The day you opened your doors, you had an inkling of how much paperwork doing business would entail—from signing building leases to tracking customer receipts. But unless you were already familiar with bookkeeping basics, you might not have known just how important drawing up the right financial documents (and doing so frequently—at least once a month) would matter to your success.

Six most useful financial documents for small businesses

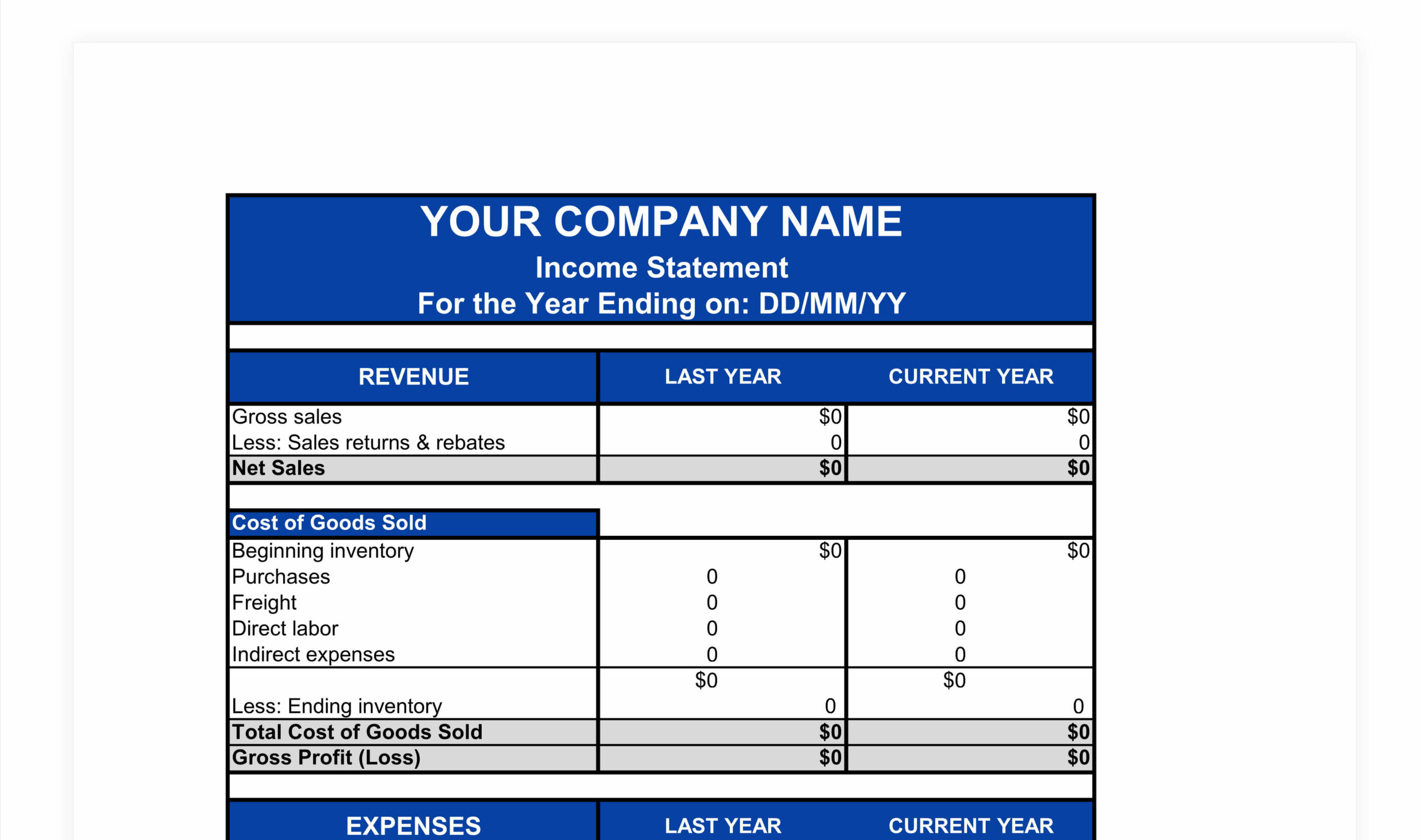

1. Income statement

An income statement lists your revenue and expenses to indicate if your business is profitable or not—which is why an income statement is your business’s most important document.

To create an income statement, list all your sources of revenue (e.g., income from property you lease or money made from sales). Next, list your direct costs, or all the money you invest directly in creating your product or selling your service. When you subtract direct costs from revenue, you end up with your gross profit.

2. Cash flow statement

A cash flow statement documents how cash is flowing into and out of your business in three main categories: operations, investments, and financing. The statement shows which parts of your business are creating the most cash and which areas are spending the most cash.

Heads-up: Depreciation and amortization

Cash flow statements are useful for calculating upcoming budgets. For instance, if you have a negative cash flow, meaning you’re spending more money than you’re making, the statement clearly identifies places for you to cut back in next month’s budget. Plus, if you’re looking for investors, the cash flow statement clearly shows if your business is profitable or not—which can impact who wants to invest and how much.

