Build To Suit Agreement Template

Document content

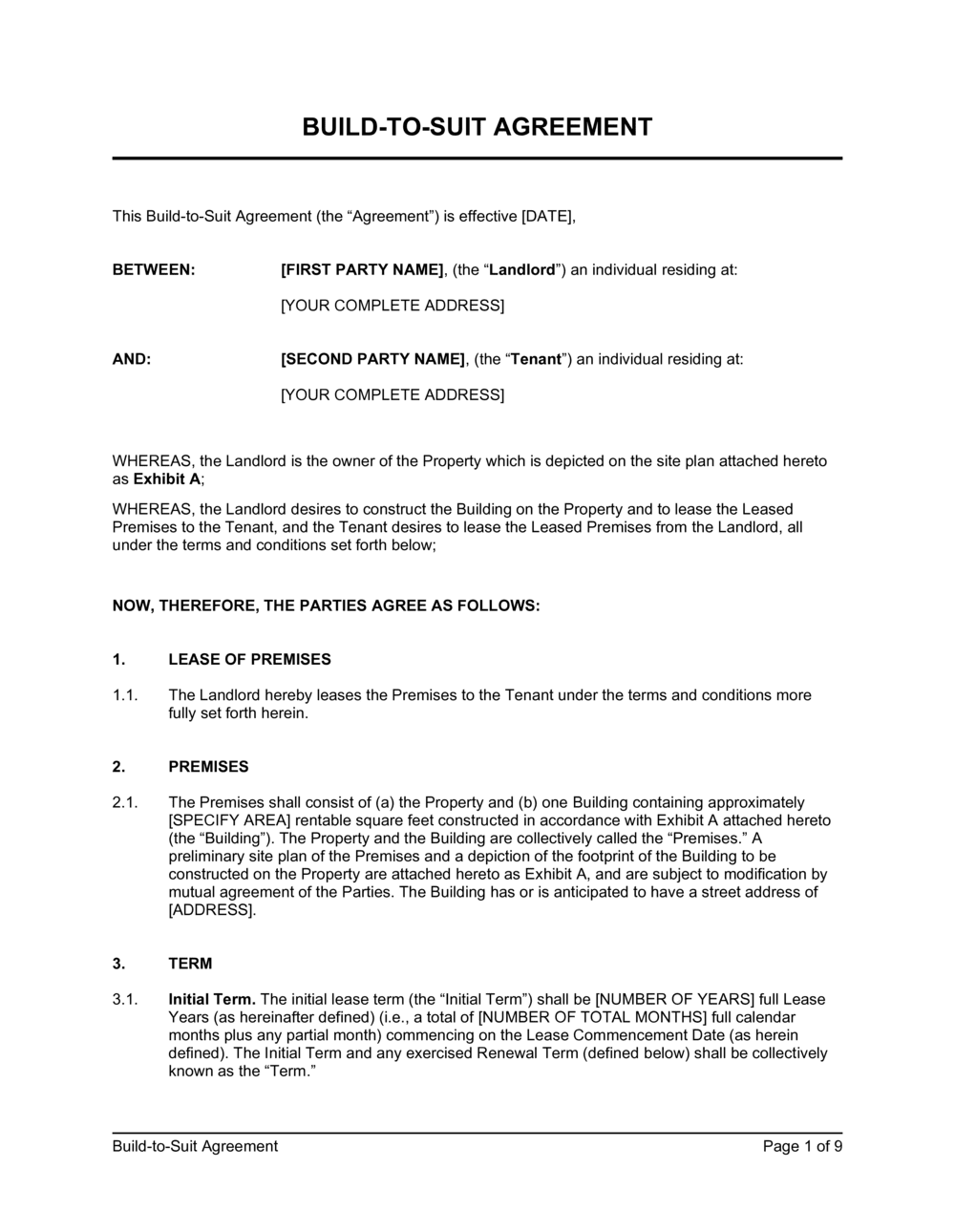

This build to suit agreement template has 9 pages and is a MS Word file type listed under our legal agreements documents.

