12 Tips To Achieve Financial Growth In Business Template

Document content

This 12 tips to achieve financial growth in business template has 4 pages and is a MS Word file type listed under our sales & marketing documents.

Sample of our 12 tips to achieve financial growth in business template:

12 TIPS TO ACHIEVE FINANCIAL GROWTH IN BUSINESS Efficient management of finances is the key to financial growth and business survival. Good management of finances will ensure that your resources are utilized properly and will also provide you with long-term financial stability. Effective management of finances should be an integral part of a business plan, as it will help to gain a competitive advantage and will help in the achievement of business goals and objectives. Below are 12 essential tips that encourage significant financial growth of a business. Develop a Strong Business Plan Having a business plan will help you strategize the long-term progress of your business. The plan will consist of precise details about the financing of your business activities, the amount of money you would require, and the sources from which you wish to acquire it. For a business plan to be effective, paying close attention to market trends and forecasting your financial position will be of immense help. Thus, you will gain an understanding of your current financial position and you will be able to amend strategies to ensure financial growth. Keep Track of Your Financial Status Regular monitoring of the financial progress of your business is essential. You should be aware of the amount of money you have in your bank account(s), the number of sales that your business is making, and also your stock levels. Having monthly targets and reviewing them is highly advantageous. Re-examining income and expenditure will help you to revise your spending habits and develop plans to properly manage your finances at all times. Invest Your Money Investing money is a very important decision for any business owner. Why? Investments will help you multiply your assets, and will also help in increasing your wealth. Financial experts note that investing money is like a backup plan that can serve as a great weapon when a business experiences a downturn. Investing in stocks and shares and making equity or debt investments in small businesses are a few commonly preferred modes of investment. Passive income investments like dividend stocks and real estate are several other methods of investing that are less expensive and less complicated. Ensure the Receiving of On-Time Payments Some businesses experience major financial setbacks and problems because of late payments from customers. How can this be resolved? Make sure that you state your credit terms and conditions clearly from the outset. This will help prevent the risk of late and/or non-payment from your clients. Quickly issuing invoices is important too. Finally, utilizing a computerized credit management system that will help you keep track of customer accounts is recommended. Monitor Your Regular Expenses Businesses that are very successful and profitable will face difficulties when there is not enough cash to manage regular expenses like rent and wages for workers. To avoid falling into a financial pothole, always ensure that you possess the minimum amount your business needs to survive and never go below that limit. Such measures will help you to stay in control of the finances of your business and will help you carry out the required groundwork for future strategies like expansion. Keep Your Accounts Records Updated Businesses sometimes postpone account management. If this happens, there is a high risk of losing money. You will not have precise details of pending customer payments and the payments that you have to make to your suppliers. Therefore, a good record-keeping system for your accounts will help you track your expenses, debts, and creditor details, and will also help you know when to apply for additional funding. This will also save a lot of time and significantly reduce accountancy costs.

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Document content

This 12 tips to achieve financial growth in business template has 4 pages and is a MS Word file type listed under our sales & marketing documents.

Sample of our 12 tips to achieve financial growth in business template:

12 TIPS TO ACHIEVE FINANCIAL GROWTH IN BUSINESS Efficient management of finances is the key to financial growth and business survival. Good management of finances will ensure that your resources are utilized properly and will also provide you with long-term financial stability. Effective management of finances should be an integral part of a business plan, as it will help to gain a competitive advantage and will help in the achievement of business goals and objectives. Below are 12 essential tips that encourage significant financial growth of a business. Develop a Strong Business Plan Having a business plan will help you strategize the long-term progress of your business. The plan will consist of precise details about the financing of your business activities, the amount of money you would require, and the sources from which you wish to acquire it. For a business plan to be effective, paying close attention to market trends and forecasting your financial position will be of immense help. Thus, you will gain an understanding of your current financial position and you will be able to amend strategies to ensure financial growth. Keep Track of Your Financial Status Regular monitoring of the financial progress of your business is essential. You should be aware of the amount of money you have in your bank account(s), the number of sales that your business is making, and also your stock levels. Having monthly targets and reviewing them is highly advantageous. Re-examining income and expenditure will help you to revise your spending habits and develop plans to properly manage your finances at all times. Invest Your Money Investing money is a very important decision for any business owner. Why? Investments will help you multiply your assets, and will also help in increasing your wealth. Financial experts note that investing money is like a backup plan that can serve as a great weapon when a business experiences a downturn. Investing in stocks and shares and making equity or debt investments in small businesses are a few commonly preferred modes of investment. Passive income investments like dividend stocks and real estate are several other methods of investing that are less expensive and less complicated. Ensure the Receiving of On-Time Payments Some businesses experience major financial setbacks and problems because of late payments from customers. How can this be resolved? Make sure that you state your credit terms and conditions clearly from the outset. This will help prevent the risk of late and/or non-payment from your clients. Quickly issuing invoices is important too. Finally, utilizing a computerized credit management system that will help you keep track of customer accounts is recommended. Monitor Your Regular Expenses Businesses that are very successful and profitable will face difficulties when there is not enough cash to manage regular expenses like rent and wages for workers. To avoid falling into a financial pothole, always ensure that you possess the minimum amount your business needs to survive and never go below that limit. Such measures will help you to stay in control of the finances of your business and will help you carry out the required groundwork for future strategies like expansion. Keep Your Accounts Records Updated Businesses sometimes postpone account management. If this happens, there is a high risk of losing money. You will not have precise details of pending customer payments and the payments that you have to make to your suppliers. Therefore, a good record-keeping system for your accounts will help you track your expenses, debts, and creditor details, and will also help you know when to apply for additional funding. This will also save a lot of time and significantly reduce accountancy costs.

Easily Create Any Business Document You Need in Minutes.

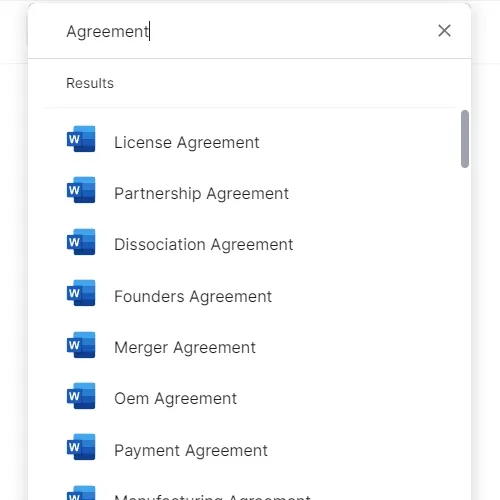

Access over 3,000+ business and legal templates for any business task, project or initiative.

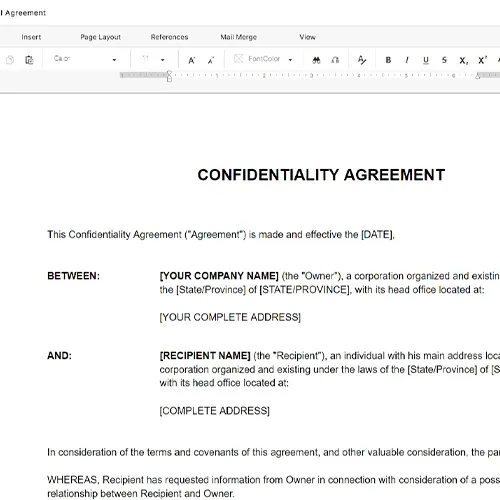

Customize your ready-made business document template and save it in the cloud.

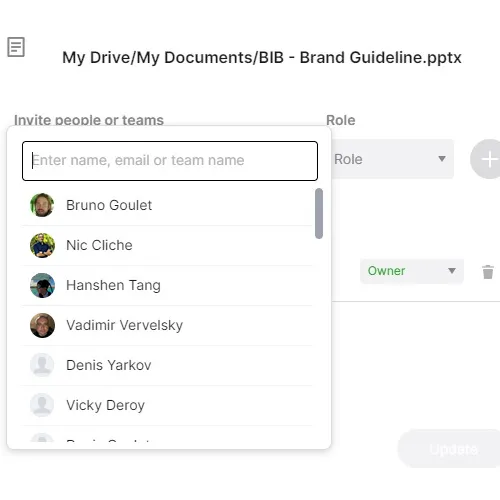

Share your files and folders with your team. Create a space of seamless collaboration.

Templates and Tools to Manage Every Aspect of Your Business.

Business in a Box Covers Every Business Department

Includes 16 Types of Business Documents You Need

and Achieve Your Business Goals Faster.