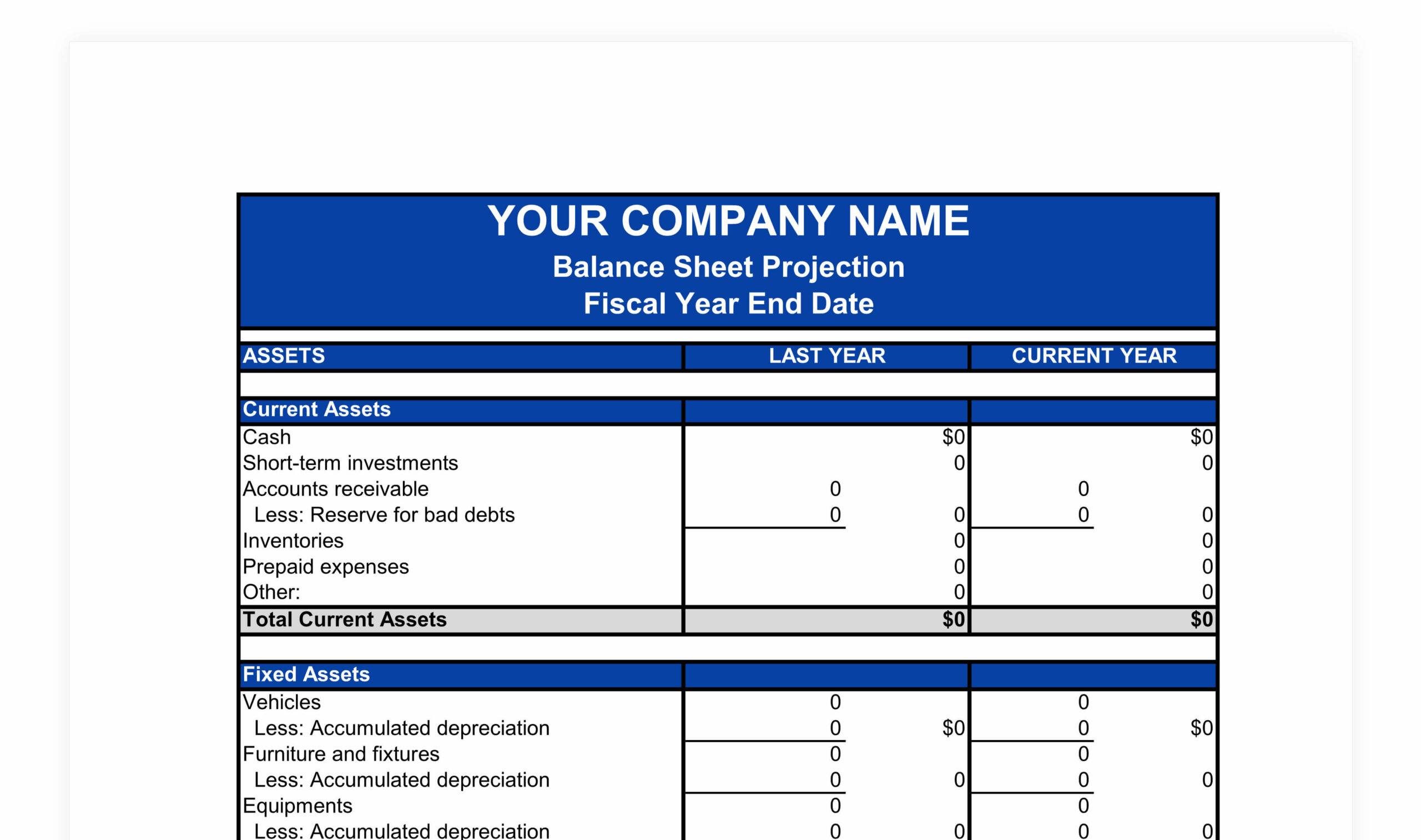

3. Balance sheet

A balance sheet shows you if your assets balance with your liabilities at a specific moment in time. In other words, the document relies on a fundamental accounting equation:

Assets = Liabilities + Equity

Think of a balance sheet as a snapshot of your business’s financial health—on one side of the sheet, you list your (tangible and intangible) assets, and on the other side, you list your liabilities (like debts owed) and equity (the amount you or other shareholders invested in the company). The numbers on both sides of the sheet should be the exact same. If you have more liabilities than you do assets, you’re losing money and need to reevaluate.