Sample of our build to suit agreement template:

BUILD-TO-SUIT AGREEMENT This Build-to-Suit Agreement (the "Agreement") is effective [DATE], BETWEEN: [FIRST PARTY NAME], (the "Landlord") an individual residing at: [YOUR COMPLETE ADDRESS] AND: [SECOND PARTY NAME], (the "Tenant") an individual residing at: [YOUR COMPLETE ADDRESS] WHEREAS, the Landlord is the owner of the Property which is depicted on the site plan attached hereto as Exhibit A; WHEREAS, the Landlord desires to construct the Building on the Property and to lease the Leased Premises to the Tenant, and the Tenant desires to lease the Leased Premises from the Landlord, all under the terms and conditions set forth below; NOW, THEREFORE, THE PARTIES AGREE AS FOLLOWS: LEASE OF PREMISES The Landlord hereby leases the Premises to the Tenant under the terms and conditions more fully set forth herein. PREMISES The Premises shall consist of (a) the Property and (b) one Building containing approximately [SPECIFY AREA] rentable square feet constructed in accordance with Exhibit A attached hereto (the "Building"). The Property and the Building are collectively called the "Premises." A preliminary site plan of the Premises and a depiction of the footprint of the Building to be constructed on the Property are attached hereto as Exhibit A, and are subject to modification by mutual agreement of the Parties. The Building has or is anticipated to have a street address of [ADDRESS]. TERM Initial Term. The initial lease term (the "Initial Term") shall be [NUMBER OF YEARS] full Lease Years (as hereinafter defined) (i.e., a total of [NUMBER OF TOTAL MONTHS] full calendar months plus any partial month) commencing on the Lease Commencement Date (as herein defined). The Initial Term and any exercised Renewal Term (defined below) shall be collectively known as the "Term." Renewal Option. Provided that this Lease is then in full force and effect (and no Event of Default has occurred and is continuing on the date the Tenant delivers its Renewal Notice to the Landlord, the Tenant shall have the right to renew this Lease for three (3) renewal terms (each, a "Renewal Term") of five (5) years each, each immediately following the expiration of the Initial Term or the first or second Renewal Term, as the case may be, on the same terms, conditions, and provisions as are set forth in this Lease, provided that: the Tenant shall have notified the Landlord in writing of the Tenant's election to renew (the "Renewal Notice") at least eighteen (18) months prior to the date on which the Initial Term, or the applicable Renewal Term, as the case may be, expires. Time is of the essence with respect to the Tenant's exercise of its rights under this subparagraph, and the Tenant acknowledges that the Landlord requires strict adherence to the requirement that the Renewal Notice be made on a timely basis and in writing. If the Tenant fails to deliver a Renewal Notice on a timely basis, then the Tenant shall be deemed to have waived any and all remaining rights to renew the Term; there shall be no further right of renewal after the third Renewal Term. LEASE COMMENCEMENT DATE The "Lease Commencement Date" shall be (a) the date the Tenant takes occupancy of the Building for the conduct of the Tenant's intended business therein, or (b) the date which is [NUMBER OF DAYS] calendar days following Substantial Completion of the Landlord's Work. Lease Commencement Agreement. On the Lease Commencement Date (or such later date as the Landlord or Tenant may reasonably request), the Landlord and Tenant shall promptly enter into a supplementary written agreement, or in such other form as the Landlord or Tenant shall prescribe, thereby specifying the Lease Commencement Date and Rentable Area. RENT AND FINANCIAL MATTERS Security Deposit. The Tenant shall not be required to deliver, and has not delivered, any form of security deposit hereunder. Rental Obligation. Commencing on the Lease Commencement Date, the Tenant shall be obligated to pay and shall pay Basic Annual Rent. The Tenant agrees to pay the Landlord "Basic Annual Rent," payable in equal monthly installments, at the rate of [RATE] x [AMOUNT] times the Rentable Area per year for the first (1st) Lease Year, which initial Basic Annual Rent is on a triple net basis, and which shall be increased each Lease Year thereafter by two and one-fourth percent (2.25%) of the previous Lease Year's Basic Annual Rent. Payment Procedure. Each installment of the Basic Annual Rent is due in advance on the first (1st) day of each and every month for which payment is due and shall be paid by electronic funds transfer in accordance with instructions provided to the Tenant by the Landlord as modified by the Landlord from time to time. Unless a different date for payment is provided for elsewhere in this Lease (including, without limitation, as provided with respect to the Landlord's Estimate of Operating Expenses and/or Taxes), all Additional Rent will be paid by the Tenant within thirty (30) calendar days after the Landlord has notified the Tenant of the amount due. The foregoing notwithstanding, the portion of Additional Rent which is attributable to the Landlord's Estimate of Operating Expenses and/or Taxes (as all of the foregoing terms are hereinafter defined) shall be paid on the first day of each month, together with the Tenant's payments of Basic Annual Rent. Partial Month Proration. If the Lease Commencement Date occurs on a day other than the first day of a month, then the Tenant will pay a prorated monthly installment of Basic Annual Rent and of the Additional Rent for the fractional part of such month. Rent Adjustment-Taxes. Commencing on the Lease Commencement Date, and during each Operating Year, the Tenant shall pay to the Landlord, as Additional Rent, with and at the same time as the payments of Basic Annual Rent are due, the Tenant's Share of the Landlord's then-current estimate of Taxes, prorated in equal amounts over the balance of the then-current Operating Year. The Landlord has the sole and exclusive right to contest any Taxes assessed against the Leased Premises (including the Building); provided, however, that in the event the Landlord does not elect to contest the Taxes assessed during any Operating Year, then the Landlord shall provide written notice thereof to the Tenant prior to the deadline to commence any such contest, in which event, the Tenant may require the Landlord to contest such Taxes on its behalf, provided that no Event of Default by the Tenant has occurred and is continuing. If the Landlord contests the Taxes, either by its election or the Tenant's direction, then the Landlord may (i) select such third-party providers as the Landlord deems prudent to assist in such proceedings, on either a fee-paid and/or contingent fee basis; and (ii) at the Landlord's discretion, include all reasonable expenses incurred by the Landlord (including attorneys' fees and court costs) in appealing any assessment as an item of Taxes for the purpose of computing Additional Rent due under this Lease and/or satisfy all or a portion of such expenses from the proceeds of any tax refunds received as a result of a successful assessment contest. The Tenant shall have the right to consult with any such third-party providers selected by the Landlord in connection with the contest of Taxes hereunder. The Tenant acknowledges that it bears the risk that a tax assessment appeal could result in a decision which increases the assessed value of the Leased Premises. UTILITIES Effective as of the Lease Commencement Date, all utilities shall be transferred directly to accounts in the Tenant's name and the Tenant shall pay directly to all utility providers all charges respecting the Leased Premises incurred during the Term

