Bank Loan Application Form and Checklist

Document content

This bank loan application form and checklist template has 6 pages and is a MS Word file type listed under our finance & accounting documents.

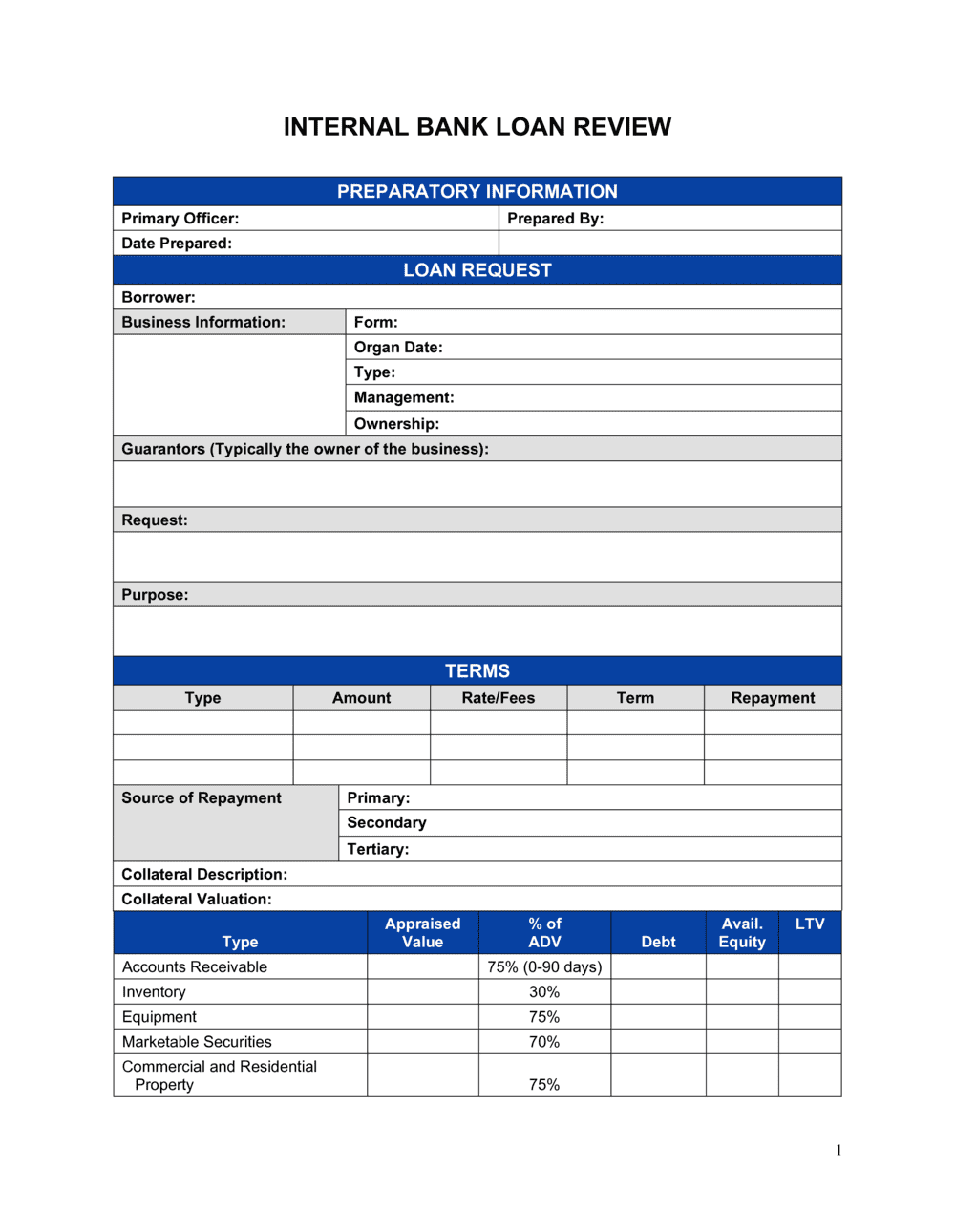

Sample of our bank loan application form and checklist template:

Internal Bank Loan Review PREPARATORY INFORMATION Primary Officer: Prepared By: Date Prepared: LOAN REQUEST Borrower: Business Information: Form: Organ Date: Type: Management: Ownership: Guarantors (Typically the owner of the business): Request: Purpose: TERMS Type Amount Rate/Fees Term Repayment Source of Repayment Primary: Secondary Tertiary: Collateral Description: Collateral Valuation: Type AppraisedValue % of ADV Debt Avail.Equity LTV Accounts Receivable 75% (0-90 days) Inventory 30% Equipment 75% Marketable Securities 70% Commercial and Residential Property 75% Vacant Land 30-50% Flood Hazard: Environmental Concerns: Bow Debt: Type Open High Bal. # of REN Rate Terms SEC LTV Bow Payment History: Line of Credit Usage: Low Balance: # of Days at Zero: Other Debts: Depository Relationship: Name Acct # Type Opened Balance Avg. Col. Bal. Rate Average Cost of Funds: Trust Relationship: Background Information: Financial Statement: Last 3 years of business financial statements and/or tax returns Last 3 years of owner's personal tax return Current personal financial statement BUSINESS LOAN APPLICATION Date: New Relationship Branch: Existing Relationship Officer: BUSINESS INFORMATION Business Name: Address: Telephone: ( ) Tax I.D.: Individual Name(s): Address: Telephone: ( ) Social Security # : Date of Birth: Proprietorship Partnership Sub-Chapter S Corporation Non-Profit Individual LLC Ownership Distribution: (List stockholders, partners, owner names) Note: Attach separate sheet if additional space needed. Name Title # of Years % SS# Name Title # of Years % SS# Name Title # of Years % SS# Nature of Business: Year Established: Number of Employees: Years at Present Location: [ ] Own [ ] Lease Accountant: Telephone: ( ) Insurance Agent: Telephone: ( ) Attorney: Telephone: ( ) FINANCIAL INFORMATION Bank of Account: Account Number: Credit Relationships:Please provide details of your business credit relationships below: Original Loan Amount Maturity Name of Creditor Purpose of Loan Amount Presently Owing Repayment Terms Date $ $ $ $ $ $ LOAN REQUEST Amount of Loan Requested Type of loan [ ]Line of Credit [ ]Term Loan Requested Term of Loan [ ]Business Home Equity [ ]Commercial Real Estate Specific Loan Purpose (Check all that apply) [ ]Working Capital [ ]Other (State type of loan required and loan [ ]Finance Purchase of Inventory purpose) [ ]Finance Purchase of Equipment [ ]Finance Purchase of Real Estate [ ]Finance Purchase of Business [ ]Refinance Existing Loan or Debts Collateral Available* (Check all that apply) [ ]All Assets (accounts receivable, inventory, machinery and equipment) [ ]Specific Equipment (Please attach equipment list, including serial numbers or description of equipment, and invoices for new equipment.) [ ]Real Estate (Please attach property address, legal description and a copy of most recent tax bill.) Square Feet Acres [ ]Cash on Deposit at (name of bank) Branch Account # [ ]Personal Assets (As described in Personal Financial Statement.) *Collateral: Loans are secured by collateral, which is property in which a security interest is granted to secure repayment of the loan. The loan collateral may include business assets, stocks, bonds, certificates of deposits, or personal assets

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This bank loan application form and checklist template has 6 pages and is a MS Word file type listed under our finance & accounting documents.

Sample of our bank loan application form and checklist template:

Internal Bank Loan Review PREPARATORY INFORMATION Primary Officer: Prepared By: Date Prepared: LOAN REQUEST Borrower: Business Information: Form: Organ Date: Type: Management: Ownership: Guarantors (Typically the owner of the business): Request: Purpose: TERMS Type Amount Rate/Fees Term Repayment Source of Repayment Primary: Secondary Tertiary: Collateral Description: Collateral Valuation: Type AppraisedValue % of ADV Debt Avail.Equity LTV Accounts Receivable 75% (0-90 days) Inventory 30% Equipment 75% Marketable Securities 70% Commercial and Residential Property 75% Vacant Land 30-50% Flood Hazard: Environmental Concerns: Bow Debt: Type Open High Bal. # of REN Rate Terms SEC LTV Bow Payment History: Line of Credit Usage: Low Balance: # of Days at Zero: Other Debts: Depository Relationship: Name Acct # Type Opened Balance Avg. Col. Bal. Rate Average Cost of Funds: Trust Relationship: Background Information: Financial Statement: Last 3 years of business financial statements and/or tax returns Last 3 years of owner's personal tax return Current personal financial statement BUSINESS LOAN APPLICATION Date: New Relationship Branch: Existing Relationship Officer: BUSINESS INFORMATION Business Name: Address: Telephone: ( ) Tax I.D.: Individual Name(s): Address: Telephone: ( ) Social Security # : Date of Birth: Proprietorship Partnership Sub-Chapter S Corporation Non-Profit Individual LLC Ownership Distribution: (List stockholders, partners, owner names) Note: Attach separate sheet if additional space needed. Name Title # of Years % SS# Name Title # of Years % SS# Name Title # of Years % SS# Nature of Business: Year Established: Number of Employees: Years at Present Location: [ ] Own [ ] Lease Accountant: Telephone: ( ) Insurance Agent: Telephone: ( ) Attorney: Telephone: ( ) FINANCIAL INFORMATION Bank of Account: Account Number: Credit Relationships:Please provide details of your business credit relationships below: Original Loan Amount Maturity Name of Creditor Purpose of Loan Amount Presently Owing Repayment Terms Date $ $ $ $ $ $ LOAN REQUEST Amount of Loan Requested Type of loan [ ]Line of Credit [ ]Term Loan Requested Term of Loan [ ]Business Home Equity [ ]Commercial Real Estate Specific Loan Purpose (Check all that apply) [ ]Working Capital [ ]Other (State type of loan required and loan [ ]Finance Purchase of Inventory purpose) [ ]Finance Purchase of Equipment [ ]Finance Purchase of Real Estate [ ]Finance Purchase of Business [ ]Refinance Existing Loan or Debts Collateral Available* (Check all that apply) [ ]All Assets (accounts receivable, inventory, machinery and equipment) [ ]Specific Equipment (Please attach equipment list, including serial numbers or description of equipment, and invoices for new equipment.) [ ]Real Estate (Please attach property address, legal description and a copy of most recent tax bill.) Square Feet Acres [ ]Cash on Deposit at (name of bank) Branch Account # [ ]Personal Assets (As described in Personal Financial Statement.) *Collateral: Loans are secured by collateral, which is property in which a security interest is granted to secure repayment of the loan. The loan collateral may include business assets, stocks, bonds, certificates of deposits, or personal assets

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.