Checklist Financial Health

Document content

This checklist financial health template has 2 pages and is a MS Word file type listed under our business plan kit documents.

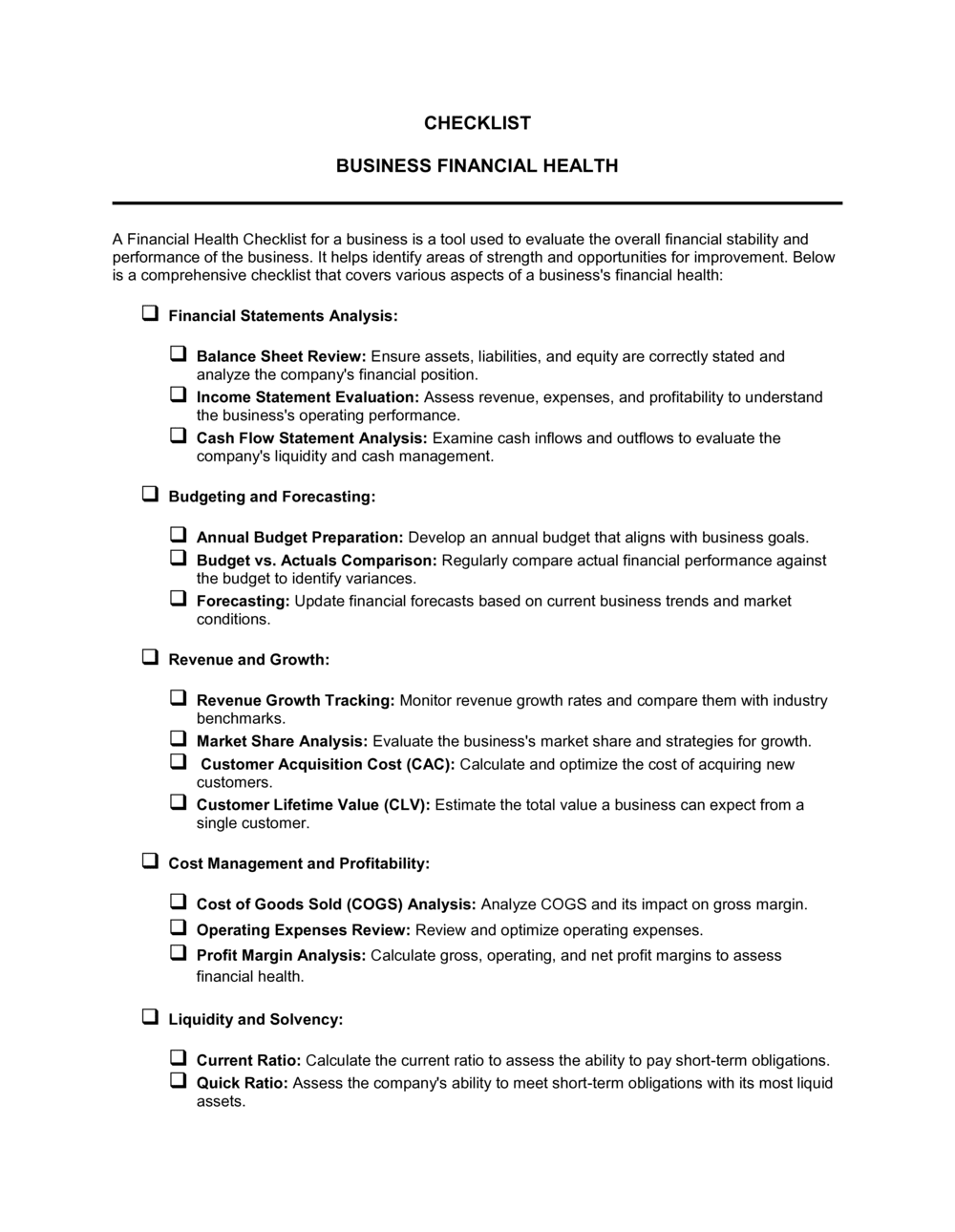

Sample of our checklist financial health template:

CHECKLIST BUSINESS FINANCIAL HEALTH A Financial Health Checklist for a business is a tool used to evaluate the overall financial stability and performance of the business. It helps identify areas of strength and opportunities for improvement. Below is a comprehensive checklist that covers various aspects of a business's financial health: Financial Statements Analysis: Balance Sheet Review: Ensure assets, liabilities, and equity are correctly stated and analyze the company's financial position. Income Statement Evaluation: Assess revenue, expenses, and profitability to understand the business's operating performance. Cash Flow Statement Analysis: Examine cash inflows and outflows to evaluate the company's liquidity and cash management. Budgeting and Forecasting: Annual Budget Preparation: Develop an annual budget that aligns with business goals. Budget vs. Actuals Comparison: Regularly compare actual financial performance against the budget to identify variances. Forecasting: Update financial forecasts based on current business trends and market conditions. Revenue and Growth: Revenue Growth Tracking: Monitor revenue growth rates and compare them with industry benchmarks. Market Share Analysis: Evaluate the business's market share and strategies for growth. Customer Acquisition Cost (CAC): Calculate and optimize the cost of acquiring new customers. Customer Lifetime Value (CLV): Estimate the total value a business can expect from a single customer. Cost Management and Profitability: Cost of Goods Sold (COGS) Analysis: Analyze COGS and its impact on gross margin. Operating Expenses Review: Review and optimize operating expenses. Profit Margin Analysis: Calculate gross, operating, and net profit margins to assess financial health. Liquidity and Solvency:

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This checklist financial health template has 2 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our checklist financial health template:

CHECKLIST BUSINESS FINANCIAL HEALTH A Financial Health Checklist for a business is a tool used to evaluate the overall financial stability and performance of the business. It helps identify areas of strength and opportunities for improvement. Below is a comprehensive checklist that covers various aspects of a business's financial health: Financial Statements Analysis: Balance Sheet Review: Ensure assets, liabilities, and equity are correctly stated and analyze the company's financial position. Income Statement Evaluation: Assess revenue, expenses, and profitability to understand the business's operating performance. Cash Flow Statement Analysis: Examine cash inflows and outflows to evaluate the company's liquidity and cash management. Budgeting and Forecasting: Annual Budget Preparation: Develop an annual budget that aligns with business goals. Budget vs. Actuals Comparison: Regularly compare actual financial performance against the budget to identify variances. Forecasting: Update financial forecasts based on current business trends and market conditions. Revenue and Growth: Revenue Growth Tracking: Monitor revenue growth rates and compare them with industry benchmarks. Market Share Analysis: Evaluate the business's market share and strategies for growth. Customer Acquisition Cost (CAC): Calculate and optimize the cost of acquiring new customers. Customer Lifetime Value (CLV): Estimate the total value a business can expect from a single customer. Cost Management and Profitability: Cost of Goods Sold (COGS) Analysis: Analyze COGS and its impact on gross margin. Operating Expenses Review: Review and optimize operating expenses. Profit Margin Analysis: Calculate gross, operating, and net profit margins to assess financial health. Liquidity and Solvency:

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.