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This build to suit agreement template has 9 pages and is a MS Word file type listed under our legal agreements documents.

Sample of our build to suit agreement template:

BUILD-TO-SUIT AGREEMENT This Build-to-Suit Agreement (the "Agreement") is effective [DATE], BETWEEN: [FIRST PARTY NAME], (the "Landlord") an individual residing at: [YOUR COMPLETE ADDRESS] AND: [SECOND PARTY NAME], (the "Tenant") an individual residing at: [YOUR COMPLETE ADDRESS] WHEREAS, the Landlord is the owner of the Property which is depicted on the site plan attached hereto as Exhibit A; WHEREAS, the Landlord desires to construct the Building on the Property and to lease the Leased Premises to the Tenant, and the Tenant desires to lease the Leased Premises from the Landlord, all under the terms and conditions set forth below; NOW, THEREFORE, THE PARTIES AGREE AS FOLLOWS: LEASE OF PREMISES The Landlord hereby leases the Premises to the Tenant under the terms and conditions more fully set forth herein. PREMISES The Premises shall consist of (a) the Property and (b) one Building containing approximately [SPECIFY AREA] rentable square feet constructed in accordance with Exhibit A attached hereto (the "Building"). The Property and the Building are collectively called the "Premises." A preliminary site plan of the Premises and a depiction of the footprint of the Building to be constructed on the Property are attached hereto as Exhibit A, and are subject to modification by mutual agreement of the Parties. The Building has or is anticipated to have a street address of [ADDRESS]. TERM Initial Term. The initial lease term (the "Initial Term") shall be [NUMBER OF YEARS] full Lease Years (as hereinafter defined) (i.e., a total of [NUMBER OF TOTAL MONTHS] full calendar months plus any partial month) commencing on the Lease Commencement Date (as herein defined). The Initial Term and any exercised Renewal Term (defined below) shall be collectively known as the "Term." Renewal Option. Provided that this Lease is then in full force and effect (and no Event of Default has occurred and is continuing on the date the Tenant delivers its Renewal Notice to the Landlord, the Tenant shall have the right to renew this Lease for three (3) renewal terms (each, a "Renewal Term") of five (5) years each, each immediately following the expiration of the Initial Term or the first or second Renewal Term, as the case may be, on the same terms, conditions, and provisions as are set forth in this Lease, provided that: the Tenant shall have notified the Landlord in writing of the Tenant's election to renew (the "Renewal Notice") at least eighteen (18) months prior to the date on which the Initial Term, or the applicable Renewal Term, as the case may be, expires. Time is of the essence with respect to the Tenant's exercise of its rights under this subparagraph, and the Tenant acknowledges that the Landlord requires strict adherence to the requirement that the Renewal Notice be made on a timely basis and in writing. If the Tenant fails to deliver a Renewal Notice on a timely basis, then the Tenant shall be deemed to have waived any and all remaining rights to renew the Term; there shall be no further right of renewal after the third Renewal Term. LEASE COMMENCEMENT DATE The "Lease Commencement Date" shall be (a) the date the Tenant takes occupancy of the Building for the conduct of the Tenant's intended business therein, or (b) the date which is [NUMBER OF DAYS] calendar days following Substantial Completion of the Landlord's Work. Lease Commencement Agreement. On the Lease Commencement Date (or such later date as the Landlord or Tenant may reasonably request), the Landlord and Tenant shall promptly enter into a supplementary written agreement, or in such other form as the Landlord or Tenant shall prescribe, thereby specifying the Lease Commencement Date and Rentable Area. RENT AND FINANCIAL MATTERS Security Deposit. The Tenant