Agreement of Purchase and Sale of Business Assets Template

Sample of Document Content

This agreement of purchase and sale of business assets template has 5 pages and is a MS Word file type listed under our finance & accounting documents.

Agreement of purchase and sale of business assets template

AGREEMENT OF PURCHASE AND SALE OF BUSINESS ASSETS This Agreement of Purchase and Sale (the "Agreement") is made in two original copies, effective [DATE] BETWEEN: [YOUR COMPANY NAME] (the "Vendor"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [PURCHASER NAME] (the "Purchaser"), an individual with his main address located at OR a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] SUBJECT-MATTER The Purchaser agrees to buy and the Vendor agrees to sell to the Purchaser as a going concern all the undertaking and assets owned by the Vendor in connection with the [TYPE OF BUSINESS] business carried on as [YOUR COMPANY NAME] at [YOUR COMPLETE ADDRESS] (the "business") including, without limiting the generality of the foregoing: The furniture, fixtures and equipment more particularly described in Schedule A (the "equipment"); All saleable stock in trade (the "stock in trade"); All useable parts and supplies (the "parts and supplies"); All leasehold interest in the lease held by the Vendor from [NAME OF LANDLORD] (the "lease"); The goodwill of the business together with the exclusive right to the Purchaser to represent itself as carrying on business in succession to the Vendor and to use the business style of the business and variations in the business to be carried on by the Purchaser (the "goodwill"). The following assets are expressly excluded from the purchase and sale: [LIST EXCLUSIONS, e.g. cash on hand or on deposit, accounts receivable, book and other debts due or accruing due]. PURCHASE PRICE The purchase price payable for the undertaking and assets agreed to be bought and sold is the total of the amounts computed and allocated as follows: For the equipment - [AMOUNT]; For the stock in trade, its direct cost to the Vendor; For the parts and supplies, their direct cost to the Vendor; For the goodwill - [AMOUNT]; For all other assets agreed to be bought and sold. The purchase price for the stock in trade shall be established by an inventory taken and valued after close of business on the day before the day of closing. The Vendor shall produce evidence satisfactory to the Purchaser of the direct cost to the Vendor of items included in stock in trade. The Purchaser may exclude from the purchase and sale any items which the Purchaser reasonably considers unsaleable by reason of defect in quality or in respect of which the Purchaser is not reasonably satisfied as to proof of direct cost. The purchase price for the parts and supplies shall be established by an inventory taken and valued after close of business on the day before the day of closing. The Vendor shall produce evidence satisfactory to the Purchaser of the direct cost to the Vendor of items included in the parts and supplies. The Purchaser may exclude from the purchase and sale any items which the Purchaser reasonably considers unusable or in respect of which the Purchaser is not reasonably satisfied as to proof of direct cost. TERMS OF PAYMENT The Vendor acknowledges receiving a check for [AMOUNT] from the Purchaser on execution of this agreement to be held as a deposit by the Vendor on account of the purchase price of the undertaking and assets agreed to be bought and sold and as security for the Purchaser's due performance of this agreement. The balance of the purchase price for the undertaking and assets agreed to be bought and sold shall be paid, subject to adjustments, by certified check on closing. The balance of the purchase price due on closing shall be specially adjusted for all prepaid and assumed operating expenses of the business including but not limited to rent and utilities. CONDITIONS, REPRESENTATIONS AND WARRANTIES In addition to anything else in this agreement, the following are conditions of completing this agreement in favor of the Purchaser: That the Purchaser obtain financing on terms satisfactory to it to complete the purchase; that the carrying on of the business at its present location is not prohibited by land use restrictions; That the lessor of the lease consents to its assignment to the Purchaser; That the Purchaser obtain all the permits and licenses required for it to carry on the business; That the Vendor supply or deliver on closing all of the closing documents; That the premises shall be in the same condition, reasonable wear and tear expected, on the date of passing as they are currently in; That Seller's board of directors has duly authorized the execution of this agreement. The following representations and warranties are made and given by the Vendor to the Purchaser and expressly survive the closing of this agreement. The representations are true as of the date of this agreement and will be true as of the date of closing when they shall continue as warranties according to their terms. At the option of the Purchaser, the representations and warranties may be treated as conditions of the closing of this agreement in favor of the Purchaser. However, the closing of this agreement shall not operate as a waiver or otherwise result in a merger to deprive the Purchaser of the right to sue the Vendor for breach of warranty in respect of any matter warranted, whether or not ascertained by the Purchaser prior to closing: The Vendor is a resident of [YOUR COUNTRY] within the meaning of the Income Tax Act of [YOUR COUNTRY]; The Vendor owns and has the right to sell the items listed in Schedule A; The assets agreed to be bought and sold are sold free and clear of all liens, encumbrances and charges; The equipment is in good operating condition;

Reviewed on

Sample of Document Content

This agreement of purchase and sale of business assets template has 5 pages and is a MS Word file type listed under our finance & accounting documents.

