Credit Policy Template

Document content

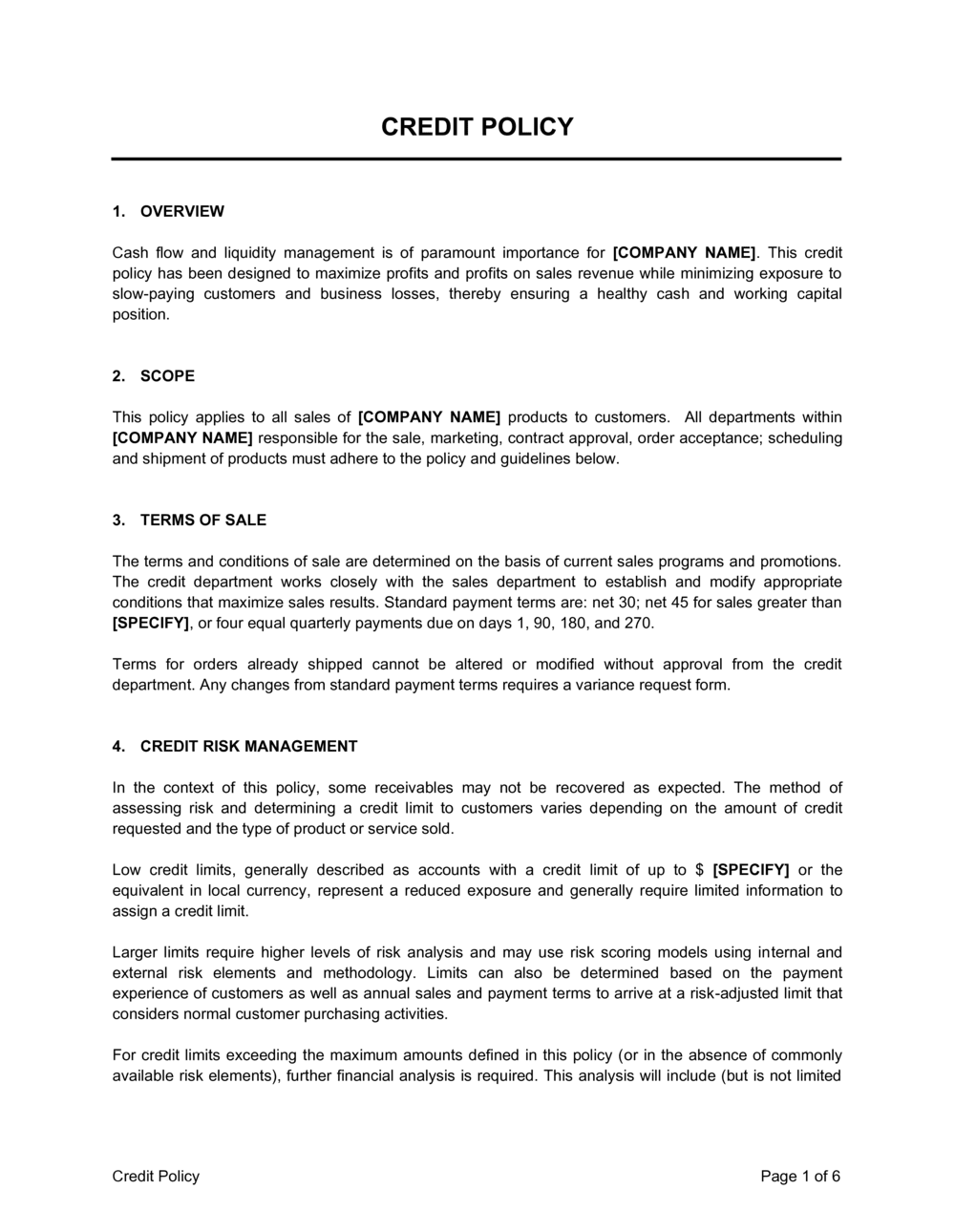

This credit policy template has 6 pages and is a MS Word file type listed under our human resources documents.