shall not be required to deliver, and has not delivered, any form of security deposit hereunder. Rental Obligation. Commencing on the Lease Commencement Date, the Tenant shall be obligated to pay and shall pay Basic Annual Rent. The Tenant agrees to pay the Landlord "Basic Annual Rent," payable in equal monthly installments, at the rate of [RATE] x [AMOUNT] times the Rentable Area per year for the first (1st) Lease Year, which initial Basic Annual Rent is on a triple net basis, and which shall be increased each Lease Year thereafter by two and one-fourth percent (2.25%) of the previous Lease Year's Basic Annual Rent. Payment Procedure. Each installment of the Basic Annual Rent is due in advance on the first (1st) day of each and every month for which payment is due and shall be paid by electronic funds transfer in accordance with instructions provided to the Tenant by the Landlord as modified by the Landlord from time to time. Unless a different date for payment is provided for elsewhere in this Lease (including, without limitation, as provided with respect to the Landlord's Estimate of Operating Expenses and/or Taxes), all Additional Rent will be paid by the Tenant within thirty (30) calendar days after the Landlord has notified the Tenant of the amount due. The foregoing notwithstanding, the portion of Additional Rent which is attributable to the Landlord's Estimate of Operating Expenses and/or Taxes (as all of the foregoing terms are hereinafter defined) shall be paid on the first day of each month, together with the Tenant's payments of Basic Annual Rent. Partial Month Proration. If the Lease Commencement Date occurs on a day other than the first day of a month, then the Tenant will pay a prorated monthly installment of Basic Annual Rent and of the Additional Rent for the fractional part of such month. Rent Adjustment-Taxes. Commencing on the Lease Commencement Date, and during each Operating Year, the Tenant shall pay to the Landlord, as Additional Rent, with and at the same time as the payments of Basic Annual Rent are due, the Tenant's Share of the Landlord's then-current estimate of Taxes, prorated in equal amounts over the balance of the then-current Operating Year. The Landlord has the sole and exclusive right to contest any Taxes assessed against the Leased Premises (including the Building); provided, however, that in the event the Landlord does not elect to contest the Taxes assessed during any Operating Year, then the Landlord shall provide written notice thereof to the Tenant prior to the deadline to commence any such contest, in which event, the Tenant may require the Landlord to contest such Taxes on its behalf, provided that no Event of Default by the Tenant has occurred and is continuing. If the Landlord contests the Taxes, either by its election or the Tenant's direction, then the Landlord may (i) select such third-party providers as the Landlord deems prudent to assist in such proceedings, on either a fee-paid and/or contingent fee basis; and (ii) at the Landlord's discretion, include all reasonable expenses incurred by the Landlord (including attorneys' fees and court costs) in appealing any assessment as an item of Taxes for the purpose of computing Additional Rent due under this Lease and/or satisfy all or a portion of such expenses from the proceeds of any tax refunds received as a result of a successful assessment contest. The Tenant shall have the right to consult with any such third-party providers selected by the Landlord in connection with the contest of Taxes hereunder. The Tenant acknowledges that it bears the risk that a tax assessment appeal could result in a decision which increases the assessed value of the Leased Premises. UTILITIES Effective as of the Lease Commencement Date, all utilities shall be transferred directly to accounts in the Tenant's name and the Tenant shall pay directly to all utility providers all charges respecting the Leased Premises incurred during the Term