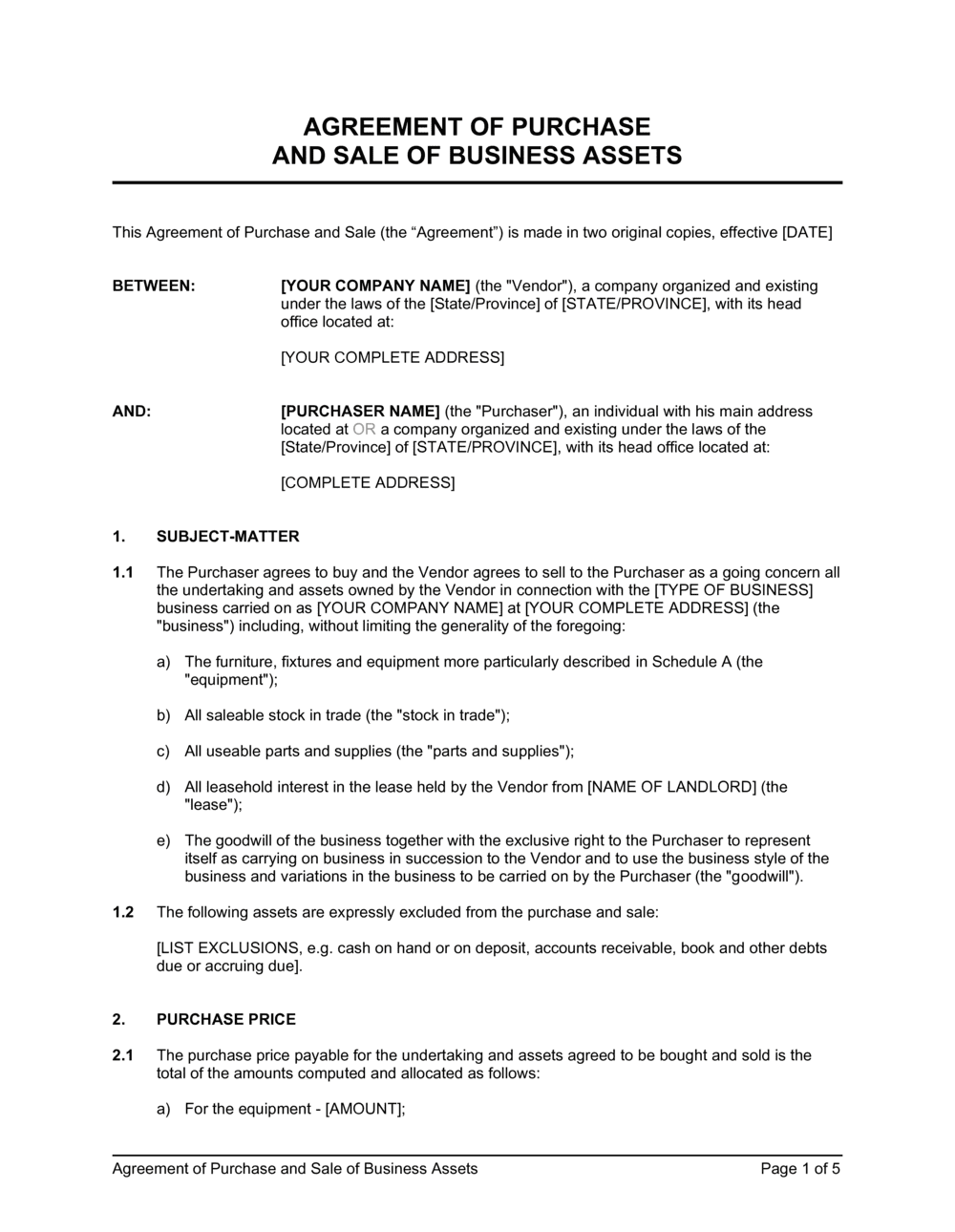

Sample of our agreement of purchase and sale of business assets template:

