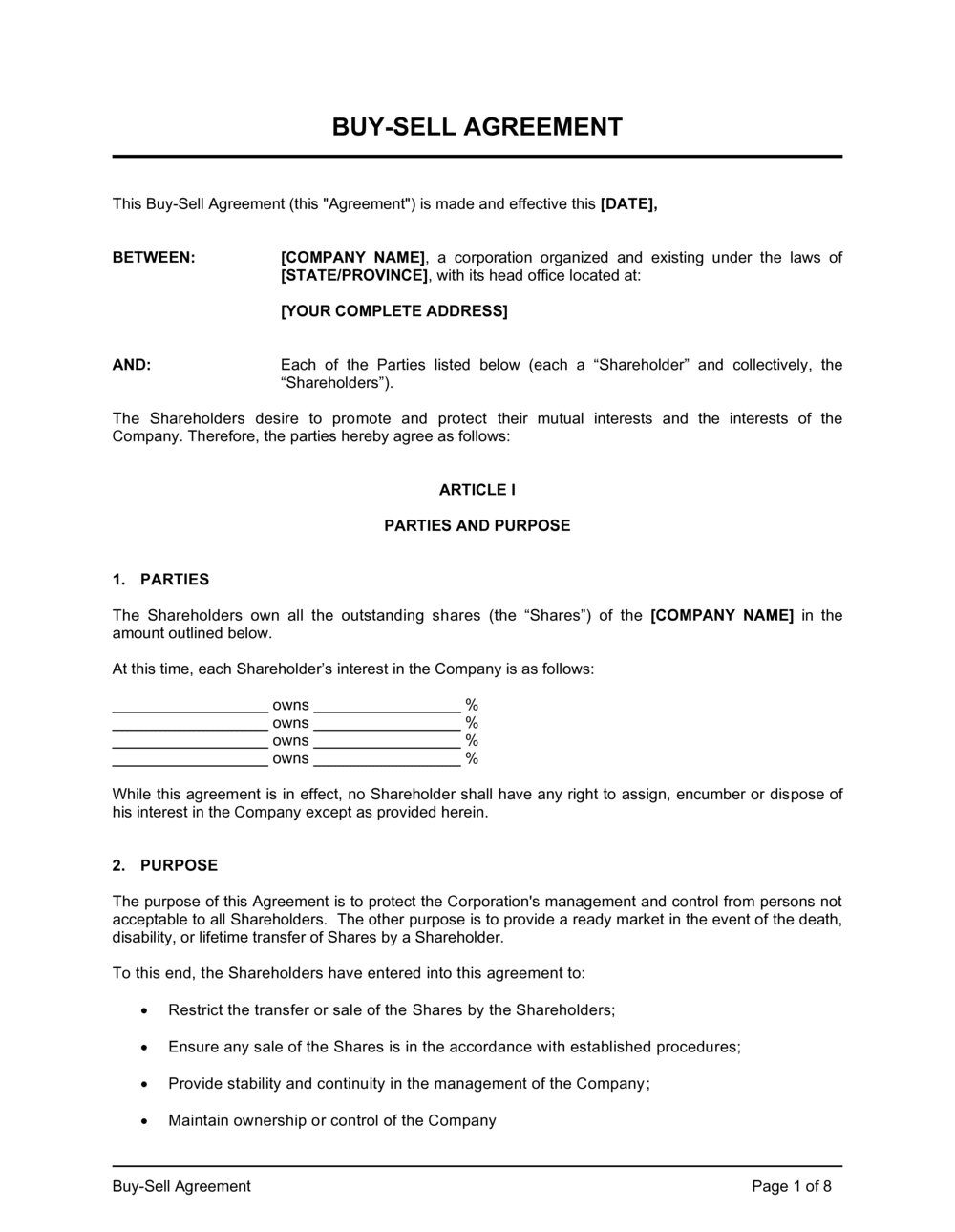

Buy Sell Agreement Template

Protecting Business Continuity with a Buy-Sell Agreement

In closely held businesses and partnerships, a Buy-Sell Agreement is essential for ensuring smooth transitions of ownership and protecting business continuity. This legal document outlines the terms for buying out an owner's share in the business under specific circumstances, such as retirement, death, or disability, ensuring that all parties have clarity on the ownership transfer process.

The Buy-Sell Agreement serves as a regulatory framework that defines the conditions and procedures for transferring ownership interests. By detailing the valuation methods, funding mechanisms, and buyout conditions, the agreement helps to prevent conflicts and ensures that the business can continue to operate smoothly despite changes in ownership.

What is a Buy-Sell Agreement?

A Buy-Sell Agreement is a formal document that outlines the terms for buying and selling ownership interests in a business. It establishes the rights and obligations of the remaining owners and the exiting owner's estate, ensuring a fair and orderly transfer of ownership in the event of retirement, disability, death, or other triggering events.

Key Elements of a Buy-Sell Agreement

A comprehensive Buy-Sell Agreement should effectively address:

- Triggering Events - Defines the events that trigger the buyout process, such as retirement, death, disability, or voluntary sale of an ownership interest.

- Valuation Methodology - Specifies the method for valuing the ownership interests, ensuring a fair and transparent valuation process.

- Funding Mechanism - Details how the buyout will be funded, such as through insurance policies, cash reserves, or external financing.

- Purchase Terms and Conditions - Outlines the terms for buying and selling ownership interests, including payment schedules, rights of first refusal, and restrictions on sales.

