Business Insurance Guide

Document content

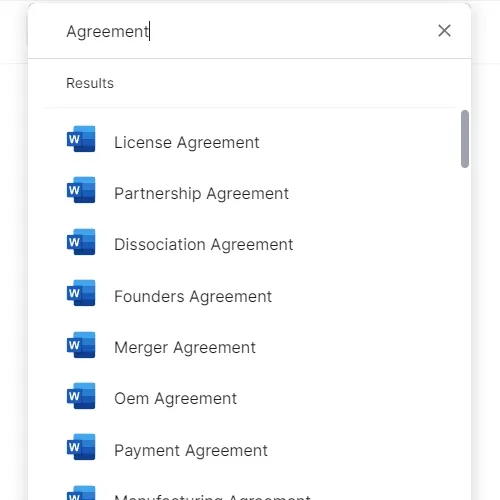

This business insurance guide template has 10 pages and is a MS Word file type listed under our finance & accounting documents.

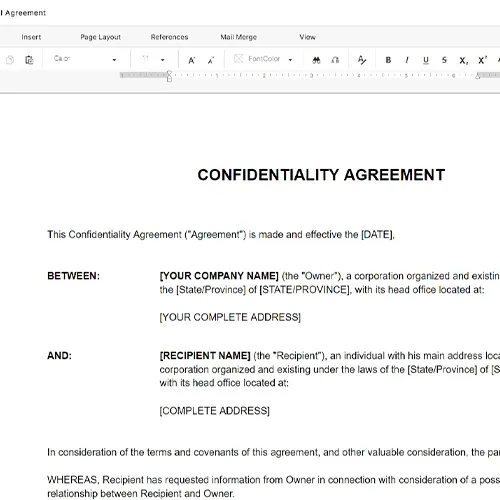

Sample of our business insurance guide template:

A Brief Guide on Business Insurance A Condensed Guidebook to Help You Understand Business Insurance Table of Contents Understanding Business Insurance 3 Types of Business Insurance 3 Property Insurance 3 Product Liability Insurance 4 General Liability Insurance 4 Business Owner's Policy 4 Professional Liability Insurance 5 Business Vehicle Insurance 5 How much Business Insurance Should You Have? 6 Purchasing "Enough" Liability Insurance 6 Insuring Your Property at a Suitable Value 6 Steps to Follow When Buying Business Insurance 8 1. Assess Risks Related to Your Business 8 2. Identify a Renowned Licensed Agent 8 3. Assess Multiple Choices 8 4. Re-Evaluate Your Insurance Policy Periodically 8 Tips to Consider When Buying Insurance 9 Final Thoughts 9 Understanding Business Insurance Business insurance is essential to consider for your organization. This is because it covers you from sudden costs associated with running a business. Selecting the right business insurance can protect you from the cost of lawsuits, natural disasters, and accidents that can potentially run you out of business. However, buying insurance for your company can be time-consuming and complicated, especially if you're inexperienced with regard to insurance policies. As a result, many entrepreneurs look for easy ways by registering for random insurance policies without entirely understanding what they need. Although this approach can provide a temporary solution, it can raise significant issues in the long run. This short guide covers key business insurance issues you need to know before buying insurance, including insurance types and best practices. Types of Business Insurance Before purchasing specific business insurance, it is crucial to consider available insurance options. This way, you can select the best insurance policy to buy, depending on the nature and structure of your business. The following are some of the commonly purchased business insurance types. Property Insurance Property insurance is a crucial requirement for businesses with physical premises. This is because it covers the buildings from events like theft and fire. All your critical business assets, including furniture, computers, machinery, and inventory, can be protected under this type of insurance. One useful add-on worth considering under property insurance is the company's loss or interruption of income insurance. Property insurance will cover you from the losses incurred due to interrupted business income flow after an incident, like fire, a natural disaster, or any other disaster. Product Liability Insurance Many liabilities can occur throughout a business' lifetime. Product liability insurance covers specific liabilities such as property damage and injuries. However, it can also cover claims associated with malfunctioning products. For instance, if you sell a product and it stops functioning within a week, you can use this insurance type to cover such customer claims. Essentially, product liability insurance is suitable for firms that produce, distribute or sell products. General Liability Insurance This insurance type is also called business liability insurance. It covers your business against claims involving property damage and bodily injuries associated with your services, products, or place of operation. Also, it covers financial losses due to medical expenses, settlement of judgments or bonds, defending lawsuits, slander, and libel. For instance, suppose a customer slips and falls while shopping in your grocery store. In that case, you might face claims for lost income or medical charges that can amount to a considerable sum of money. A business liability insurance can protect your company from such claims. Although general liability insurance covers you against many issues that can potentially occur in your business, it doesn't cover basic problems like vehicle accidents. Therefore, it is essential to understand what it does cover and what it doesn't cover before buying it. Business Owner's Policy The business owner's policy, also called the umbrella policy, combines multiple critical coverage options into a single bundle. For instance, it can include specific liability insurance types, property insurance, and interruption insurance. However, a business owner's policy doesn't offer employee, auto, and professional liability coverage. It is the most suitable for small and medium-sized enterprises. This is because it simplifies the process of purchasing insurance and can be more cost-saving than when a company covers each risk independently. Professional Liability Insurance This business insurance type protects your company against financial losses associated with negligence, errors, and malpractice. It is most suitable for firms that offer professional services to customers, including real estate agents, IT consultants, and doctors, just to mention a few. Professional liability insurance can also reimburse the legal costs you suffer when defending yourself against malpractice, error, or negligence claims. Therefore, if you're operating a professional service company as a digital business solutions vendor, professional liability insurance can help you cover lawsuits resulting from simple errors and employee malpractice. After all, these issues are bound to happen in the course of business operations. Business Vehicle Insurance This insurance policy protects the vehicles owned and used by a company to fulfill its business operations. Also, it can apply to the vehicles that the business leases or hires.