AGREEMENT OF PURCHASE AND SALE OF BUSINESS ASSETS This Agreement of Purchase and Sale (the "Agreement") is made in two original copies, effective [DATE] BETWEEN: [YOUR COMPANY NAME] (the "Vendor"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [PURCHASER NAME] (the "Purchaser"), an individual with his main address located at OR a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] SUBJECT-MATTER The Purchaser agrees to buy and the Vendor agrees to sell to the Purchaser as a going concern all the undertaking and assets owned by the Vendor in connection with the [TYPE OF BUSINESS] business carried on as [YOUR COMPANY NAME] at [YOUR COMPLETE ADDRESS] (the "business") including, without limiting the generality of the foregoing: The furniture, fixtures and equipment more particularly described in Schedule A (the "equipment"); All saleable stock in trade (the "stock in trade"); All useable parts and supplies (the "parts and supplies"); All leasehold interest in the lease held by the Vendor from [NAME OF LANDLORD] (the "lease"); The goodwill of the business together with the exclusive right to the Purchaser to represent itself as carrying on business in succession to the Vendor and to use the business style of the business and variations in the business to be carried on by the Purchaser (the "goodwill"). The following assets are expressly excluded from the purchase and sale: [LIST EXCLUSIONS, e.g. cash on hand or on deposit, accounts receivable, book and other debts due or accruing due]. PURCHASE PRICE The purchase price payable for the undertaking and assets agreed to be bought and sold is the total of the amounts computed and allocated as follows: For the equipment - [AMOUNT]; For the stock in trade, its direct cost to the Vendor; For the parts and supplies, their direct cost to the Vendor; For the goodwill - [AMOUNT]; For all other assets agreed to be bought and sold. The purchase price for the stock in trade shall be established by an inventory taken and valued after close of business on the day before the day of closing. The Vendor shall produce evidence satisfactory to the Purchaser of the direct cost to the Vendor of items included in stock in trade. The Purchaser may exclude from the purchase and sale any items which the Purchaser reasonably considers unsaleable by reason of defect in quality or in respect of which the Purchaser is not reasonably satisfied as to proof of direct cost. The purchase price for the parts and supplies shall be established by an inventory taken and valued after close of business on the day before the day of closing. The Vendor shall produce evidence satisfactory to the Purchaser of the direct cost to the Vendor of items included in the parts and supplies. The Purchaser may exclude from the purchase and sale any items which the Purchaser reasonably considers unusable or in respect of which the Purchaser is not reasonably satisfied as to proof of direct cost. TERMS OF PAYMENT The Vendor acknowledges receiving a check for [AMOUNT] from the Purchaser on execution of this agreement to be held as a deposit by the Vendor on account of the purchase price of the undertaking and assets agreed to be bought and sold and as security for the Purchaser's due performance of this agreement. The balance of the purchase price for the undertaking and assets agreed to be bought and sold shall be paid, subject to adjustments, by certified check on closing. The balance of the purchase price due on closing shall be specially adjusted for all prepaid and assumed operating expenses of the business including but not limited to rent and utilities. CONDITIONS, REPRESENTATIONS AND WARRANTIES In addition to anything else in this agreement, the following are conditions of completing this agreement in favor of the Purchaser: That the Purchaser obtain financing on terms satisfactory to it to complete the purchase; that the carrying on of the business at its present location is not prohibited by land use restrictions; That the lessor of the lease consents to its assignment to the Purchaser; That the Purchaser obtain all the permits and licenses required for it to carry on the business; That the Vendor supply or deliver on closing all of the closing documents; That the premises shall be in the same condition, reasonable wear and tear expected, on the date of passing as they are currently in; That Seller's board of directors has duly authorized the execution of this agreement. The following representations and warranties are made and given by the Vendor to the Purchaser and expressly survive the closing of this agreement. The representations are true as of the date of this agreement and will be true as of the date of closing when they shall continue as warranties according to their terms. At the option of the Purchaser, the representations and warranties may be treated as conditions of the closing of this agreement in favor of the Purchaser. However, the closing of this agreement shall not operate as a waiver or otherwise result in a merger to deprive the Purchaser of the right to sue the Vendor for breach of warranty in respect of any matter warranted, whether or not ascertained by the Purchaser prior to closing: The Vendor is a resident of [YOUR COUNTRY] within the meaning of the Income Tax Act of [YOUR COUNTRY]; The Vendor owns and has the right to sell the items listed in Schedule A; The assets agreed to be bought and sold are sold free and clear of all liens, encumbrances and charges; The equipment is in good operating condition;

Easily Create Any Business Document You Need in Minutes.

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.