Asset Purchase Agreement For a Retail Business Template

Document content

This asset purchase agreement for a retail business template has 71 pages and is a MS Word file type listed under our legal agreements documents.

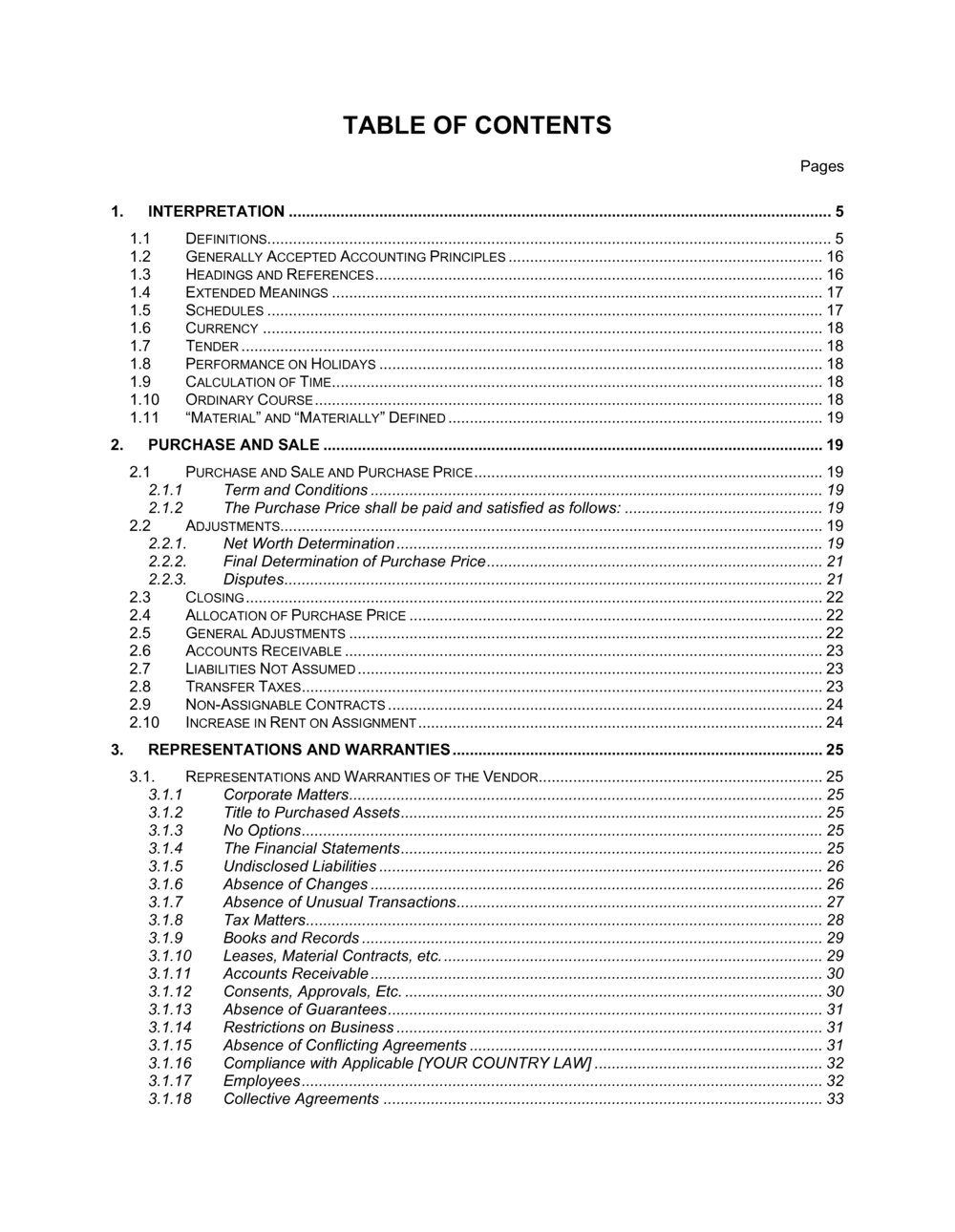

Sample of our asset purchase agreement for a retail business template:

TABLE OF CONTENTS Pages 1. INTERPRETATION 5 1.1 Definitions 5 1.2 Generally Accepted Accounting Principles 7 1.3 Headings and References 7 1.4 Extended Meanings 7 1.5 Schedules 7 1.6 Currency 7 1.7 Tender 7 1.8 Performance on Holidays 7 1.9 Calculation of Time 7 1.10 Ordinary Course 7 1.11 "Material" and "Materially" Defined 7 2. PURCHASE AND SALE 7 2.1 Purchase and Sale and Purchase Price 7 2.1.1 Term and Conditions 7 2.1.2 The Purchase Price shall be paid and satisfied as follows: 7 2.2 Adjustments 7 2.2.1. Net Worth Determination 7 2.2.2. Final Determination of Purchase Price 7 2.2.3. Disputes 7 2.3 Closing 7 2.4 Allocation of Purchase Price 7 2.5 General Adjustments 7 2.6 Accounts Receivable 7 2.7 Liabilities Not Assumed 7 2.8 Transfer Taxes 7 2.9 Non-Assignable Contracts 7 2.10 Increase in Rent on Assignment 7 3. REPRESENTATIONS AND WARRANTIES 7 3.1. Representations and Warranties of the Vendor 7 3.1.1 Corporate Matters 7 3.1.2 Title to Purchased Assets 7 3.1.3 No Options 7 3.1.4 The Financial Statements 7 3.1.5 Undisclosed Liabilities 7 3.1.6 Absence of Changes 7 3.1.7 Absence of Unusual Transactions 7 3.1.8 Tax Matters 7 3.1.9 Books and Records 7 3.1.10 Leases, Material Contracts, etc. 7 3.1.11 Accounts Receivable 7 3.1.12 Consents, Approvals, Etc. 7 3.1.13 Absence of Guarantees 7 3.1.14 Restrictions on Business 7 3.1.15 Absence of Conflicting Agreements 7 3.1.16 Compliance with Applicable [YOUR COUNTRY LAW] 7 3.1.17 Employees 7 3.1.18 Collective Agreements 7 3.1.19 Benefit Plans 7 3.1.20 Litigation 7 3.1.21 Insurance 7 3.1.22 Leases 7 3.1.23 Premises 7 3.1.24 No Expropriation 7 3.1.25 Leased Equipment 7 3.1.26 Licenses 7 3.1.27 Intellectual Property Rights 7 3.1.28 Assets 7 3.1.29 Inventories 7 3.1.30 Forward Commitments 7 3.1.31 Copies of Documents 7 3.1.32 Residency 7 3.1.33 Environmental Matters 7 3.1.34 Occupational Health and Safety 7 3.1.35 Workers' Compensation 7 3.1.36 Disclosure 7 3.1.37 Obligations to Customers 7 3.1.38 Retail Outlets 7 3.2. Representations and Warranties of the Purchaser 7 3.2.1 Incorporation 7 3.2.2 Corporate Power and Due Authorization 7 3.2.3 Enforceability of Obligations 7 3.2.4 Absence of Conflicting Agreements 7 3.2.5 Consents and Approvals 7 3.3. Interpretation 7 3.4. Commission 7 3.5. Qualification of Representations and Warranties 7 3.6. Non-Waiver 7 3.7. Survival of Representations and Warranties of the Vendor 7 3.8. Survival of Representations and Warranties of Purchaser 7 3.9. Knowledge of the Vendor 7 4. OTHER COVENANTS OF THE [COMPANY NAME] 7 4.1. Conduct of Business Prior to Closing 7 4.2. Conduct Business in Ordinary Course 7 4.3. Contracts 7 4.4. Continue Insurance 7 4.5. Comply with [YOUR COUNTRY LAW] 7 4.6. Taxes 7 4.7. Employees 7 4.8. Material Changes 7 4.9. Liens 7 4.10. Action by Vendor 7 4.11. Capital Expenditures 7 4.12. [SPECIFY] Claim 7 4.13. Conduct of Business Prior to Closing 7 4.14. Lease Consents and Estoppel Certificates 7 4.15. Consents and Waivers 7 4.16. Access for Investigation 7 4.17. Delivery of Books and Records 7 4.18. Accounts Receivable 7 4.19. Discharge of Obligations 7 4.20. Cooperation 7 4.21. Employees 7 4.21.1. Offer of Employment 7 4.21.2. Employment Process 7 4.21.3. Indemnification for Severance Claims of Non-Hired Employees 7 4.21.4. Claims Re: Employment Prior to Closing 7 4.21.5. Benefit Plans 7 4.21.6. Termination after Time of Closing 7 4.22. Pension Plan for Employees 7 4.23. Actions to Satisfy Closing Conditions 7 4.24. Disclosure 7 4.25. Injunctions 7 4.26. Action by the Vendor 7 4.27. Competition Act 7 4.28. Bulk Sales Legislation and Provincial Legislation 7 4.29. Consignment Goods and Contractual Rights 7 4.30. [DATE] Financial Statements 7 4.31. Purchaser Radius Clauses 7 5. INDEMNIFICATION 7 5.1 Definitions 