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This business insurance guide template has 10 pages and is a MS Word file type listed under our finance & accounting documents.

Sample of our business insurance guide template:

A Brief Guide on Business Insurance A Condensed Guidebook to Help You Understand Business Insurance Table of Contents Understanding Business Insurance 3 Types of Business Insurance 3 Property Insurance 3 Product Liability Insurance 4 General Liability Insurance 4 Business Owner's Policy 4 Professional Liability Insurance 5 Business Vehicle Insurance 5 How much Business Insurance Should You Have? 6 Purchasing "Enough" Liability Insurance 6 Insuring Your Property at a Suitable Value 6 Steps to Follow When Buying Business Insurance 8 1. Assess Risks Related to Your Business 8 2. Identify a Renowned Licensed Agent 8 3. Assess Multiple Choices 8 4. Re-Evaluate Your Insurance Policy Periodically 8 Tips to Consider When Buying Insurance 9 Final Thoughts 9 Understanding Business Insurance Business insurance is essential to consider for your organization. This is because it covers you from sudden costs associated with running a business. Selecting the right business insurance can protect you from the cost of lawsuits, natural disasters, and accidents that can potentially run you out of business. However, buying insurance for your company can be time-consuming and complicated, especially if you're inexperienced with regard to insurance policies. As a result, many entrepreneurs look for easy ways by registering for random insurance policies without entirely understanding what they need. Although this approach can provide a temporary solution, it can raise significant issues in the long run. This short guide covers key business insurance issues you need to know before buying insurance, including insurance types and best practices. Types of Business Insurance Before purchasing specific business insurance, it is crucial to consider available insurance options. This way, you can select the best insurance policy to buy, depending on the nature and structure of your business. The following are some of the commonly purchased business insurance types. Property Insurance Property insurance is a crucial requirement for businesses with physical premises. This is because it covers the buildings from events like theft and fire. All your critical business assets, including furniture, computers, machinery, and inventory, can be protected under this type of insurance. One useful add-on worth considering under property insurance is the company's loss or interruption of income insurance. Property insurance will cover you from the losses incurred due to interrupted business income flow after an incident, like fire, a natural disaster, or any other disaster. Product Liability Insurance Many liabilities can occur throughout a business' lifetime. Product liability insurance covers specific liabilities such as property damage and injuries. However, it can also cover claims associated with malfunctioning products. For instance, if you sell a product and it stops functioning within a week, you can use this insurance type to cover such customer claims. Essentially, product liability insurance is suitable for firms that produce, distribute or sell products. General Liability Insurance This insurance type is also called business liability insurance. It covers your business against claims involving property damage and bodily injuries associated with your services, products, or place of operation. Also, it covers financial losses due to medical expenses, settlement of judgments or bonds, defending lawsuits, slander, and libel. For instance, suppose a customer slips and falls while shopping in your grocery store. In that case, you might face claims for lost income or medical charges that can amount to a considerable sum of money. A business liability insurance can protect your company from such claims. Although general liability insurance covers you against many issues that can potentially occur in your business, it doesn't cover basic problems like vehicle accidents. Therefore, it is essential to understand what it does cover and what it doesn't cover before buying it. Business Owner's Policy The business owner's policy, also called the umbrella policy, combines multiple critical coverage options into a single bundle. For instance, it can include specific liability insurance types, property insurance, and interruption insurance. However, a business owner's policy doesn't offer employee, auto, and professional liability coverage. It is the most suitable for small and medium-sized enterprises. This is because it simplifies the process of purchasing insurance and can be more cost-saving than when a company covers each risk independently. Professional Liability Insurance This business insurance type protects your company against financial losses associated with negligence, errors, and malpractice. It is most suitable for firms that offer professional services to customers, including real estate agents, IT consultants, and doctors, just to mention a few. Professional liability insurance can also reimburse the legal costs you suffer when defending yourself against malpractice, error, or negligence claims. Therefore, if you're operating a professional service company as a digital business solutions vendor, professional liability insurance can help you cover lawsuits resulting from simple errors and employee malpractice. After all, these issues are bound to happen in the course of business operations. Business Vehicle Insurance This insurance policy protects the vehicles owned and used by a company to fulfill its business operations. Also, it can apply to the vehicles that the business leases or hires.

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

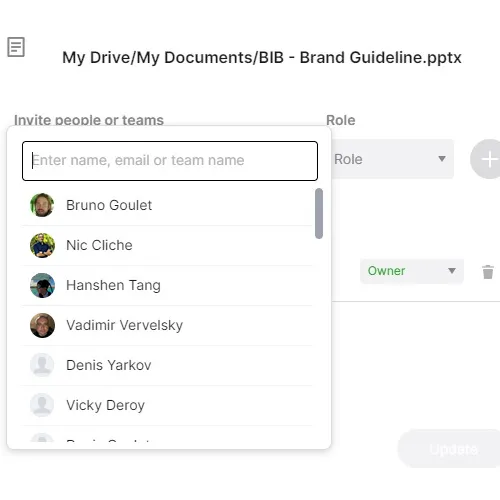

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.