Agreement with Accountant Template

Document content

This agreement with accountant template has 3 pages and is a MS Word file type listed under our consultant & contractors documents.

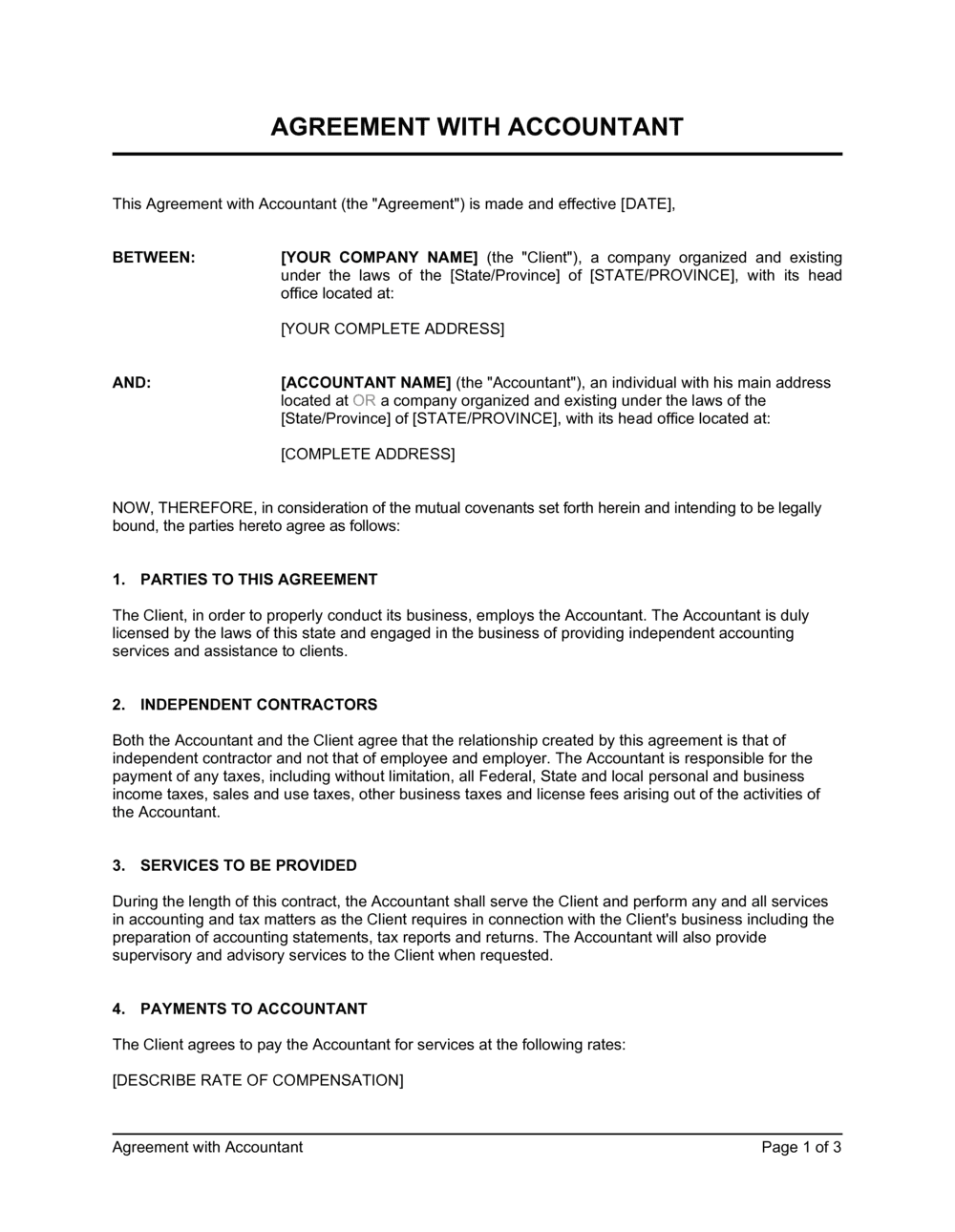

Sample of our agreement with accountant template:

AGREEMENT WITH ACCOUNTANT This Agreement with Accountant (the "Agreement") is made and effective [Date], BETWEEN: [YOUR COMPANY NAME] (the "Client"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [ACCOUNTANT NAME] (the "Accountant"), an individual with his main address located at OR a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] NOW, THEREFORE, in consideration of the mutual covenants set forth herein and intending to be legally bound, the parties hereto agree as follows: Parties to This Agreement The Client, in order to properly conduct its business, employs the Accountant. The Accountant is duly licensed by the laws of this state and engaged in the business of providing independent accounting services and assistance to clients. Independent Contractors Both the Accountant and the Client agree that the relationship created by this agreement is that of independent contractor and not that of employee and employer. The Accountant is responsible for the payment of any taxes, including without limitation, all Federal, State and local personal and business income taxes, sales and use taxes, other business taxes and license fees arising out of the activities of the Accountant. Services to be Provided During the length of this contract, the Accountant shall serve the Client and perform any and all services in accounting and tax matters as the Client requires in connection with the Client's business including the preparation of accounting statements, tax reports and returns. The Accountant will also provide supervisory and advisory services to the Client when requested. Payments to Accountant The Client agrees to pay the Accountant for services at the following rates: [Describe rate of compensation] When Payments Are Due The Accountant shall bill the Client on a regular basis for services rendered which bills will be due and payable [UPON RECEIPT/NET 30 DAYS/ETC]. Confidentiality Accountant hereby acknowledges that Company has made, or may make, available to Accountant certain customer lists, pricing data, supply sources, techniques, computerized data, maps, methods, product design information, market information, technical information, benchmarks, performance standards and other confidential and/or Proprietary Information of, or licensed to, the Company or its clients/customers ("Customers"), including without limitation, trade secrets, inventions, patents, and copyrighted materials (collectively, the "Confidential Material"). Accountant acknowledges that this information has independent economic value, actual or potential, that is not generally known to the public or to others who could obtain economic value from their disclosure or use, and that this information is subject to a reasonable effort by the Company to maintain its secrecy and confidentiality. Except as essential to Accountant's obligation under this Agreement, Accountant shall not make any disclosure of this Agreement, the terms of this Agreement, or any of the Confidential Material. Except as essential to Accountant's obligations pursuant to their relationship with the Company, Accountant shall not make any duplication or other copy of the Confidential Material. Accountant shall not remove Confidential Material or proprietary property or documents without written authorization

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This agreement with accountant template has 3 pages and is a MS Word file type listed under our consultant & contractors documents.

Sample of our agreement with accountant template:

AGREEMENT WITH ACCOUNTANT This Agreement with Accountant (the "Agreement") is made and effective [Date], BETWEEN: [YOUR COMPANY NAME] (the "Client"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [ACCOUNTANT NAME] (the "Accountant"), an individual with his main address located at OR a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] NOW, THEREFORE, in consideration of the mutual covenants set forth herein and intending to be legally bound, the parties hereto agree as follows: Parties to This Agreement The Client, in order to properly conduct its business, employs the Accountant. The Accountant is duly licensed by the laws of this state and engaged in the business of providing independent accounting services and assistance to clients. Independent Contractors Both the Accountant and the Client agree that the relationship created by this agreement is that of independent contractor and not that of employee and employer. The Accountant is responsible for the payment of any taxes, including without limitation, all Federal, State and local personal and business income taxes, sales and use taxes, other business taxes and license fees arising out of the activities of the Accountant. Services to be Provided During the length of this contract, the Accountant shall serve the Client and perform any and all services in accounting and tax matters as the Client requires in connection with the Client's business including the preparation of accounting statements, tax reports and returns. The Accountant will also provide supervisory and advisory services to the Client when requested. Payments to Accountant The Client agrees to pay the Accountant for services at the following rates: [Describe rate of compensation] When Payments Are Due The Accountant shall bill the Client on a regular basis for services rendered which bills will be due and payable [UPON RECEIPT/NET 30 DAYS/ETC]. Confidentiality Accountant hereby acknowledges that Company has made, or may make, available to Accountant certain customer lists, pricing data, supply sources, techniques, computerized data, maps, methods, product design information, market information, technical information, benchmarks, performance standards and other confidential and/or Proprietary Information of, or licensed to, the Company or its clients/customers ("Customers"), including without limitation, trade secrets, inventions, patents, and copyrighted materials (collectively, the "Confidential Material"). Accountant acknowledges that this information has independent economic value, actual or potential, that is not generally known to the public or to others who could obtain economic value from their disclosure or use, and that this information is subject to a reasonable effort by the Company to maintain its secrecy and confidentiality. Except as essential to Accountant's obligation under this Agreement, Accountant shall not make any disclosure of this Agreement, the terms of this Agreement, or any of the Confidential Material. Except as essential to Accountant's obligations pursuant to their relationship with the Company, Accountant shall not make any duplication or other copy of the Confidential Material. Accountant shall not remove Confidential Material or proprietary property or documents without written authorization

Easily Create Any Business Document You Need in Minutes.

Access over 3,000+ business and legal templates for any business task, project or initiative.

Customize your ready-made business document template and save it in the cloud.

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.