7 5.2 Indemnification by the Vendor 7 5.3 Indemnification by the Purchaser 7 5.4 Notice of and the Defense of Third Party Claims 7 5.5 Assistance for Third Party Claims 7 5.6 Settlement of Third Party Claims 7 5.7 Direct Claims 7 5.8 Failure to Give Timely Notice 7 5.9 Payment and Interest 7 5.10 Limitation 7 5.11 Rights in Addition 7 5.12 Survival 7 5.13 Subsequent Recovery 7 5.14 Subrogation 7 5.15 Letter of Credit 7 5.16 Notices to Escrow Agent 7 6. CONDITIONS PRECEDENT 7 6.1 Purchaser's Conditions 7 6.2 Accuracy of Representations and Performance of Covenants 7 6.3 Consents to Assignments 7 6.4 No Material Adverse Change 7 6.5 Litigation 7 6.6 Receipt of Closing Documentation 7 6.7 Non-Competition Agreement 7 6.8 Opinion of Counsel for Vendor 7 6.9 Approval of Board of Directors 7 6.10 Management Agreement 7 6.11 Space and Facilities Agreement 7 6.12 Trade Mark License Agreement 7 6.13 Trade Mark Assignment 7 6.14 Cancellation of Certain Agreements 7 6.15 Environmental Audit 7 6.16 Escrow Agreement 7 6.17 Minimum Number of Leases 7 6.18 Vendor's Conditions 7 6.18.1. Accuracy of Representations and Performance of Covenants 7 6.18.2. Litigation 7 6.18.3. Opinion of Counsel for Purchaser 7 6.18.4. Competition Act 7 6.18.5. Minimum Number of Leases 7 6.18.6. Approval of [SPECIFY] Board of Directors 7 6.18.7. Escrow Agreement 7 6.18.8. Management Agreement 7 6.19 Waiver 7 6.20 Failure to Satisfy Conditions 7 6.21 Destruction or Expropriation 7 7. POST CLOSING OPERATIONS 7 7.1 Failure to Obtain Consent to Assignment of Lease 7 7.1.1. If with respect of any Lease described in Schedule [SPECIFY], the Vendor is unable to obtain any necessary consent, substantially in form or forms approved or deemed approved pursuant to subsection 4.1.10, to the assignment thereof to the Purchaser as herein contemplated at the Time of Closing (a "Non-Assignable Lease"), then the Non-Assignable Lease shall not be assigned and the Purchaser shall, in accordance with the terms of a management agreement to be entered into by the parties at Closing, manage the Business as it is carried on at the location covered by the Non-Assignable Lease for the account of the Vendor provided that such agreement does not result in a violation of any Applicable [YOUR COUNTRY LAW] or result in the early termination of the Non-Assignable Lease. 7 7.2 Delivery of Space and Facilities Agreement 7 7.3 Release of Vendor from Lease Covenants 7 7.4 No Hiring of Employees 7 7.5 Access for Taxes 7 7.6 Volume Rebates 7 7.7 Remediation of Certain Outstanding Phase I Violations 7 8. GENERAL 7 8.1 Further Assurances 7 8.2 Time of the Essence 7 8.3 Expenses 7 8.4 Benefit of the Agreement 7 8.5 Entire Agreement 7 8.6 Amendments and Waiver 7 8.7 Assignment 7 8.8 Notices 7 8.9 Confidentiality 7 8.10 Governing [YOUR COUNTRY LAW] 7 8.11 Attornment 7 8.12 Counterparts 7 ASSET PURCHASE AGREEMENT This Asset Purchase Agreement (the "Agreement") is effective [DATE], BETWEEN: [YOUR COMPANY NAME] (the "Purchaser"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [COMPANY NAME] (the "Vendor"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] WHEREAS the Vendor, through its [COMPANY NAME], is in the [SPECIFY] business; AND WHEREAS the Vendor desires to sell and the Purchaser desires to purchase as a going concern the undertaking and substantially all of the assets relating to the business of the Vendor's [COMPANY NAME], upon and subject to the terms and conditions hereinafter set forth; NOW THEREFORE THIS AGREEMENT WITNESSES that in consideration of the premises and the covenants and agreements herein contained the parties hereto agree as follows: INTERPRETATION Definitions In this Agreement, unless something in the subject matter or context is inconsistent therewith:

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This asset purchase agreement for a retail business template has 71 pages and is a MS Word file type listed under our legal agreements documents.

Sample of our asset purchase agreement for a retail business template:

TABLE OF CONTENTS Pages 1. INTERPRETATION 5 1.1 Definitions 5 1.2 Generally Accepted Accounting Principles 7 1.3 Headings and References 7 1.4 Extended Meanings 7 1.5 Schedules 7 1.6 Currency 7 1.7 Tender 7 1.8 Performance on Holidays 7 1.9 Calculation of Time 7 1.10 Ordinary Course 7 1.11 "Material" and "Materially" Defined 7 2. PURCHASE AND SALE 7 2.1 Purchase and Sale and Purchase Price 7 2.1.1 Term and Conditions 7 2.1.2 The Purchase Price shall be paid and satisfied as follows: 7 2.2 Adjustments 7 2.2.1. Net Worth Determination 7 2.2.2. Final Determination of Purchase Price 7 2.2.3. Disputes 7 2.3 Closing 7 2.4 Allocation of Purchase Price 7 2.5 General Adjustments 7 2.6 Accounts Receivable 7 2.7 Liabilities Not Assumed 7 2.8 Transfer Taxes 7 2.9 Non-Assignable Contracts 7 2.10 Increase in Rent on Assignment 7 3. REPRESENTATIONS AND WARRANTIES 7 3.1. Representations and Warranties of the Vendor 7 3.1.1 Corporate Matters 7 3.1.2 Title to Purchased Assets 7 3.1.3 No Options 7 3.1.4 The Financial Statements 7 3.1.5 Undisclosed Liabilities 7 3.1.6 Absence of Changes 7 3.1.7 Absence of Unusual Transactions 7 3.1.8 Tax Matters 7 3.1.9 Books and Records 7 3.1.10 Leases, Material Contracts, etc. 7 3.1.11 Accounts Receivable 7 3.1.12 Consents, Approvals, Etc. 7 3.1.13 Absence of Guarantees 7 3.1.14 Restrictions on Business 7 3.1.15 Absence of Conflicting Agreements 7 3.1.16 Compliance with Applicable [YOUR COUNTRY LAW] 7 3.1.17 Employees 7 3.1.18 Collective Agreements 7 3.1.19 Benefit Plans 7 3.1.20 Litigation 7 3.1.21 Insurance 7 3.1.22 Leases 7 3.1.23 Premises 7 3.1.24 No Expropriation 7 3.1.25 Leased Equipment 7 3.1.26 Licenses 7 3.1.27 Intellectual Property Rights 7 3.1.28 Assets 7 3.1.29 Inventories 7 3.1.30 Forward Commitments 7 3.1.31 Copies of Documents 7 3.1.32 Residency 7 3.1.33 Environmental Matters 7 3.1.34 Occupational Health and Safety 7 3.1.35 Workers' Compensation 7 3.1.36 Disclosure 7 3.1.37 Obligations to Customers 7 3.1.38 Retail Outlets 7 3.2. Representations and Warranties of the Purchaser 7 3.2.1 Incorporation 7 3.2.2 Corporate Power and Due Authorization 7 3.2.3 Enforceability of Obligations 7 3.2.4 Absence of Conflicting Agreements 7 3.2.5 Consents and Approvals 7 3.3. Interpretation 7 3.4. Commission 7 3.5. Qualification of Representations and Warranties 7 3.6. Non-Waiver 7 3.7. Survival of Representations and Warranties of the Vendor 7 3.8. Survival of Representations and Warranties of Purchaser 7 3.9. Knowledge of the Vendor 7 4. OTHER COVENANTS OF THE [COMPANY NAME] 7 4.1. Conduct of Business Prior to Closing 7 4.2. Conduct Business in Ordinary Course 7 4.3. Contracts 7 4.4. Continue Insurance 7 4.5. Comply with [YOUR COUNTRY LAW] 7 4.6. Taxes 7 4.7. Employees 7 4.8. Material Changes 7 4.9. Liens 7 4.10. Action by Vendor 7 4.11. Capital Expenditures 7 4.12. [SPECIFY] Claim 7 4.13. Conduct of Business Prior to Closing 7 4.14. Lease Consents and Estoppel Certificates 7 4.15. Consents and Waivers 7 4.16. Access for Investigation 7 4.17. Delivery of Books and Records 7 4.18. Accounts Receivable 7 4.19. Discharge of Obligations 7 4.20. Cooperation 7 4.21. Employees 7 4.21.1. Offer of Employment 7 4.21.2. Employment Process 7 4.21.3. Indemnification for Severance Claims of Non-Hired Employees 7 4.21.4. Claims Re: Employment Prior to Closing 7 4.21.5. Benefit Plans 7 4.21.6. Termination after Time of Closing 7 4.22. Pension Plan for Employees 7 4.23. Actions to Satisfy Closing Conditions 7 4.24. Disclosure 7 4.25. Injunctions 7 4.26. Action by the Vendor 7 4.27. Competition Act 7 4.28. Bulk Sales Legislation and Provincial Legislation 7 4.29. Consignment Goods and Contractual Rights 