Collection Letter_By Collection Agency Template

Document content

This collection letter_by collection agency template has 2 pages and is a MS Word file type listed under our credit & collection documents.

Sample of our collection letter_by collection agency template:

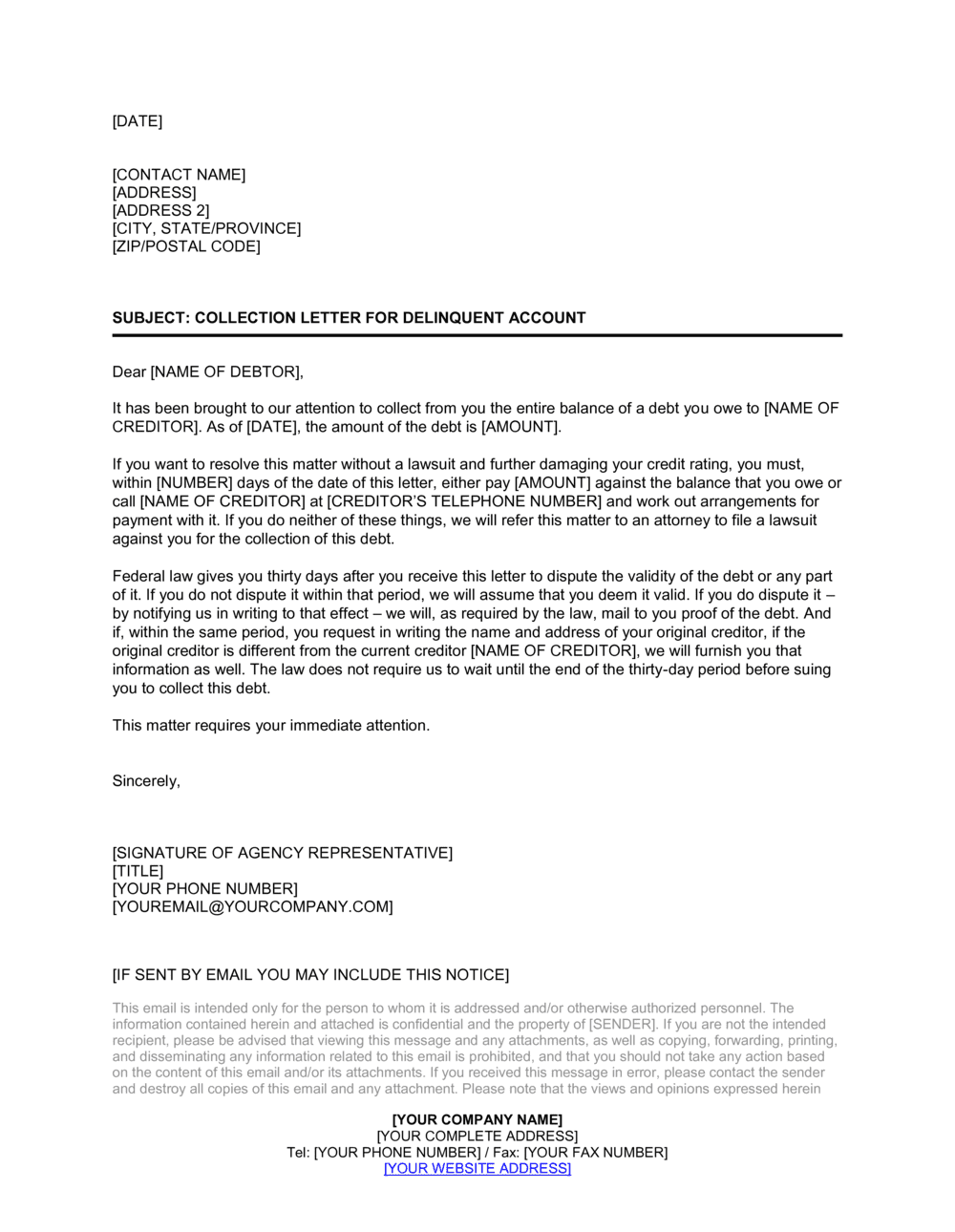

[DATE] [CONTACT NAME] [ADDRESS] [ADDRESS 2] [CITY, STATE/PROVINCE] [ZIP/POSTAL CODE] SUBJECT: COLLECTION LETTER FOR DELINQUENT ACCOUNT Dear [NAME OF DEBTOR], It has been brought to our attention to collect from you the entire balance of a debt you owe to [NAME OF CREDITOR]. As of [DATE], the amount of the debt is [AMOUNT]. If you want to resolve this matter without a lawsuit and further damaging your credit rating, you must, within [NUMBER] days of the date of this letter, either pay [AMOUNT] against the balance that you owe or call [NAME OF CREDITOR] at [CREDITOR'S TELEPHONE NUMBER] and work out arrangements for payment with it. If you do neither of these things, we will refer this matter to an attorney to file a lawsuit against you for the collection of this debt. Federal law gives you thirty days after you receive this letter to dispute the validity of the debt or any part of it. If you do not dispute it within that period, we will assume that you deem it valid. If you do dispute it - by notifying us in writing to that effect - we will, as required by the law, mail to you proof of the debt. And if, within the same period, you request in writing the name and address of your original creditor, if the original creditor is different from the current creditor [NAME OF CREDITOR], we will furnish you that information as well

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This collection letter_by collection agency template has 2 pages and is a MS Word file type listed under our credit & collection documents.

Sample of our collection letter_by collection agency template:

[DATE] [CONTACT NAME] [ADDRESS] [ADDRESS 2] [CITY, STATE/PROVINCE] [ZIP/POSTAL CODE] SUBJECT: COLLECTION LETTER FOR DELINQUENT ACCOUNT Dear [NAME OF DEBTOR], It has been brought to our attention to collect from you the entire balance of a debt you owe to [NAME OF CREDITOR]. As of [DATE], the amount of the debt is [AMOUNT]. If you want to resolve this matter without a lawsuit and further damaging your credit rating, you must, within [NUMBER] days of the date of this letter, either pay [AMOUNT] against the balance that you owe or call [NAME OF CREDITOR] at [CREDITOR'S TELEPHONE NUMBER] and work out arrangements for payment with it. If you do neither of these things, we will refer this matter to an attorney to file a lawsuit against you for the collection of this debt. Federal law gives you thirty days after you receive this letter to dispute the validity of the debt or any part of it. If you do not dispute it within that period, we will assume that you deem it valid. If you do dispute it - by notifying us in writing to that effect - we will, as required by the law, mail to you proof of the debt. And if, within the same period, you request in writing the name and address of your original creditor, if the original creditor is different from the current creditor [NAME OF CREDITOR], we will furnish you that information as well

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.