Sample of our credit policy template:

CREDIT POLICY OVERVIEW Cash flow and liquidity management is of paramount importance for [COMPANY NAME]. This credit policy has been designed to maximize profits and profits on sales revenue while minimizing exposure to slow-paying customers and business losses, thereby ensuring a healthy cash and working capital position. SCOPE This policy applies to all sales of [COMPANY NAME] products to customers. All departments within [COMPANY NAME] responsible for the sale, marketing, contract approval, order acceptance; scheduling and shipment of products must adhere to the policy and guidelines below. TERMS OF SALE The terms and conditions of sale are determined on the basis of current sales programs and promotions. The credit department works closely with the sales department to establish and modify appropriate conditions that maximize sales results. Standard payment terms are: net 30; net 45 for sales greater than [SPECIFY], or four equal quarterly payments due on days 1, 90, 180, and 270. Terms for orders already shipped cannot be altered or modified without approval from the credit department. Any changes from standard payment terms requires a variance request form. CREDIT RISK MANAGEMENT In the context of this policy, some receivables may not be recovered as expected. The method of assessing risk and determining a credit limit to customers varies depending on the amount of credit requested and the type of product or service sold. Low credit limits, generally described as accounts with a credit limit of up to $ [SPECIFY] or the equivalent in local currency, represent a reduced exposure and generally require limited information to assign a credit limit. Larger limits require higher levels of risk analysis and may use risk scoring models using internal and external risk elements and methodology. Limits can also be determined based on the payment experience of customers as well as annual sales and payment terms to arrive at a risk-adjusted limit that considers normal customer purchasing activities. For credit limits exceeding the maximum amounts defined in this policy (or in the absence of commonly available risk elements), further financial analysis is required. This analysis will include (but is not limited to) the analysis of financial statement ratios, cash flow analysis, evaluation of the availability of external financing and evaluation of future activities by the company's management. Typical minimum components of risk assessment include: Demographic assessment; Payment history (especially at comparable exposure levels).; Length of time in business; Business reputation (absence of adverse public information, i.e. court cases, judgments, etc); Knowledgeable assessment of company management; Financial analysis i.e. analysis of historical financial data, company accounts (based upon anticipated credit limit); External credit risk rating; Business analysis i.e. the situation of the economic sector the customer is in and their market position within it; Adequacy and enforceability of collateral/guarantee where applicable. ROLE AND RESPONSIBILITIES In order to facilitate the flow of orders and the shipment of products, [COMPANY NAME]'s policy is that credit should be extended to all customers who demonstrate both the ability to pay and a history of timely debt payment. Credit limits will be determined by comparing the following averages: the customer's working capital, the average credit limits granted by the trade references and the customer's credit line needs. Credit department - The credit department will outline the requirements for establishing trade credit for new customers and maintaining lines of credit and limits for active accounts and returning customers with appropriate payment terms. The VP Credit has overall credit and collections responsibility for the credit department. Employees in these roles have authority to approve credit lines up to $[SPECIFY]. Anything exceeding this amount needs approval from the VP Credit. The credit department will evaluate all new customers to determine the terms and methods of payment that will be required and the level of credit that will be established. The credit department will also seek to offer optional payment methods to facilitate sales to customers with sub-optimal credit histories. Credit department will periodically review and reassess the payment terms and lines of credit of existing customers to meet new customer requirements and manage risks as financial and business conditions change. The credit managers are responsible for managing the credit evaluation, review, and approval process, as well as managing overall risk to the portfolio. Only credit managers are authorized to issue communications with customers concerning credit-related issues. Sales department - The sales department is responsible for ensuring that the credit application form is submitted to the credit department by a prospective new customer, in advance of order acceptance. The sales representative also is responsible for instructing the customer regarding the respective roles and requirements of the credit, order administration and sales departments for introducing the customer to the appropriate representative of these departments. Accounts receivable - This position/team reports to the credit manager and is responsible for daily accounts receivable activity, including invoicing and cash posting. Collections manager - This position/team oversees collections and works with contracted collections agencies. CUSTOMER CREDIT REVIEWS The process involves assessing a customer's ability and willingness to pay under the terms of sale and the likelihood of late or defaulted payment. The credit limit is a measure of the customer's creditworthiness and is based on the ability to pay amounts due on time. For existing customers, the credit department reviews credit limits as needed. All limits may be modified according to the evolution of the customer's creditworthiness. Customer credit limits and payment terms must be recorded in the operational and financial systems that are linked to the accounting systems that manage the activities of customer accounts. Any adverse changes to the customer's creditworthiness or risk rating will trigger a review of the customer credit limit in accordance with the guidelines set in this policy. The credit analysis will: Determine amount of credit needed based on estimated purchases (including seasonality) and proposed payment terms provided by country. Review customer risk analysis (credit report or manual assessment). Assess business analytical information. The end result is the determination of a credit limit for that customer consistent with the risk assessment, expected purchase levels, and payment terms Customer accounts must be forwarded to the credit department when an account exceeds its credit limit and/or the customer is in arrears and every effort has been made to obtain a payment

