Different Business Structures Explained Template

Document content

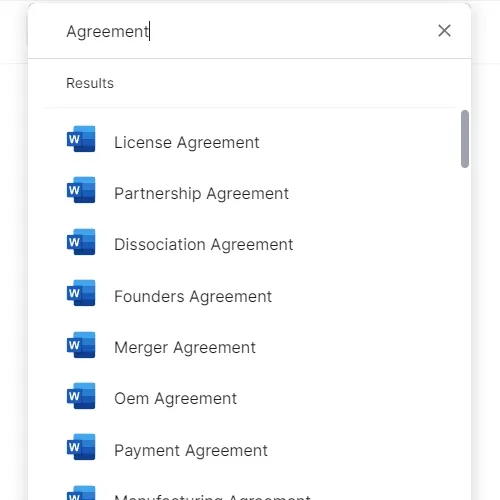

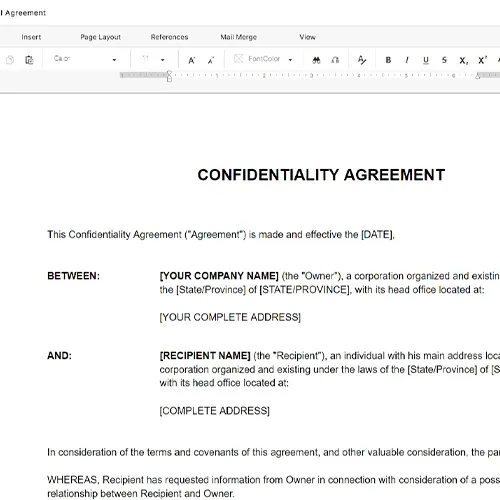

This different business structures explained template has 3 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our different business structures explained template:

THE DIFFERENT BUSINESS STRUCTURES EXPLAINED One of the most important decisions you must make when starting out a business is choosing a business structure that fits your business entity and the aim you want to achieve with your business entity. There are several factors that need to be considered when you're pondering which legal business structure to follow. The common factors include the nature of the business in question, the liability assumed, the complexities of the business, the required formalities, and tax incentives. A business structure is a type of legal organization for a business. It ensures that a business is recognized legally in the market. The type of structure your business takes on will be determined by the structure needed to achieve your business objectives. You must consider the following when deciding on a business structure: Business representation required Business operations Personnel involved Taxes Investments and liabilities There are various business structures with distinctive pros and cons that should fit with the goals of the business. The five most common business structures are: Sole Proprietorship This is the most common business structure. A business structure that's referred to as a sole proprietorship means that one person is the sole owner of the business. According to the IRS, "someone who owns an unincorporated business by himself or herself" is referred to as a sole proprietor. This means that the sole owner is responsible for the daily operations of the business. The sole proprietor does not have a separate entity from his business, and all liabilities and revenues are the entitlement and responsibility of the owner. The pros of a sole proprietorship include a low requirement for capital and ease of maintenance with no need for registration to start or maintain the business. On the other hand, the cons include being personally liable for the entire business. Also, there are no tax benefits that accrue to the sole proprietor; rather, they must pay self-employment tax on all business earnings after filling out Form 1040 with Schedule C and SE, or the form specific for your country, city or state. Partnership This is another common form of business structure where two or more people come together to own a business entity and carry out business ventures together. A partnership business can either be a general partnership, a limited partnership, or a limited liability partnership. In a way, partnerships are like sole proprietorships because they also don't have separate legal recognition from their owners. Rather, the owners and the enterprise are considered the same entity. Also, the partners are involved in the daily operations of the business, making growth and expansion decisions, while they share the liabilities and revenues equally.

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This different business structures explained template has 3 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our different business structures explained template:

THE DIFFERENT BUSINESS STRUCTURES EXPLAINED One of the most important decisions you must make when starting out a business is choosing a business structure that fits your business entity and the aim you want to achieve with your business entity. There are several factors that need to be considered when you're pondering which legal business structure to follow. The common factors include the nature of the business in question, the liability assumed, the complexities of the business, the required formalities, and tax incentives. A business structure is a type of legal organization for a business. It ensures that a business is recognized legally in the market. The type of structure your business takes on will be determined by the structure needed to achieve your business objectives. You must consider the following when deciding on a business structure: Business representation required Business operations Personnel involved Taxes Investments and liabilities There are various business structures with distinctive pros and cons that should fit with the goals of the business. The five most common business structures are: Sole Proprietorship This is the most common business structure. A business structure that's referred to as a sole proprietorship means that one person is the sole owner of the business. According to the IRS, "someone who owns an unincorporated business by himself or herself" is referred to as a sole proprietor. This means that the sole owner is responsible for the daily operations of the business. The sole proprietor does not have a separate entity from his business, and all liabilities and revenues are the entitlement and responsibility of the owner. The pros of a sole proprietorship include a low requirement for capital and ease of maintenance with no need for registration to start or maintain the business. On the other hand, the cons include being personally liable for the entire business. Also, there are no tax benefits that accrue to the sole proprietor; rather, they must pay self-employment tax on all business earnings after filling out Form 1040 with Schedule C and SE, or the form specific for your country, city or state. Partnership This is another common form of business structure where two or more people come together to own a business entity and carry out business ventures together. A partnership business can either be a general partnership, a limited partnership, or a limited liability partnership. In a way, partnerships are like sole proprietorships because they also don't have separate legal recognition from their owners. Rather, the owners and the enterprise are considered the same entity. Also, the partners are involved in the daily operations of the business, making growth and expansion decisions, while they share the liabilities and revenues equally.

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

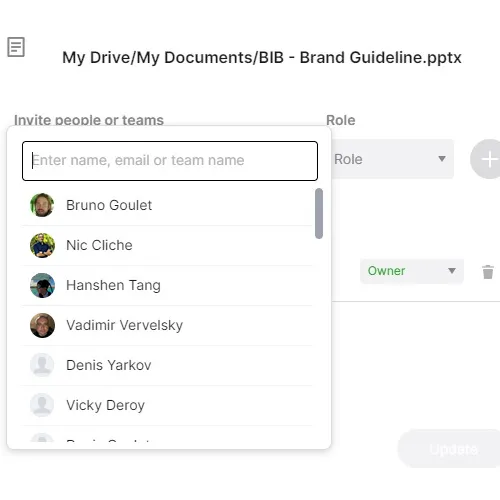

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.