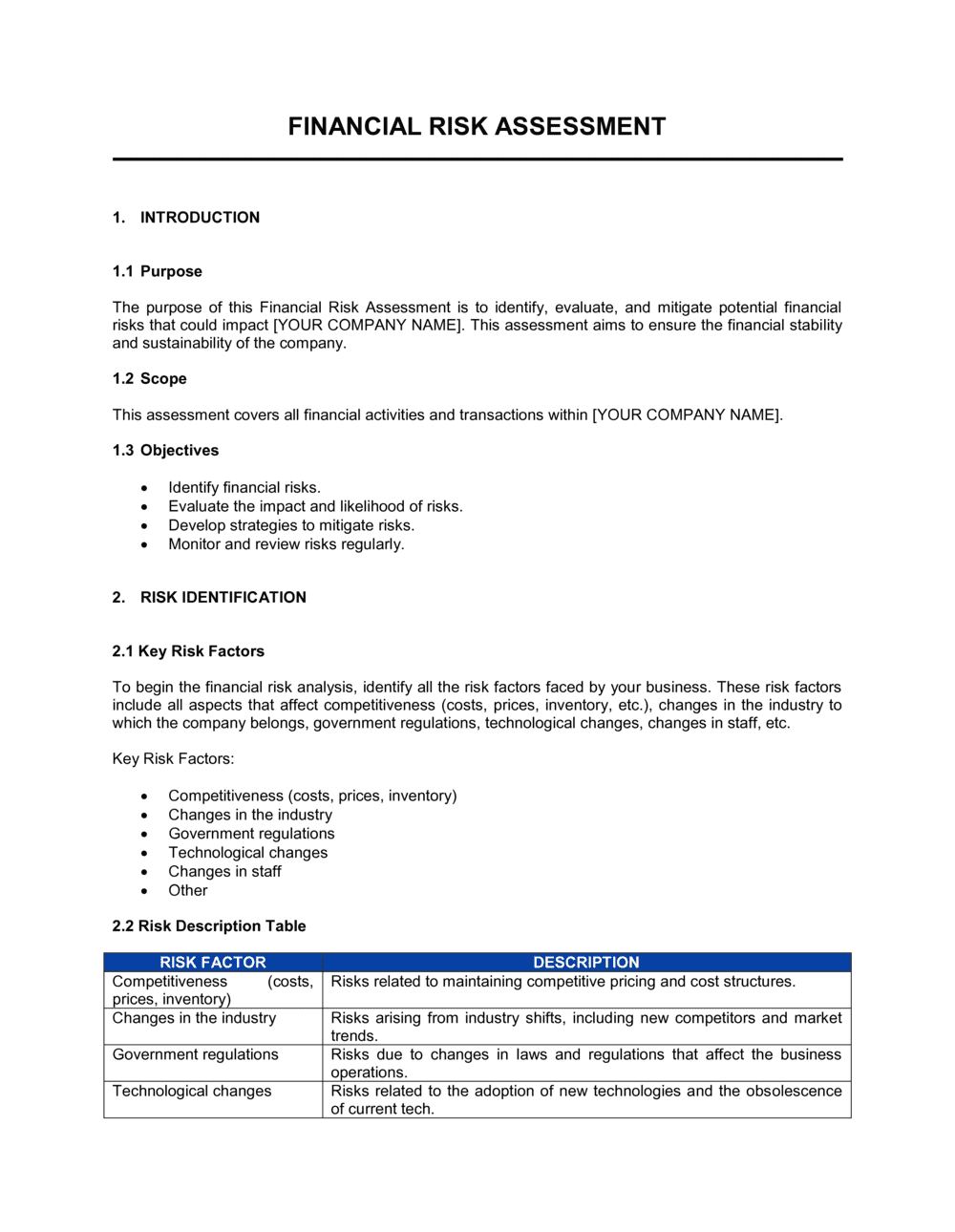

Sample of our financial risk assessment template:

financial risk Assessment INTRODUCTION Purpose The purpose of this Financial Risk Assessment is to identify, evaluate, and mitigate potential financial risks that could impact [YOUR COMPANY NAME]. This assessment aims to ensure the financial stability and sustainability of the company. Scope This assessment covers all financial activities and transactions within [YOUR COMPANY NAME]. Objectives Identify financial risks. Evaluate the impact and likelihood of risks. Develop strategies to mitigate risks. Monitor and review risks regularly. RISK IDENTIFICATION 2.1 Key Risk Factors To begin the financial risk analysis, identify all the risk factors faced by your business. These risk factors include all aspects that affect competitiveness (costs, prices, inventory, etc.), changes in the industry to which the company belongs, government regulations, technological changes, changes in staff, etc. Key Risk Factors: Competitiveness (costs, prices, inventory) Changes in the industry Government regulations Technological changes Changes in staff Other 2.2 Risk Description Table RISK FACTOR DESCRIPTION Competitiveness (costs, prices, inventory) Risks related to maintaining competitive pricing and cost structures. Changes in the industry Risks arising from industry shifts, including new competitors and market trends. Government regulations Risks due to changes in laws and regulations that affect the business operations. Technological changes Risks related to the adoption of new technologies and the obsolescence of current tech. Changes in staff Risks associated with turnover, recruitment, and retention of key Other Any other risks specific to the company. RISK EVALUATION Criteria for Evaluation Prioritizing risks is critical to the efficient allocation of resources and efforts. That way, you can create a plan in case a threat materializes. Evaluation Criteria: Likelihood: The probability of the risk occurring (High/Medium/Low). Impact: The potential effect of the risk on the company (High/Medium/Low). Weight: Assign a numerical value (1-10) to prioritize the risk based on its likelihood and impact. Risk Evaluation Table

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This financial risk assessment template has 4 pages and is a MS Word file type listed under our human resources documents.

Sample of our financial risk assessment template:

financial risk Assessment INTRODUCTION Purpose The purpose of this Financial Risk Assessment is to identify, evaluate, and mitigate potential financial risks that could impact [YOUR COMPANY NAME]. This assessment aims to ensure the financial stability and sustainability of the company. Scope This assessment covers all financial activities and transactions within [YOUR COMPANY NAME]. Objectives Identify financial risks. Evaluate the impact and likelihood of risks. Develop strategies to mitigate risks. Monitor and review risks regularly. RISK IDENTIFICATION 2.1 Key Risk Factors To begin the financial risk analysis, identify all the risk factors faced by your business. These risk factors include all aspects that affect competitiveness (costs, prices, inventory, etc.), changes in the industry to which the company belongs, government regulations, technological changes, changes in staff, etc. Key Risk Factors: Competitiveness (costs, prices, inventory) Changes in the industry Government regulations Technological changes Changes in staff Other 2.2 Risk Description Table RISK FACTOR DESCRIPTION Competitiveness (costs, prices, inventory) Risks related to maintaining competitive pricing and cost structures. Changes in the industry Risks arising from industry shifts, including new competitors and market trends. Government regulations Risks due to changes in laws and regulations that affect the business operations. Technological changes Risks related to the adoption of new technologies and the obsolescence of current tech. Changes in staff Risks associated with turnover, recruitment, and retention of key Other Any other risks specific to the company. RISK EVALUATION Criteria for Evaluation Prioritizing risks is critical to the efficient allocation of resources and efforts. That way, you can create a plan in case a threat materializes. Evaluation Criteria: Likelihood: The probability of the risk occurring (High/Medium/Low). Impact: The potential effect of the risk on the company (High/Medium/Low). Weight: Assign a numerical value (1-10) to prioritize the risk based on its likelihood and impact. Risk Evaluation Table

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.