Easily Create Any Business Document You Need in Minutes.

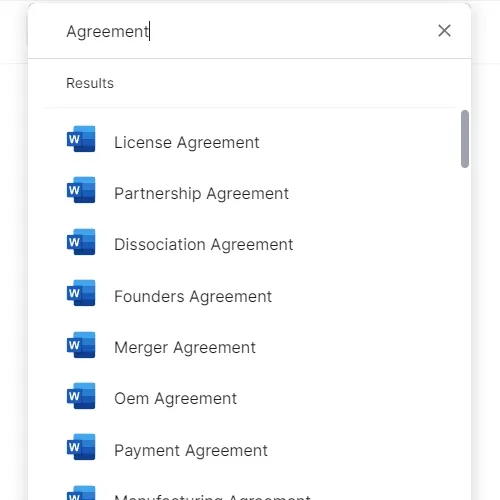

Access over 3,000+ business and legal templates for any business task, project or initiative.

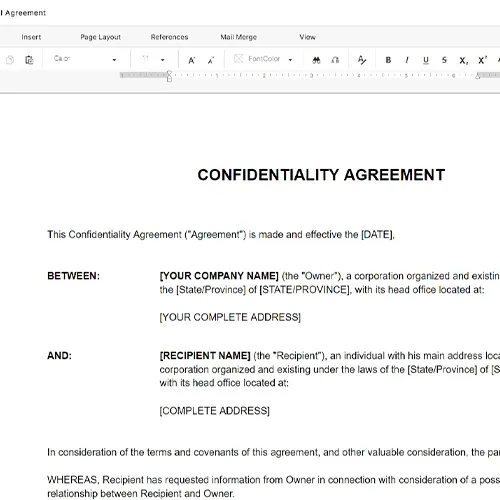

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.