Checklist Alternate Term Sheet Provisions

Document content

This checklist alternate term sheet provisions template has 2 pages and is a MS Word file type listed under our finance & accounting documents.

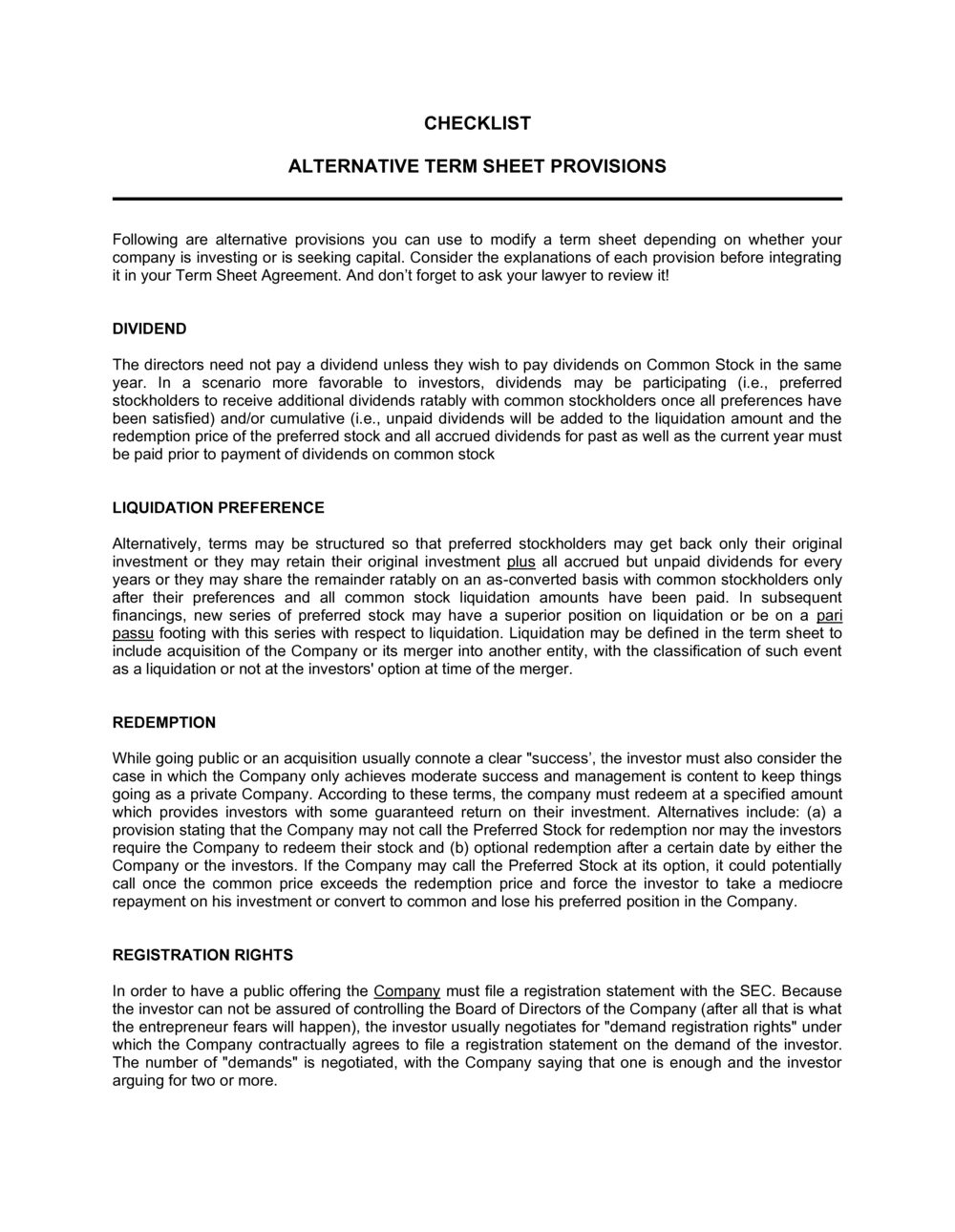

Sample of our checklist alternate term sheet provisions template:

CHECKLIST ALTERNATIVE TERM SHEET PROVISIONS Following are alternative provisions you can use to modify a term sheet depending on whether your company is investing or is seeking capital. Consider the explanations of each provision before integrating it in your Term Sheet Agreement. And don't forget to ask your lawyer to review it! DIVIDEND The directors need not pay a dividend unless they wish to pay dividends on Common Stock in the same year. In a scenario more favorable to investors, dividends may be participating (i.e., preferred stockholders to receive additional dividends ratably with common stockholders once all preferences have been satisfied) and/or cumulative (i.e., unpaid dividends will be added to the liquidation amount and the redemption price of the preferred stock and all accrued dividends for past as well as the current year must be paid prior to payment of dividends on common stock liquidation preference Alternatively, terms may be structured so that preferred stockholders may get back only their original investment or they may retain their original investment plus all accrued but unpaid dividends for every years or they may share the remainder ratably on an as-converted basis with common stockholders only after their preferences and all common stock liquidation amounts have been paid. In subsequent financings, new series of preferred stock may have a superior position on liquidation or be on a pari passu footing with this series with respect to liquidation. Liquidation may be defined in the term sheet to include acquisition of the Company or its merger into another entity, with the classification of such event as a liquidation or not at the investors' option at time of the merger. Redemption While going public or an acquisition usually connote a clear "success', the investor must also consider the case in which the Company only achieves moderate success and management is content to keep things going as a private Company. According to these terms, the company must redeem at a specified amount which provides investors with some guaranteed return on their investment. Alternatives include: (a) a provision stating that the Company may not call the Preferred Stock for redemption nor may the investors require the Company to redeem their stock and (b) optional redemption after a certain date by either the Company or the investors. If the Company may call the Preferred Stock at its option, it could potentially call once the common price exceeds the redemption price and force the investor to take a mediocre repayment on his investment or convert to common and lose his preferred position in the Company. Registration Rights In order to have a public offering the Company must file a registration statement with the SEC. Because the investor can not be assured of controlling the Board of Directors of the Company (after all that is what the entrepreneur fears will happen), the investor usually negotiates for "demand registration rights" under which the Company contractually agrees to file a registration statement on the demand of the investor

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This checklist alternate term sheet provisions template has 2 pages and is a MS Word file type listed under our finance & accounting documents.

Sample of our checklist alternate term sheet provisions template:

CHECKLIST ALTERNATIVE TERM SHEET PROVISIONS Following are alternative provisions you can use to modify a term sheet depending on whether your company is investing or is seeking capital. Consider the explanations of each provision before integrating it in your Term Sheet Agreement. And don't forget to ask your lawyer to review it! DIVIDEND The directors need not pay a dividend unless they wish to pay dividends on Common Stock in the same year. In a scenario more favorable to investors, dividends may be participating (i.e., preferred stockholders to receive additional dividends ratably with common stockholders once all preferences have been satisfied) and/or cumulative (i.e., unpaid dividends will be added to the liquidation amount and the redemption price of the preferred stock and all accrued dividends for past as well as the current year must be paid prior to payment of dividends on common stock liquidation preference Alternatively, terms may be structured so that preferred stockholders may get back only their original investment or they may retain their original investment plus all accrued but unpaid dividends for every years or they may share the remainder ratably on an as-converted basis with common stockholders only after their preferences and all common stock liquidation amounts have been paid. In subsequent financings, new series of preferred stock may have a superior position on liquidation or be on a pari passu footing with this series with respect to liquidation. Liquidation may be defined in the term sheet to include acquisition of the Company or its merger into another entity, with the classification of such event as a liquidation or not at the investors' option at time of the merger. Redemption While going public or an acquisition usually connote a clear "success', the investor must also consider the case in which the Company only achieves moderate success and management is content to keep things going as a private Company. According to these terms, the company must redeem at a specified amount which provides investors with some guaranteed return on their investment. Alternatives include: (a) a provision stating that the Company may not call the Preferred Stock for redemption nor may the investors require the Company to redeem their stock and (b) optional redemption after a certain date by either the Company or the investors. If the Company may call the Preferred Stock at its option, it could potentially call once the common price exceeds the redemption price and force the investor to take a mediocre repayment on his investment or convert to common and lose his preferred position in the Company. Registration Rights In order to have a public offering the Company must file a registration statement with the SEC. Because the investor can not be assured of controlling the Board of Directors of the Company (after all that is what the entrepreneur fears will happen), the investor usually negotiates for "demand registration rights" under which the Company contractually agrees to file a registration statement on the demand of the investor

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.