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This credit policy template has 6 pages and is a MS Word file type listed under our human resources documents.

Sample of our credit policy template:

CREDIT POLICY OVERVIEW Cash flow and liquidity management is of paramount importance for [COMPANY NAME]. This credit policy has been designed to maximize profits and profits on sales revenue while minimizing exposure to slow-paying customers and business losses, thereby ensuring a healthy cash and working capital position. SCOPE This policy applies to all sales of [COMPANY NAME] products to customers. All departments within [COMPANY NAME] responsible for the sale, marketing, contract approval, order acceptance; scheduling and shipment of products must adhere to the policy and guidelines below. TERMS OF SALE The terms and conditions of sale are determined on the basis of current sales programs and promotions. The credit department works closely with the sales department to establish and modify appropriate conditions that maximize sales results. Standard payment terms are: net 30; net 45 for sales greater than [SPECIFY], or four equal quarterly payments due on days 1, 90, 180, and 270. Terms for orders already shipped cannot be altered or modified without approval from the credit department. Any changes from standard payment terms requires a variance request form. CREDIT RISK MANAGEMENT In the context of this policy, some receivables may not be recovered as expected. The method of assessing risk and determining a credit limit to customers varies depending on the amount of credit requested and the type of product or service sold. Low credit limits, generally described as accounts with a credit limit of up to $ [SPECIFY] or the equivalent in local currency, represent a reduced exposure and generally require limited information to assign a credit limit. Larger limits require higher levels of risk analysis and may use risk scoring models using internal and external risk elements and methodology. Limits can also be determined based on the payment experience of customers as well as annual sales and payment terms to arrive at a risk-adjusted limit that considers normal customer purchasing activities. For credit limits exceeding the maximum amounts defined in this policy (or in the absence of commonly available risk elements), further financial analysis is required. This analysis will include (but is not limited to) the analysis of financial statement ratios, cash flow analysis, evaluation of the availability of external financing and evaluation of future activities by the company's management. Typical minimum components of risk assessment include: Demographic assessment; Payment history (especially at comparable exposure levels).; Length of time in business; Business reputation (absence of adverse public information, i.e. court cases, judgments, etc); Knowledgeable assessment of company management; Financial analysis i.e. analysis of historical financial data, company accounts (based upon anticipated credit limit); External credit risk rating; Business analysis i.e. the situation of the economic sector the customer is in and their market position within it; Adequacy and enforceability of collateral/guarantee where applicable. ROLE AND RESPONSIBILITIES In order to facilitate the flow of orders and the shipment of products, [COMPANY NAME]'s policy is that credit should be extended to all customers who demonstrate both the ability to pay and a history of timely debt payment. Credit limits will be determined by comparing the following averages: the customer's working capital, the average credit limits granted by the trade references and the customer's credit line needs. Credit department - The credit department will outline the requirements for establishing trade credit for new customers and maintaining lines of credit and limits for active accounts and returning customers with appropriate payment terms. The VP Credit has overall credit and collections responsibility for the credit department. Employees in these roles have authority to approve credit lines up to $[SPECIFY]. Anything exceeding this amount needs approval from the VP Credit. The credit department will evaluate all new customers to determine the terms and methods of payment that will be required and the level of credit that will be established. The credit department will also seek to offer optional payment methods to facilitate sales to customers with sub-optimal credit histories. Credit department will periodically review and reassess the payment terms and lines of credit of existing customers to meet new customer requirements and manage risks as financial and business conditions change. The credit managers are responsible for managing the credit evaluation, review, and approval process, as well as managing overall risk to the portfolio. Only credit managers are authorized to issue communications with customers concerning credit-related issues. Sales department - The sales department is responsible for ensuring that the credit application form is submitted to the credit department by a prospective new customer, in advance of order acceptance. The sales representative also is responsible for instructing the customer regarding the respective roles and requirements of the credit, order administration and sales departments for introducing the customer to the appropriate representative of these departments. Accounts receivable - This position/team reports to the credit manager and is responsible for daily accounts receivable activity, including invoicing and cash posting. Collections manager - This position/team oversees collections and works with contracted collections agencies. CUSTOMER CREDIT REVIEWS The process involves assessing a customer's ability and willingness to pay under the terms of sale and the likelihood of late or defaulted payment. The credit limit is a measure of the customer's creditworthiness and is based on the ability to pay amounts due on time. For existing customers, the credit department reviews credit limits as needed. All limits may be modified according to the evolution of the customer's creditworthiness. Customer credit limits and payment terms must be recorded in the operational and financial systems that are linked to the accounting systems that manage the activities of customer accounts. Any adverse changes to the customer's creditworthiness or risk rating will trigger a review of the customer credit limit in accordance with the guidelines set in this policy. The credit analysis will: Determine amount of credit needed based on estimated purchases (including seasonality) and proposed payment terms provided by country. Review customer risk analysis (credit report or manual assessment). Assess business analytical information. The end result is the determination of a credit limit for that customer consistent with the risk assessment, expected purchase levels, and payment terms Customer accounts must be forwarded to the credit department when an account exceeds its credit limit and/or the customer is in arrears and every effort has been made to obtain a payment