- Buyout Procedures - Specifies the steps and timeline for executing the buyout, ensuring a smooth and orderly transfer of ownership.

- Dispute Resolution - Establishes procedures for resolving disputes related to the agreement, minimizing the impact of disagreements.

Supporting Documents for Implementing a Buy-Sell Agreement

To enhance the effectiveness of a Buy-Sell Agreement, related documents can be incorporated:

- Valuation Report - Provides an independent assessment of the business's value, ensuring an objective basis for the buyout.

- Shareholders Agreement - A legally binding document that outlines the rights, responsibilities, and relationships among shareholders in a company. It governs matters like voting rights, dividend distribution, and share transfers, ensuring alignment with the company's goals and protecting shareholders' interests.

- Partnership Agreement - A comprehensive document that sets the framework for the partnership's structure, governance, and operations. It details the partners' rights and obligations, profit-sharing arrangements, and dispute-resolution mechanisms, providing a clear framework for the partnership.

- General Bylaws - A foundational document that outlines the fundamental rules and procedures for the governance and management of a business. It defines the roles and responsibilities of the board, the process for holding meetings, voting protocols, and other operational guidelines, ensuring a structured framework for business operations and decision-making.

Why Employ a Detailed Template for a Buy-Sell Agreement?

Utilizing a detailed template for drafting your Buy-Sell Agreement offers significant benefits:

- Business Continuity - Ensures the business can continue to operate smoothly despite ownership changes.

- Fair Valuation and Terms - Establishes clear methods for valuing ownership interests and fair terms for buyouts.

- Legal Protection - Clearly defines the terms and conditions, reducing the risk of disputes and legal issues.

- Risk Mitigation - Specifies funding mechanisms and buyout procedures, protecting against financial strain.

A well-structured Buy-Sell Agreement is crucial for protecting the continuity and stability of a business. This essential document not only provides clarity on ownership transitions but also helps manage and mitigate potential risks effectively.

Updated in May 2024

Reviewed on

Protecting Business Continuity with a Buy-Sell Agreement

In closely held businesses and partnerships, a Buy-Sell Agreement is essential for ensuring smooth transitions of ownership and protecting business continuity. This legal document outlines the terms for buying out an owner's share in the business under specific circumstances, such as retirement, death, or disability, ensuring that all parties have clarity on the ownership transfer process.

The Buy-Sell Agreement serves as a regulatory framework that defines the conditions and procedures for transferring ownership interests. By detailing the valuation methods, funding mechanisms, and buyout conditions, the agreement helps to prevent conflicts and ensures that the business can continue to operate smoothly despite changes in ownership.

What is a Buy-Sell Agreement?

A Buy-Sell Agreement is a formal document that outlines the terms for buying and selling ownership interests in a business. It establishes the rights and obligations of the remaining owners and the exiting owner's estate, ensuring a fair and orderly transfer of ownership in the event of retirement, disability, death, or other triggering events.

Key Elements of a Buy-Sell Agreement

A comprehensive Buy-Sell Agreement should effectively address:

- Triggering Events - Defines the events that trigger the buyout process, such as retirement, death, disability, or voluntary sale of an ownership interest.

- Valuation Methodology - Specifies the method for valuing the ownership interests, ensuring a fair and transparent valuation process.

- Funding Mechanism - Details how the buyout will be funded, such as through insurance policies, cash reserves, or external financing.

- Purchase Terms and Conditions - Outlines the terms for buying and selling ownership interests, including payment schedules, rights of first refusal, and restrictions on sales.

- Buyout Procedures - Specifies the steps and timeline for executing the buyout, ensuring a smooth and orderly transfer of ownership.

- Dispute Resolution - Establishes procedures for resolving disputes related to the agreement, minimizing the impact of disagreements.

Supporting Documents for Implementing a Buy-Sell Agreement

To enhance the effectiveness of a Buy-Sell Agreement, related documents can be incorporated:

- Valuation Report - Provides an independent assessment of the business's value, ensuring an objective basis for the buyout.

- Shareholders Agreement - A legally binding document that outlines the rights, responsibilities, and relationships among shareholders in a company. It governs matters like voting rights, dividend distribution, and share transfers, ensuring alignment with the company's goals and protecting shareholders' interests.

- Partnership Agreement - A comprehensive document that sets the framework for the partnership's structure, governance, and operations. It details the partners' rights and obligations, profit-sharing arrangements, and dispute-resolution mechanisms, providing a clear framework for the partnership.

- General Bylaws - A foundational document that outlines the fundamental rules and procedures for the governance and management of a business. It defines the roles and responsibilities of the board, the process for holding meetings, voting protocols, and other operational guidelines, ensuring a structured framework for business operations and decision-making.

Why Employ a Detailed Template for a Buy-Sell Agreement?

Utilizing a detailed template for drafting your Buy-Sell Agreement offers significant benefits:

- Business Continuity - Ensures the business can continue to operate smoothly despite ownership changes.

- Fair Valuation and Terms - Establishes clear methods for valuing ownership interests and fair terms for buyouts.

- Legal Protection - Clearly defines the terms and conditions, reducing the risk of disputes and legal issues.

- Risk Mitigation - Specifies funding mechanisms and buyout procedures, protecting against financial strain.

A well-structured Buy-Sell Agreement is crucial for protecting the continuity and stability of a business. This essential document not only provides clarity on ownership transitions but also helps manage and mitigate potential risks effectively.

Updated in May 2024

Easily Create Any Business Document You Need in Minutes.

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.