7 4.30. [DATE] Financial Statements 7 4.31. Purchaser Radius Clauses 7 5. INDEMNIFICATION 7 5.1 Definitions 7 5.2 Indemnification by the Vendor 7 5.3 Indemnification by the Purchaser 7 5.4 Notice of and the Defense of Third Party Claims 7 5.5 Assistance for Third Party Claims 7 5.6 Settlement of Third Party Claims 7 5.7 Direct Claims 7 5.8 Failure to Give Timely Notice 7 5.9 Payment and Interest 7 5.10 Limitation 7 5.11 Rights in Addition 7 5.12 Survival 7 5.13 Subsequent Recovery 7 5.14 Subrogation 7 5.15 Letter of Credit 7 5.16 Notices to Escrow Agent 7 6. CONDITIONS PRECEDENT 7 6.1 Purchaser's Conditions 7 6.2 Accuracy of Representations and Performance of Covenants 7 6.3 Consents to Assignments 7 6.4 No Material Adverse Change 7 6.5 Litigation 7 6.6 Receipt of Closing Documentation 7 6.7 Non-Competition Agreement 7 6.8 Opinion of Counsel for Vendor 7 6.9 Approval of Board of Directors 7 6.10 Management Agreement 7 6.11 Space and Facilities Agreement 7 6.12 Trade Mark License Agreement 7 6.13 Trade Mark Assignment 7 6.14 Cancellation of Certain Agreements 7 6.15 Environmental Audit 7 6.16 Escrow Agreement 7 6.17 Minimum Number of Leases 7 6.18 Vendor's Conditions 7 6.18.1. Accuracy of Representations and Performance of Covenants 7 6.18.2. Litigation 7 6.18.3. Opinion of Counsel for Purchaser 7 6.18.4. Competition Act 7 6.18.5. Minimum Number of Leases 7 6.18.6. Approval of [SPECIFY] Board of Directors 7 6.18.7. Escrow Agreement 7 6.18.8. Management Agreement 7 6.19 Waiver 7 6.20 Failure to Satisfy Conditions 7 6.21 Destruction or Expropriation 7 7. POST CLOSING OPERATIONS 7 7.1 Failure to Obtain Consent to Assignment of Lease 7 7.1.1. If with respect of any Lease described in Schedule [SPECIFY], the Vendor is unable to obtain any necessary consent, substantially in form or forms approved or deemed approved pursuant to subsection 4.1.10, to the assignment thereof to the Purchaser as herein contemplated at the Time of Closing (a "Non-Assignable Lease"), then the Non-Assignable Lease shall not be assigned and the Purchaser shall, in accordance with the terms of a management agreement to be entered into by the parties at Closing, manage the Business as it is carried on at the location covered by the Non-Assignable Lease for the account of the Vendor provided that such agreement does not result in a violation of any Applicable [YOUR COUNTRY LAW] or result in the early termination of the Non-Assignable Lease. 7 7.2 Delivery of Space and Facilities Agreement 7 7.3 Release of Vendor from Lease Covenants 7 7.4 No Hiring of Employees 7 7.5 Access for Taxes 7 7.6 Volume Rebates 7 7.7 Remediation of Certain Outstanding Phase I Violations 7 8. GENERAL 7 8.1 Further Assurances 7 8.2 Time of the Essence 7 8.3 Expenses 7 8.4 Benefit of the Agreement 7 8.5 Entire Agreement 7 8.6 Amendments and Waiver 7 8.7 Assignment 7 8.8 Notices 7 8.9 Confidentiality 7 8.10 Governing [YOUR COUNTRY LAW] 7 8.11 Attornment 7 8.12 Counterparts 7 ASSET PURCHASE AGREEMENT This Asset Purchase Agreement (the "Agreement") is effective [DATE], BETWEEN: [YOUR COMPANY NAME] (the "Purchaser"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [COMPANY NAME] (the "Vendor"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] WHEREAS the Vendor, through its [COMPANY NAME], is in the [SPECIFY] business; AND WHEREAS the Vendor desires to sell and the Purchaser desires to purchase as a going concern the undertaking and substantially all of the assets relating to the business of the Vendor's [COMPANY NAME], upon and subject to the terms and conditions hereinafter set forth; NOW THEREFORE THIS AGREEMENT WITNESSES that in consideration of the premises and the covenants and agreements herein contained the parties hereto agree as follows: INTERPRETATION Definitions In this Agreement, unless something in the subject matter or context is inconsistent therewith:

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.