Easily Create Any Business Document You Need in Minutes.

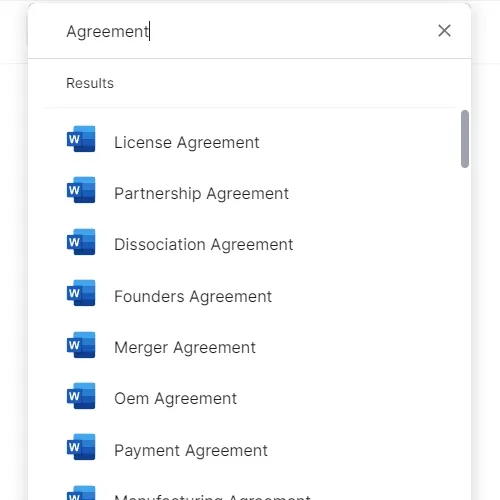

Access over 3,000+ business and legal templates for any business task, project or initiative.

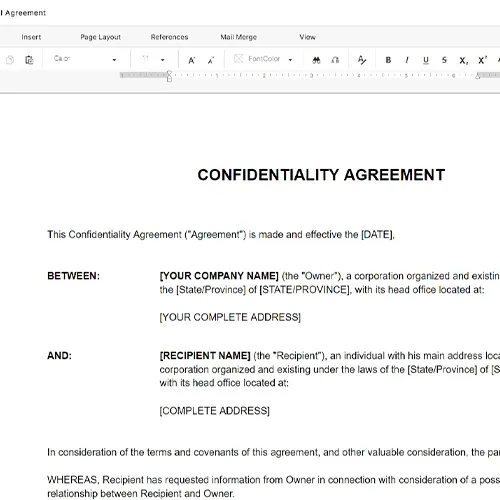

Customize your ready-made business document template and save it in the cloud.

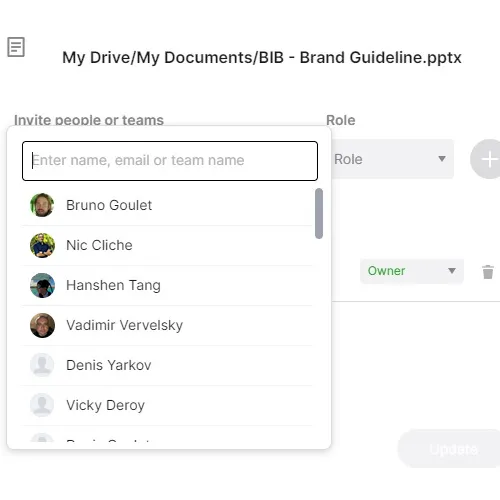

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.