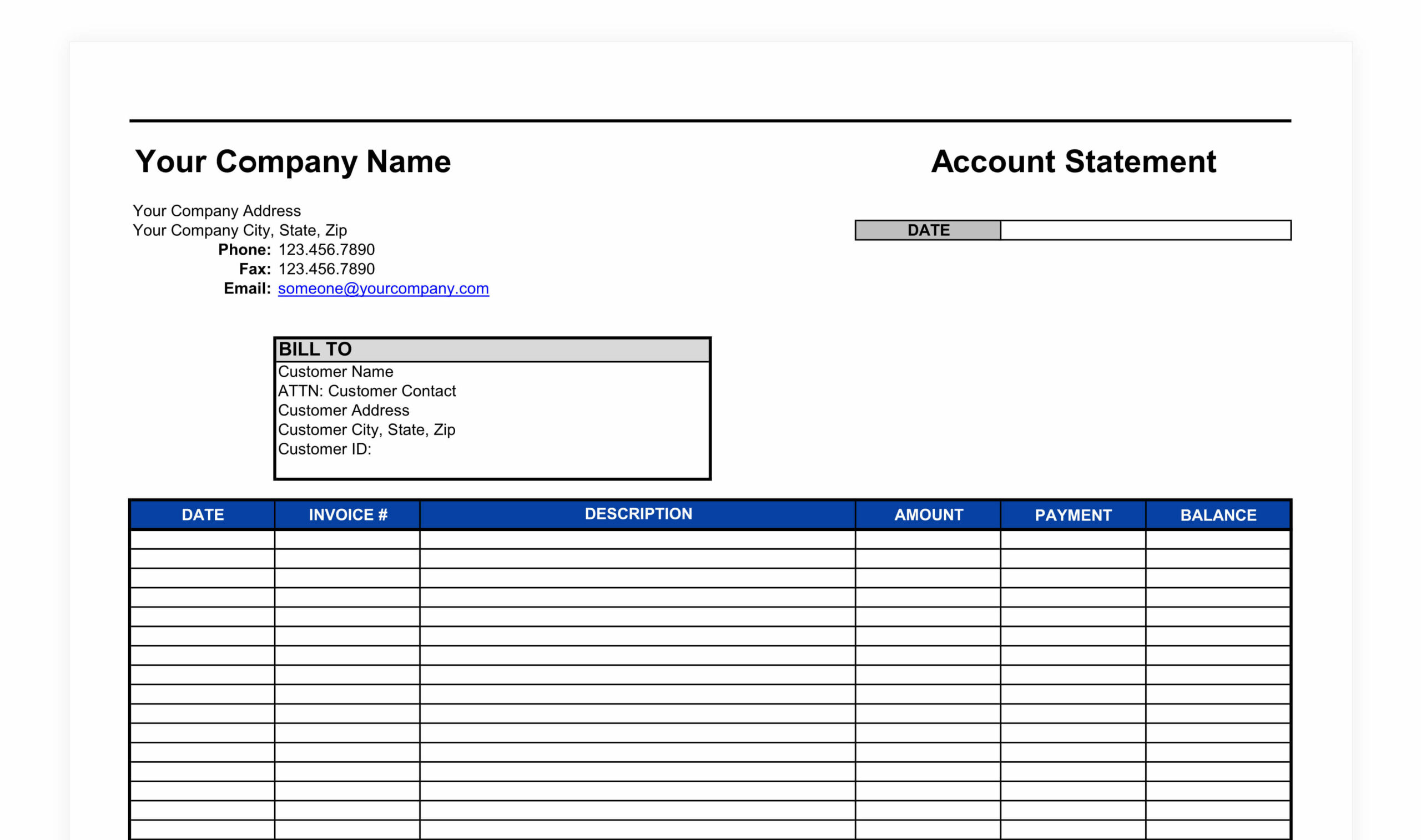

4. Accounts receivable aging report

The accounts receivable aging report (a.k.a. the A/R aging report or, simply, the aging report) is a list of overdue customer invoices. The aging report covers when a customer’s payment was due, how late the payment is, and how to contact the customer for collection purposes.

5. Business plan

A business plan maps out where your business is, where you hope it’s going, and how you plan to get there. The document can be pretty informal, especially if you just want to use it internally to guide your company’s strategy. But if you want to share your business plan with investors or lenders, you’ll want it to look a little more formal. In particular, it should include information about your business and the details of your financial plan.

6. Budget report

While other financial documents show you where your business stands, a budget report is a future projection based on the financial documents in your repertoire, particularly the cash flow statement and income statement. The numbers in a budget report estimate your projected income and losses over a specific period of time, from a month to several years.

A bookkeeper or bookkeeping software can draw up a budget report template that makes the most sense for your unique business.

FAQs

Who else looks at these financial documents?

Primarily, these key financial documents are for you, but they’re also the first things other stakeholders will use to evaluate your business’s profitability. For instance, if you want to take out a small-business loan, your lender will always look at your income statement, business plan, and several other documents to boot.

How do I create these financial documents?

You can draw up most of these documents using a spreadsheet program like Excel or Google Sheets. If you want to save time, accounting software like Business in a Box will generate these types of documents for you and help identify trends that could impact your bottom line.

The takeaway

When you put in the time to assemble and analyze these financial documents, you’re giving yourself the tools to keep your small business on track. Set aside some time each week (at least!) to balance your books, draw up crucial financial reports, and create financial goals for the coming weeks, months, and years.

Need a way to quickly assemble accurate documents? See our page on the best bookkeeping software for small businesses.

If you are interested in learning more about how to plan your finances and build a solid foundation for your online business’s success, check out our Financial Kit “Finance for Founders.”

Source: business.org