There is no passion to be found playing small – in setting for a life that is less than one you are capable of living” – Nelson Mandela.

Consumers today typically have mixed or unfavorable attitudes toward marketing practices.

Whether it’s the promise of more value than can be delivered, being persuaded to buy something you don’t need, or buying unsafe, shoddy products, unsustainable marketing leads to distrust.

Marketing has been criticized for harming consumers with deceptive claims and practices and high-pressure sales. Unsustainable marketing has often fueled the desire for materialism versus quality of life. Increasing demand for more and more stuff has also led to environmental consequences.

Consumers today want a better quality of life and be more active in making the world a better place. They want to support companies – big, small, and in between – that demonstrate strong ethics and stewardship of human beings and the planet.

In fact, according to the Ethical Consumer US report of 2015 by Mintel, more than 63% of consumers feel that ethical issues are becoming more important. And consumers are strongly supporting businesses that incorporate meaningful values into their core business.

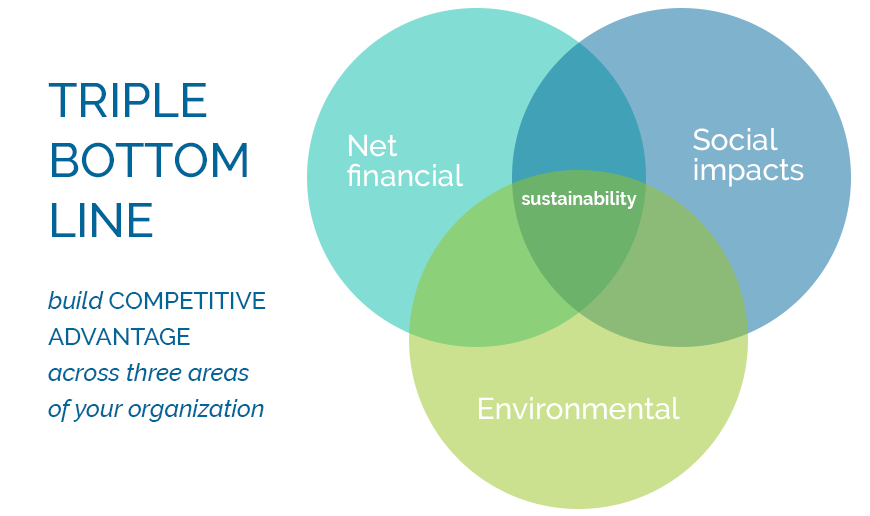

This desire to make a positive impact translates into a key concept in today’s business world: sustainability. Sustainability as a business strategy is becoming increasingly appealing to managers, executives, and business owners, and more businesses and organizations are driving change – and success – with sustainable business goals.

Here, we’ll take a close look at sustainability and how it plays out as a strategy for both business and marketing. What do sustainable businesses look like? And how can sustainable marketing help those businesses succeed?

→ Download Now: Free Business Plan Guide

Manage your personal credit

Credit is the lifeblood of a small business, and you need to make sure your personal credit is also solid. Pay your bills on time. Even if money is tight and you can only afford to make a minimum payment on a credit card, it’s better to do that than to miss a payment or pay late.

Also, pay attention to your credit utilization ratio—the percentage of your available credit limits that you’re actually borrowing at any given time during the month. If you can keep this ratio below 30%, this will help you to have a better credit score and an easier time getting approved for personal loans.

Having better personal credit can also be helpful for your business, especially if your business is still establishing credit under the business’s name. And staying on top of your debt payments and due dates will help you have a stronger foundation for your personal finances.

Save for retirement

Small business owners often invest a lot of their profits back into their business, but there are also some great options for small business owners to save for retirement. Consider setting up a SEP IRA or other tax-advantaged retirement savings plan for your business, even if you don’t have any employees.

Depending on your income and qualifying factors, you may find you can save more money for retirement as a self-employed person than you could as an employee.

Instead of investing all your profits back into your business, saving for retirement can help you diversify your savings into a wider array of investment options: stocks, bonds, ETFs, and money market mutual funds. Your business is already your biggest investment. You already are depending on your business for income and insurance. You don’t have to invest every last dollar back into your business; invest in a broader range of opportunities, too.

Once you’re saving for retirement, make sure you are investing in a diversified portfolio of assets that are appropriate for your time horizon and risk tolerance. If you are still relatively young and have several decades until you reach retirement age, you should invest your portfolio mostly in stocks.

For example, an old rule of thumb for asset allocation used to be that you should take 100 minus your age, and that would be the percentage of your portfolio that should be invested in stocks. So if you were 40 years old, to calculate your portfolio, you would subtract 40 from 100, and the result would be investing 60% of your money in stocks; 40% in bonds and cash.

However, depending on your investment goals, you might want to invest an even larger percentage of your portfolio in stocks, so you can capture more of their potential long-term growth until you retire. Stocks can be risky, but they generally offer the best potential for long-term ROI.

Seek professional help

Talk to a financial adviser for more specific advice; this column does not constitute professional financial advice, but it helps to consider some of your options so you can make informed decisions about your personal finances.

If you can improve your personal finances—with a solid emergency fund, strong personal credit, and a diversified portfolio of retirement savings aside from the equity that you own in your business—you will more likely be able to focus on running your company with a mindset of calmness and optimism. And for business owners, who are some of the busiest people in the world, having peace of mind about personal finances can be truly priceless.